Last updated: 9/24/2018

Motion To Obtain Credit {NM LF 364}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

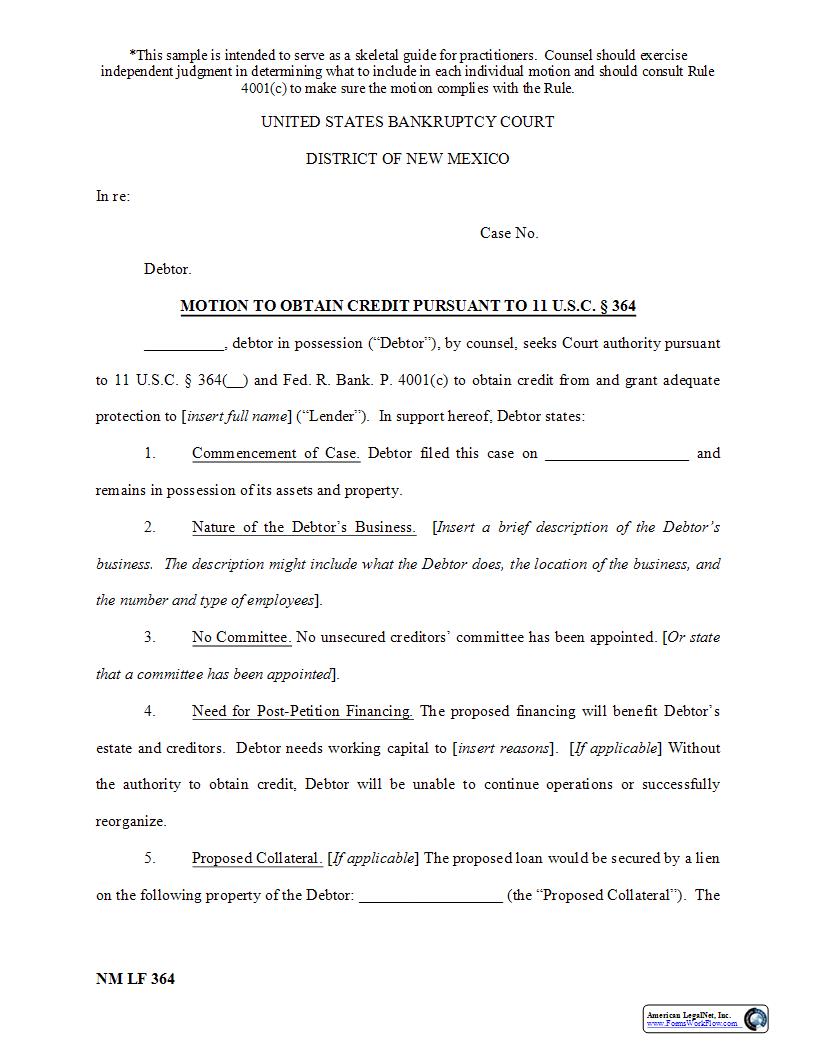

*This sample is intended to serve as a skeletal guide for practitioners. Counsel should exercise independent judgment in determining what to include in each individual motion and should consult Rule 4001(c) to make sure the motion complies with the Rule. NM LF 364 UNITED STATES BANKRUPTCY COURT DISTRICT OF NEW MEXICO In re: Case No. Debtor. MOTION TO OBTAIN CREDIT PURSUANT TO 11 U.S.C. 247 364 , debtor in possession (223Debtor224), by counsel, seeks Court authority pursuant to 11 U.S.C. 247 364() and Fed. R. Bank. P. 4001(c) to obtain credit from and grant adequate protection to [insert full name] (223Lender224). In support hereof, Debtor states: 1. Commencement of Case. Debtor filed this case on and remains in possession of its assets and property. 2. Nature of the Debtor222s Business. [Insert a brief description of the Debtor222s business. The description might include what the Debtor does, the location of the business, and the number and type of employees]. 3. No Committee. No unsecured creditors222 committee has been appointed. [Or state that a committee has been appointed]. 4. Need for Post-Petition Financing. The proposed financing will benefit Debtor222s estate and creditors. Debtor needs working capital to [insert reasons]. [If applicable] Without the authority to obtain credit, Debtor will be unable to continue operations or successfully reorganize. 5. Proposed Collateral. [If applicable] The proposed loan would be secured by a lien on the following property of the Debtor: (the 223Proposed Collateral224). The American LegalNet, Inc. www.FormsWorkFlow.com -2- Debtor estimates that the Proposed Collateral has a current value of $. This estimate is based upon the following information: . 6. Proposed Order and Credit Agreement. Debtor seeks an order substantially conforming to Exhibit A attached hereto (the 223Proposed Order224), which inter alia authorizes Debtor to: (1) obtain secured post-petition financing in the amount of [insert amount] from Lender on the terms and conditions set forth in the Order and Post-Petition Loan Documents attached hereto as Exhibit B (the 223Credit Agreement224); (2) [if applicable] grant Lender a lien against the Proposed Collateral; (3) [if applicable] to grant Lender additional adequate protection in the form of [describe the arrangement]; and (4) [if applicable] grant Lender an administrative claim under Section 364(c). 7. Loan Provisions. The essential terms of the proposed loan are as follows: [Include at least the following, with citations to the location on which each provision appears in the relevant documents.] Borrowing limit: Not to exceed [amount], subject to certain restrictions set forth more fully in the Loan Agreement and Proposed Order. Conditions: Interest rate: Default rate: Maturity date: Events of default: Collateral: Lien(s)/Priority: American LegalNet, Inc. www.FormsWorkFlow.com -3- 8. Applicable Provisions Identified in Rule 4001(c)(1)(B). The Loan Agreement and Proposed Order also include the following provisions identified in Rule 4001(c)(1)(B)(i) - (xi): [Include here and in the notice all of those provisions that apply. If none of those provisions apply, affirmatively state that. Cite to the location where each provision appears in the relevant documents.]. 9. Pre-petition Financing. [If applicable] On the bankruptcy petition date, the Debtor owed Lender $, including accrued unpaid interest of $ and costs or fees of $. This pre-petition loan is secured by a first lien on the following Debtor property: . [Or describe other collateral position]. 10. Relationship Between Debtor and Lender. There is no insider relationship between the Debtor and Lender [Or describe the relationship]. 11. Better Alternative Sources of Financing Not Available. Debtor is unable to obtain any alternative and better offers for post-petition financing. Lender is the only source of funds from whom Debtor can obtain post-petition financing. [Describe efforts to obtain alternate financing]. 12. Loans Procured in Good Faith. [If applicable] Lender extended credit to Debtor in good faith within the meaning of 247 364(e) and is entitled to the protections afforded by that section. WHEREFORE, Debtor asks the Court to approve the proposal to incur credit on the terms set forth in Exhibit B, to enter a final order substantially conforming to Exhibit A, and for all other just and proper relief. American LegalNet, Inc. www.FormsWorkFlow.com -4- Signature Name: Address: Telephone: Email: I certify that on , 20, I served this motion by first class mail, postage prepaid, on: [insert names, titles, addresses] And electronically on: [list] Signature NOTE: If the Motion is more than five pages, it must begin with a concise statement of the relief requested as required by Rule 4001(c)(1)(B). American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Certification-Statement Regarding Marital Status

Certification-Statement Regarding Marital Status

New Mexico/Federal/Bankruptcy Court/ -

Late Notice To Additional Parties Of Bankruptcy Case Filing {1009-1(d)}

Late Notice To Additional Parties Of Bankruptcy Case Filing {1009-1(d)}

New Mexico/Federal/Bankruptcy Court/ -

Debtors Certification in Support of Chapter 13 Discharge

Debtors Certification in Support of Chapter 13 Discharge

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object To Chapter 13 Plan

Notice Of Deadline To Object To Chapter 13 Plan

New Mexico/Federal/Bankruptcy Court/ -

Certificate of Mailing Statement of Social Security Number

Certificate of Mailing Statement of Social Security Number

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Amendment to Bankruptcy Schedule

Notice Of Amendment to Bankruptcy Schedule

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object To Chapter 13 Plan With Petition {NM LF 3015-2(e)A}

Notice Of Deadline To Object To Chapter 13 Plan With Petition {NM LF 3015-2(e)A}

New Mexico/Federal/Bankruptcy Court/ -

Application For Payment Of Unclaimed Funds

Application For Payment Of Unclaimed Funds

New Mexico/Federal/Bankruptcy Court/ -

Certification Of Judgment For Registration In Another District

Certification Of Judgment For Registration In Another District

New Mexico/Federal/Bankruptcy Court/ -

Consent Or Refusal To Bankruptcy Court Hearing

Consent Or Refusal To Bankruptcy Court Hearing

New Mexico/Federal/Bankruptcy Court/ -

Corporate Ownership Statement (Adversary)

Corporate Ownership Statement (Adversary)

New Mexico/Federal/Bankruptcy Court/ -

Corporate Ownership Statement {NM LF 1007(a)(1)}

Corporate Ownership Statement {NM LF 1007(a)(1)}

New Mexico/Federal/Bankruptcy Court/ -

Court Reporters Acknowledgment Of Request For Transcript

Court Reporters Acknowledgment Of Request For Transcript

New Mexico/Federal/Bankruptcy Court/ -

Order Confirming Chapter 13 Plan

Order Confirming Chapter 13 Plan

New Mexico/Federal/Bankruptcy Court/ -

Report Of Unclaimed Funds

Report Of Unclaimed Funds

New Mexico/Federal/Bankruptcy Court/ -

Writ Of Garnishment

Writ Of Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Answer By Garnishee

Answer By Garnishee

New Mexico/Federal/Bankruptcy Court/ -

Application For Payment Of Unclaimed Funds Notarized

Application For Payment Of Unclaimed Funds Notarized

New Mexico/Federal/Bankruptcy Court/ -

Application For Writ Of Garnishment

Application For Writ Of Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Certificate Of Mailing Notice Of Corrected SSN

Certificate Of Mailing Notice Of Corrected SSN

New Mexico/Federal/Bankruptcy Court/ -

Claim Of Exemption From Garnishment

Claim Of Exemption From Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Default Order Granting Relief Of Mobile Home

Default Order Granting Relief Of Mobile Home

New Mexico/Federal/Bankruptcy Court/ -

Default Order Granting Relief Of Personal Property

Default Order Granting Relief Of Personal Property

New Mexico/Federal/Bankruptcy Court/ -

Default Order Granting Relief Of Real Estate

Default Order Granting Relief Of Real Estate

New Mexico/Federal/Bankruptcy Court/ -

Judgment On Writ Of Garnishment {NM LF 5003-6(4-811)}

Judgment On Writ Of Garnishment {NM LF 5003-6(4-811)}

New Mexico/Federal/Bankruptcy Court/ -

Motion For Temp Waiver Of Credit Counseling {NM LF 109(h)(3)}

Motion For Temp Waiver Of Credit Counseling {NM LF 109(h)(3)}

New Mexico/Federal/Bankruptcy Court/ -

Motion To Assume Or Reject Contract Or Lease

Motion To Assume Or Reject Contract Or Lease

New Mexico/Federal/Bankruptcy Court/ -

Motion To Avoid Judicial Lien

Motion To Avoid Judicial Lien

New Mexico/Federal/Bankruptcy Court/ -

Motion To Avoid Lien On Household Goods

Motion To Avoid Lien On Household Goods

New Mexico/Federal/Bankruptcy Court/ -

Motion To Obtain Credit

Motion To Obtain Credit

New Mexico/Federal/Bankruptcy Court/ -

Motion To Value Collateral

Motion To Value Collateral

New Mexico/Federal/Bankruptcy Court/ -

Motion To Waive Credit Counseling {NM LF 109(h)(4)}

Motion To Waive Credit Counseling {NM LF 109(h)(4)}

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Corrected SSN

Notice Of Corrected SSN

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object

Notice Of Deadline To Object

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Right To Claim Exemption From Garnishment

Notice Of Right To Claim Exemption From Garnishment

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Unavailability

Notice Of Unavailability

New Mexico/Federal/Bankruptcy Court/ -

Order Avoiding Lien On Household Goods

Order Avoiding Lien On Household Goods

New Mexico/Federal/Bankruptcy Court/ -

Order Dismissing Duplicate Case

Order Dismissing Duplicate Case

New Mexico/Federal/Bankruptcy Court/ -

Order Fixing Time For Filing Proofs Of Claim

Order Fixing Time For Filing Proofs Of Claim

New Mexico/Federal/Bankruptcy Court/ -

Order Granting Motion On Contract Or Lease

Order Granting Motion On Contract Or Lease

New Mexico/Federal/Bankruptcy Court/ -

Order Granting Motion To Release Funds

Order Granting Motion To Release Funds

New Mexico/Federal/Bankruptcy Court/ -

Order Striking Case

Order Striking Case

New Mexico/Federal/Bankruptcy Court/ -

Order Valuing Collateral

Order Valuing Collateral

New Mexico/Federal/Bankruptcy Court/ -

Pretrial Order

Pretrial Order

New Mexico/Federal/Bankruptcy Court/ -

Pro Se Electronic Service Consent {NM LF 5005-2(b)-1}

Pro Se Electronic Service Consent {NM LF 5005-2(b)-1}

New Mexico/Federal/Bankruptcy Court/ -

Pro Se Electronic Service Consent Adversary {NM LF 5005-2(b)-2}

Pro Se Electronic Service Consent Adversary {NM LF 5005-2(b)-2}

New Mexico/Federal/Bankruptcy Court/ -

Report Of Small Dividends Deposited

Report Of Small Dividends Deposited

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Avoiding Lien On Household Goods

Stipulated Order Avoiding Lien On Household Goods

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Avoiding Lien On Residence

Stipulated Order Avoiding Lien On Residence

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Valuing Collateral

Stipulated Order Valuing Collateral

New Mexico/Federal/Bankruptcy Court/ -

Transcript Of Judgment

Transcript Of Judgment

New Mexico/Federal/Bankruptcy Court/ -

Unsworn Declaration

Unsworn Declaration

New Mexico/Federal/Bankruptcy Court/ -

Change Of Address For Creditor Or Other Party {NM LF 2002(g)}

Change Of Address For Creditor Or Other Party {NM LF 2002(g)}

New Mexico/Federal/Bankruptcy Court/ -

Stipulated Order Confirming Confirming Discussions

Stipulated Order Confirming Confirming Discussions

New Mexico/Federal/Bankruptcy Court/ -

Change Of Address For Debtor

Change Of Address For Debtor

New Mexico/Federal/Bankruptcy Court/ -

Motion For Use Of Cash Collateral

Motion For Use Of Cash Collateral

New Mexico/4 Federal/Bankruptcy Court/ -

Order Granting Motion To Redact Previously Filed Document

Order Granting Motion To Redact Previously Filed Document

New Mexico/4 Federal/Bankruptcy Court/ -

Affidavit Regarding Mortgage Payments

Affidavit Regarding Mortgage Payments

New Mexico/4 Federal/Bankruptcy Court/ -

Certificate Of Service Forms In Contested Matters

Certificate Of Service Forms In Contested Matters

New Mexico/4 Federal/Bankruptcy Court/ -

Copy Request

Copy Request

New Mexico/Federal/Bankruptcy Court/ -

Mediation Order

Mediation Order

New Mexico/4 Federal/Bankruptcy Court/ -

Notice Of Amendment To Bankruptcy Schedule C

Notice Of Amendment To Bankruptcy Schedule C

New Mexico/Federal/Bankruptcy Court/ -

Order On Debtors Motion To Dismiss CH 13

Order On Debtors Motion To Dismiss CH 13

New Mexico/Federal/Bankruptcy Court/ -

Certificate Of Service Of Summons And Complaint

Certificate Of Service Of Summons And Complaint

New Mexico/4 Federal/Bankruptcy Court/ -

Order Approving Fee Application

Order Approving Fee Application

New Mexico/4 Federal/Bankruptcy Court/ -

Attorney Fee Application

Attorney Fee Application

New Mexico/4 Federal/Bankruptcy Court/ -

Chapter 13 Plan Effective 7-1-22

Chapter 13 Plan Effective 7-1-22

New Mexico/Federal/Bankruptcy Court/ -

Order Limiting Notice Of Certain Matters

Order Limiting Notice Of Certain Matters

New Mexico/Federal/Bankruptcy Court/ -

Order Avoiding Judicial Lien On Debtors Residence

Order Avoiding Judicial Lien On Debtors Residence

New Mexico/Federal/Bankruptcy Court/ -

Order Approving Employment

Order Approving Employment

New Mexico/Federal/Bankruptcy Court/ -

Notice Of Deadline To Object To Chapter 13 Plan After Petition {NM LF 3015-2(e)B}

Notice Of Deadline To Object To Chapter 13 Plan After Petition {NM LF 3015-2(e)B}

New Mexico/Federal/Bankruptcy Court/ -

Request For Transcript For Appeal

Request For Transcript For Appeal

New Mexico/Federal/Bankruptcy Court/ -

Audio Recording Copy Request

Audio Recording Copy Request

New Mexico/Federal/Bankruptcy Court/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!