Last updated: 12/27/2018

Child Support Computing Form

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

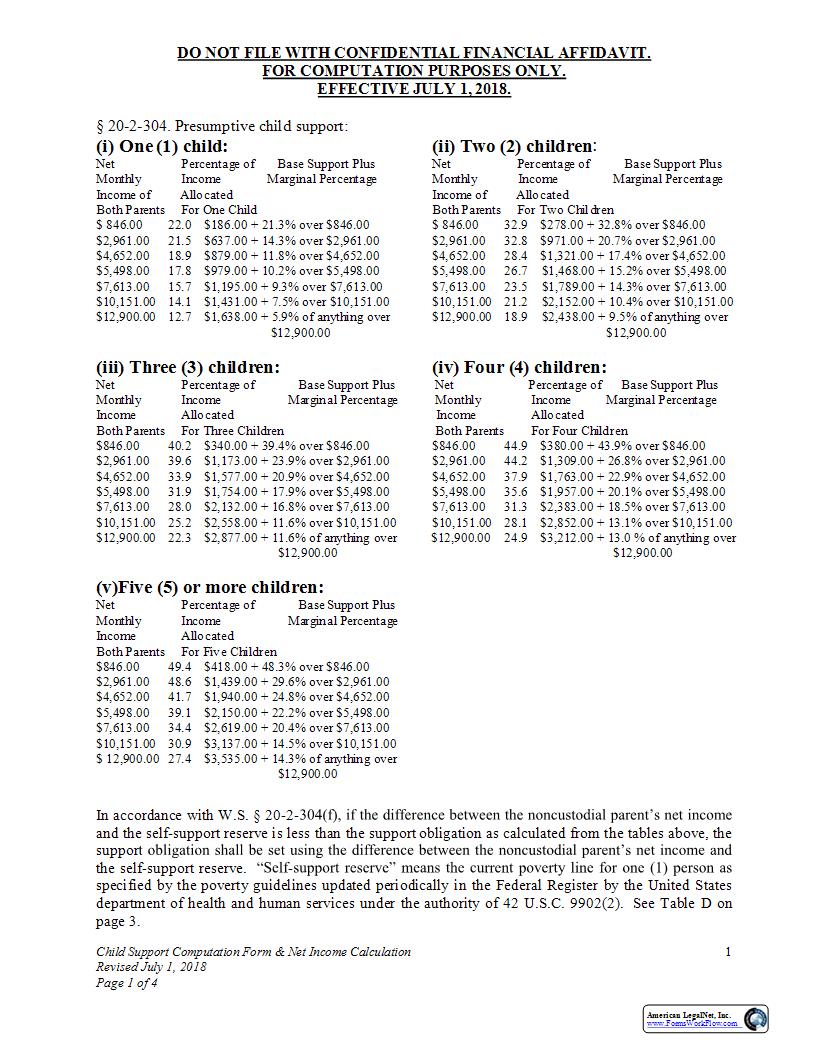

Child Support Computation Form & Net Income Calculation Revised July 1, 2018 Page 1 of 4 1 DO NOT FILE WITH CONFIDENTIAL FINANCIAL AFFIDAVIT. FOR COMPUTATION PURPOSES ONLY. EFFECTIVE JULY 1, 2018. 247 20 - 2 - 304. Presumptive child support: (i) One (1) child: (ii) Two (2) children : Net Percentage of Base Support Plus Net Percentage of Base Support Plus Monthly Income Marginal Percentage Monthly Income Marginal Percentage Income of Allocated Income of Allocated Both Parents For One Child Both Parents For Two Children $ 846.00 22.0 $186.00 + 21.3% over $846.00 $ 846.00 32.9 $278.00 + 32.8% over $846.00 $2,961.00 21.5 $637.00 + 14.3% over $2,961.00 $2,961.00 32.8 $971.00 + 20.7% over $2,961.00 $4,652.00 18.9 $879.00 + 11.8% over $4,652.00 $4,652.00 28 .4 $1,321.00 + 17.4% over $4,652.00 $5,498.00 17.8 $979.00 + 10.2% over $5,498.00 $5,498.00 26.7 $1,468.00 + 15.2% over $5,498.00 $7,613.00 15.7 $1,195.00 + 9.3% over $7,613.00 $7,613.00 23.5 $1,789.00 + 14.3% over $7,613.00 $10,151.00 14.1 $1,431 .00 + 7.5% over $10,151.00 $10,151.00 21.2 $2,152.00 + 10.4% over $10,151.00 $12,900.00 12.7 $1,638.00 + 5.9% of anything over $12,900.00 18.9 $2,438.00 + 9.5% of anything over $12,900.00 $12,900.00 (iii) Th ree (3) children: (iv) Four (4) children: Net Percentage of Base Support Plus Net Percentage of Base Support Plus Monthly Income Marginal Percentage Monthly Income Marginal Percentage Income Allocated Income Allocated Both Parents For Three Children Both Parents For Four Children $846.00 40.2 $340.00 + 39.4% over $846.00 $846.00 44.9 $380.00 + 43.9% over $846.00 $2,961.00 39.6 $1,173.00 + 23.9% over $2,961.00 $2,961.00 44.2 $1,309.00 + 26.8% over $2,961.00 $4,652.00 33.9 $1,577.00 + 20.9% over $4,652.00 $4,652.00 37.9 $1,763.00 + 22.9% over $4,652.00 $5,498.00 31.9 $1,754.00 + 17.9% over $5,498.00 $5,498.00 35.6 $1,957.00 + 20.1% over $5,498.00 $7,613.00 28.0 $2,132.00 + 16.8% over $7,613.00 $7,613.00 31. 3 $2,383.00 + 18.5% over $7,613.00 $10 ,151.00 25.2 $2,558.00 + 11.6% over $10,151.00 $10,151.00 28.1 $2,852.00 + 13.1% over $10,151.00 $12,900.00 22.3 $2,877.00 + 11.6% of anything over $12,900.00 24.9 $3,212.00 + 13.0 % of anything over $12,900.00 $12,9 00.00 (v)Five (5) or more children: Net Percentage of Base Support Plus Monthly Income Marginal Percentage Income Allocated Both Parents For Five Children $846.00 49.4 $418.00 + 48.3% over $846.00 $2,961.00 48.6 $1,439 .00 + 29.6% over $2,961.00 $4,652.00 41.7 $1,940.00 + 24.8% over $4,652.00 $5,498.00 39.1 $2,150.00 + 22.2% over $5,498.00 $7,613.00 34.4 $2,619.00 + 20.4% over $7,613.00 $10,151.00 30.9 $3,137.00 + 14.5% over $10,151.00 $ 12,900.00 27.4 $3,535.00 + 14. 3% of anything over $12,900.00 In accordance with W.S. 247 20 - 2 - and the self - support reserve is less than the support obligation as calculated from the tables above, the suppor the self - support reserve. - specified by the poverty guidelines updated periodically in the Federal Register by the United States department of health and human services under the authority of 42 U.S.C. 9902(2 ). See Table D on page 3. American LegalNet, Inc. www.FormsWorkFlow.com Child Support Computation Form & Net Income Calculation Revised July 1, 2018 Page 2 of 4 2 DO NOT FILE WITH CONFIDENTIAL FINANCIAL AFFIDAVIT. FOR COMPUTATION PURPOSES ONL Y. EFF ECTIVE JULY 1, 2018 . Depending on the details of the custody arrangement, the parties may need to complete more than one table to calculate child support. Please read through the instructions for each table carefully. CHILD SUPPORT COMPUTATION F ORM A. COMPUTATION OF BASIC SUPPORT OBLIGATIONS: WYO. STAT. 24720 - 2 - 304 1. Net Monthly Income: $ 2. Net Monthly Income: $ 3. Combined Net Monthly Income: $ 4. Using the support tables for pr esumptive support at Wyo. Stat. 247 20 - 2 - 304 (a), the basic joint su pport obligation of the parents = $ 5. Proportionate Share: Line 1/Line 3 x Line 4 = $ 6. Proportionate Share: Line 2/Line 3 x Line 4 = $ 7. MONTHLY SUPPORT DUE FROM NONCUSTODIAL PARENT (Amount from Line 5 or Line 6) = $ NOTE: If the custody of the children is shared or split as defined under Wyo. St at. 247 20 - 2 - 304 (c) and (d) other formulas apply. If ) , the amount shall be allocated to each parent based upon the number of those children in the ph ysical custody of that parent ( see Table C on page 3 ). each parent has actual overnight custody of the children for a certain percentage of time ) , the amount will be allocated b ased on the percentage of time ( Table B below). B. SHARED PHYSICAL CUSTOD Y: Wyo. Stat. 247 20 - 2 - 304 (c) provides for special support computation of support when each parent keeps the children overnight for more than twenty - five percent ( 25 %) of the year and both parents contribute substantially to the expenses of the children in addition to the payment of child support. If this is the custodial arrangement, support may be computed as follows assuming all other statutory provisions apply. 8 . a) Percent of year children will reside overnight with Plaintiff/Petitioner % b) percent of year children will reside overnight with Defendant/Respondent % 9 . support obligation: Line 5 x 150% x Line 8 b $ 10 . supp ort obligation : Line 6 x 150% x Line 8 a $ 11 . MONTHLY SUPPORT DUE: The difference between lines 9 and 10 represents the net monthly support due from the parent having the greater support obligation. $ American LegalNet, Inc. www.FormsWorkFlow.com Child Support Computation Form & Net Income Calculation Revised July 1, 2018 Page 3 of 4 3 C. SPLIT CUSTODY: Wyo. Stat. 24720 - 2 - 304 (d) provi des for special computations of support when each parent has physical custody of at least one (1) child. In such cases the support should be computed as follows: 12 . Shared responsibility child support per child: Line 4 367 Total children of parents. $ 13 . support obligation for children in custody of Defendant/Respondent: Line 1/Line 3 x Number of children with Defendant/Respondent x Line 12 $ 14 . support obligation for children in custody of Plaintiff/Petitioner : Line 2/Line 3 x Number of children with Plaintiff/Petitioner x Line 12 $ 15 . MONTHLY SUPPORT DUE: The difference between lines 13 a nd 14 represents the net monthly support due from the parent having the greater support obligation. $ D . SELF - SUPPORT RESERVE COMPUTATION : Wyo. Stat. 247 20 - 2 - 304 (f) provides for speci al computation - support rese rve is less than the support obligation as calculated u sing the support tables for presumptive support on page 1 . In such cases, the support should be computed as follows: 16 . Net income of the obligor or parent paying support $ 17 . Self - - going to the Family Law Forms at www.courts.state.wy.us/legal - assistances - and - forms/court - self - help - forms/ . Enter the number provided . $ 18 . Subtract line 17 from line 16 . $ 19 . If the amount on line 18 is less than the chi ld support due as calculated on l ine 7 of Table A, line 11 of Table B, or line 15 of Table C, th en line 18 is the monthly child support obligation . Enter the amount here . If the amount on line 18 is more than line 7 of Table A , line 11 of Table B, or line 15 of Table C, then skip to line 20 . $ 20 . If the amount on line 18 is more t han the chi ld support due as calculated on line 7 of Table A , line 11 of Table B, or line 15 of Table C, then the child support calculated on line 7 of Table A, line 11 of Table B , or line 15 of Table C is the monthly child support obligation . Enter the a mount here. $ American LegalNet, Inc. www.FormsWorkFlow.com Child Support Computation Form & Net Income Calculation Revised July 1, 2018 Page 4 of 4 4 DO NOT FILE WITH CONFIDENTIAL FINANCIAL AFFIDAVIT. FOR COMPUTATION PURPOSES ONLY. NET INCOME CALCULATION WORKSHEET FOR CHILD SUPPORT A. For Employed Persons: 1. Gross income* (amount before any deductions): $ per month 2. F ederal Income Tax: $ per month 3. State Income Tax: $ per month 4. Social Security Tax (FICA): $ per month 5. Medicare Tax: $ per month 6. Mandatory Retirement/Pension: $ per month 7. $ pe r month 8. Child Support Actually Paid for Other Children: $ per month (Do not include payments towards back child support) Tot