New Jersey

Statewide

Division Of Taxation

Local Property Tax

200 Ratings

200 Ratings

Last updated: 4/2/2007

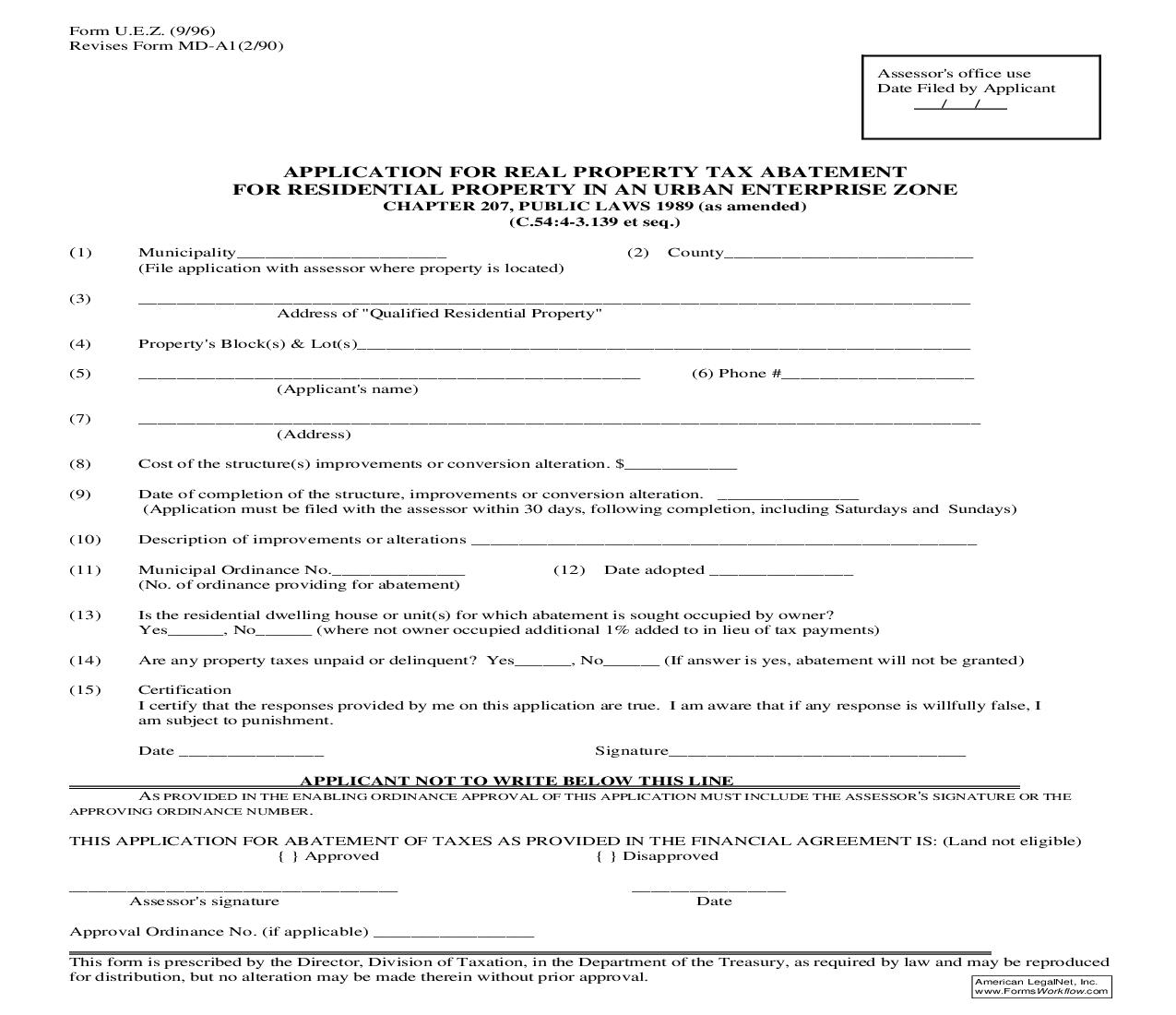

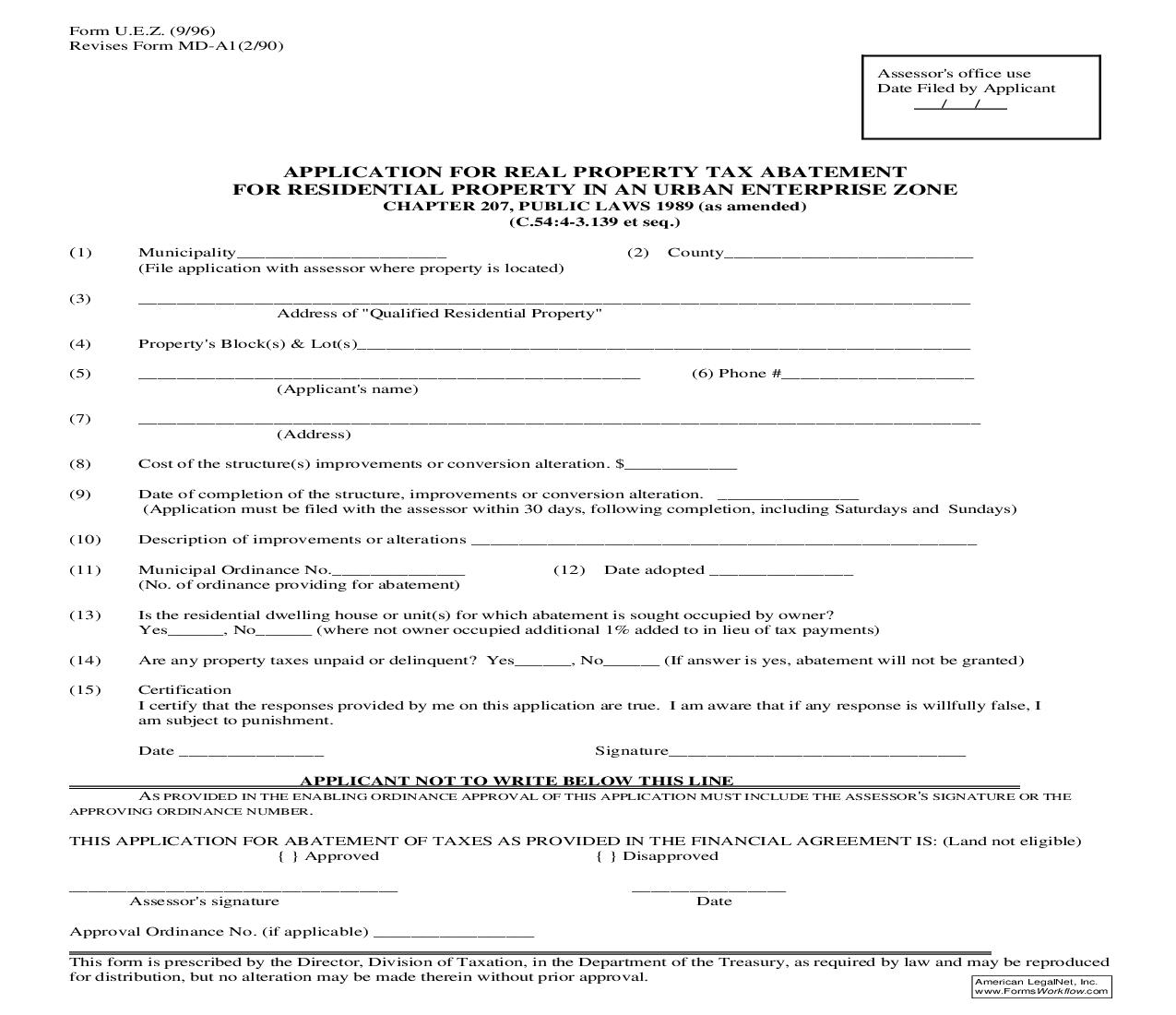

Application For Real Property Tax Abatement For Residential Property In An Urban Enterprise Zone {UEZ}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form U.E.Z. (9/96)

Related forms

-

Itemized Breakdown Listing (Supplement To Form CNC-1}

Itemized Breakdown Listing (Supplement To Form CNC-1}

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Certification For Loss In Assessed Value Of Vacant Land Attributable To Revaluation

Certification For Loss In Assessed Value Of Vacant Land Attributable To Revaluation

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Application For Real Property Tax Exemption For Certain Contaminated Real Property

Application For Real Property Tax Exemption For Certain Contaminated Real Property

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Further Statement Of Organization Claiming Property Tax Exemption

Further Statement Of Organization Claiming Property Tax Exemption

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Initial Statement Of Organization Claiming Property Tax Exemption

Initial Statement Of Organization Claiming Property Tax Exemption

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Filing Of Protest Of Fee Assessment

Filing Of Protest Of Fee Assessment

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Application For Real Property Tax Abatement For Residential Property In An Urban Enterprise Zone

Application For Real Property Tax Abatement For Residential Property In An Urban Enterprise Zone

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Aggregate Decline In True Value Of Eligible Vacant Land

Aggregate Decline In True Value Of Eligible Vacant Land

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Certification For Loss In Assessed Value Of Vacant Land Attributable To Revaluation

Certification For Loss In Assessed Value Of Vacant Land Attributable To Revaluation

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Certification Of New Construction Improvements Partial Assessments

Certification Of New Construction Improvements Partial Assessments

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Affidavit Of Consideration (Statement Of Prior Mortgage, Liens Or Encumbrances) For Sheriffs Deeds

Affidavit Of Consideration (Statement Of Prior Mortgage, Liens Or Encumbrances) For Sheriffs Deeds

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Claim For Real Property Tax Deduction Senior Or Disabled Person

Claim For Real Property Tax Deduction Senior Or Disabled Person

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Certification Of Eligibility Disabled Veterans Real Property Tax Exemption

Certification Of Eligibility Disabled Veterans Real Property Tax Exemption

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Controlling Interest Transfer Tax

Controlling Interest Transfer Tax

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Real Property Tax Deduction Supplemental Income Form

Real Property Tax Deduction Supplemental Income Form

New Jersey/1 Statewide/Division Of Taxation/Local Property Tax/ -

Affidavit Of Consideration For Use By Seller

Affidavit Of Consideration For Use By Seller

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Petition Of Appeal

Petition Of Appeal

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Application For Reassessment Program

Application For Reassessment Program

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Added Or Omitted Petition Of Appeal

Added Or Omitted Petition Of Appeal

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Claim For Refund - Realty Transfer Fee

Claim For Refund - Realty Transfer Fee

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Notice Of Disallowance Of Claim For Veterans Property Tax Deduction Exemption

Notice Of Disallowance Of Claim For Veterans Property Tax Deduction Exemption

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Compliance Plan

Compliance Plan

New Jersey/Statewide/Division Of Taxation/Local Property Tax/ -

Affidavit Of Consideration For Graduated Percent Fee

Affidavit Of Consideration For Graduated Percent Fee

New Jersey/Statewide/Division Of Taxation/Local Property Tax/

Form Preview

Sorry, we couldn't download the pdf file.

Our Products

Contact Us

Success: Your message was sent.

Thank you!