Official Federal Forms

Department Of Treasury

200 Ratings

200 Ratings

Last updated: 8/15/2018

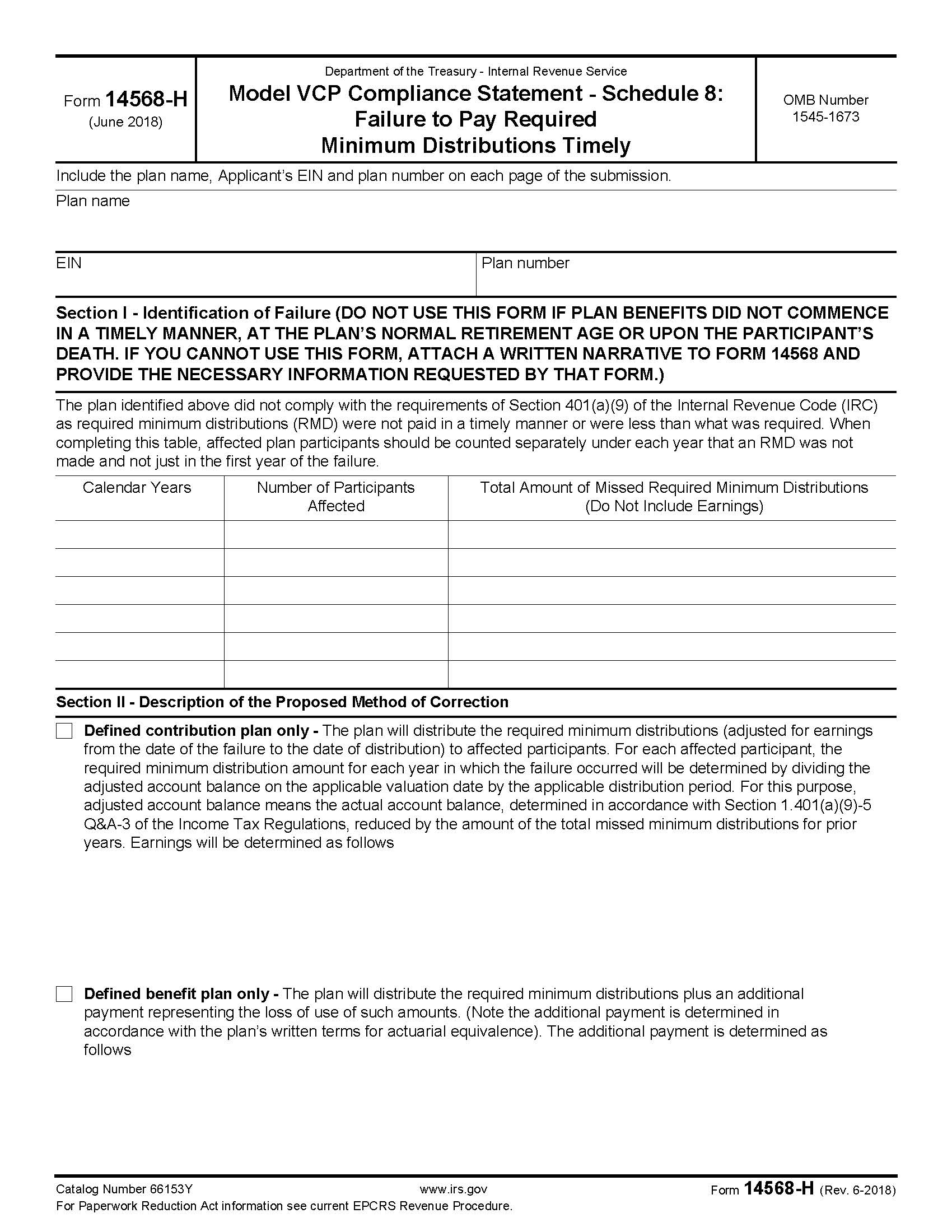

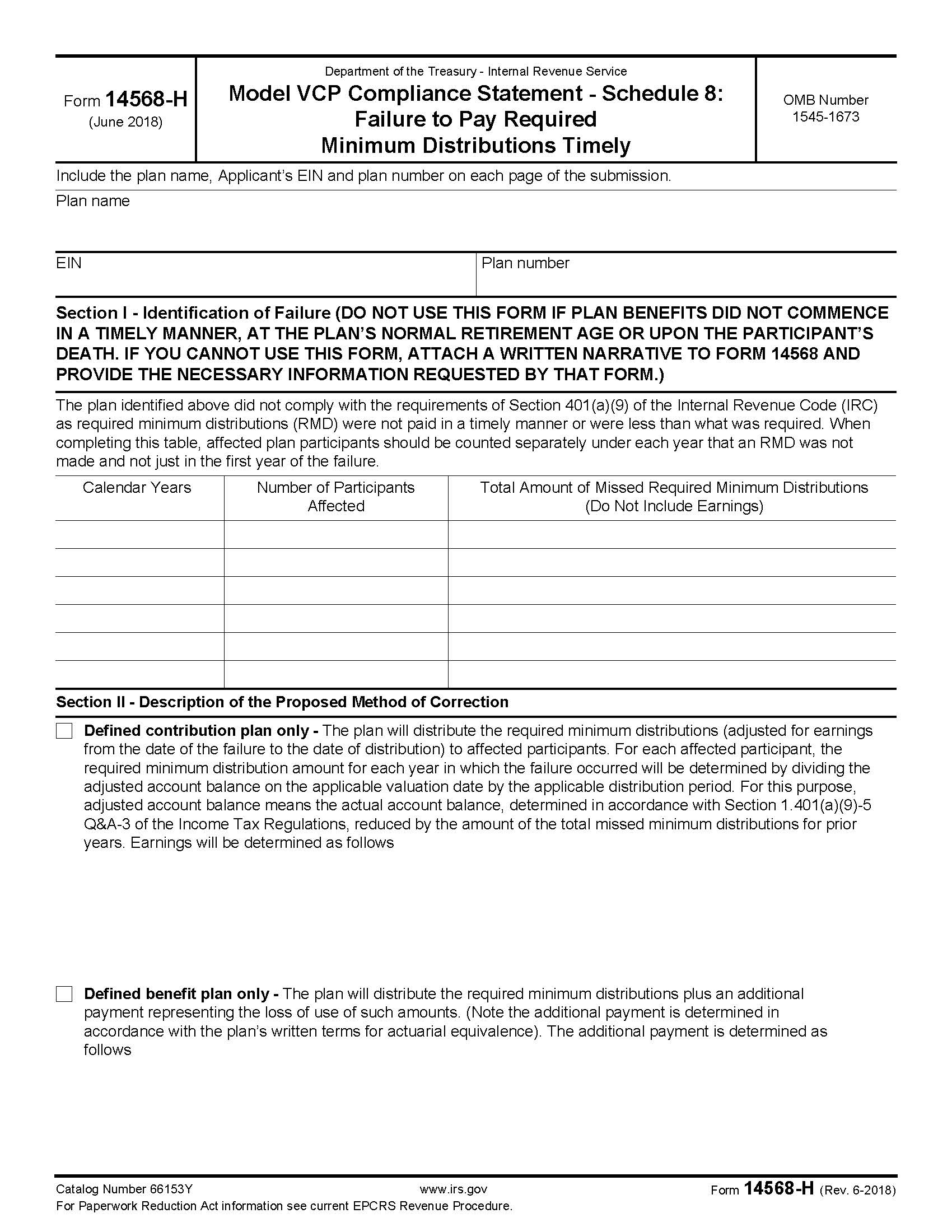

Form 14568 H Appendix C Part II Schedule 8 Failure To Pay Required Minimum {14568-H}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form 14568-H (Rev. 6-2018), Model VCP Compliance Statement - Schedule 8: Failure to Pay Required Minimum Distributions Timely, If the plan failed to make required minimum distributions pursuant to § 401(a)(9) and proposes to correct such failure using the method described in Appendix A, section .06, the Plan Sponsor may submit Form 14568-H. www.FormsWorkflow.com

Related forms

-

Form 5305 Traditional Individual Retirement Trust Account

Form 5305 Traditional Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-A Tranditional Individual Retirement Custodial Account

Form 5305-A Tranditional Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-E Education Individual Retirement Trust Account

Form 5305-E Education Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-EA Education Individual Retirement Custodial Account

Form 5305-EA Education Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-R Roth Individual Retirement Trust Account

Form 5305-R Roth Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-RA Roth Individual Retirement Custodial Account

Form 5305-RA Roth Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-RB Roth Individual Retirement Annuity Endorsement

Form 5305-RB Roth Individual Retirement Annuity Endorsement

Official Federal Forms/Department Of Treasury/ -

Form 5305-S Simple Individual Retirement Trust Account

Form 5305-S Simple Individual Retirement Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-SA SIMPLE Individual Retirement Custodial Account

Form 5305-SA SIMPLE Individual Retirement Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-SEP Simplified Employee Pension-Individual Retirement Accounts Contribution Agreement

Form 5305-SEP Simplified Employee Pension-Individual Retirement Accounts Contribution Agreement

Official Federal Forms/Department Of Treasury/ -

Form 5305-B Health Savings Trust Account

Form 5305-B Health Savings Trust Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-C Health Savings Custodial Account

Form 5305-C Health Savings Custodial Account

Official Federal Forms/Department Of Treasury/ -

Form 5305-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Form 5305-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Official Federal Forms/Department Of Treasury/ -

Form 5309 Application For Determination Of Employee Stock Ownership Plan

Form 5309 Application For Determination Of Employee Stock Ownership Plan

Official Federal Forms/Department Of Treasury/ -

Form 966 Corporate Dissolution Or Liquidation

Form 966 Corporate Dissolution Or Liquidation

Official Federal Forms/Department Of Treasury/ -

Form 8928 Return Of Certain Excise Taxes Under Chapter 43

Form 8928 Return Of Certain Excise Taxes Under Chapter 43

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 8038-T

Instructions For Form 8038-T

Official Federal Forms/Department Of Treasury/ -

Form 8038-B Information Return For Build America Bonds

Form 8038-B Information Return For Build America Bonds

Official Federal Forms/Department Of Treasury/ -

Form 8038-TC Information Return For Tax Credit Bonds And Specified Tax Credit Bonds

Form 8038-TC Information Return For Tax Credit Bonds And Specified Tax Credit Bonds

Official Federal Forms/Department Of Treasury/ -

Form 5304-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Form 5304-SIMPLE Savings Incentive Match Plan For Employees Of Small Employers (SIMPLE)

Official Federal Forms/Department Of Treasury/ -

Form 2553 Election By A Small Business Corporation

Form 2553 Election By A Small Business Corporation

Official Federal Forms/Department Of Treasury/ -

Form 8950 Application For Voluntary Correction Program (VCP)

Form 8950 Application For Voluntary Correction Program (VCP)

Official Federal Forms/Department Of Treasury/ -

Form 8951 Compliance Fee For Application For Voluntary Correction Program (VCP)

Form 8951 Compliance Fee For Application For Voluntary Correction Program (VCP)

Official Federal Forms/Department Of Treasury/ -

Form 4421 Declaration Executors Commissioners And Attorneys Fees

Form 4421 Declaration Executors Commissioners And Attorneys Fees

Official Federal Forms/Department Of Treasury/ -

Form 14568 E Appendix C Part II Schedule 5 Plan Loan Failures

Form 14568 E Appendix C Part II Schedule 5 Plan Loan Failures

Official Federal Forms/Department Of Treasury/ -

Form 14568 H Appendix C Part II Schedule 8 Failure To Pay Required Minimum

Form 14568 H Appendix C Part II Schedule 8 Failure To Pay Required Minimum

Official Federal Forms/Department Of Treasury/ -

Form 14568-I Appendix C Part II Schedule 9 Correction By Plan Amendment

Form 14568-I Appendix C Part II Schedule 9 Correction By Plan Amendment

Official Federal Forms/Department Of Treasury/ -

Form 4876-A Election To Be Treated As An Interest Charge DISC

Form 4876-A Election To Be Treated As An Interest Charge DISC

Official Federal Forms/Department Of Treasury/ -

Form 8971 Information Regarding Beneficiaries Acquiring Property From A Decedent

Form 8971 Information Regarding Beneficiaries Acquiring Property From A Decedent

Official Federal Forms/Department Of Treasury/ -

Form 14135 Application For Certificate Of Discharge Of Property From Federal Tax

Form 14135 Application For Certificate Of Discharge Of Property From Federal Tax

Official Federal Forms/Department Of Treasury/ -

Form 5305-A-SEP Salary Reduction And Other Elective Simplified Employee Pension

Form 5305-A-SEP Salary Reduction And Other Elective Simplified Employee Pension

Official Federal Forms/Department Of Treasury/ -

Form 8940 Request For Miscellaneous Determination

Form 8940 Request For Miscellaneous Determination

Official Federal Forms/Department Of Treasury/ -

Form 5310-A Notice Of Plan Merger Or Consolidation Spinoff Or Transfer Of Plan Assets Or Liabilities

Form 5310-A Notice Of Plan Merger Or Consolidation Spinoff Or Transfer Of Plan Assets Or Liabilities

Official Federal Forms/Department Of Treasury/ -

Form 5306 Application For Approval Of Prototype Or Employer Sponsored Individual Retirement Account

Form 5306 Application For Approval Of Prototype Or Employer Sponsored Individual Retirement Account

Official Federal Forms/Department Of Treasury/ -

Form 5306-A Application For Approval Of Prototypes Simplified Employee Pension (SEP)

Form 5306-A Application For Approval Of Prototypes Simplified Employee Pension (SEP)

Official Federal Forms/Department Of Treasury/ -

Form 14429 Tax Exempt Bonds Voluntary Closing Agreement Program Request

Form 14429 Tax Exempt Bonds Voluntary Closing Agreement Program Request

Official Federal Forms/Department Of Treasury/ -

Form 14568-F Appendix C Part II Schedule 6 Employer Eligibility Failure

Form 14568-F Appendix C Part II Schedule 6 Employer Eligibility Failure

Official Federal Forms/Department Of Treasury/ -

Form 14568-G Appendix C Part II Schedule 7 Failure To Distribute Elective Deferrals

Form 14568-G Appendix C Part II Schedule 7 Failure To Distribute Elective Deferrals

Official Federal Forms/Department Of Treasury/ -

Form 5308 Request For Change In Plan-Trust Year

Form 5308 Request For Change In Plan-Trust Year

Official Federal Forms/Department Of Treasury/ -

Form 4768 Application For Extension To File A Return-Estate-Taxes

Form 4768 Application For Extension To File A Return-Estate-Taxes

Official Federal Forms/Department Of Treasury/ -

Form 5471 Information Return Of US Person With Respect To Certain Foreign Corporations

Form 5471 Information Return Of US Person With Respect To Certain Foreign Corporations

Official Federal Forms/Department Of Treasury/ -

Form 8822-B Change Of Address Or Responsible Party-Business

Form 8822-B Change Of Address Or Responsible Party-Business

Official Federal Forms/Department Of Treasury/ -

Form 8821 Tax Information Authorization

Form 8821 Tax Information Authorization

Official Federal Forms/Department Of Treasury/ -

Form 8822 Change Of Address

Form 8822 Change Of Address

Official Federal Forms/Department Of Treasury/ -

Form 4422 Application For Certificate Discharging Property Subject To Estate Tax Lien

Form 4422 Application For Certificate Discharging Property Subject To Estate Tax Lien

Official Federal Forms/Department Of Treasury/ -

5310-A Instructions

5310-A Instructions

Official Federal Forms/Department Of Treasury/ -

Form W-8BEN Certificate Of Foreign Status Of Beneficial Owner-Tax Withholding

Form W-8BEN Certificate Of Foreign Status Of Beneficial Owner-Tax Withholding

Official Federal Forms/Department Of Treasury/ -

Form 8038-G Information Return For Tax-Exempt Governmental Obligations

Form 8038-G Information Return For Tax-Exempt Governmental Obligations

Official Federal Forms/Department Of Treasury/ -

Form 8038-GC Information Return For Small Tax-Exempt Governmental Bond Issues

Form 8038-GC Information Return For Small Tax-Exempt Governmental Bond Issues

Official Federal Forms/Department Of Treasury/ -

Form 8038-T Arbitrage Rebate Yield Reduction And Penalty In Lieu Of Arbitrage Rebate

Form 8038-T Arbitrage Rebate Yield Reduction And Penalty In Lieu Of Arbitrage Rebate

Official Federal Forms/Department Of Treasury/ -

Form W-8BEN-E Certificate Of Entities Status Of Beneficial Owner-Tax Withholding

Form W-8BEN-E Certificate Of Entities Status Of Beneficial Owner-Tax Withholding

Official Federal Forms/Department Of Treasury/ -

Form 8038-R Request For Recovery Of Overpayments Under Arbitrage Rebate Provisions

Form 8038-R Request For Recovery Of Overpayments Under Arbitrage Rebate Provisions

Official Federal Forms/Department Of Treasury/ -

Form 8718 User Fee For Exempt Organization Determination Letter Request

Form 8718 User Fee For Exempt Organization Determination Letter Request

Official Federal Forms/Department Of Treasury/ -

Form 8609 Low Income Housing Credit Allocation And Certification

Form 8609 Low Income Housing Credit Allocation And Certification

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 8950 Application For Voluntary Correction Program (VCP) Submission

Instructions For Form 8950 Application For Voluntary Correction Program (VCP) Submission

Official Federal Forms/Department Of Treasury/ -

Form 8038-CP Return For Credit Payments To Issuers Of Qualified Bonds

Form 8038-CP Return For Credit Payments To Issuers Of Qualified Bonds

Official Federal Forms/Department Of Treasury/ -

Form 14497 Notice Of Nonjudicial Sale Of Property

Form 14497 Notice Of Nonjudicial Sale Of Property

Official Federal Forms/Department Of Treasury/ -

Form 14498 Application For Consent To Sale Of Property

Form 14498 Application For Consent To Sale Of Property

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 8038

Instructions For Form 8038

Official Federal Forms/Department Of Treasury/ -

Form 8717 User Fee For Employee Plan Determination

Form 8717 User Fee For Employee Plan Determination

Official Federal Forms/Department Of Treasury/ -

Form 8832 Entity Classification Election

Form 8832 Entity Classification Election

Official Federal Forms/Department Of Treasury/ -

Form 56 Notice Concerning Fiduciary Relationship

Form 56 Notice Concerning Fiduciary Relationship

Official Federal Forms/Department Of Treasury/ -

Form 56-F Notice Concerning Fiduciary Relationship Of Financial Institution

Form 56-F Notice Concerning Fiduciary Relationship Of Financial Institution

Official Federal Forms/Department Of Treasury/ -

Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)

Form 8833 Treaty-Based Return Position Disclosure Under Section 6114 or 7701(b)

Official Federal Forms/Department Of Treasury/ -

Form 5330 Return Of Excise Taxes Related To Employee Benefit Plans

Form 5330 Return Of Excise Taxes Related To Employee Benefit Plans

Official Federal Forms/Department Of Treasury/ -

5300 Instructions

5300 Instructions

Official Federal Forms/Department Of Treasury/ -

Form 14568 Model VCP Compliance Statement

Form 14568 Model VCP Compliance Statement

Official Federal Forms/Department Of Treasury/ -

Form 14568-A Model VCP Compliance Statement Schedule 1 Interim Nonamender Failures

Form 14568-A Model VCP Compliance Statement Schedule 1 Interim Nonamender Failures

Official Federal Forms/Department Of Treasury/ -

Form 14568-B Model VCP Compliance Statement Schedule 2 Other Nonamender Failures

Form 14568-B Model VCP Compliance Statement Schedule 2 Other Nonamender Failures

Official Federal Forms/Department Of Treasury/ -

Form 14568-C Model VCP Compliance Statement Schedule 3 SEPs And SARSEPs

Form 14568-C Model VCP Compliance Statement Schedule 3 SEPs And SARSEPs

Official Federal Forms/Department Of Treasury/ -

Form 14568-D Model VCP Compliance Statement Schedule 4 SIMPLE IRAs

Form 14568-D Model VCP Compliance Statement Schedule 4 SIMPLE IRAs

Official Federal Forms/Department Of Treasury/ -

Form 3520-A Annual Information Return Of Foreign Trust With A US Owner

Form 3520-A Annual Information Return Of Foreign Trust With A US Owner

Official Federal Forms/Department Of Treasury/ -

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt

Form 3520 Annual Return To Report Transactions With Foreign Trusts And Receipt

Official Federal Forms/Department Of Treasury/ -

Instructions For Form SS-4 Application For Employer Identification Number

Instructions For Form SS-4 Application For Employer Identification Number

Official Federal Forms/Department Of Treasury/ -

Form 8283 Noncash Charitable Contributions

Form 8283 Noncash Charitable Contributions

Official Federal Forms/Department Of Treasury/ -

Instructions For Form 5330

Instructions For Form 5330

Official Federal Forms/Department Of Treasury/ -

Form 4180 Report Of Interview With Individual Relative To Trust Fund Recovery

Form 4180 Report Of Interview With Individual Relative To Trust Fund Recovery

Official Federal Forms/Department Of Treasury/ -

Request For Tax Payer Identification Number And Certification

Request For Tax Payer Identification Number And Certification

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule B Interest And Ordinary Dividends

Form 1040 Schedule B Interest And Ordinary Dividends

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule E Supplement Income And Loss

Form 1040 Schedule E Supplement Income And Loss

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule SE Self-Employment Tax

Form 1040 Schedule SE Self-Employment Tax

Official Federal Forms/Department Of Treasury/ -

Form 8865 Return Of US Persons With Respect To Certain Foreign Partnerships

Form 8865 Return Of US Persons With Respect To Certain Foreign Partnerships

Official Federal Forms/Department Of Treasury/ -

Form 1041-V Payment Voucher

Form 1041-V Payment Voucher

Official Federal Forms/Department Of Treasury/ -

Form 8960 Net Investment Income Tax-Individuals Estates And Trusts

Form 8960 Net Investment Income Tax-Individuals Estates And Trusts

Official Federal Forms/Department Of Treasury/ -

Form 990 Or 990-EZ Schedule C Political Campaign And Lobbying Activities

Form 990 Or 990-EZ Schedule C Political Campaign And Lobbying Activities

Official Federal Forms/Department Of Treasury/ -

Form 8582 Passive Activity Loss Limitations

Form 8582 Passive Activity Loss Limitations

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule D Capital Gains And Losses

Form 1040 Schedule D Capital Gains And Losses

Official Federal Forms/Department Of Treasury/ -

Form 1040 Schedule A Itemized Deductions

Form 1040 Schedule A Itemized Deductions

Official Federal Forms/Department Of Treasury/ -

Form 6251 Alternative Minimum Tax-Individuals

Form 6251 Alternative Minimum Tax-Individuals

Official Federal Forms/Department Of Treasury/ -

Form 1040 US Individual Income Tax Return

Form 1040 US Individual Income Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 990 Return Of Organization Exempt For Income Tax

Form 990 Return Of Organization Exempt For Income Tax

Official Federal Forms/Department Of Treasury/ -

Form 4797 Sales Of Business Property

Form 4797 Sales Of Business Property

Official Federal Forms/Department Of Treasury/ -

Form 8949 Sales And Other Dispositions Of Capital Assets

Form 8949 Sales And Other Dispositions Of Capital Assets

Official Federal Forms/Department Of Treasury/ -

Form W-4 Employees Withholding Certificate

Form W-4 Employees Withholding Certificate

Official Federal Forms/Department Of Treasury/ -

Form 4868 Application For Automatic Extension Of Time To File

Form 4868 Application For Automatic Extension Of Time To File

Official Federal Forms/Department Of Treasury/ -

Form 4562 Depreciation And Amortization

Form 4562 Depreciation And Amortization

Official Federal Forms/Department Of Treasury/ -

Form 843 Claim For Refund And Request For Abatement

Form 843 Claim For Refund And Request For Abatement

Official Federal Forms/Department Of Treasury/ -

Form 8606 Nondeductible IRAs

Form 8606 Nondeductible IRAs

Official Federal Forms/Department Of Treasury/ -

Form 8868 Application For Extension Of Time To File An Exempt Organization

Form 8868 Application For Extension Of Time To File An Exempt Organization

Official Federal Forms/Department Of Treasury/ -

Form 990 Schedule D Supplemental Financial Statements

Form 990 Schedule D Supplemental Financial Statements

Official Federal Forms/Department Of Treasury/ -

Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

Form 709 United States Gift (And Generation-Skipping Transfer) Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 990 990-EZ Or 990-PF Schedule B Schedule Of Contributors

Form 990 990-EZ Or 990-PF Schedule B Schedule Of Contributors

Official Federal Forms/Department Of Treasury/ -

5307 Instructions For Form 5307

5307 Instructions For Form 5307

Official Federal Forms/Department Of Treasury/ -

Form 2848 Power Of Attorney And Declaration Of Representative

Form 2848 Power Of Attorney And Declaration Of Representative

Official Federal Forms/Department Of Treasury/ -

Form 990 Schedule J Compensation Information

Form 990 Schedule J Compensation Information

Official Federal Forms/Department Of Treasury/ -

Form 990 Schedule O Supplemental Information To Form 990 Or 990-EZ

Form 990 Schedule O Supplemental Information To Form 990 Or 990-EZ

Official Federal Forms/Department Of Treasury/ -

Form 5558 Application For Extension Of Time To File Certain Employee Plan Returns

Form 5558 Application For Extension Of Time To File Certain Employee Plan Returns

Official Federal Forms/Department Of Treasury/ -

Form 8892 Application For Automatic Extension Of Time To File Form 709

Form 8892 Application For Automatic Extension Of Time To File Form 709

Official Federal Forms/Department Of Treasury/ -

Form 1041 US Income Tax Return For Estates And Trusts

Form 1041 US Income Tax Return For Estates And Trusts

Official Federal Forms/Department Of Treasury/ -

5310 Instructions

5310 Instructions

Official Federal Forms/Department Of Treasury/ -

Form 4506-T Request for Transcript of Tax Return

Form 4506-T Request for Transcript of Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 4506 Request For Copy Of Tax Return

Form 4506 Request For Copy Of Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 706-NA United States Estate (And Generation-Skipping Transfer) Tax Return

Form 706-NA United States Estate (And Generation-Skipping Transfer) Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 706 United States Estate (And Generation-Skipping Transfer) Tax Return

Form 706 United States Estate (And Generation-Skipping Transfer) Tax Return

Official Federal Forms/Department Of Treasury/ -

Form 8038 Information Return For Tax-Exempt Private Activity Bond Issues

Form 8038 Information Return For Tax-Exempt Private Activity Bond Issues

Official Federal Forms/Department Of Treasury/ -

Form SS-4 Application For Employer Identification Number

Form SS-4 Application For Employer Identification Number

Official Federal Forms/Department Of Treasury/

Form Preview

Sorry, we couldn't download the pdf file.

Our Products

Contact Us

Success: Your message was sent.

Thank you!