Last updated: 9/21/2009

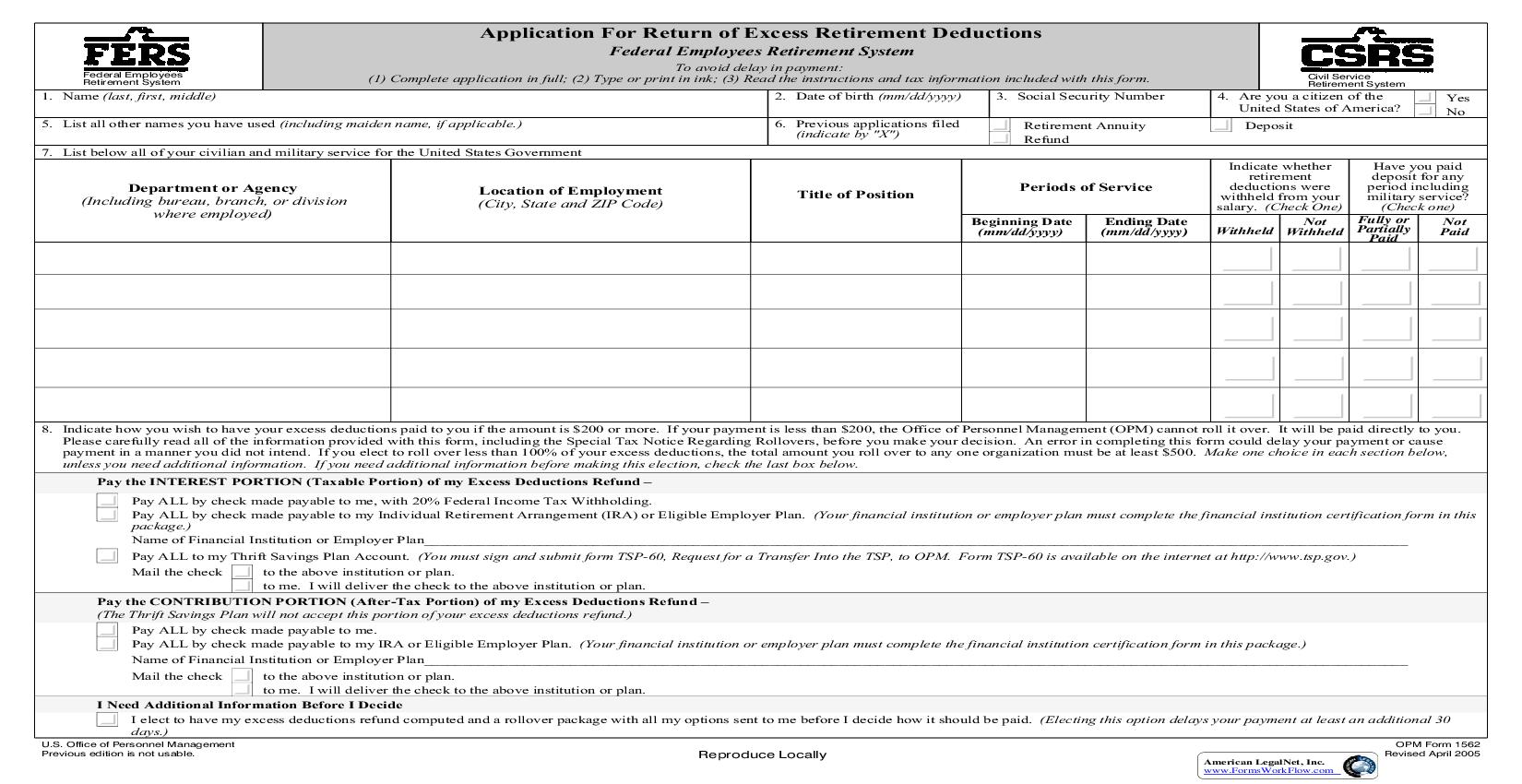

Application For Return Of Excess Retirement Deductions {OPM 1562}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Application For Return of Excess Retirement Deductions Federal Employees Retirement System Federal Employees Retirement System To avoid delay in payment: (1) Complete application in full; (2) Type or print in ink; (3) Read the instructions and tax information included with this form. 2. Date of birth (mm/dd/yyyy) 6. Previous applications filed (indicate by "X") 3. Social Security Number Retirement Annuity Refund Civil Service Retirement System 1. Name (last, first, middle) 5. List all other names you have used (including maiden name, if applicable.) 7. List below all of your civilian and military service for the United States Government 4. Are you a citizen of the United States of America? Deposit Yes No Department or Agency (Including bureau, branch, or division where employed) Location of Employment (City, State and ZIP Code) Title of Position Periods of Service Beginning Date (mm/dd/yyyy) Ending Date (mm/dd/yyyy) Indicate whether Have you paid retirement deposit for any deductions were period including withheld from your military service? salary. (Check One) (Check one) Fully or Not Not Withheld Withheld Partially Paid Paid 8. Indicate how you wish to have your excess deductions paid to you if the amount is $200 or more. If your payment is less than $200, the Office of Personnel Management (OPM) cannot roll it over. It will be paid directly to you. Please carefully read all of the information provided with this form, including the Special Tax Notice Regarding Rollovers, before you make your decision. An error in completing this form could delay your payment or cause payment in a manner you did not intend. If you elect to roll over less than 100% of your excess deductions, the total amount you roll over to any one organization must be at least $500. Make one choice in each section below, unless you need additional information. If you need additional information before making this election, check the last box below. Pay the INTEREST PORTION (Taxable Portion) of my Excess Deductions Refund Pay ALL by check made payable to me, with 20% Federal Income Tax Withholding. Pay ALL by check made payable to my Individual Retirement Arrangement (IRA) or Eligible Employer Plan. (Your financial institution or employer plan must complete the financial institution certification form in this package.) Name of Financial Institution or Employer Plan________________________________________________________________________________________________________________________________ Pay ALL to my Thrift Savings Plan Account. (You must sign and submit form TSP-60, Request for a Transfer Into the TSP, to OPM. Form TSP-60 is available on the internet at http://www.tsp.gov.) to the above institution or plan. to me. I will deliver the check to the above institution or plan. Pay the CONTRIBUTION PORTION (After-Tax Portion) of my Excess Deductions Refund (The Thrift Savings Plan will not accept this portion of your excess deductions refund.) Pay ALL by check made payable to me. Pay ALL by check made payable to my IRA or Eligible Employer Plan. (Your financial institution or employer plan must complete the financial institution certification form in this package.) Name of Financial Institution or Employer Plan________________________________________________________________________________________________________________________________ to the above institution or plan. to me. I will deliver the check to the above institution or plan. I Need Additional Information Before I Decide I elect to have my excess deductions refund computed and a rollover package with all my options sent to me before I decide how it should be paid. (Electing this option delays your payment at least an additional 30 days.) U.S. Office of Personnel Management Previous edition is not usable. Mail the check Mail the check Reproduce Locally OPM Form 1562 Revised April 2005 American LegalNet, Inc. www.FormsWorkFlow.com 9. APPLICANT CERTIFICATION: I hereby certify that all statements in this application, including any information I have given, are true to the best of my belief and knowledge and that the tax withholding election made here reflects my wishes. Your Signature (Do not print) Date (mm/dd/yyyy) WARNING: Any intentional false statement in this application or willful misrepresentation relative thereto is a violation of the law punishable by a fine of not more than $10,000 or imprisonment of not more than 5 years, or both. (18 U.S.C. 1001) 10. Address for mailing refund check (number, street, city, state, ZIP Code) We cannot authorize payment if this address is erased or otherwise changed Telephone Number (including area code) ( ) NOTE: This application should not be offered to a financial institution or other person as collateral or security for a loan. An employee must apply for payment personally and payment must be made directly to him or her. However, outstanding debts to the U.S. Government can, at the Government's request, be withheld from a payment provided all legal requirements are met. Privacy Act Statement Solicitation of this information is authorized by the Civil Service Retirement law (Chapter 83, title 5, U.S. Code) and the Federal Employees Retirement law (Chapter 84, title 5, U.S. Code). The information you furnish will be used to identify records properly associated with your application for Federal benefits, to obtain additional information if necessary, to determine and allow present or future benefits, and to maintain a uniquely identifiable claim file. The information may be shared and is subject to verification, via paper, electronic media, or through the use of computer matching programs, with national, state, local or other charitable or social security administrative agencies in order to determine benefits under their programs, to obtain information necessary for determination or continuation of benefits under this program, or to report income for tax purposes. It may also be shared and verified, as noted above, with law enforcement agencies when they are investigating a violation or potential violation of civil or criminal law. Executive Order 9397 (November 22, 1943) authorizes the use of the Social Security Number. The Government may use your number in collecting and reporting amounts that you owe the Government. Failure to provide information may delay or prevent our determination of your eligibility to receive a refund of your excess retirement deductions. Where to File your Application 1. 2. If you