Last updated: 2/5/2024

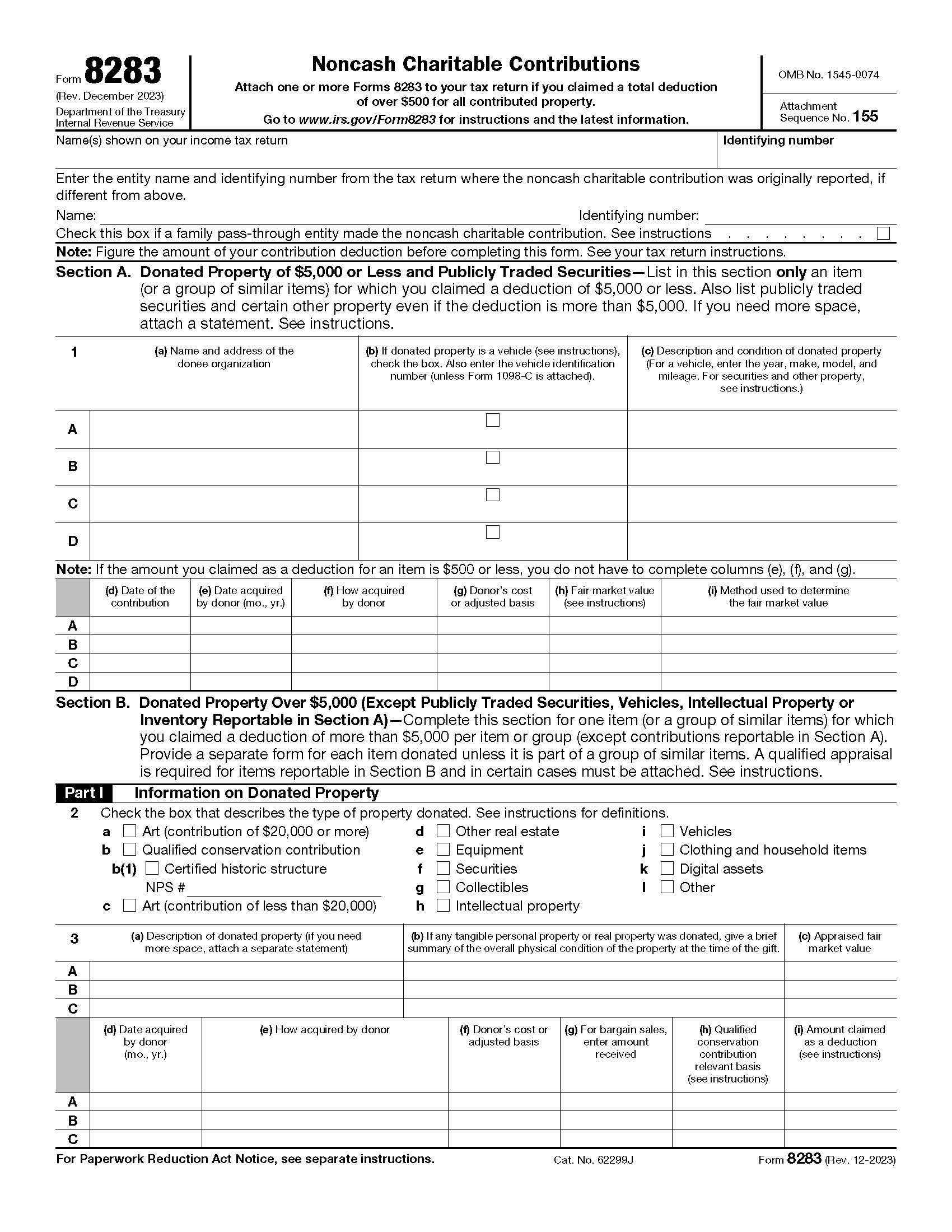

Form 8283 Noncash Charitable Contributions {8283}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form 8283 - NONCASH CHARITABLE CONTRIBUTIONS. Use this form to report information about noncash charitable contributions. Attach one or more Forms 8283 to your tax return if you claimed a total deduction of over $500 for all contributed property. Do not use Form 8283 to report out-of-pocket expenses for volunteer work or amounts you gave by check or credit card. Treat these items as cash contributions. Also, do not use Form 8283 to figure your charitable contribution deduction. For details on how to figure the amount of the deduction, see your tax return instructions and Pub. 526, Charitable Contributions. www.FormsWorkflow.com

Related forms

-

Form 5305 Traditional Individual Retirement Trust Account

Form 5305 Traditional Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-A Tranditional Individual Retirement Custodial Account

Form 5305-A Tranditional Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-E Education Individual Retirement Trust Account

Form 5305-E Education Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-EA Education Individual Retirement Custodial Account

Form 5305-EA Education Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-R Roth Individual Retirement Trust Account

Form 5305-R Roth Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-RA Roth Individual Retirement Custodial Account

Form 5305-RA Roth Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-RB Roth Individual Retirement Annuity Endorsement

Form 5305-RB Roth Individual Retirement Annuity Endorsement

Official Federal Forms/Department Of Treasury/ -

Form 5305-S Simple Individual Retirement Trust Account

Form 5305-S Simple Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-SA SIMPLE Individual Retirement Custodial Account

Form 5305-SA SIMPLE Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-SEP Simplified Employee Pension-Individual Retirement Accounts Contribution Agreement

Form 5305-SEP Simplified Employee Pension-Individual Retirement Accounts Contribution Agreement

Official Federal Forms/Department Of Treasury/ -

Form 5305-B Health Savings Trust Account

Form 5305-B Health Savings Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-C Health Savings Custodial Account

Form 5305-C Health Savings Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Form 5305-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Official Federal Forms/Department Of Treasury/ -

Form 5309 Application For Determination Of Employee Stock Ownership Plan

Form 5309 Application For Determination Of Employee Stock Ownership Plan

Official Federal Forms/Department Of Treasury/ -

Form 966 Corporate Dissolution Or Liquidation

Form 966 Corporate Dissolution Or Liquidation

Official Federal Forms/Department Of Treasury/ -

Form 8928 Return Of Certain Excise Taxes Under Chapter 43

Form 8928 Return Of Certain Excise Taxes Under Chapter 43

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 8038-T

Instructions For Form 8038-T

Official Federal Forms/Department Of Treasury/ -

Form 8038-B Information Return For Build America Bonds

Form 8038-B Information Return For Build America Bonds

Official Federal Forms/Department Of Treasury/ -

Form 8038-TC Information Return For Tax Credit Bonds And Specified Tax Credit Bonds

Form 8038-TC Information Return For Tax Credit Bonds And Specified Tax Credit Bonds

Official Federal Forms/Department Of Treasury/ -

Form 5304-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Form 5304-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Official Federal Forms/Department Of Treasury/ -

Form 2553 Election By A Small Business Corporation

Form 2553 Election By A Small Business Corporation

Official Federal Forms/Department Of Treasury/ -

Form 8950 Application For Voluntary Correction Program (VCP)

Form 8950 Application For Voluntary Correction Program (VCP)

Official Federal Forms/Department Of Treasury/ -

Form 8951 Compliance Fee For Application For Voluntary Correction Program (VCP)

Form 8951 Compliance Fee For Application For Voluntary Correction Program (VCP)

Official Federal Forms/Department Of Treasury/ -

Form 4421 Declaration Executors Commissioners And Attorneys Fees

Form 4421 Declaration Executors Commissioners And Attorneys Fees

Official Federal Forms/Department Of Treasury/ -

Form 14568 E Appendix C Part II Schedule 5 Plan Loan Failures

Form 14568 E Appendix C Part II Schedule 5 Plan Loan Failures

Official Federal Forms/Department Of Treasury/ -

Form 14568 H Appendix C Part II Schedule 8 Failure To Pay Required Minimum

Form 14568 H Appendix C Part II Schedule 8 Failure To Pay Required Minimum

Official Federal Forms/Department Of Treasury/ -

Form 14568-I Appendix C Part II Schedule 9 Correction By Plan Amendment

Form 14568-I Appendix C Part II Schedule 9 Correction By Plan Amendment

Official Federal Forms/Department Of Treasury/ -

Form 4876-A Election To Be Treated As An Interest Charge DISC

Form 4876-A Election To Be Treated As An Interest Charge DISC

Official Federal Forms/Department Of Treasury/ -

Form 8971 Information Regarding Beneficiaries Acquiring Property From A Decedent

Form 8971 Information Regarding Beneficiaries Acquiring Property From A Decedent

Official Federal Forms/Department Of Treasury/ -

Form 14135 Application For Certificate Of Discharge Of Property From Federal Tax

Form 14135 Application For Certificate Of Discharge Of Property From Federal Tax

Official Federal Forms/Department Of Treasury/ -

Form 5305-A-SEP Salary Reduction And Other Elective Simplified Employee Pension

Form 5305-A-SEP Salary Reduction And Other Elective Simplified Employee Pension

Official Federal Forms/Department Of Treasury/ -

Form 8940 Request For Miscellaneous Determination

Form 8940 Request For Miscellaneous Determination

Official Federal Forms/Department Of Treasury/ -

Form 5310-A Notice Of Plan Merger Or Consolidation Spinoff Or Transfer Of Plan Assets Or Liabilities

Form 5310-A Notice Of Plan Merger Or Consolidation Spinoff Or Transfer Of Plan Assets Or Liabilities

Official Federal Forms/Department Of Treasury/ -

Form 5306 Application For Approval Of Prototype Or Employer Sponsored Individual Retirement Account

Form 5306 Application For Approval Of Prototype Or Employer Sponsored Individual Retirement Account

Official Federal Forms/Department Of Treasury/ -

Form 5306-A Application For Approval Of Prototypes Simplified Employee Pension (SEP)

Form 5306-A Application For Approval Of Prototypes Simplified Employee Pension (SEP)

Official Federal Forms/Department Of Treasury/ -

Form 14429 Tax Exempt Bonds Voluntary Closing Agreement Program Request

Form 14429 Tax Exempt Bonds Voluntary Closing Agreement Program Request

Official Federal Forms/Department Of Treasury/ -

Form 14568-F Appendix C Part II Schedule 6 Employer Eligibility Failure

Form 14568-F Appendix C Part II Schedule 6 Employer Eligibility Failure

Official Federal Forms/Department Of Treasury/ -

Form 14568-G Appendix C Part II Schedule 7 Failure To Distribute Elective Deferrals

Form 14568-G Appendix C Part II Schedule 7 Failure To Distribute Elective Deferrals

Official Federal Forms/Department Of Treasury/ -

Form 5308 Request For Change In Plan-Trust Year

Form 5308 Request For Change In Plan-Trust Year

Official Federal Forms/Department Of Treasury/ -

Form 4768 Application For Extension To File A Return-Estate-Taxes

Form 4768 Application For Extension To File A Return-Estate-Taxes

Official Federal Forms/Department Of Treasury/ -

Form 5471 Information Return Of US Person With Respect To Certain Foreign Corporations

Form 5471 Information Return Of US Person With Respect To Certain Foreign Corporations

Official Federal Forms/Department Of Treasury/ -

Form 8822-B Change Of Address Or Responsible Party-Business

Form 8822-B Change Of Address Or Responsible Party-Business

Official Federal Forms/Department Of Treasury/ -

Form 8821 Tax Information Authorization

Form 8821 Tax Information Authorization

Official Federal Forms/Department Of Treasury/ -

Form 8822 Change Of Address

Form 8822 Change Of Address

Official Federal Forms/Department Of Treasury/ -

Form 4422 Application For Certificate Discharging Property Subject To Estate Tax Lien

Form 4422 Application For Certificate Discharging Property Subject To Estate Tax Lien

Official Federal Forms/Department Of Treasury/ -

5310-A Instructions

5310-A Instructions

Official Federal Forms/Department Of Treasury/ -

Form W-8BEN Certificate Of Foreign Status Of Beneficial Owner-Tax Withholding

Form W-8BEN Certificate Of Foreign Status Of Beneficial Owner-Tax Withholding

Official Federal Forms/Department Of Treasury/ -

Form 8038-G Information Return For Tax-Exempt Governmental Obligations

Form 8038-G Information Return For Tax-Exempt Governmental Obligations

Official Federal Forms/Department Of Treasury/ -

Form 8038-GC Information Return For Small Tax-Exempt Governmental Bond Issues

Form 8038-GC Information Return For Small Tax-Exempt Governmental Bond Issues

Official Federal Forms/Department Of Treasury/ -

Form 8038-T Arbitrage Rebate Yield Reduction And Penalty In Lieu Of Arbitrage Rebate

Form 8038-T Arbitrage Rebate Yield Reduction And Penalty In Lieu Of Arbitrage Rebate

Official Federal Forms/Department Of Treasury/ -

Form W-8BEN-E Certificate Of Entities Status Of Beneficial Owner-Tax Withholding

Form W-8BEN-E Certificate Of Entities Status Of Beneficial Owner-Tax Withholding

Official Federal Forms/Department Of Treasury/ -

Form 8038-R Request For Recovery Of Overpayments Under Arbitrage Rebate Provisions

Form 8038-R Request For Recovery Of Overpayments Under Arbitrage Rebate Provisions

Official Federal Forms/Department Of Treasury/ -

Form 8718 User Fee For Exempt Organization Determination Letter Request

Form 8718 User Fee For Exempt Organization Determination Letter Request

Official Federal Forms/Department Of Treasury/ -

Form 8609 Low Income Housing Credit Allocation And Certification

Form 8609 Low Income Housing Credit Allocation And Certification

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 8950 Application For Voluntary Correction Program (VCP) Submission

Instructions For Form 8950 Application For Voluntary Correction Program (VCP) Submission

Official Federal Forms/Department Of Treasury/ -

Form 8038-CP Return For Credit Payments To Issuers Of Qualified Bonds

Form 8038-CP Return For Credit Payments To Issuers Of Qualified Bonds

Official Federal Forms/Department Of Treasury/ -

Form 14497 Notice Of Nonjudicial Sale Of Property

Form 14497 Notice Of Nonjudicial Sale Of Property

Official Federal Forms/Department Of Treasury/ -

Form 14498 Application For Consent To Sale Of Property

Form 14498 Application For Consent To Sale Of Property

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 8038

Instructions For Form 8038

Official Federal Forms/Department Of Treasury/ -

Form 8717 User Fee For Employee Plan Determination

Form 8717 User Fee For Employee Plan Determination

Official Federal Forms/Department Of Treasury/ -

Form 8832 Entity Classification Election

Form 8832 Entity Classification Election

Official Federal Forms/Department Of Treasury/ -

Form 56 Notice Concerning Fiduciary Relationship

Form 56 Notice Concerning Fiduciary Relationship

Official Federal Forms/Department Of Treasury/ -

Form 56-F Notice Concerning Fiduciary Relationship Of Financial Institution

Form 56-F Notice Concerning Fiduciary Relationship Of Financial Institution

Official Federal Forms/Department Of Treasury/ -

Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)

Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)

Official Federal Forms/Department Of Treasury/ -

Form 5330 Return Of Excise Taxes Related To Employee Benefit Plans

Form 5330 Return Of Excise Taxes Related To Employee Benefit Plans

Official Federal Forms/Department Of Treasury/ -

5300 Instructions

5300 Instructions

Official Federal Forms/Department Of Treasury/ -

Form 14568 Model VCP Compliance Statement

Form 14568 Model VCP Compliance Statement

Official Federal Forms/Department Of Treasury/ -

Form 14568-A Model VCP Compliance Statement Schedule 1 Interim Nonamender Failures

Form 14568-A Model VCP Compliance Statement Schedule 1 Interim Nonamender Failures

Official Federal Forms/Department Of Treasury/ -

Form 14568-B Model VCP Compliance Statement Schedule 2 Other Nonamender Failures

Form 14568-B Model VCP Compliance Statement Schedule 2 Other Nonamender Failures

Official Federal Forms/Department Of Treasury/ -

Form 14568-C Model VCP Compliance Statement Schedule 3 SEPs And SARSEPs

Form 14568-C Model VCP Compliance Statement Schedule 3 SEPs And SARSEPs

Official Federal Forms/Department Of Treasury/ -

Form 14568-D Model VCP Compliance Statement Schedule 4 SIMPLE IRAs

Form 14568-D Model VCP Compliance Statement Schedule 4 SIMPLE IRAs

Official Federal Forms/Department Of Treasury/ -

Form 3520-A Annual Information Return Of Foreign Trust With A US Owner

Form 3520-A Annual Information Return Of Foreign Trust With A US Owner

Official Federal Forms/Department Of Treasury/ -

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt

Official Federal Forms/Department Of Treasury/ -

Instructions For Form SS-4 Application For Employer Identification Number

Instructions For Form SS-4 Application For Employer Identification Number

Official Federal Forms/Department Of Treasury/ -

Form 8283 Noncash Charitable Contributions

Form 8283 Noncash Charitable Contributions

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 5330

Instructions For Form 5330

Official Federal Forms/Department Of Treasury/ -

Form 4180 Report Of Interview With Individual Relative To Trust Fund Recovery

Form 4180 Report Of Interview With Individual Relative To Trust Fund Recovery

Official Federal Forms/Department Of Treasury/ -

Request For Tax Payer Identification Number And Certification

Request For Tax Payer Identification Number And Certification

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule B Interest And Ordinary Dividends

Form 1040 Schedule B Interest And Ordinary Dividends

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule E Supplement Income And Loss

Form 1040 Schedule E Supplement Income And Loss

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule SE Self-Employment Tax

Form 1040 Schedule SE Self-Employment Tax

Official Federal Forms/Department Of Treasury/ -

Form 8865 Return Of US Persons With Respect To Certain Foreign Partnerships

Form 8865 Return Of US Persons With Respect To Certain Foreign Partnerships

Official Federal Forms/Department Of Treasury/ -

Form 1041-V Payment Voucher

Form 1041-V Payment Voucher

Official Federal Forms/Department Of Treasury/ -

Form 8960 Net Investment Income Tax-Individuals Estates And Trusts

Form 8960 Net Investment Income Tax-Individuals Estates And Trusts

Official Federal Forms/Department Of Treasury/ -

Form 990 Or 990-EZ Schedule C Political Campaign And Lobbying Activities

Form 990 Or 990-EZ Schedule C Political Campaign And Lobbying Activities

Official Federal Forms/Department Of Treasury/ -

Form 8582 Passive Activity Loss Limitations

Form 8582 Passive Activity Loss Limitations

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule D Capital Gains And Losses

Form 1040 Schedule D Capital Gains And Losses

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule A Itemized Deductions

Form 1040 Schedule A Itemized Deductions

Official Federal Forms/Department Of Treasury/ -

Form 6251 Alternative Minimum Tax-Individuals

Form 6251 Alternative Minimum Tax-Individuals

Official Federal Forms/Department Of Treasury/ -

Form 1040 US Individual Income Tax Return

Form 1040 US Individual Income Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 990 Return Of Organization Exempt For Income Tax

Form 990 Return Of Organization Exempt For Income Tax

Official Federal Forms/Department Of Treasury/ -

Form 4797 Sales Of Business Property

Form 4797 Sales Of Business Property

Official Federal Forms/Department Of Treasury/ -

Form 8949 Sales And Other Dispositions Of Capital Assets

Form 8949 Sales And Other Dispositions Of Capital Assets

Official Federal Forms/Department Of Treasury/ -

Form W-4 Employees Withholding Certificate

Form W-4 Employees Withholding Certificate

Official Federal Forms/Department Of Treasury/ -

Form 4868 Application For Automatic Extension Of Time To File

Form 4868 Application For Automatic Extension Of Time To File

Official Federal Forms/Department Of Treasury/ -

Form 4562 Depreciation And Amortization

Form 4562 Depreciation And Amortization

Official Federal Forms/Department Of Treasury/ -

Form 843 Claim For Refund And Request For Abatement

Form 843 Claim For Refund And Request For Abatement

Official Federal Forms/Department Of Treasury/ -

Form 8606 Nondeductible IRAs

Form 8606 Nondeductible IRAs

Official Federal Forms/Department Of Treasury/ -

Form 8868 Application For Extension Of Time To File An Exempt Organization

Form 8868 Application For Extension Of Time To File An Exempt Organization

Official Federal Forms/Department Of Treasury/ -

Form 990 Schedule D Supplemental Financial Statements

Form 990 Schedule D Supplemental Financial Statements

Official Federal Forms/Department Of Treasury/ -

Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 990 990-EZ Or 990-PF Schedule B Schedule Of Contributors

Form 990 990-EZ Or 990-PF Schedule B Schedule Of Contributors

Official Federal Forms/Department Of Treasury/ -

5307 Instructions For Form 5307

5307 Instructions For Form 5307

Official Federal Forms/Department Of Treasury/ -

Form 2848 Power Of Attorney And Declaration Of Representative

Form 2848 Power Of Attorney And Declaration Of Representative

Official Federal Forms/Department Of Treasury/ -

Form 990 Schedule J Compensation Information

Form 990 Schedule J Compensation Information

Official Federal Forms/Department Of Treasury/ -

Form 990 Schedule O Supplemental Information To Form 990 Or 990-EZ

Form 990 Schedule O Supplemental Information To Form 990 Or 990-EZ

Official Federal Forms/Department Of Treasury/ -

Form 5558 Application For Extension Of Time To File Certain Employee Plan Returns

Form 5558 Application For Extension Of Time To File Certain Employee Plan Returns

Official Federal Forms/Department Of Treasury/ -

Form 8892 Application For Automatic Extension Of Time To File Form 709

Form 8892 Application For Automatic Extension Of Time To File Form 709

Official Federal Forms/Department Of Treasury/ -

Form 1041 US Income Tax Return For Estates And Trusts

Form 1041 US Income Tax Return For Estates And Trusts

Official Federal Forms/Department Of Treasury/ -

5310 Instructions

5310 Instructions

Official Federal Forms/Department Of Treasury/ -

Form 4506-T Request for Transcript of Tax Return

Form 4506-T Request for Transcript of Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 4506 Request For Copy Of Tax Return

Form 4506 Request For Copy Of Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 706-NA United States Estate (And Generation-Skipping Transfer) Tax Return

Form 706-NA United States Estate (And Generation-Skipping Transfer) Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 706 United States Estate (And Generation-Skipping Transfer) Tax Return

Form 706 United States Estate (And Generation-Skipping Transfer) Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 8038 Information Return For Tax-Exempt Private Activity Bond Issues

Form 8038 Information Return For Tax-Exempt Private Activity Bond Issues

Official Federal Forms/Department Of Treasury/ -

Form SS-4 Application For Employer Identification Number

Form SS-4 Application For Employer Identification Number

Official Federal Forms/Department Of Treasury/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!