Last updated: 9/24/2018

Notice Of Right To Claim Exemption From Garnishment {NM LF 5003-6}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

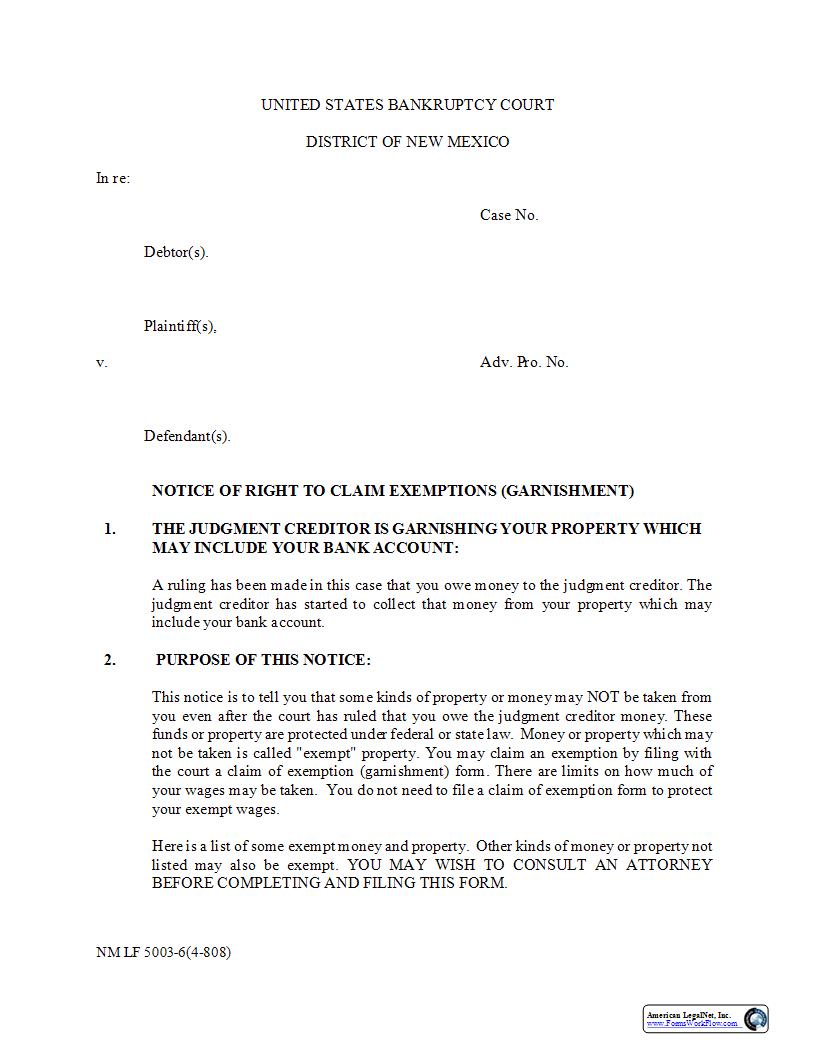

NM LF 5003-6(4-808) UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW MEXICO In re: Case No. Debtor(s). Plaintiff(s), v. Adv. Pro. No. Defendant(s). NOTICE OF RIGHT TO CLAIM EXEMPTIONS (GARNISHMENT) 1. THE JUDGMENT CREDITOR IS GARNISHING YOUR PROPERTY WHICH MAY INCLUDE YOUR BANK ACCOUNT: A ruling has been made in this case that you owe money to the judgment creditor. The judgment creditor has started to collect that money from your property which may include your bank account. 2. PURPOSE OF THIS NOTICE: This notice is to tell you that some kinds of property or money may NOT be taken from you even after the court has ruled that you owe the judgment creditor money. These funds or property are protected under federal or state law. Money or property which may not be taken is called "exempt" property. You may claim an exemption by filing with the court a claim of exemption (garnishment) form. There are limits on how much of your wages may be taken. You do not need to file a claim of exemption form to protect your exempt wages. Here is a list of some exempt money and property. Other kinds of money or property not listed may also be exempt. YOU MAY WISH TO CONSULT AN ATTORNEY BEFORE COMPLETING AND FILING THIS FORM. American LegalNet, Inc. www.FormsWorkFlow.com - 2 - 3. PARTIAL LIST OF EXEMPTIONS: a. social security benefits (OASDI, SSI); b. public assistance benefits (AFDC, welfare, GA); c. life, accident or health insurance proceeds; d. workers' compensation benefits (part may be garnished for child or spousal support); e. occupational health benefits; f. unemployment compensation benefits subject to the limitations of Section 51-1-37 NMSA 1978; g. veterans' benefits; h. pensions or retirement funds; i. a partner's interest in specific partnership property subject to the limitations of Section 54-1-25 NMSA 1978; j. crime victims' reparation fund payments; k. a family allowance to a decedent's surviving spouse and children, subject to the limitations of Sections 45-2-401 and 45-2-402 NMSA 1978; l. the minimum amount of shares necessary for certain cooperative associations as provided by Section 53-4-28 NMSA 1978; m. fraternal benefit society payments; n. oil and gas equipment not financed by the judgment creditor to be used for purposes for which it was purchased as provided by Section 70-4-12 NMSA 1978. 4. HOW TO PROTECT EXEMPT PROPERTY: A "claim of exemption (garnishment)" form is attached for you to complete and file with the bankruptcy court. YOU MUST COMPLETE AND RETURN THE ATTACHED CLAIM OF EXEMPTIONS (GARNISHMENT) FORM TO THE CLERK OF THE BANKRUPTCY COURT WITHIN TEN (10) DAYS AFTER SERVICE OF THIS NOTICE UPON YOU. YOU MUST ALSO SERVE A COPY OF THE COMPLETED AND SIGNED CLAIM OF EXEMPTIONS (GARNISHMENT) FORM ON THE JUDGMENT CREDITOR AND ON THE GARNISHEE. American LegalNet, Inc. www.FormsWorkFlow.com - 3 - If the judgment creditor disputes a claimed exemption, the clerk or the judge will notify you of the date and time for a court hearing on your claim. You must go to that hearing and explain why your money or property is exempt. You must bring to the hearing any proof that your money or property is exempt. If you do not complete and file the claim of exemptions (garnishment) form within ten (10) days and attend the hearing, your money or property may be turned over to the judgment creditor. DO NOT FILE THE CLAIM OF EXEMPTION FORM TO PROTECT ONLY WAGES. YOU SHOULD COMPLETE AND RETURN THE CLAIM OF EXEMPTION FORM TO THE CLERK OF THE BANKRUPTCY COURT WITHIN TEN (10) DAYS AFTER SERVICE OF THIS FORM UPON YOU. MAKE A COPY OF THE COMPLETED FORM FOR YOUR RECORDS AND SERVE A COPY ON THE JUDGMENT CREDITOR AND ON THE GARNISHEE. [Except for the addition of 223bankruptcy224 to adapt the form for use in Bankruptcy Court, the content of this NM LF 5003-6(4-808) matches Form 4-808 NMRA, last amended December 3, 2001.] American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Certification-Statement Regarding Marital Status

Certification-Statement Regarding Marital Status

New Mexico/Federal/Bankruptcy Court/ -

Late Notice To Additional Parties Of Bankruptcy Case Filing {1009-1(d)}

Late Notice To Additional Parties Of Bankruptcy Case Filing {1009-1(d)}

New Mexico/Federal/Bankruptcy Court/ -

Debtors Certification in Support of Chapter 13 Discharge

Debtors Certification in Support of Chapter 13 Discharge

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object To Chapter 13 Plan

Notice Of Deadline To Object To Chapter 13 Plan

New Mexico/Federal/Bankruptcy Court/ -

Certificate of Mailing Statement of Social Security Number

Certificate of Mailing Statement of Social Security Number

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Amendment to Bankruptcy Schedule

Notice Of Amendment to Bankruptcy Schedule

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object To Chapter 13 Plan With Petition {NM LF 3015-2(e)A}

Notice Of Deadline To Object To Chapter 13 Plan With Petition {NM LF 3015-2(e)A}

New Mexico/Federal/Bankruptcy Court/ -

Application For Payment Of Unclaimed Funds

Application For Payment Of Unclaimed Funds

New Mexico/Federal/Bankruptcy Court/ -

Certification Of Judgment For Registration In Another District

Certification Of Judgment For Registration In Another District

New Mexico/Federal/Bankruptcy Court/ -

Consent Or Refusal To Bankruptcy Court Hearing

Consent Or Refusal To Bankruptcy Court Hearing

New Mexico/Federal/Bankruptcy Court/ -

Corporate Ownership Statement (Adversary)

Corporate Ownership Statement (Adversary)

New Mexico/Federal/Bankruptcy Court/ -

Corporate Ownership Statement {NM LF 1007(a)(1)}

Corporate Ownership Statement {NM LF 1007(a)(1)}

New Mexico/Federal/Bankruptcy Court/ -

Court Reporters Acknowledgment Of Request For Transcript

Court Reporters Acknowledgment Of Request For Transcript

New Mexico/Federal/Bankruptcy Court/ -

Order Confirming Chapter 13 Plan

Order Confirming Chapter 13 Plan

New Mexico/Federal/Bankruptcy Court/ -

Report Of Unclaimed Funds

Report Of Unclaimed Funds

New Mexico/Federal/Bankruptcy Court/ -

Writ Of Garnishment

Writ Of Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Answer By Garnishee

Answer By Garnishee

New Mexico/Federal/Bankruptcy Court/ -

Application For Payment Of Unclaimed Funds Notarized

Application For Payment Of Unclaimed Funds Notarized

New Mexico/Federal/Bankruptcy Court/ -

Application For Writ Of Garnishment

Application For Writ Of Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Certificate Of Mailing Notice Of Corrected SSN

Certificate Of Mailing Notice Of Corrected SSN

New Mexico/Federal/Bankruptcy Court/ -

Claim Of Exemption From Garnishment

Claim Of Exemption From Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Default Order Granting Relief Of Mobile Home

Default Order Granting Relief Of Mobile Home

New Mexico/Federal/Bankruptcy Court/ -

Default Order Granting Relief Of Personal Property

Default Order Granting Relief Of Personal Property

New Mexico/Federal/Bankruptcy Court/ -

Default Order Granting Relief Of Real Estate

Default Order Granting Relief Of Real Estate

New Mexico/Federal/Bankruptcy Court/ -

Judgment On Writ Of Garnishment {NM LF 5003-6(4-811)}

Judgment On Writ Of Garnishment {NM LF 5003-6(4-811)}

New Mexico/Federal/Bankruptcy Court/ -

Motion For Temp Waiver Of Credit Counseling {NM LF 109(h)(3)}

Motion For Temp Waiver Of Credit Counseling {NM LF 109(h)(3)}

New Mexico/Federal/Bankruptcy Court/ -

Motion To Assume Or Reject Contract Or Lease

Motion To Assume Or Reject Contract Or Lease

New Mexico/Federal/Bankruptcy Court/ -

Motion To Avoid Judicial Lien

Motion To Avoid Judicial Lien

New Mexico/Federal/Bankruptcy Court/ -

Motion To Avoid Lien On Household Goods

Motion To Avoid Lien On Household Goods

New Mexico/Federal/Bankruptcy Court/ -

Motion To Obtain Credit

Motion To Obtain Credit

New Mexico/Federal/Bankruptcy Court/ -

Motion To Value Collateral

Motion To Value Collateral

New Mexico/Federal/Bankruptcy Court/ -

Motion To Waive Credit Counseling {NM LF 109(h)(4)}

Motion To Waive Credit Counseling {NM LF 109(h)(4)}

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Corrected SSN

Notice Of Corrected SSN

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object

Notice Of Deadline To Object

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Right To Claim Exemption From Garnishment

Notice Of Right To Claim Exemption From Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Unavailability

Notice Of Unavailability

New Mexico/Federal/Bankruptcy Court/ -

Order Avoiding Lien On Household Goods

Order Avoiding Lien On Household Goods

New Mexico/Federal/Bankruptcy Court/ -

Order Dismissing Duplicate Case

Order Dismissing Duplicate Case

New Mexico/Federal/Bankruptcy Court/ -

Order Fixing Time For Filing Proofs Of Claim

Order Fixing Time For Filing Proofs Of Claim

New Mexico/Federal/Bankruptcy Court/ -

Order Granting Motion On Contract Or Lease

Order Granting Motion On Contract Or Lease

New Mexico/Federal/Bankruptcy Court/ -

Order Granting Motion To Release Funds

Order Granting Motion To Release Funds

New Mexico/Federal/Bankruptcy Court/ -

Order Striking Case

Order Striking Case

New Mexico/Federal/Bankruptcy Court/ -

Order Valuing Collateral

Order Valuing Collateral

New Mexico/Federal/Bankruptcy Court/ -

Pretrial Order

Pretrial Order

New Mexico/Federal/Bankruptcy Court/ -

Pro Se Electronic Service Consent {NM LF 5005-2(b)-1}

Pro Se Electronic Service Consent {NM LF 5005-2(b)-1}

New Mexico/Federal/Bankruptcy Court/ -

Pro Se Electronic Service Consent Adversary {NM LF 5005-2(b)-2}

Pro Se Electronic Service Consent Adversary {NM LF 5005-2(b)-2}

New Mexico/Federal/Bankruptcy Court/ -

Report Of Small Dividends Deposited

Report Of Small Dividends Deposited

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Avoiding Lien On Household Goods

Stipulated Order Avoiding Lien On Household Goods

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Avoiding Lien On Residence

Stipulated Order Avoiding Lien On Residence

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Valuing Collateral

Stipulated Order Valuing Collateral

New Mexico/Federal/Bankruptcy Court/ -

Transcript Of Judgment

Transcript Of Judgment

New Mexico/Federal/Bankruptcy Court/ -

Unsworn Declaration

Unsworn Declaration

New Mexico/Federal/Bankruptcy Court/ -

Change Of Address For Creditor Or Other Party {NM LF 2002(g)}

Change Of Address For Creditor Or Other Party {NM LF 2002(g)}

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Confirming Confirming Discussions

Stipulated Order Confirming Confirming Discussions

New Mexico/Federal/Bankruptcy Court/ -

Change Of Address For Debtor

Change Of Address For Debtor

New Mexico/Federal/Bankruptcy Court/ -

Motion For Use Of Cash Collateral

Motion For Use Of Cash Collateral

New Mexico/4 Federal/Bankruptcy Court/ -

Order Granting Motion To Redact Previously Filed Document

Order Granting Motion To Redact Previously Filed Document

New Mexico/4 Federal/Bankruptcy Court/ -

Affidavit Regarding Mortgage Payments

Affidavit Regarding Mortgage Payments

New Mexico/4 Federal/Bankruptcy Court/ -

Certificate Of Service Forms In Contested Matters

Certificate Of Service Forms In Contested Matters

New Mexico/4 Federal/Bankruptcy Court/ -

Copy Request

Copy Request

New Mexico/Federal/Bankruptcy Court/ -

Mediation Order

Mediation Order

New Mexico/4 Federal/Bankruptcy Court/ -

Notice Of Amendment To Bankruptcy Schedule C

Notice Of Amendment To Bankruptcy Schedule C

New Mexico/Federal/Bankruptcy Court/ -

Order On Debtors Motion To Dismiss CH 13

Order On Debtors Motion To Dismiss CH 13

New Mexico/Federal/Bankruptcy Court/ -

Certificate Of Service Of Summons And Complaint

Certificate Of Service Of Summons And Complaint

New Mexico/4 Federal/Bankruptcy Court/ -

Order Approving Fee Application

Order Approving Fee Application

New Mexico/4 Federal/Bankruptcy Court/ -

Attorney Fee Application

Attorney Fee Application

New Mexico/4 Federal/Bankruptcy Court/ -

Chapter 13 Plan Effective 7-1-22

Chapter 13 Plan Effective 7-1-22

New Mexico/Federal/Bankruptcy Court/ -

Order Limiting Notice Of Certain Matters

Order Limiting Notice Of Certain Matters

New Mexico/Federal/Bankruptcy Court/ -

Order Avoiding Judicial Lien On Debtors Residence

Order Avoiding Judicial Lien On Debtors Residence

New Mexico/Federal/Bankruptcy Court/ -

Order Approving Employment

Order Approving Employment

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object To Chapter 13 Plan After Petition {NM LF 3015-2(e)B}

Notice Of Deadline To Object To Chapter 13 Plan After Petition {NM LF 3015-2(e)B}

New Mexico/Federal/Bankruptcy Court/ -

Request For Transcript For Appeal

Request For Transcript For Appeal

New Mexico/Federal/Bankruptcy Court/ -

Audio Recording Copy Request

Audio Recording Copy Request

New Mexico/Federal/Bankruptcy Court/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!