Last updated:

Affidavit of Imputed Income

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

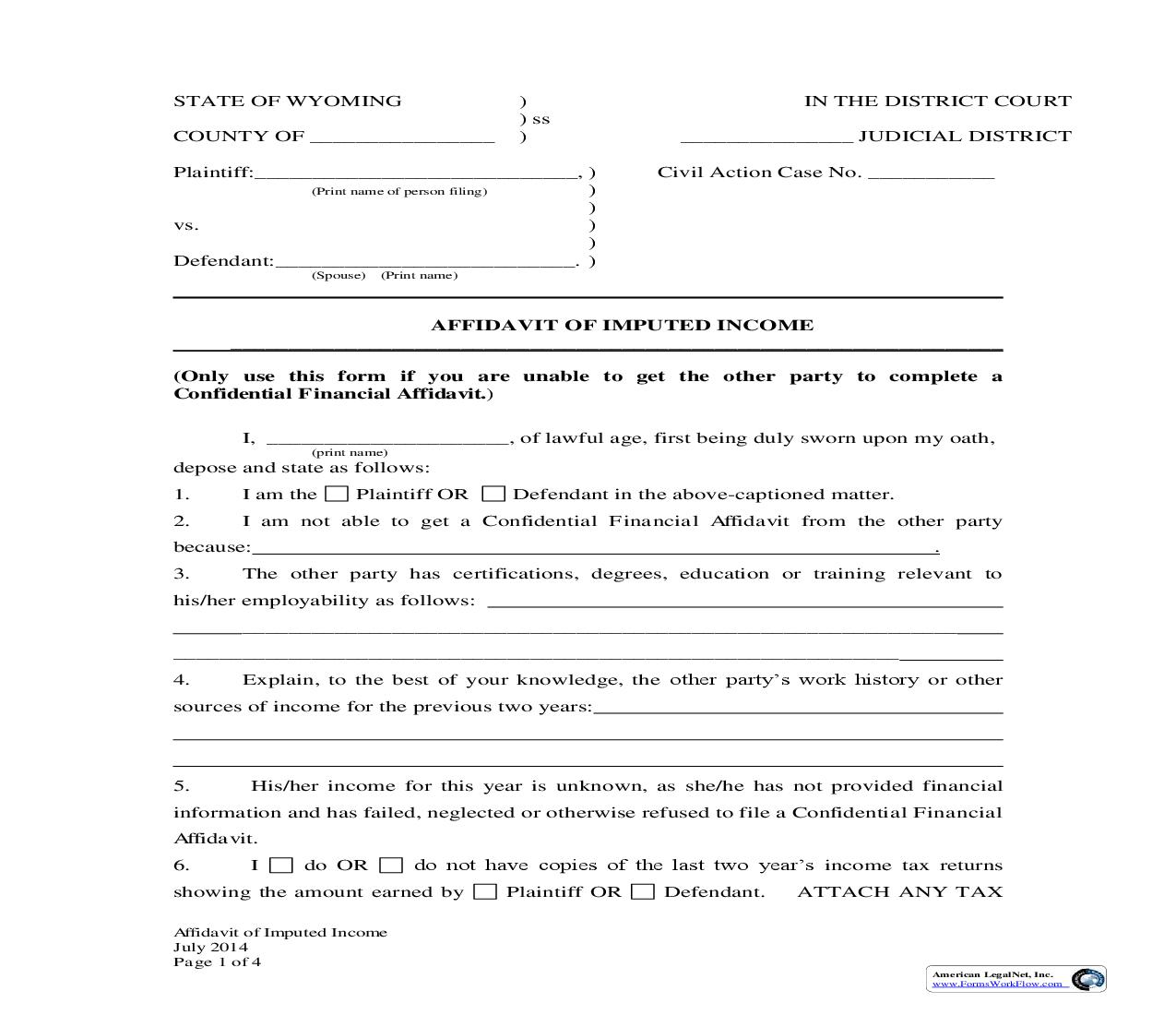

Affidavit of Imputed Income July 2014 Page 1 of 4 STATE OF WYOMING ) IN THE DISTRICT COURT ) ss COUNTY OF ) JUDICIAL DISTRICT Plaintiff:, ) Civil Action Case No. (Print name of person filing) ) ) vs. ) ) Defendant:. ) (Spouse) (Print name) AFFIDAVIT OF IMPUTED INCOME (Only use this form if you are unable to get the other party to complete a Confidential Financial Affidavit.) I, , of lawful age, first being duly sworn upon my oath, (print name) depose and state as follows: 1. I am the Plaintiff OR Defendant in the above-captioned matter. 2. I am not able to get a Confidential Financial Affidavit from the other party because: . 3. The other party has certifications, degrees, education or training relevant to his/her employability as follows: 4. Explain, to the best of your knowledge, the or other sources of income for the previous two years: 5. His/her income for this year is unknown, as she/he has not provided financial information and has failed, neglected or otherwise refused to file a Confidential Financial Affidavit. 6. I do OR income tax returns showing the amount earned by Plaintiff OR Defendant. ATTACH ANY TAX American LegalNet, Inc. www.FormsWorkFlow.com Affidavit of Imputed Income July 2014 Page 2 of 4 RETURNS, W-4s, CHECK STUBS OR OTHER INFORMATION ABOUT THE INCOME TO THIS DOCUMENT. If you have information about th previous or current employment by area and occupation, you may be able to get information regarding wages by visiting the U.S. Department of Labor Bureau of Labor Statistics website for wage information by area and occupation http://www.bls.gov/bls/blswage.htm. Attach any relevant documentation to this Affidavit. 7. OR income is based on him/her being paid: weekly every two weeks twice per month (i.e. 1st and 15th of every month) monthly annually Convert annual, bi- weekly, bi-monthly, and weekly amounts to monthly amounts below. ** Gross income (includes tips, commission and bonuses). Monthly amounts are calculated by multiplying weekly amount by 52 and dividing by 12; multiplying bi-weekly amounts by 26 and dividing by 12; and multiplying semi-monthly amounts by 24 and dividing by 12; annually by dividing by 12. If other number if instructed by Court) and then subtract that amount from the gross to arrive at the net monthly income. If the other party has a history of only working for minimum wage or less, and is capable, to your knowledge of working 40 hours/week, the court may impute his/her income at $1,141.25 net monthly for a noncustodial parent and $1,185.67 net monthly for a custodial parent. You may call your local child support enforcement office for more information on imputing a custodial or non-custodial p wage is $7.25/hour as of July 1, 2012. 8. OR estimated gross income (before deductions) is: $ per month, to the best of my information and belief. "Income" means any form of payment or return in money or in kind to an individual, regardless of source. Income includes, but is not limited to wages, earnings, salary, commission, compensation as an independent contractor, temporary total disability, permanent partial disability and permanent total disability worker's compensation payments, unemployment compensation, disability, annuity and retirement benefits, and any other payments made by any payor, but shall not include any earnings derived from overtime work unless the court, after considering all overtime earnings derived in the preceding twenty-four (24) month period, determines the overtime earnings can reasonably be expected to continue on a consistent basis. In determining income, all reasonable unreimbursed legitimate business expenses shall be deducted. Means tested sources of income such as Pell grants, aid under the personal opportunities with employment responsibilities (POWER) program, food stamps and supplemental security income (SSI) shall not be considered as income . Gross income also means potential income of parents who are voluntarily unemployed or underemployed. "Net income" means income as defined in the box above, less personal income taxes, social security deductions, cost of dependent health care coverage for all dependent children, actual payments being made under preexisting support orders for current support of other children, other court-ordered support obligations currently being paid and mandatory pension deductions. Payments towards child support arrearage shall not be deducted to arrive at net income. American LegalNet, Inc. www.FormsWorkFlow.com Affidavit of Imputed Income July 2014 Page 3 of 4 9. Based on the previous work history and/or income, Plaintiff OR Defendant has the ability to earn a net (after appropriate deductions) monthly income of $ and said amount should be used to calculate child support under the presumptive child support guidelines. * If the other party has a history of only working for minimum wage or less, and is capable, to your knowledge of working 40 hours/week, the court may impute his/her income at $1,141.25 net monthly for a noncustodial parent and $1,185.67 net monthly for a custodial parent. 10. Further your affiant sayeth naught. DATED this day of 20. Signature Printed Name: Address: Phone Number: STATE OF ) ) ss. COUNTY OF ) The foregoing instrument was subscribed and sworn to before me by this day of , 20 Witness my hand and official seal. Notarial Officer My commission expires: American LegalNet, Inc. www.FormsWorkFlow.com Affidavit of Imputed Income July 2014 Page 4 of 4 CERTIFICATE OF SERVICE I certify that on (date) the original of this document was filed with the Clerk of District Court; and, a true and accurate copy of this document was served on the other party by Hand Delivery OR Faxed to this number OR by placing it in the United States mail, postage pre-paid, and addressed to the following: (Print TO: Your signature Print name American LegalNet, Inc. www.FormsWorkFlow.com