Last updated: 5/6/2020

Claim For Real Property Tax Deduction Senior Or Disabled Person {PTD}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

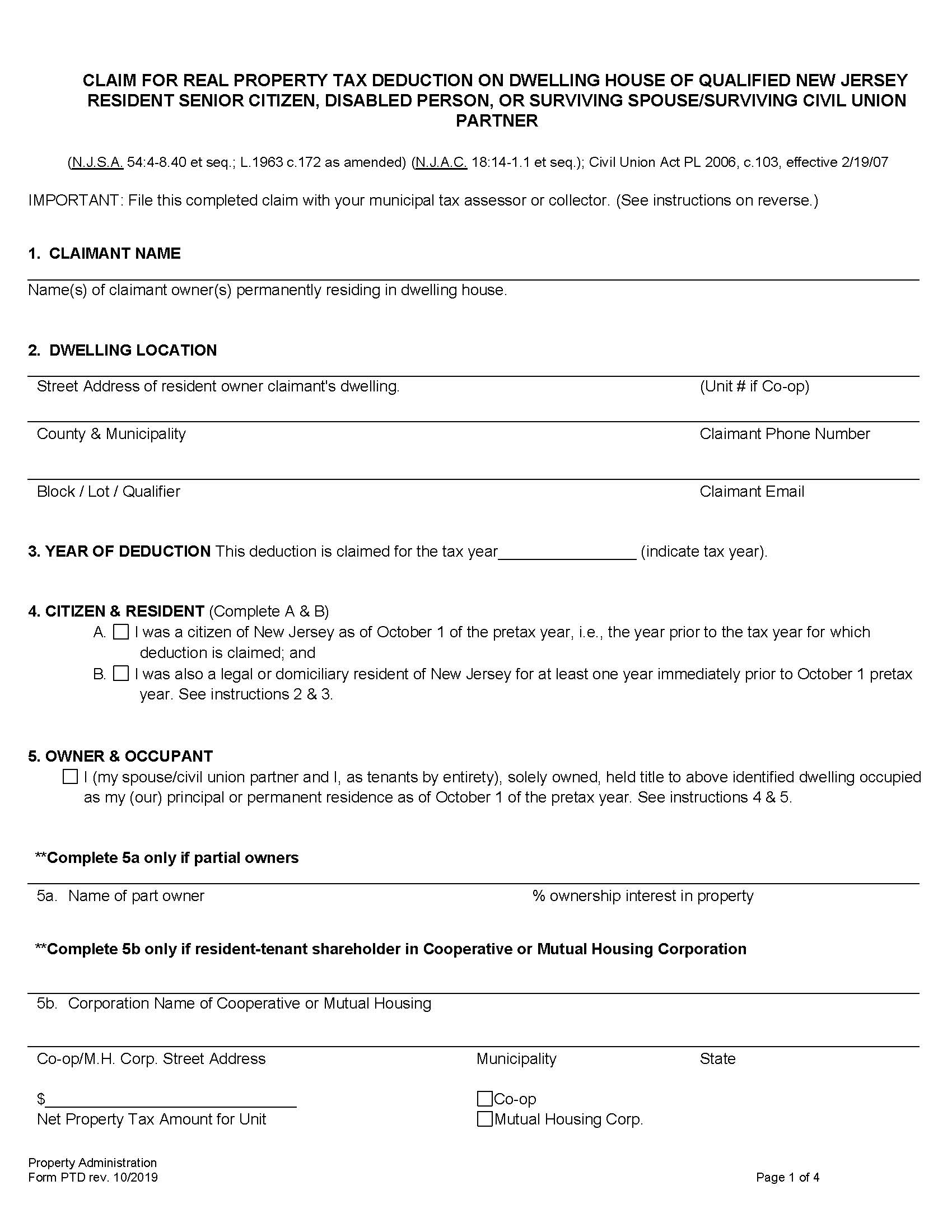

Form PTD - CLAIM FOR REAL PROPERTY TAX DEDUCTION ON DWELLING HOUSE OF QUALIFIED NEW JERSEY RESIDENT SENIOR CITIZEN, DISABLED PERSON, OR SURVIVING SPOUSE/SURVIVING CIVIL UNION PARTNER. This form is used to request a property tax deduction on a primary residence in New Jersey. This benefit is available to eligible residents who meet specific criteria under New Jersey law (N.J.S.A. 54:4-8.40 et seq.). Eligible claimants include individuals who are 65 years or older, permanently and totally disabled, or surviving spouses or surviving civil union partners of someone who previously received the deduction. To qualify, applicants must meet residency, ownership, and income requirements, such as having been a legal resident of New Jersey for at least one year prior to October 1 of the pretax year, and owning and occupying the dwelling as their primary residence on that date. The claimant’s annual income, after allowable exclusions (e.g., Social Security or certain government pensions), must not exceed $10,000. The form must be filed with the municipal tax assessor or tax collector within the designated time frame, depending on whether it is being filed in the pretax or tax year. Applicants must also submit supporting documents as proof of eligibility, such as a birth certificate, proof of disability, death certificate, property deed, and residency documents. If approved, the deduction reduces the amount of property tax owed on the claimant’s primary residence. Failure to file an annual Post-Tax Year Income Statement (Form PD5) by March 1 following the tax year may result in disqualification and a bill for the deduction amount. The form is part of New Jersey’s effort to provide tax relief to vulnerable populations and may only be used for one principal residence per eligible claimant. www.FormsWorkflow.com