Last updated: 3/21/2019

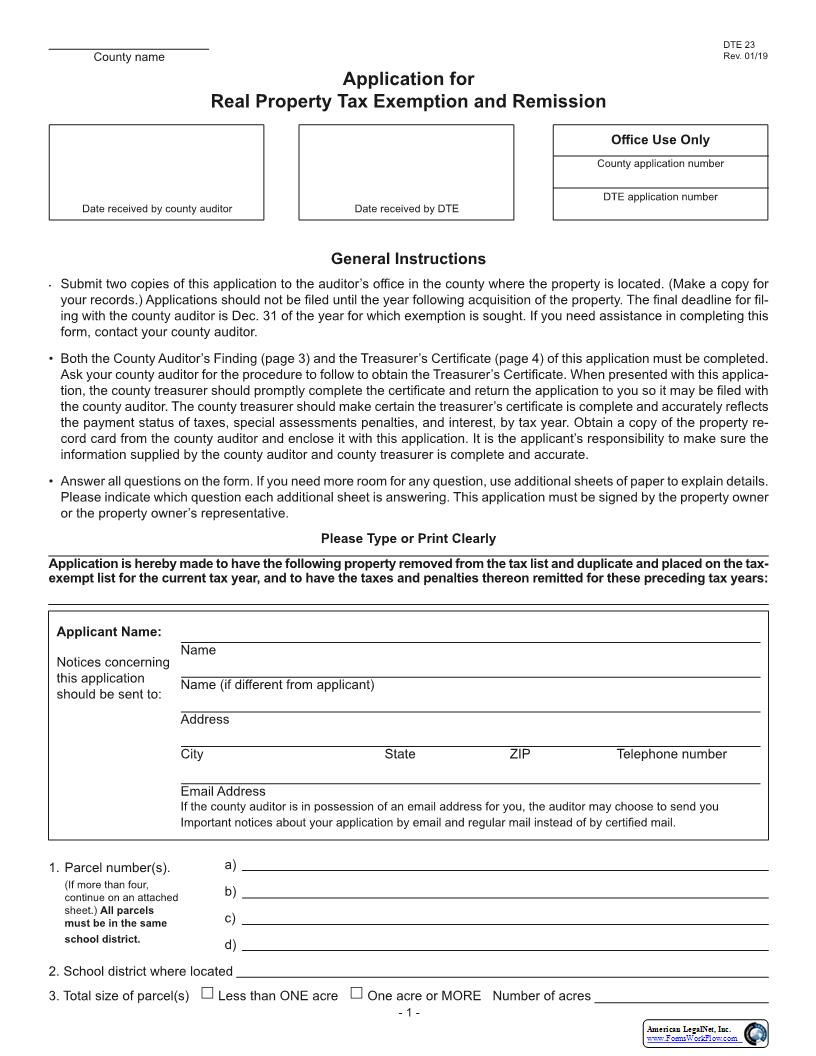

Application For Real Property Tax Exemption And Remission {DTE 23}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

General Instructions225 þ - þ -- þ Please Type or Print ClearlyApplication is hereby made to have the following property removed from the tax list and duplicate and placed on the tax-exempt list for the current tax year, and to have the taxes and penalties thereon remitted for these preceding tax years: þ Name þ þ þ þ þ þ þ þ þ þ þ þ þ Application for Real Property Tax Exemption and Remission Applicant Name:this applicationshould be sent to: þ þ þ continue on an attached þ All parcels þ must be in the same þ school district. American LegalNet, Inc. www.FormsWorkFlow.com þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þ þþ þ YesNo þ þþ þ þ þ þ þ þ þ þ þ þ Do not þ þ þ þ þ Yes þ No þ þ þ þ Yes þ No þ þ þ Yes þ No þ þ þ Yes þ No þ Note: If the answer to any part of question 15 is 223yes,224 enclose all details on a separate sheet of paper. If money statements. þ þ þ Yes þ No þ þ þ þ þ þ þ þ þ Yes þ No þ þ þ Yes þ No þ þ charitable purposes. þ þ þ senior citizens222 residences. þ residence for senior citizens þ - 2 - American LegalNet, Inc. www.FormsWorkFlow.com The Ohio Department of Taxation may set a hearing on this application. If there is a hearing, the applicant must present a witness who can accurately describe the use of the property in question. A notice of at least 10 days will be given to the applicant concerning the time and place of any hearing. þ þ Print name and title þ þ þ County Auditor222s Finding þ þ New construction on þ þ þ þ þ Auditor222s Recommendation: Grant NoneComments: þ þ þ þ Building LandTotal - American LegalNet, Inc. www.FormsWorkFlow.com no jurisdiction to act on the application, and it will be subject to dismissal. Notice to treasurer:taxes, penalties and interestunpaid taxes, penalties and interestas follows: þ þ þ þ þ þ If additional years are unpaid, please list on an attached sheet. þ Yes þ No þ Yes þ NoComments: þ þ þ Tax YearParcel NumberTaxes (including penalties and interest) þ American LegalNet, Inc. www.FormsWorkFlow.com