Last updated: 4/8/2025

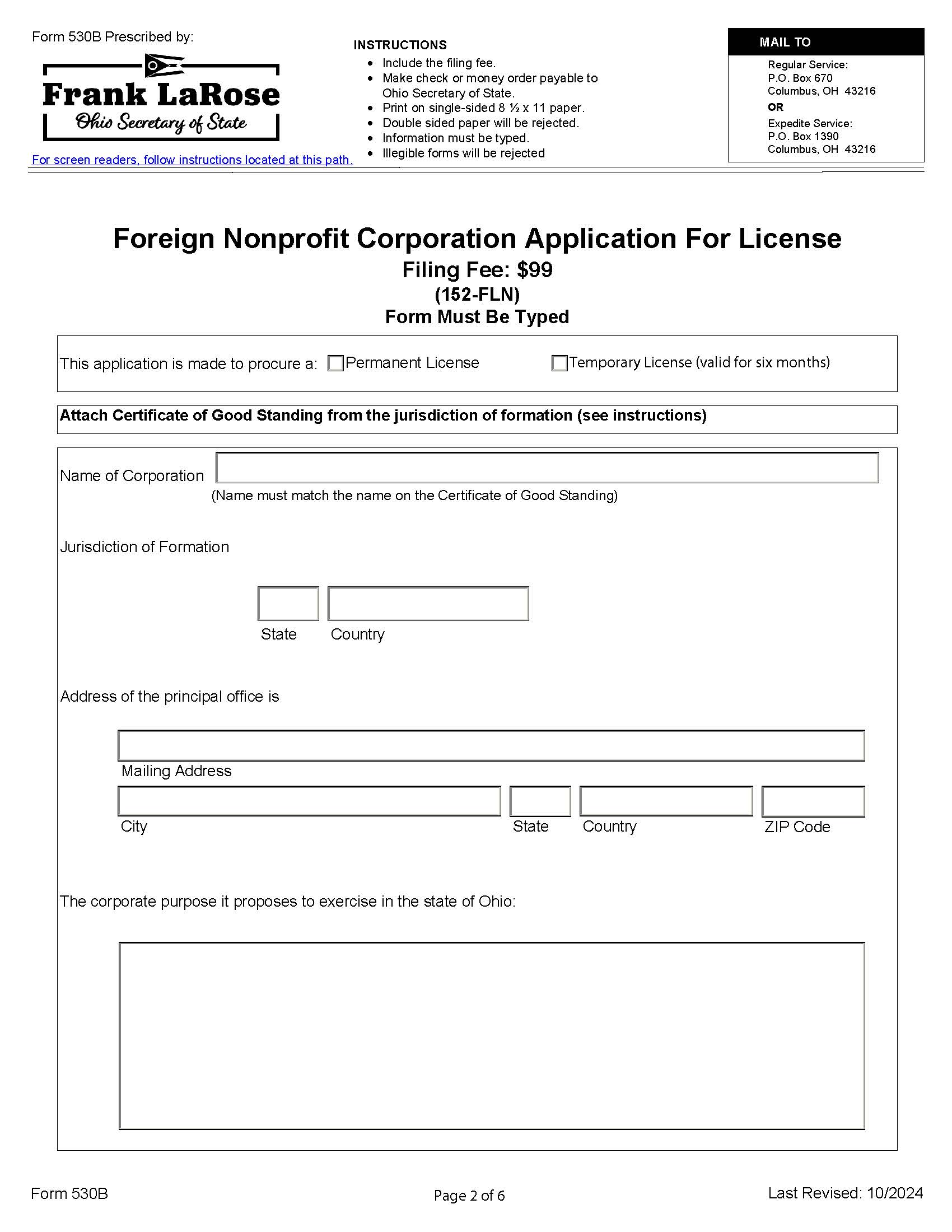

Foreign Nonprofit Corporation Application For License {530B}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form 530B - FOREIGN NONPROFIT CORPORATION APPLICATION FOR LICENSE. This form is used by nonprofit corporations that are incorporated outside of Ohio but wish to legally conduct business within the state. This application allows a foreign nonprofit to either obtain a permanent license or a temporary license (valid for six months) to operate in Ohio. Pursuant to Ohio Revised Code §1703.13, no foreign corporation shall be granted more than two temporary licenses within any period of three years. A permanent license allows a corporation to transact business in Ohio until the license is cancelled or surrendered. Pursuant to Ohio Revised Code §1703.27, to obtain a license to transact business in Ohio, a foreign nonprofit corporation must file a certificate of good standing or subsistence, setting forth the exact corporate title and the fact that the corporation is in good standing or is a subsisting corporation, certified by the secretary of state, or other proper official, of the state under the laws of which the corporation was incorporated. To complete this form, the corporation must provide details about its corporate purpose in Ohio, and the appointment of a statutory agent who will be responsible for accepting legal documents on behalf of the corporation in Ohio. The form also includes options for expedited processing with associated fees and requires notarized signatures from an authorized officer of the corporation. Corporations filing for the purpose of prosecuting or defending a legal action in Ohio may need to pay an extra $250 fee and provide a certificate from the Ohio Tax Commissioner if they began transacting business in the state before 2009 without a license. www.FormsWorkflow.com

Related forms

-

Certificate Of Disclaimer Of General Partner Status Certificate Of Cancellation Of Disclaimer

Certificate Of Disclaimer Of General Partner Status Certificate Of Cancellation Of Disclaimer

Ohio/Secretary Of State/Corporations/ -

Statement Of Denial Dissociation Dissolution

Statement Of Denial Dissociation Dissolution

Ohio/Secretary Of State/Corporations/ -

Statement Of Correction (Partnership or LLP)

Statement Of Correction (Partnership or LLP)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment Of A Cooperative Association

Certificate Of Amendment Of A Cooperative Association

Ohio/Secretary Of State/Corporations/ -

Registration Of Corporation Name

Registration Of Corporation Name

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment (For Profit Domestic Corporation)

Certificate Of Amendment (For Profit Domestic Corporation)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Limited Partnership Cancellation Limited Partnership Cancellation Amendment

Certificate Of Limited Partnership Cancellation Limited Partnership Cancellation Amendment

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment Correction Of Certification Of Limited Partnership

Certificate Of Amendment Correction Of Certification Of Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment To Foreign Licensed Corporation Application

Certificate Of Amendment To Foreign Licensed Corporation Application

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution (LLC)

Certificate Of Dissolution (LLC)

Ohio/Secretary Of State/Corporations/ -

Domestic Limited Liability Company Certificate Of Amendment Or Restatement

Domestic Limited Liability Company Certificate Of Amendment Or Restatement

Ohio/Secretary Of State/Corporations/ -

Certificate Of Correction (LLC)

Certificate Of Correction (LLC)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Surrender Of Foreign Licensed Corporation

Certificate Of Surrender Of Foreign Licensed Corporation

Ohio/Secretary Of State/Corporations/ -

Verified Oath To Submit Foreign Corporation Application For License

Verified Oath To Submit Foreign Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Statutory Agent Update

Statutory Agent Update

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution For Profit Domestic Corporation

Certificate Of Dissolution For Profit Domestic Corporation

Ohio/Secretary Of State/Corporations/ -

Reinstatement And Appointment Of Agent

Reinstatement And Appointment Of Agent

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment (Nonprofit Domestic Corporation)

Certificate Of Amendment (Nonprofit Domestic Corporation)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution Nonprofit Domestic Corporation

Certificate Of Dissolution Nonprofit Domestic Corporation

Ohio/Secretary Of State/Corporations/ -

Statement Of Continued Existence

Statement Of Continued Existence

Ohio/Secretary Of State/Corporations/ -

Reinstatement

Reinstatement

Ohio/Secretary Of State/Corporations/ -

Amendment Cancellation Of Partnership Statement

Amendment Cancellation Of Partnership Statement

Ohio/Secretary Of State/Corporations/ -

Articles Of Organization (LLC)

Articles Of Organization (LLC)

Ohio/Secretary Of State/Corporations/ -

Biennial Report

Biennial Report

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution (Cooperative Association)

Certificate Of Dissolution (Cooperative Association)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Domestic Limited Partnership

Certificate Of Domestic Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Certificate Of Foreign Limited Partnership

Certificate Of Foreign Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Foreign For-Profit Corporation Application For License

Foreign For-Profit Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Foreign Nonprofit Corporation Application For License

Foreign Nonprofit Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Multiple Agent Name And Address Change

Multiple Agent Name And Address Change

Ohio/Secretary Of State/Corporations/ -

Registration Of A Foreign LLC

Registration Of A Foreign LLC

Ohio/Secretary Of State/Corporations/ -

Reinstatement And Appointment Of Agent

Reinstatement And Appointment Of Agent

Ohio/Secretary Of State/Corporations/ -

Statement Of Domestic Qualification

Statement Of Domestic Qualification

Ohio/Secretary Of State/Corporations/ -

Statement Of Foreign Qualification (Limited Liability Partnership)

Statement Of Foreign Qualification (Limited Liability Partnership)

Ohio/Secretary Of State/Corporations/ -

Statement Of Partnership Authority

Statement Of Partnership Authority

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation For A Cooperative Association

Initial Articles Of Incorporation For A Cooperative Association

Ohio/Secretary Of State/Corporations/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!