Last updated: 4/4/2024

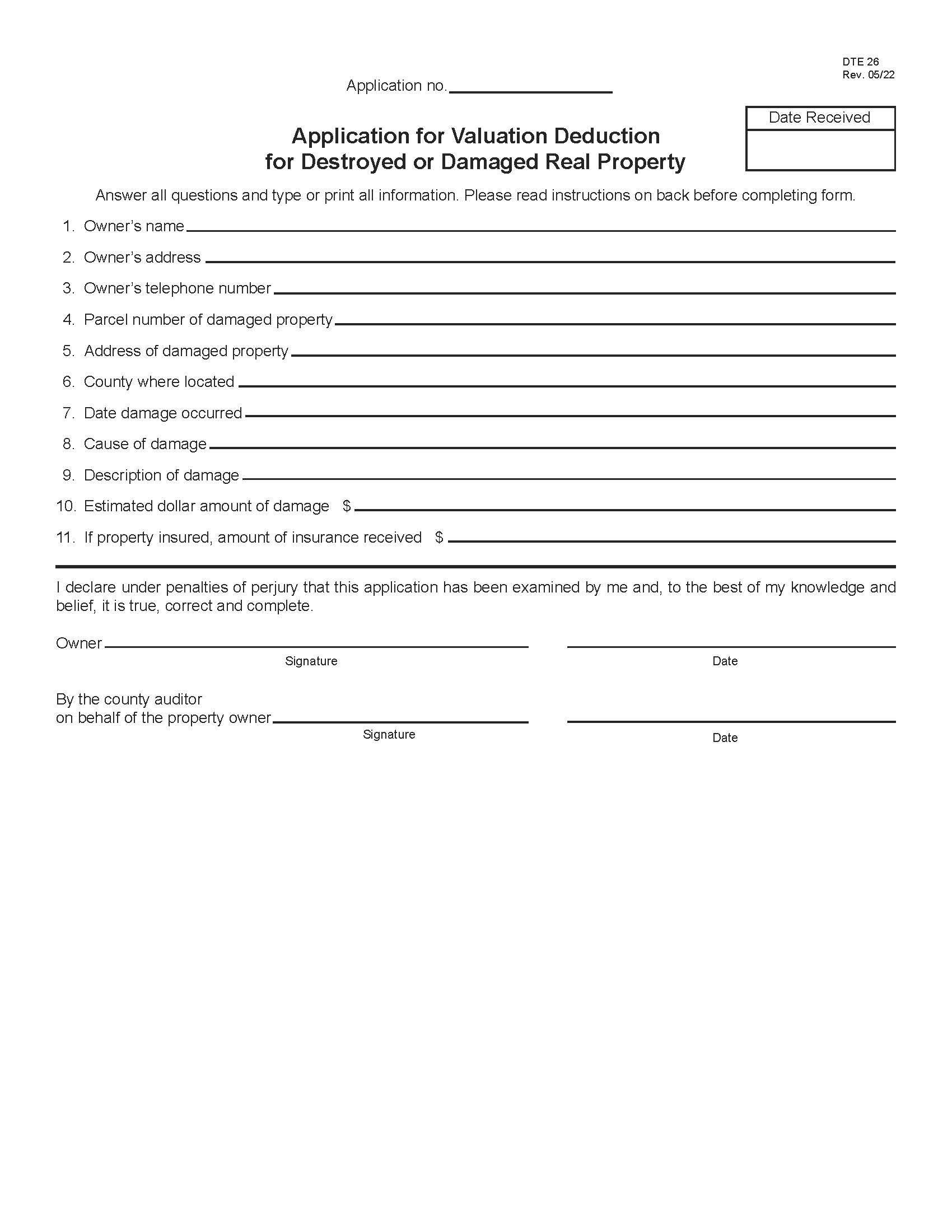

Application For Valuation Deduction For Destroyed Or Damaged Real Property {DTE 26}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

DTE 26 -- APPLICATION FOR VALUATION DEDUCTION FOR DESTROYED OR DAMAGED REAL PROPERTY. An application for a deduction from the current year’s value must be filed by Dec. 31 for property that is destroyed or dam-aged in the first nine months of the year. For property damaged in the last three months of the year, the filing deadline is Jan. 31 of the following year. This form should be filed with the county auditor of the county in which the property is located. Any deduction from value approved will affect the tax bills due the following year. The amount of the deduction equals a percentage of the reduction in value caused by the damage or destruction. That percentage is determined by the calendar quarter in which the damage occurred. www.FormsWorkflow.com