Last updated:

Confidential Financial Affidavit

Start Your Free Trial $ 27.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

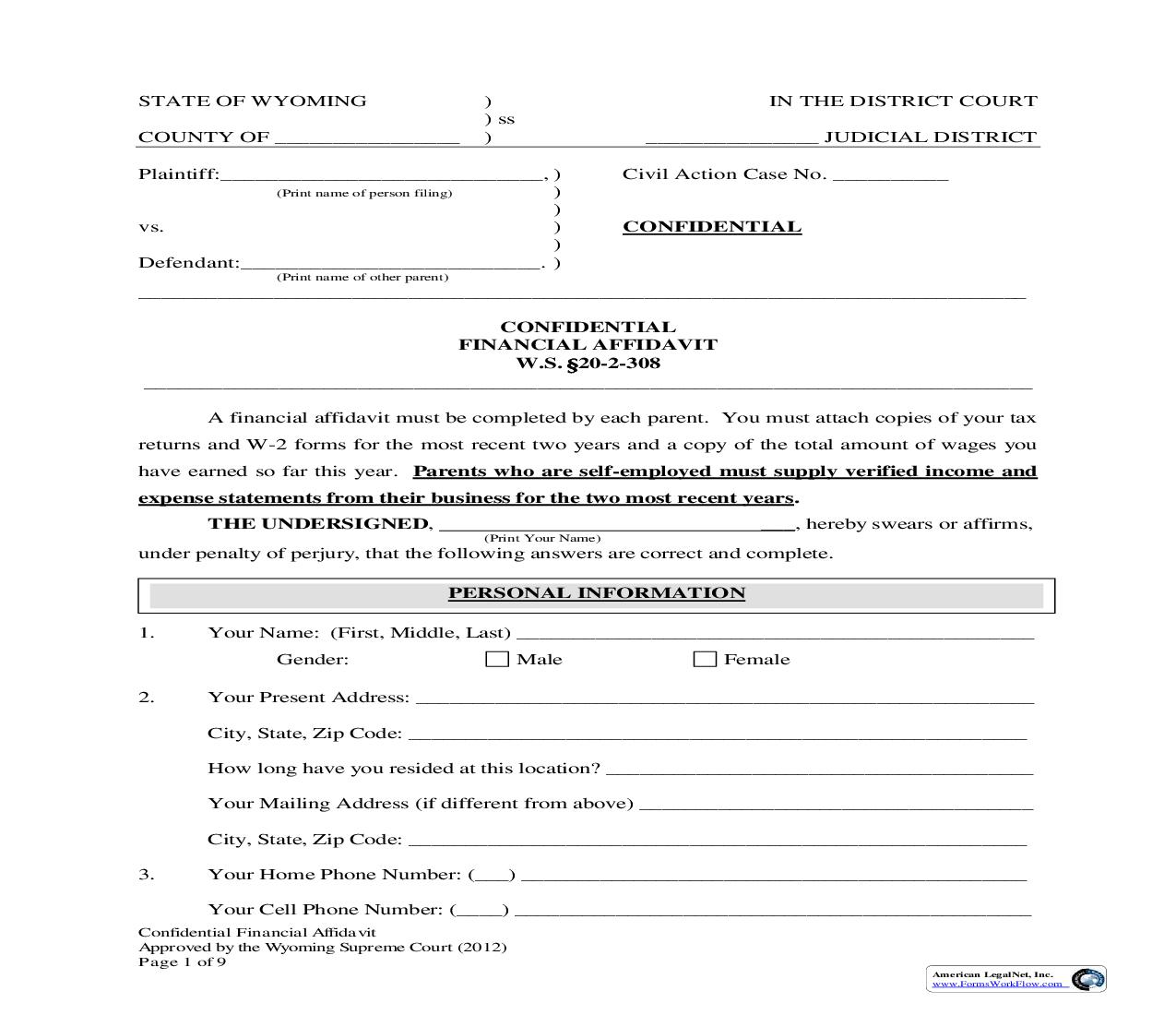

Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 1 of 9 STATE OF WYOMING ) IN THE DISTRICT COURT ) ss COUNTY OF ) JUDICIAL DISTRICT Plaintiff:, ) Civil Action Case No. (Print name of person filing) ) ) vs. ) CONFIDENTIAL ) Defendant:. ) (Print name of other parent) CONFIDENTIAL FINANCIAL AFFIDAVIT W.S. 24720-2-308 A financial affidavit must be completed by each parent. You must attach copies of your tax returns and W-2 forms for the most recent two years and a copy of the total amount of wages you have earned so far this year. Parents who are self-employed must supply verified income and expense statements from their business for the two most recent years . THE UNDERSIGNED, , hereby swears or affirms, (Print Your Name) under penalty of perjury, that the following answers are correct and complete. 1. Your Name: (First, Middle, Last) Gender: Male Female 2. Your Present Address: City, State, Zip Code: How long have you resided at this location? Your Mailing Address (if different from above) City, State, Zip Code: 3. Your Home Phone Number: () Your Cell Phone Number: () PERSONAL INFORMATION American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 2 of 9 A Message Phone Number: ( ) 4. Your Social Security Number is: 5. Your Date of Birth is: 6. Your Education is: years of high school; years of college; years of trade school; years other (list training) 7. List your degree(s) or certificate(s): 8. List all child(ren) involved in this matter: Sex Birth Date Social Security No. Does this child live with you? M F Yes No M F Yes No M F Yes No M F Yes No M F Yes No Additional sheets of paper are attached (if needed) 9. List YOUR minor children (not named above) who live with you: Birth Date Social Security No. Additional sheets of paper are attached (if needed) American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 3 of 9 10. List YOUR minor children (not named above) who do not live with you but for whom YOU are court-ordered to pay child support: Child's Name Birth Date Social Security No. Court and Date of Order Support/Month Arrears (Amount Past Due) Child's Name Birth Date Social Security No. Court and Date of Order Support/Month Arrears (Amount Past Due) Child's Name Birth Date Social Security No. Court and Date of Order Support/Month Arre ars (Amount Past Due) Child's Name Birth Date Social Security No. Court and Date of Order Support/Month Arrears (Amount Past Due) Additional sheets of paper are attached (if needed) 11. Do you owe back child support (arrears) in this case? If so, how much? $. 12. List any income-qualified state or federal benefits that your child(ren) receive (POWER, Medicaid, Kid Care, Title 19, General Assistance, Food Stamps, Supplemental Security Income, etc.): CHILD'S NAME BIRTH DATE STATE TYPE OF BENEFIT Additional sheets of paper are attached (if needed) American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 4 of 9 13. Are you currently: Employed Self- Employed Unemployed If you are employed, please provide the following: Job No. 1: City, State, Zip Code: : Your Occupation: Your Hourly Wage or Monthly Salary: Job No. 2: : : City, State, Zip Code: : Your Occupation: Your Hourly Wage or Monthly Salary: Job No. 3: me: : City, State, Zip Code: : Your Occupation: Your Hourly Wage or Monthly Salary: INCOME & EXPENSE INFORMATION American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 5 of 9 Add additional sheets of paper if necessary to list additional jobs. How many hours do you work each week? Job No. 1: Job No. 2: Job No. 3 Regular Regular Regular Overtime Overtime Overtime Total Total Total How often do you receive overtime compensation? How often are you paid: Job No. 1: Job No. 2: Job No. 3 weekly weekly weekly every two weeks every two weeks every two weeks twice per month twice per month twice per month monthly monthly monthly annually annually annually Date of your last salary increase or decrease: 14. List all income you have received for the last 12 months: Income Source Monthly Amount Income Source Monthly Amount Gross Wages ** Job 1 - $ Job 2 - $ Job 3 - $ Annuity $ Unemployment $ Spousal Support $ $ Contract Receipts $ Socia l Security Benefits (Excluding SSI) $ Rental Income $ Retirement $ Fringe Benefits/Bonuses $ Interest/Dividend Income $ Profit (Loss) from Self - Employment $ Reimbursements $ Other $ $ Other $ **Gross Wage - Monthly amounts are calculated by multiplying weekly amount by 52 and dividing by 12; multiplying bi-weekly (every two weeks) amounts by 26 and dividing by 12; and multiplying semi-monthly (i.e., paid on the 1st and 15th) amounts by 24 and dividing by 12. Additional sheets of paper are attached (if needed) American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 6 of 9 15. IF YOU ARE EMPLOYED: Please complete list and calculate the following: A. Gross income: $ per month (Amount of income from all sources before deductions) B. Federal Income Tax: $ per month C. State Income Tax: $ per month D. Social Security Tax: $ per month E. Medicare Tax: $ per month F. Mandatory Retirement/Pension: $ per month G. $ per month H. Current Child Support Paid for Other Children: $ per month I. Total Mandatory Deductions: $ per month J. Net Income (line A minus line I): $ per month K. Income Tax Filing Status: L. Number of Dependents Claimed for Tax Purposes: Please provide copies of pay-stubs for all payroll deductions. Attach copies of your tax returns and W-2 forms for the most recent two years and a copy of a cumulative earning statement(s) for the current year 16. IF YOU ARE SELF-EMPLOYED: Please list the following: A. Gross income : $ per month *amount of income from all sources before deductions B. Federal Income Tax: $ per month C. State Income Tax: $ per month D. Social Security Tax: $ per month E. Medicare Tax: $ per month F. Unreimbursed Business Expenses: $ per month G. $ per month H. Current Child Support Paid for Other Children: $ per month I. Total Mandatory Deductions: $ per month J. Net Income (line A minus line I): $ per month K. Income Tax Filing Status: L. Number of Dependents Claimed for Tax Purposes: Attach verified income and expense statements from your business, copies of your personal and business tax returns, and 1099 forms for the most recent two years. American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 7 of 9 17. List your work experience for the last three years: COMPANY AND LOCATION DATES FROM - TO JOB DESCRIPTION/ TITLE SALARY OR WAGE REASON YOU LEFT Additional sheets of paper are attached (if needed) 18. Has anyone been ordered to provide health insurance for the child(ren) involved in this case, or is there any other medical provision in an existing court order? YES NO If yes, please list who is ordered to provide insurance: Are the children currently covered by insurance? YES NO If yes, please list who is providing the insurance: If you are currently providing insurance for your children, you must provide current written proof from your insurance carrier verifying the names of the actual person(s) covered under your policy. Is health insurance available for the minor child(ren) through your employment? YES NO If yes, how much is the monthly premium to cover ONLY the minor child(ren) on the policy? $ 19. Attach the following to this Confidential Financial Affidavit: If Employed: Copies of my last two years income tax returns; Copies of my W-2 Forms for the last two years; and Copies of statements of earnings from each of my employers showing cumulative pay for this year. American LegalNet, Inc. www.FormsWorkFlow.com Confidential Financial Affidavit Approved by the Wyoming Supreme Court (2012) Page 8 of 9 If Self-Employed: Verified income and expense statements for the business for the two most recent