Last updated: 3/29/2021

Continuing Application For Homestead Exemption {DTE 105B}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

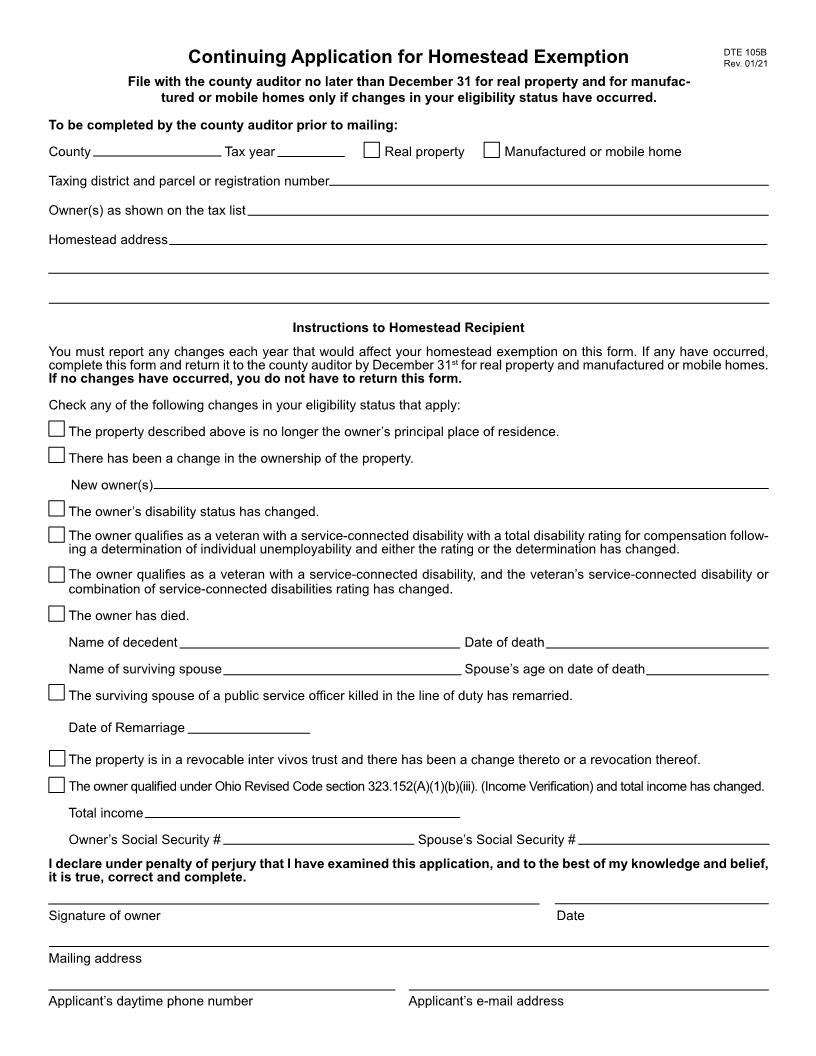

DTE 105B Rev. 9/16 Continuing Application for Homestead Exemption File with the county auditor no later than Dec. 31 for real property and no later than the first Monday in June for manufactured or mobile homes only if changes in your eligibility status have occurred. To be completed by the county auditor prior to mailing: County Tax year Real property Manufactured or mobile home Taxing district and parcel or registration number Owner(s) as shown on the tax list Homestead address Instructions to Homestead Recipient You must report any changes each year that would affect your homestead exemption on this form. If any have occurred, complete this form and return it to the county auditor by Dec. 31st for real property and by the first Monday in June for manufactured or mobile homes. If no changes have occurred, you do not have to return this form. Check any of the following changes in your eligibility status that apply: The property described above is no longer the owner's principal place of residence. There has been a change in the ownership of the property. New owner(s) The owner's disability status has changed. The owner qualifies as a veteran with a service-connected disability with a total disability rating for compensation following a determination of individual unemployability and either the rating or the determination has changed. The owner qualifies as a veteran with a service-connected disability, and the veteran's service-connected disability or combination of service-connected disabilities rating has changed. The owner has died. Name of decedent Name of surviving spouse Date of death Spouse's age on date of death The property is in a revocable inter vivos trust and there has been a change thereto or a revocation thereof. The owner qualified under Ohio Revised Code section 323.152(A)(1)(b)(iii). (Income Verification) and total income has changed. Total income Owner's Social Security # Spouse's Social Security # I declare under penalty of perjury that I have examined this application, and to the best of my knowledge and belief, it is true, correct and complete. Signature of owner Mailing address Applicant's daytime phone number Date Applicant's e-mail address American LegalNet, Inc. www.FormsWorkFlow.com