Last updated: 10/4/2023

Chapter 13 Plan Effective 7-1-22 {NM LF 3015-2}

Start Your Free Trial $ 24.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

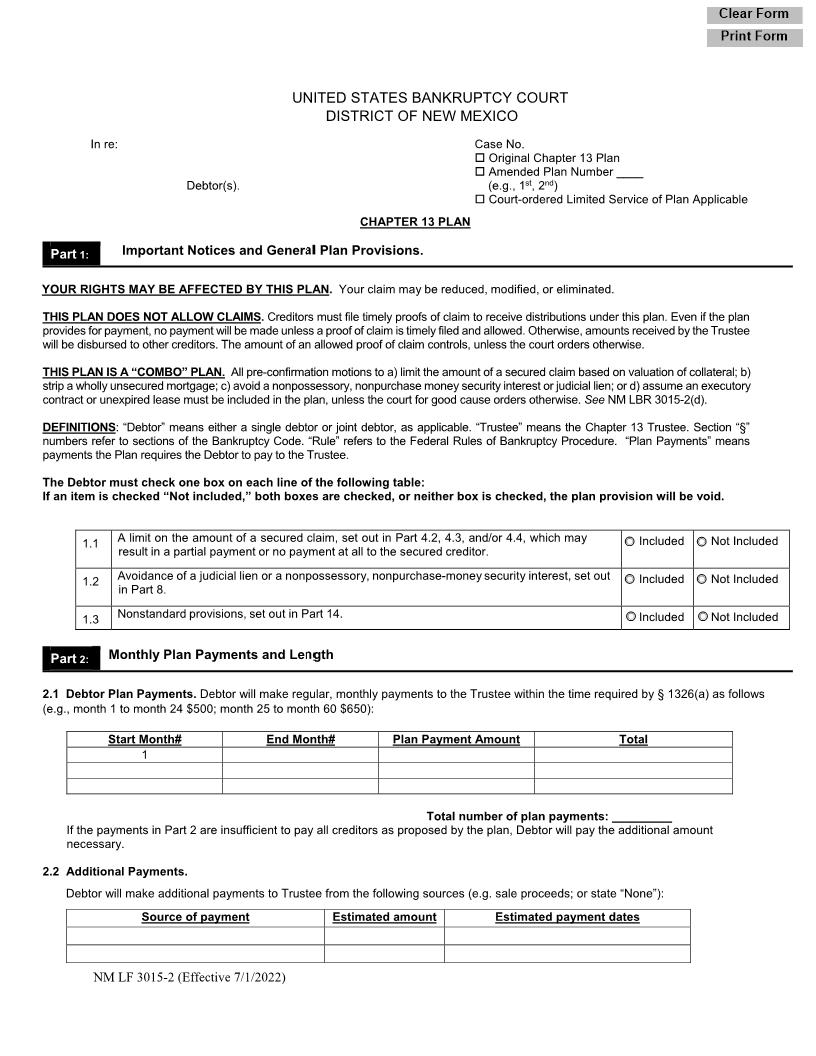

NM LF 3015-2 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW MEXICO In re: Case No. Debtors. Check if this is an amended plan Amended Plan (e.g., 1st, 2nd) CHAPTER 13 PLAN 1.1 Important Notices About This Plan. a. Nonstandard Provisions. (Debtor MUST check one). This plan has nonstandard provisions in Part 9. Yes No. If 223No224 is checked, neither box is checked, or both boxes are checked, no non-standard provision will be effective. b. Bifurcation of Claim; Lien Avoidance; Lien Stripping. (Debtor MUST check one). This plan seeks to limit the amount of a secured claim based on a valuation of collateral; strip a wholly unsecured mortgage; and/or avoid a nonpossessory, nonpurchase money security interest or judicial lien. Yes No. If yes, the treatment (see Part 3) may result in a partial payment or no payment at all to the secured creditor. If 223No224 is checked, neither box is checked, or both boxes are checked, no provision to limit a secured claim, strip a mortgage, or avoid a lien will be effective. c. Proof of Claim Requirement. Creditors must file a timely proof of claim to receive any distribution under this plan. Creditors should have received a separate notice that includes the deadline to file a proof of claim. 1.2 Definitions. 223Debtor224 means either a single debtor or joint debtor as applicable. 223Trustee224 means Chapter 13 Trustee. Section 223247224 numbers refer to sections of Title 11 of the United States Bankruptcy Code. 223Rule224 refers to the Federal Rules of Bankruptcy Procedure. 223Interest rate224 is per annum. 223Petition224 means the date of the order for relief under Chapter 13. 1.3 Debtor222s Income. (Check one). Debtor222s current monthly income is Less than the applicable median income specified in 2471325(b)(4)(A). Equal to or greater than the applicable median income specified in 2471325(b)(4)(A). 1.4 Debtor222s Eligibility for Discharge. (Check if applicable). Debtor is not eligible for a discharge. Joint debtor (the second named debtor) is not eligible for a discharge. Part 1: General American LegalNet, Inc. www.FormsWorkFlow.com -2- 2.1 Debtor222s Plan Payments. Debtor will pay Trustee $ a month for months beginning , and (if applicable) $ per month for months. (insert additional lines as needed). If the payments in Part 2 are not enough to satisfy Part 5, Debtor will pay the additional amount necessary to satisfy Part 5. 2.2 Additional Payments. Debtor will make additional payments to Trustee from the following sources (e.g. sale proceeds; increased amount after repayment of retirement loans; or state 223None224): Source of payment Estimated amount Estimated payment dates Included in 2.1? (Yes/No) 2.3 Method of Payment: (Check one). Debtor will make payments pursuant to a wage withholding order. Debtor will make payments directly to Trustee by money order/certified funds, TFS billpay, or TFS Moneygram. Payments made by money order/certified funds will be payable to Trustee and mailed to Chapter 13 Trustee, P.O. Box 454, Memphis, TN 38101-0454. Each payment must include Debtor222s name and case number on its face. 2.4 Income Tax Returns and Refunds. Debtor will file federal and state income tax returns during the plan term by the April tax filing deadline each year, or within the extended time if Debtor has obtained an extension. Debtor will provide a copy of any extension to Trustee within 14 days after submission. Debtor will pay directly any post-petition taxes or estimated taxes when due. Debtor will provide Trustee with a complete copy of all federal and state income tax returns, together with all schedules and attachments, within 14 days of the filing of the returns. 223Tax refund224 means the total amount of the net state and federal tax refund for each tax year, less documented costs to prepare the return. Check one: Debtor will retain any income tax refunds received during the plan term. Debtor will turn over to Trustee all income tax refunds for tax years through within seven days of receipt, unless the Court orders otherwise. Debtor will not change exemptions, decrease withholding, or otherwise reduce refunds without prior Court approval. Debtor will treat income tax refunds as follows: . 2.5 Funds Recovered by Trustee. Any funds Trustee recovers from avoidance of transfers under 247247 546, 547, 548, and 549 will be contributed to this plan as additional payments, unless the Court orders otherwise. 3.1 Treatment of Claims. The treatment of each secured claim listed on Official Form 106D (223Schedule D224) is specified below. Unless the Court orders otherwise, the claim amount stated in a timely filed proof of claim or amended proof of claim controls over any contrary amount listed below. Part 2: Plan Payments and Length Part 3: Treatment of Secured Claims American LegalNet, Inc. www.FormsWorkFlow.com -3- Creditor Estimated claim amount Collateral Collateral value Treatment (See codes below) Interest rate Estimated arrearage Adequate protection ( Yes/No ) Equal monthly payments (PIF, BIF or AV only) ( Yes/No ) a. Direct (223DIR224). Debtor will make direct payments under the terms of the original agreement between Debtor and the creditor on amounts due from the petition date forward. Trustee will pay the allowed pre-petition arrearage in full pursuant to 2471322(b)(5), with interest as set forth above. b. Direct by other than Debtor (223DOD224). Debtor incurred the debt for the benefit of another, who is making and will continue to make payments. Debtor will not make payments on or related to this debt post-petition. If the obligation is in default, Debtor will not oppose relief from the stay with respect to the collateral. The debt will not be discharged. c. Pay in full (223PIF224) (including 223910 car224 claims). Trustee will pay in full the allowed secured claim at the interest rate set forth above. If proposed above, creditor will also receive pre-confirmation adequate protection payments as provided in 3.4. d. Bifurcate under 247506 (223BIF224). Unless the creditor, Debtor and Trustee stipulate to value or the Court orders otherwise, creditor222s collateral will be valued at the amount set forth above. The total claim amount listed on the proof of claim controls over any contrary amount listed above, unless the Court orders otherwise. Trustee will pay the allowed secured claim in the amount of the value of the collateral with interest at the rate set forth above. The balance of creditor222s allowed claim will be treated as an allowed nonpriority unsecured claim. If proposed above, the creditor will also receive adequate protection payments as provided in 3.4. If creditor does not file a timely objection, the proposed collateral value will be binding on the creditor upon confirmation of the plan. If creditor timely objects, the confirmation hearing will include a valuation hearing under 247506 and Rule 3012. This sub-paragraph will be effective only if 223Yes224 is checked in 1.1.b. Valuation requires service in accordance with Rule 7004. e. Strip wholly unsecured mortgage (223STR224). Debtor seeks to value real property and avoid a mortgage wholly unsecured by the value of that property. Unless creditor, Debtor, and Trustee stipulate to value, or the Court orders otherwise, the property identified below will be valued at the amount set forth below. If creditor does not file a timely objection, the value will be binding on creditor upon confirmation of the plan, and the mortgage will be avoided in its entirety upon discharge. If creditor timely objects, the confirmation hearing will include a valuation hearing under 247 506 and Rule 3012. This sub-paragraph will be effective only if 223Yes224 is checked in 1.1.b. Valuation and lien stripping require service in accordance with Rule 7004. Creditor Est. Mortgage amount P roperty a ddress Property value B asis for valuation Est. t otal a mount of senior mortgages f. Avoid under 247522(f) (223AV224). Debtor contends that the judicial lien or nonpossessory, nonpurchase money security interest identified below (223Lien or Interest224) impairs an exemption to which the Debtor would have been entitled under 247 522(b). Debtor seeks to avoid the