Last updated: 9/21/2009

Military Service Deposit Election {OPM 1515}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

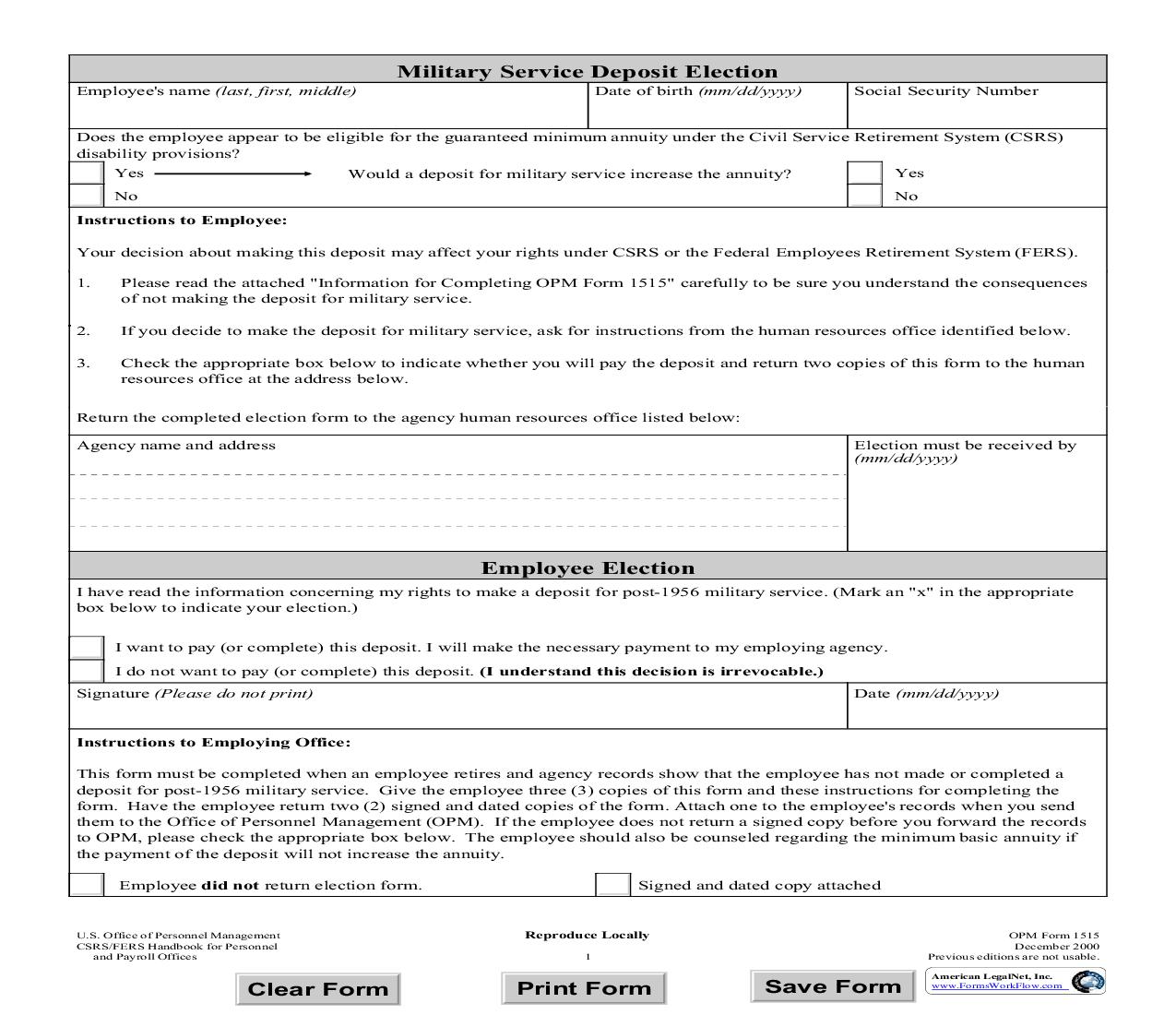

Military Service Deposit Election Employee's name (last, first, middle) Date of birth (mm/dd/yyyy) Social Security Number Does the employee appear to be eligible for the guaranteed minimum annuity under the Civil Service Retirement System (CSRS) disability provisions? Yes No Instructions to Employee: Your decision about making this deposit may affect your rights under CSRS or the Federal Employees Retirement System (FERS). 1. Please read the attached "Information for Completing OPM Form 1515" carefully to be sure you understand the consequences of not making the deposit for military service. If you decide to make the deposit for military service, ask for instructions from the human resources office identified below. Check the appropriate box below to indicate whether you will pay the deposit and return two copies of this form to the human resources office at the address below. Would a deposit for military service increase the annuity? Yes No 2. 3. Return the completed election form to the agency human resources office listed below: Agency name and address Election must be received by (mm/dd/yyyy) Employee Election I have read the information concerning my rights to make a deposit for post-1956 military service. (Mark an "x" in the appropriate box below to indicate your election.) I want to pay (or complete) this deposit. I will make the necessary payment to my employing agency. I do not want to pay (or complete) this deposit. (I understand this decision is irrevocable.) Signature (Please do not print) Date (mm/dd/yyyy) Instructions to Employing Office: This form must be completed when an employee retires and agency records show that the employee has not made or completed a deposit for post-1956 military service. Give the employee three (3) copies of this form and these instructions for completing the form. Have the employee return two (2) signed and dated copies of the form. Attach one to the employee's records when you send them to the Office of Personnel Management (OPM). If the employee does not return a signed copy before you forward the records to OPM, please check the appropriate box below. The employee should also be counseled regarding the minimum basic annuity if the payment of the deposit will not increase the annuity. Employee did not return election form. Signed and dated copy attached U.S. Office of Personnel Management CSRS/FERS Handbook for Personnel and Payroll Offices Reproduce Locally 1 OPM Form 1515 December 2000 Previous editions are not usable. Clear Form Print Form Save Form American LegalNet, Inc. www.FormsWorkFlow.com Information for Completing OPM Form 1515 Military Service Deposit Election Section A (This section applies to all employees) Agency Contact Information: If you need further information, contact _______________________________________________ about making a deposit for your military service that occurred after December 31, 1956. Full Periods of Military Service: Military deposits must cover full periods of military service. For retirement purposes, a period of military service begins with the initial entry on active duty and ends on the date of final discharge or release from active duty. A period of military service includes consecutive periods unless there is a break of at least 1 day. It does not include lost time. The Office of Personnel Management (OPM) will refund partial deposits that do not cover a full period of military service. Effect of Military Retired Pay: You must waive your military retired pay before you can receive credit for the military service for civil service retirement purposes unless you receive retired pay under one of the following reasons. The waiver must be effective before the starting date of your civil service annuity: · · retired pay awarded because of a service-connected disability incurred in combat with an enemy of the United States, or retired pay awarded because of service-connected disability caused by an instrumentality of war and incurred in the line of duty during a period of war, or retired pay awarded under the reserve retiree provision (Chapter 1223 of title 10, United States Code). · NOTE: Current military regulations require that if you enrolled in the military Survivor Benefit Plan (SBP), you must remain enrolled if you waive your military retired pay for civil service credit and you do not elect a survivor annuity under your civil service benefit. You are responsible for making monthly payments for the SBP coverage. Amount of deposit: A Civil Service Retirement System (CSRS) or CSRS Offset military deposit is 7% and a Federal Employment Retirement System (FERS) military deposit is 3% of the basic pay you received during the period of active duty military service plus interest. Military basic pay does not include allowances, flight pay, combat pay, etc. The military deposit percentages of basic pay are slightly higher for military service that occurred in the years 1999 through 2000 (through 2002 for Members of Congress) because there was a temporary increase in retirement deductions for those years. If your military service interrupted Federal civilian employment and you were reemployed under the provisions of chapter 43 of title 38, United States Code on or after August 1, 1990, your military deposit will be the lesser of: · · the required percentage (7% or 3%) of your military basic pay, or the retirement deductions that would have been withheld from your Federal civilian pay if you had remained in that position during your period of military service. Reemployed annuitants: Your civil service annuity amount will not be increased by payment of a military deposit if you have less than 5 years of service as a reemployed annuitant. If you have the equivalent of 5 or more years of service as a reemployed annuitant and you are otherwise eligible for retirement, you may ask OPM to recompute your civil service benefit. If you choose this option, you must make a deposit for all reemployment service that was not covered by retirement deductions. The information contained in this form regarding military deposits applies to recomputed (redetermined) civil service annuities. Alternative Form of Annuity: CSRS retirement law provides an alternative form of annuity (AFA) for an employee retiring under a nondisability retirement who has a life-threatening affliction or critical medical condition. Under the provisions of the law, OPM can deem most service credit deposits paid. They cannot deem the military d