Last updated: 2/4/2011

Garnishment Exemption Worksheet {CV-426}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

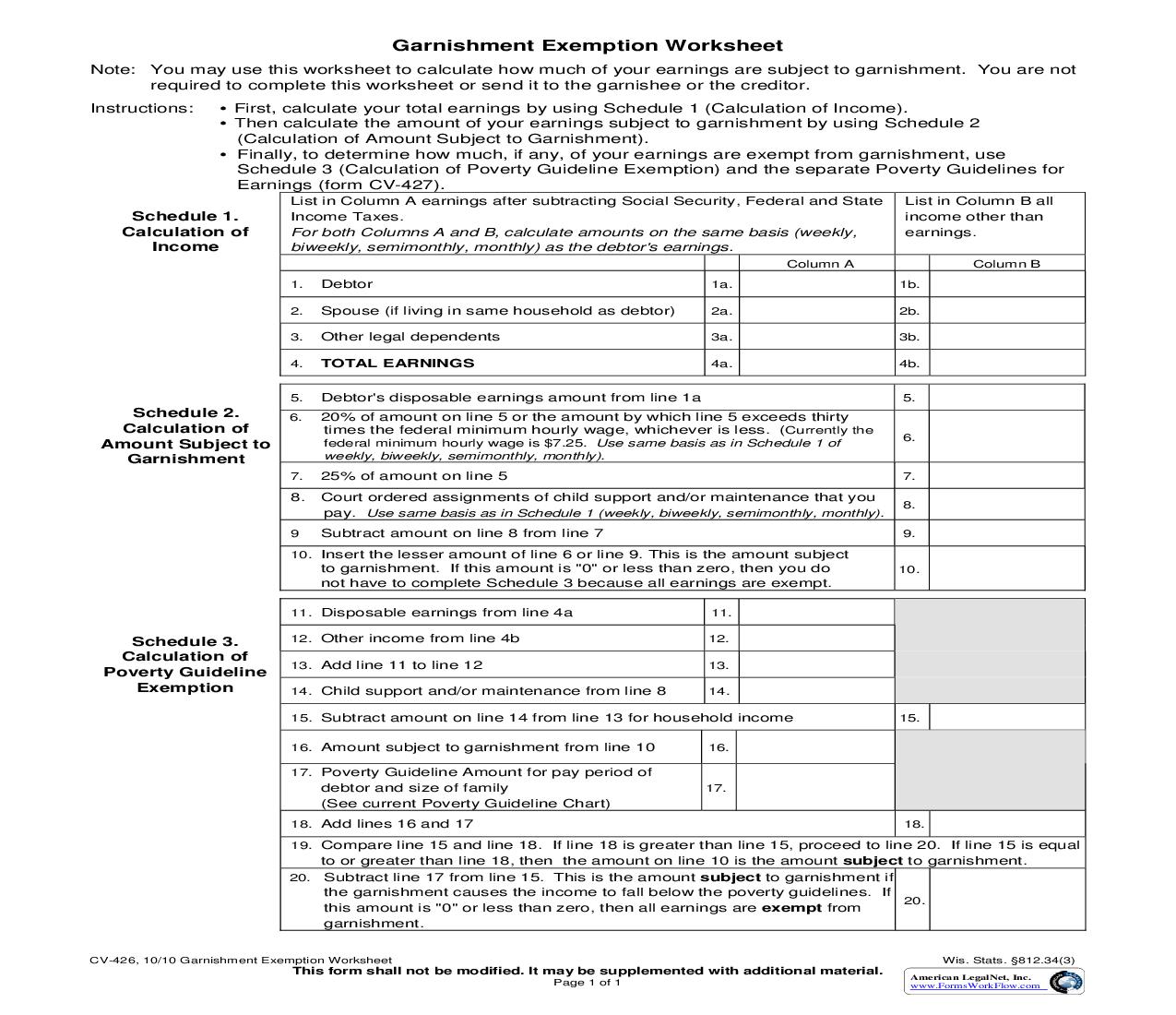

Garnishment Exemption Worksheet Note: You may use this worksheet to calculate how much of your earnings are subject to garnishment. You are not required to complete this worksheet or send it to the garnishee or the creditor. Instructions: · First, calculate your total earnings by using Schedule 1 (Calculation of Income). · Then calculate the amount of your earnings subject to garnishment by using Schedule 2 (Calculation of Amount Subject to Garnishment). · Finally, to determine how much, if any, of your earnings are exempt from garnishment, use Schedule 3 (Calculation of Poverty Guideline Exemption) and the separate Poverty Guidelines for Earnings (form CV-427). Schedule 1. Calculation of Income List in Column A earnings after subtracting Social Security, Federal and State Income Taxes. For both Columns A and B, calculate amounts on the same basis (weekly, biweekly, semimonthly, monthly) as the debtor's earnings. Column A List in Column B all income other than earnings. Column B 1. Debtor 1a. 1b. 2. Spouse (if living in same household as debtor) 2a. 2b. 3. Other legal dependents 3a. 3b. 4. TOTAL EARNINGS 4a. 4b. 5. Debtor's disposable earnings amount from line 1a 5. Schedule 2. 6. 20% of amount on line 5 or the amount by which line 5 exceeds thirty Calculation of times the federal minimum hourly wage, whichever is less. (Currently the federal minimum hourly wage is $7.25. Use same basis as in Schedule 1 of Amount Subject to weekly, biweekly, semimonthly, monthly). Garnishment 7. 6. 25% of amount on line 5 7. 8. Court ordered assignments of child support and/or maintenance that you pay. Use same basis as in Schedule 1 (weekly, biweekly, semimonthly, monthly). 9 8. Subtract amount on line 8 from line 7 9. 10. Insert the lesser amount of line 6 or line 9. This is the amount subject to garnishment. If this amount is "0" or less than zero, then you do not have to complete Schedule 3 because all earnings are exempt. 11. Disposable earnings from line 4a 11. 10. Schedule 3. Calculation of Poverty Guideline Exemption 12. Other income from line 4b 12. 13. Add line 11 to line 12 13. 14. Child support and/or maintenance from line 8 14. 15. Subtract amount on line 14 from line 13 for household income 15. 16. Amount subject to garnishment from line 10 16. 17. Poverty Guideline Amount for pay period of debtor and size of family (See current Poverty Guideline Chart) 18. Add lines 16 and 17 17. 18. 19. Compare line 15 and line 18. If line 18 is greater than line 15, proceed to line 20. If line 15 is equal to or greater than line 18, then the amount on line 10 is the amount subject to garnishment. 20. Subtract line 17 from line 15. This is the amount subject to garnishment if the garnishment causes the income to fall below the poverty guidelines. If 20. this amount is "0" or less than zero, then all earnings are exempt from garnishment. CV-426, 10/10 Garnishment Exemption Worksheet Wis. Stats. §812.34(3) Page 1 of 1 American LegalNet, Inc. www.FormsWorkFlow.com This form shall not be modified. It may be supplemented with additional material.

Related forms

-

Garnishment Exemption Worksheet

Garnishment Exemption Worksheet

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice To Department Of Corrections Of Actual Filing Fees And Costs

Notice To Department Of Corrections Of Actual Filing Fees And Costs

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Modify Mandatory Release Date Extended Supervision Good Time

Order To Modify Mandatory Release Date Extended Supervision Good Time

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Sheriff For Firearms Record Check Response To Sheriff

Order To Sheriff For Firearms Record Check Response To Sheriff

Wisconsin/Statewide/Circuit Court/Civil/ -

Publication Notice (Domestic Abuse Injunction Hearing)

Publication Notice (Domestic Abuse Injunction Hearing)

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Denying Change Of Name

Order Denying Change Of Name

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Denying Confidential Name Change

Order Denying Confidential Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Non-Earnings Garnishment Objection To Answer(s) And Demand For Hearing

Non-Earnings Garnishment Objection To Answer(s) And Demand For Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Wireless Telephone Service Transfer In Injunction Case

Wireless Telephone Service Transfer In Injunction Case

Wisconsin/Statewide/Circuit Court/Civil/ -

Order For Collection Of A Biological Specimen For DNA Analysis

Order For Collection Of A Biological Specimen For DNA Analysis

Wisconsin/Statewide/Circuit Court/Civil/ -

Bench Warrant - Capias Failure To Provide Biological Specimen

Bench Warrant - Capias Failure To Provide Biological Specimen

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice and Order For Injunction Hearing-TRO Not Issued (Individual at Risk)

Notice and Order For Injunction Hearing-TRO Not Issued (Individual at Risk)

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice And Order For Injunction Hearing-TRO Not Issued-Harassment

Notice And Order For Injunction Hearing-TRO Not Issued-Harassment

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice Of Firearm Surrender Hearing

Notice Of Firearm Surrender Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice-Order For Injunction Hearing TRO Not Issued (Child Abuse)

Notice-Order For Injunction Hearing TRO Not Issued (Child Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice-Order For Injunction Hearing When TRO Not Issued (Domestic Abuse)

Notice-Order For Injunction Hearing When TRO Not Issued (Domestic Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Civil Or Juvenile Child Abuse

Order Extending Injunction - Civil Or Juvenile Child Abuse

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Civil Or Juvenile Harassment

Order Extending Injunction - Civil Or Juvenile Harassment

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Domestic Abuse

Order Extending Injunction - Domestic Abuse

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Individual At Risk

Order Extending Injunction - Individual At Risk

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Produce A DNA Specimen

Order To Produce A DNA Specimen

Wisconsin/Statewide/Circuit Court/Civil/ -

Publication Notice (Harrasment Injunction Hearing)

Publication Notice (Harrasment Injunction Hearing)

Wisconsin/Statewide/Circuit Court/Civil/ -

Confidential Address Information Domestic Abuse-Harassment-TRO And Injunction Actions

Confidential Address Information Domestic Abuse-Harassment-TRO And Injunction Actions

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment Objection To Debtors Answer And Demand For Hearing

Earnings Garnishment Objection To Debtors Answer And Demand For Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Motion For De Novo Hearing TRO Injunction

Motion For De Novo Hearing TRO Injunction

Wisconsin/Statewide/Circuit Court/Civil/ -

Non-Earnings Garnishment Debtors Answer

Non-Earnings Garnishment Debtors Answer

Wisconsin/Statewide/Circuit Court/Civil/ -

Respondent Statement Of Possession Of Firearms

Respondent Statement Of Possession Of Firearms

Wisconsin/1 Statewide/Circuit Court/Civil/ -

Application For Order Of Satisfaction Of Judgment(s) Due To Discharge In Bankruptcy

Application For Order Of Satisfaction Of Judgment(s) Due To Discharge In Bankruptcy

Wisconsin/Statewide/Circuit Court/Civil/ -

Petitioner Statement Of Respondent Possession Of Firearms

Petitioner Statement Of Respondent Possession Of Firearms

Wisconsin/1 Statewide/Circuit Court/Civil/ -

Order For Name Change

Order For Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Surrender Firearms And Notice Of Firearm Surrender Hearing

Order To Surrender Firearms And Notice Of Firearm Surrender Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment Exemption Notice

Earnings Garnishment Exemption Notice

Wisconsin/Statewide/Circuit Court/Civil/ -

Dismissal Order

Dismissal Order

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment - Debtors Answer

Earnings Garnishment - Debtors Answer

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment

Earnings Garnishment

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Individual At Risk (Order Of Protection)

Injunction-Individual At Risk (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Non-Earnings Garnishment Garnishee Answer

Non-Earnings Garnishment Garnishee Answer

Wisconsin/Statewide/Circuit Court/Civil/ -

Order For Confidential Name Change

Order For Confidential Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Confidential Name Change

Petition For Confidential Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition Change Of Name (Adult or Minor 14 or Older)

Petition Change Of Name (Adult or Minor 14 or Older)

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Confidential Name Change - Minor

Petition For Confidential Name Change - Minor

Wisconsin/1 Statewide/Circuit Court/Civil/ -

Dismissal Order Prisoner Litigation

Dismissal Order Prisoner Litigation

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Child Abuse (Order Of Protection)

Injunction-Child Abuse (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Domestic Abuse (Order Of Protection)

Injunction-Domestic Abuse (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Harassment (Order Of Protection)

Injunction-Harassment (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice Of Firearms Possession Penalties

Notice Of Firearms Possession Penalties

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Concerning Return Of Firearms

Order Concerning Return Of Firearms

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Petition For Waiver Of Fees And Costs

Order On Petition For Waiver Of Fees And Costs

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice Of Injunction Hearing (Domestic Abuse-30709)

Temporary Restraining Order And Notice Of Injunction Hearing (Domestic Abuse-30709)

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment Notice

Earnings Garnishment Notice

Wisconsin/Statewide/Circuit Court/Civil/ -

Summons And Complaint Non-Earnings Garnishment

Summons And Complaint Non-Earnings Garnishment

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Of Satisfaction Due To Bankruptcy

Order Of Satisfaction Due To Bankruptcy

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Gender Change

Petition For Gender Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Petition For Gender Change

Order On Petition For Gender Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition To Return Firearms

Petition To Return Firearms

Wisconsin/Statewide/Circuit Court/Civil/ -

Response Non-Petitioning Parent To Name Change Of Minor Child Under 14

Response Non-Petitioning Parent To Name Change Of Minor Child Under 14

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And-Or Injunction (Individual At Risk)

Petition For Temporary Restraining Order And-Or Injunction (Individual At Risk)

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice of Injunction Hearing (Individual At Risk-30713)

Temporary Restraining Order And Notice of Injunction Hearing (Individual At Risk-30713)

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice Of Injunction Hearing (Harassment-30711)

Temporary Restraining Order And Notice Of Injunction Hearing (Harassment-30711)

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice Of Injunction Hearing (Child Abuse-30710)

Temporary Restraining Order And Notice Of Injunction Hearing (Child Abuse-30710)

Wisconsin/Statewide/Circuit Court/Civil/ -

Publication Affidavit Of Mailing Or Facsimile For Domestic-Harassment

Publication Affidavit Of Mailing Or Facsimile For Domestic-Harassment

Wisconsin/Statewide/Circuit Court/Civil/ -

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger - Affidavit Of Indigency

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger - Affidavit Of Indigency

Wisconsin/Statewide/Circuit Court/Civil/ -

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs - Affidavit Of Indigency

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs - Affidavit Of Indigency

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Waiver Of Fees And Costs Affidavit Of Indigency

Petition For Waiver Of Fees And Costs Affidavit Of Indigency

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And-Or Injunction (Domestic Abuse)

Petition For Temporary Restraining Order And-Or Injunction (Domestic Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And-Or Injunction (Child Abuse)

Petition For Temporary Restraining Order And-Or Injunction (Child Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Name Change (Under 14)

Petition For Name Change (Under 14)

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Time For Hearing

Order Extending Time For Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Dismissing-Denying Petition for TRO

Order Dismissing-Denying Petition for TRO

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice And Order For Name Change Hearing

Notice And Order For Name Change Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice And Order For Confidential Name Change Hearing

Notice And Order For Confidential Name Change Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Eligible Thrid Party Bidder Affidavit

Eligible Thrid Party Bidder Affidavit

Wisconsin/Statewide/Circuit Court/Civil/ -

Affidavit Of Mailing - Bankruptcy

Affidavit Of Mailing - Bankruptcy

Wisconsin/Statewide/Circuit Court/Civil/ -

Affidavit Of Attempted Service On Non-Petitioning Parent

Affidavit Of Attempted Service On Non-Petitioning Parent

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And Injunction

Petition For Temporary Restraining Order And Injunction

Wisconsin/Statewide/Circuit Court/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!