Last updated: 4/13/2015

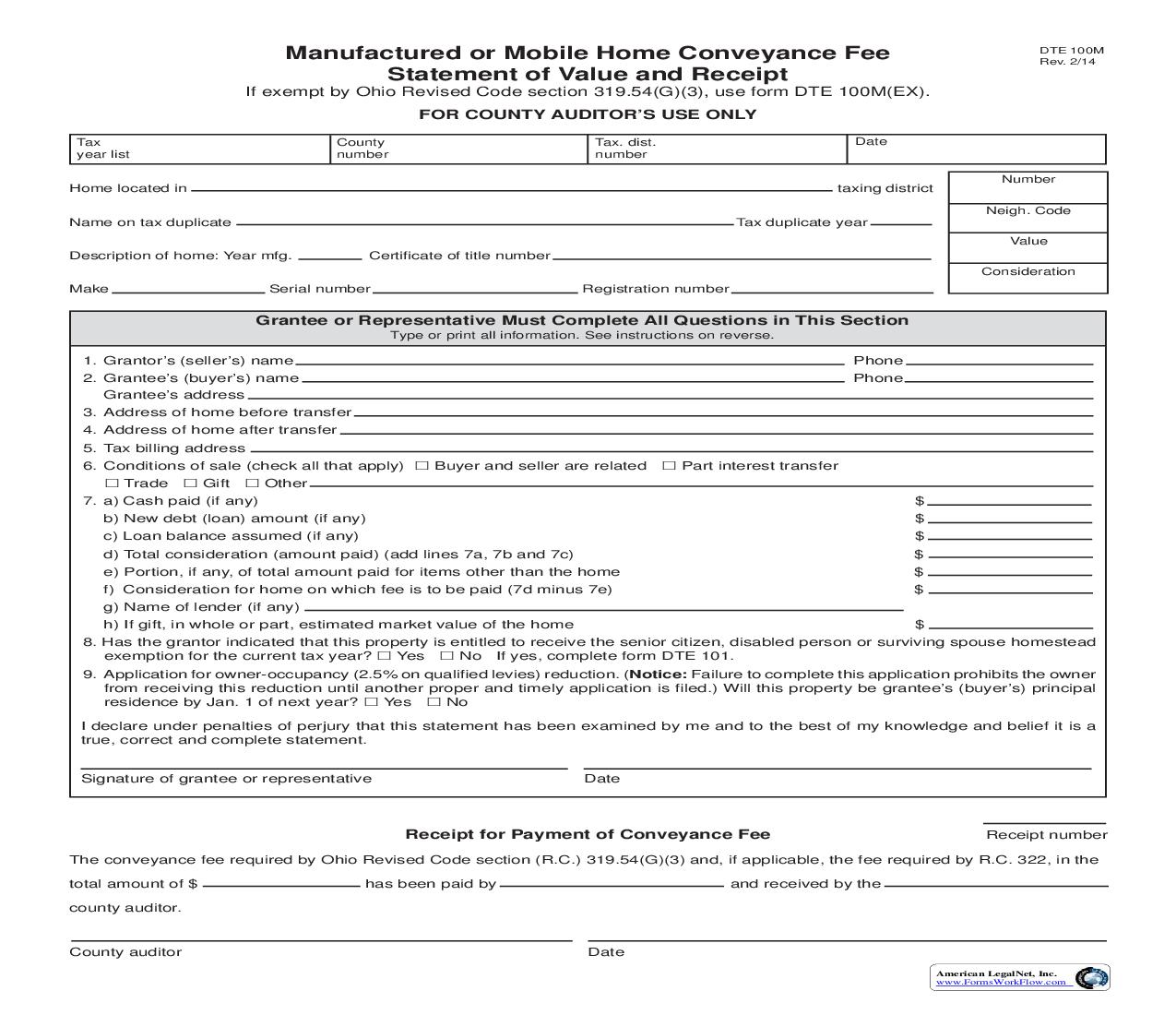

Manufactured And Mobile Home Conveyance Fee Statement Of Value And Receipt {DTE 100M}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Manufactured or Mobile Home Conveyance Fee Statement of Value and Receipt If exempt by Ohio Revised Code section 319.54(G)(3), use form DTE 100M(EX). FOR COUNTY AUDITOR'S USE ONLY Tax year list County number Tax. dist. number Date DTE 100M Rev. 2/14 Home located in Name on tax duplicate Description of home: Year mfg. Make Certificate of title number taxing district Tax duplicate year Number Neigh. Code Value Consideration Serial number Registration number Grantee or Representative Must Complete All Questions in This Section Type or print all information. See instructions on reverse. 1. Grantor's (seller's) name 2. Grantee's (buyer's) name Grantee's address 3. Address of home before transfer 4. Address of home after transfer 5. Tax billing address 6. Conditions of sale (check all that apply) Trade Gift Other 7. a) Cash paid (if any) b) New debt (loan) amount (if any) c) Loan balance assumed (if any) d) Total consideration (amount paid) (add lines 7a, 7b and 7c) e) Portion, if any, of total amount paid for items other than the home f) Consideration for home on which fee is to be paid (7d minus 7e) g) Name of lender (if any) h) If gift, in whole or part, estimated market value of the home Buyer and seller are related Part interest transfer Phone Phone $ $ $ $ $ $ $ 8. Has the grantor indicated that this property is entitled to receive the senior citizen, disabled person or surviving spouse homestead exemption for the current tax year? Yes No If yes, complete form DTE 101. 9. Application for owner-occupancy (2.5% on qualified levies) reduction. (Notice: Failure to complete this application prohibits the owner from receiving this reduction until another proper and timely application is filed.) Will this property be grantee's (buyer's) principal residence by Jan. 1 of next year? Yes No I declare under penalties of perjury that this statement has been examined by me and to the best of my knowledge and belief it is a true, correct and complete statement. Signature of grantee or representative Date Receipt for Payment of Conveyance Fee Receipt number The conveyance fee required by Ohio Revised Code section (R.C.) 319.54(G)(3) and, if applicable, the fee required by R.C. 322, in the total amount of $ county auditor. has been paid by and received by the County auditor Date American LegalNet, Inc. www.FormsWorkFlow.com DTE 100M Rev. 2/14 Page 2 Instructions to Grantee (Buyer) or Representative for Completing Manufactured or Mobile Home Conveyance Fee Statement of Value Complete lines 1 through 9. WARNING: All questions must be completed to the best of your knowledge to comply with Ohio Revised Code section (R.C.) 319.202. Persons willfully failing to comply or falsifying information are guilty of a misdemeanor of the first degree (R.C. section 319.99(B)). The county auditor has discretionary power under R.C. section 319.202(A) to request additional information in any form of documentation deemed necessary to verify the accuracy of the information provided by the grantee on the front of the form. NOTE: This form and fee only apply to the transfer of manufactured or mobile homes where (i) the grantor is not a new manufactured or mobile home dealer or (ii) the grantor is a new manufactured or mobile home dealer, but the home was previously titled to an owner who was not a new manufactured or mobile home dealer. Line 1 Line 2 Line 3 Line 4 Line 5 Line 6 Line 7 List grantor's (seller's) name as shown in the title conveying this home. List grantee's (buyer's) name as shown in the title conveying this home and the grantee's mailing address. List address of home before this transfer by street number and name. List address of home after this transfer (address to which buyer will relocate if this home is relocated). List complete name and address to which bill are to be sent. CAUTION: Each property owner is responsible for paying the property taxes on time even if no tax bill is received. Show any special condition of sale that would affect the purchase price. If any of the special conditions noted are involved, check the appropriate box. Briefly describe other conditions in the space provided. a) b) c) d) e) Enter cash paid for this home (if any). Enter amount of new loan on this home (if any). Enter amount of the balance assumed on an existing loan (if any). Add lines 7a, 7b and 7c. If any portion of the amount paid reported on line 7d was paid for items other than the home, enter the amount paid for those items. f) Deduct line 7e from line 7d and enter the difference on this line. g) List lender (if any). h) In the case of a gift, in whole or part, enter the estimated price that the home would bring in the open market. The manufactured home conveyance fee is payable on the amount of money reported on either line 7(f) or 7(h). Line 8 If the grantor (seller) has indicated that the home conveyed will receive the senior citizen, disabled person or surviving spouse homestead exemption for current tax year under R.C. section 4503.065, grantor (seller() must complete DTE 101 or submit a statement that complies with the provisions of R.C. section 319.202(A)(2), and the grantee (buyer) must submit such form to the county auditor along with this statement. Complete line 9 (application for owner-occupancy reduction on qualified levies) only if the parcel is used for residential purposes. To receive the owner-occupancy homestead tax reduction on qualified levies for next year, you must own and occupy your home as your principal place of residence (domicile) on Jan. 1 of that year. A homeowner and spouse may receive this reduction on only one home in Ohio. Failure to complete this application prohibits the owner from receiving this reduction until another proper and timely application is filed. Line 9 American LegalNet, Inc. www.FormsWorkFlow.com