Last updated: 4/17/2025

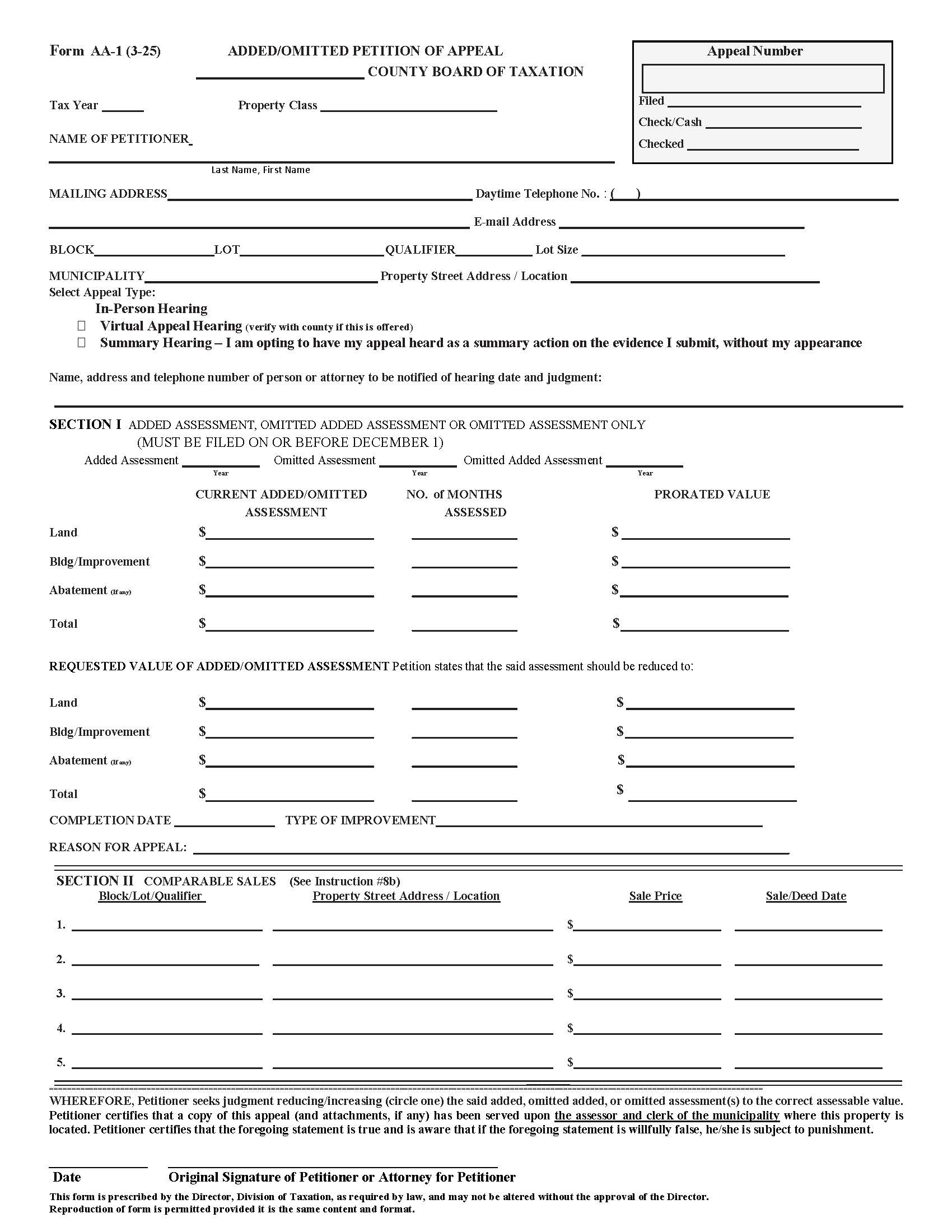

Added Or Omitted Petition Of Appeal {AA-1}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form AA-1 - ADDED/OMITTED PETITION OF APPEAL. This form is used by property owners or their legal representatives in New Jersey to challenge an added, omitted, or omitted added property tax assessment for a specific tax year. This form allows petitioners to appeal to the County Board of Taxation when they believe the tax assessment of newly added improvements, previously omitted property, or both, is inaccurate or excessive. It requires detailed information about the petitioner, the property (including block, lot, and street address), and the type of hearing requested—whether in-person, virtual (if offered by the county), or a summary hearing based solely on submitted evidence. The petitioner must provide current and requested assessment values for land and improvements, describe the type of improvement made, and state the reason for the appeal. Comparable property sales may be submitted as supporting evidence to justify the requested assessment change. Your appeal must be received (not postmarked) by the County Board of Taxation on or before December 1 of the tax year, or thirty (30) days from the date the collector completes the bulk mailing of tax bills for added or omitted assessments, whichever is later. An appeal received after the close of business hours on December 1 is untimely filed and will result in dismissal of the appeal. If the last day for filing an appeal falls on a Saturday, Sunday or legal holiday, the last day shall be extended to the first succeeding business day. Separate appeals must be filed for each taxed parcel unless the County Tax Administrator grants prior approval to consolidate parcels or lots into one appeal filing using form MAS (Multiple Appeal Schedule). A filing fee based on the prorated assessed valuation must accompany the petition. Petitioners must also serve copies of the appeal on the municipal assessor and clerk, and comply with specific evidence submission rules, including appraisal reports and income statements for income-producing properties. www.FormsWorkflow.com