Last updated: 4/8/2025

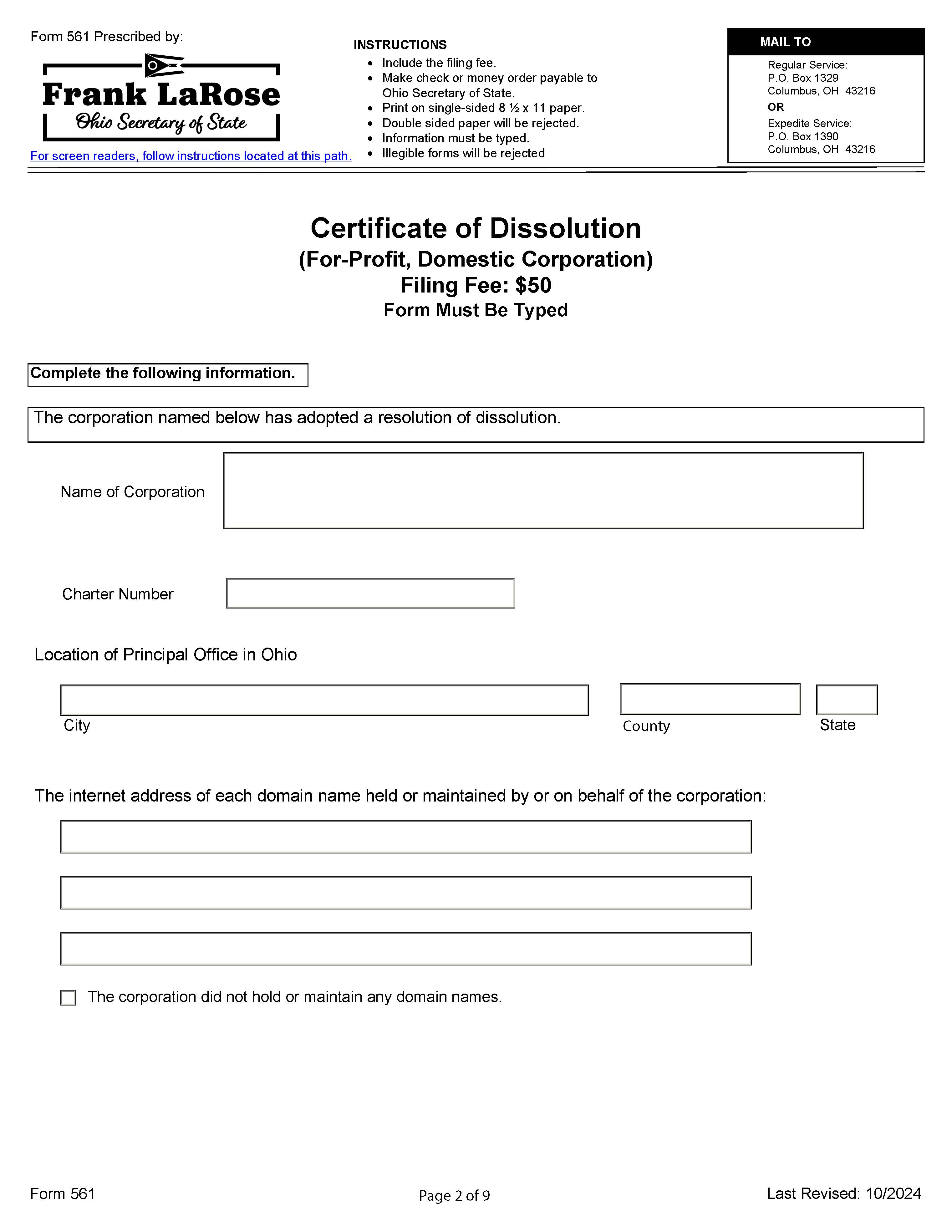

Certificate Of Dissolution For Profit Domestic Corporation {561}

Start Your Free Trial $ 27.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Form 561 - CERTIFICATE OF DISSOLUTION (FOR-PROFIT, DOMESTIC CORPORATION). This form is filed with the Ohio Secretary of State to formally dissolve a corporation that was formed in Ohio for profit. This form is used when a corporation has decided to permanently cease operations and terminate its legal existence under Ohio law. The process involves adopting a resolution of dissolution, which can be authorized by the corporation’s incorporators, directors, or shareholders, depending on the corporation’s circumstances and compliance with Ohio Revised Code § 1701.86. The form requires the corporation to provide essential details such as its name, charter number, principal office location, and any domain names held or maintained. If the corporation holds no domain names, that must be indicated as well. It also includes the appointment or reaffirmation of a statutory agent, who is responsible for receiving legal documents on behalf of the corporation, and whose address must be a physical location in Ohio—post office boxes and commercial mail receiving agency addresses are not permitted. The form includes a section to indicate the basis for the dissolution, such as a court order, the sale of all assets, or shareholder agreement. A notice of dissolution must be provided to creditors and claimants, informing them of the deadline to present any claims. Furthermore, an affidavit is required to confirm that various state agencies, such as the Ohio Bureau of Workers' Compensation, Ohio Department of Taxation, and Ohio Department of Job & Family Services, have been notified of the corporation’s intent to dissolve. Another affidavit may be included to clarify whether the corporation owns any personal property in Ohio counties, which affects tax responsibilities. www.FormsWorkflow.com

Related forms

-

Certificate Of Disclaimer Of General Partner Status Certificate Of Cancellation Of Disclaimer

Certificate Of Disclaimer Of General Partner Status Certificate Of Cancellation Of Disclaimer

Ohio/Secretary Of State/Corporations/ -

Statement Of Denial Dissociation Dissolution

Statement Of Denial Dissociation Dissolution

Ohio/Secretary Of State/Corporations/ -

Statement Of Correction (Partnership or LLP)

Statement Of Correction (Partnership or LLP)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment Of A Cooperative Association

Certificate Of Amendment Of A Cooperative Association

Ohio/Secretary Of State/Corporations/ -

Registration Of Corporation Name

Registration Of Corporation Name

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment (For Profit Domestic Corporation)

Certificate Of Amendment (For Profit Domestic Corporation)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Limited Partnership Cancellation Limited Partnership Cancellation Amendment

Certificate Of Limited Partnership Cancellation Limited Partnership Cancellation Amendment

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment Correction Of Certification Of Limited Partnership

Certificate Of Amendment Correction Of Certification Of Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment To Foreign Licensed Corporation Application

Certificate Of Amendment To Foreign Licensed Corporation Application

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution (LLC)

Certificate Of Dissolution (LLC)

Ohio/Secretary Of State/Corporations/ -

Domestic Limited Liability Company Certificate Of Amendment Or Restatement

Domestic Limited Liability Company Certificate Of Amendment Or Restatement

Ohio/Secretary Of State/Corporations/ -

Certificate Of Correction (LLC)

Certificate Of Correction (LLC)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Surrender Of Foreign Licensed Corporation

Certificate Of Surrender Of Foreign Licensed Corporation

Ohio/Secretary Of State/Corporations/ -

Verified Oath To Submit Foreign Corporation Application For License

Verified Oath To Submit Foreign Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Statutory Agent Update

Statutory Agent Update

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution For Profit Domestic Corporation

Certificate Of Dissolution For Profit Domestic Corporation

Ohio/Secretary Of State/Corporations/ -

Reinstatement And Appointment Of Agent

Reinstatement And Appointment Of Agent

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment (Nonprofit Domestic Corporation)

Certificate Of Amendment (Nonprofit Domestic Corporation)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution Nonprofit Domestic Corporation

Certificate Of Dissolution Nonprofit Domestic Corporation

Ohio/Secretary Of State/Corporations/ -

Statement Of Continued Existence

Statement Of Continued Existence

Ohio/Secretary Of State/Corporations/ -

Reinstatement

Reinstatement

Ohio/Secretary Of State/Corporations/ -

Amendment Cancellation Of Partnership Statement

Amendment Cancellation Of Partnership Statement

Ohio/Secretary Of State/Corporations/ -

Articles Of Organization (LLC)

Articles Of Organization (LLC)

Ohio/Secretary Of State/Corporations/ -

Biennial Report

Biennial Report

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution (Cooperative Association)

Certificate Of Dissolution (Cooperative Association)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Domestic Limited Partnership

Certificate Of Domestic Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Certificate Of Foreign Limited Partnership

Certificate Of Foreign Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Foreign For-Profit Corporation Application For License

Foreign For-Profit Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Foreign Nonprofit Corporation Application For License

Foreign Nonprofit Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Multiple Agent Name And Address Change

Multiple Agent Name And Address Change

Ohio/Secretary Of State/Corporations/ -

Registration Of A Foreign LLC

Registration Of A Foreign LLC

Ohio/Secretary Of State/Corporations/ -

Reinstatement And Appointment Of Agent

Reinstatement And Appointment Of Agent

Ohio/Secretary Of State/Corporations/ -

Statement Of Domestic Qualification

Statement Of Domestic Qualification

Ohio/Secretary Of State/Corporations/ -

Statement Of Foreign Qualification (Limited Liability Partnership)

Statement Of Foreign Qualification (Limited Liability Partnership)

Ohio/Secretary Of State/Corporations/ -

Statement Of Partnership Authority

Statement Of Partnership Authority

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation For A Cooperative Association

Initial Articles Of Incorporation For A Cooperative Association

Ohio/Secretary Of State/Corporations/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!