Last updated: 9/28/2018

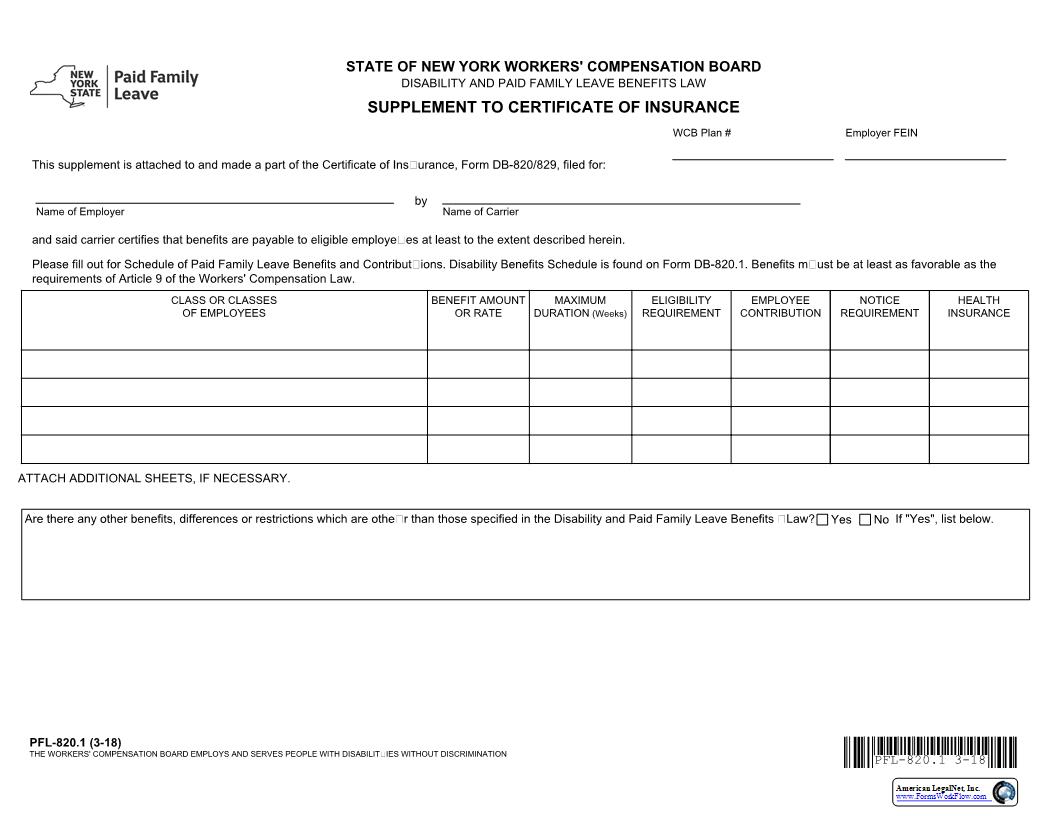

Paid Family Leave Supplement To Certificate Of Insurance {PFL-820.1}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

This supplement is attached to and made a part of the Certificate of Insurance, Form DB-820/829, filed for: by and said carrier certifies that benefits are payable to eligible employees at least to the extent described herein. Name of Employer Name of Carrier Employer FEIN WCB Plan # CLASS OR CLASSES OF EMPLOYEES BENEFIT AMOUNT OR RATE EMPLOYEE CONTRIBUTION ELIGIBILITY REQUIREMENT MAXIMUM DURATION (Weeks) NOTICE REQUIREMENT HEALTH INSURANCE Please fill out for Schedule of Paid Family Leave Benefits and Contributions. Disability Benefits Schedule is found on Form DB-820.1. Benefits must be at least as favorable as the requirements of Article 9 of the Workers' Compensation Law. Are there any other benefits, differences or restrictions which are other than those specified in the Disability and Paid Family Leave Benefits Law? If "Yes", list below. Yes NoTHE WORKERS' COMPENSATION BOARD EMPLOYS AND SERVES PEOPLE WITH DISABILITIES WITHOUT DISCRIMINATIONPFL-820.1 (3-18)STATE OF NEW YORK WORKERS' COMPENSATION BOARD DISABILITY AND PAID FAMILY LEAVE BENEFITS LAW SUPPLEMENT TO CERTIFICATE OF INSURANCE ATTACH ADDITIONAL SHEETS, IF NECESSARY. American LegalNet, Inc. www.FormsWorkFlow.com PFL-820.1 (3-18) INSTRUCTIONSWEEKLY BENEFIT AMOUNT OR RATE: The minimum acceptable weekly benefit amount is, on or after January 1, 2018, at least 50% of the employee's average weekly wage or 50% of the state average weekly wage, whichever is less. Beginning January 1, 2019, at least 55% of the employee's average weekly wage or 55% of the state average weekly wage, whichever is less. Beginning January 1, 2020, at least 60% of the employee's average weekly wage or 60% of the state average weekly wage, whichever is less. Beginning on January 1, 2021 and thereafter, at least 67% of the employee's average weekly wage or 67% of the state average weekly wage, whichever is less. In all cases, if the employee's average weekly wage is less than $100, the benefit amount must be at least the employee's average weekly wage. DURATION OF BENEFIT (IN WEEKS): Under Section 204 of the WCL, the minimum acceptable duration benefit periods are: on or after January 1, 2018, at least 8 weeks during any 52 week period; on or after January 1, 2019, at least 10 weeks during any 52 week period; and on January 1, 2021, at least 12 weeks during any 52 week period. ELIGIBILITY PERIOD: Employees working a normal work week must become eligible after 26 consecutive weeks of work; those working less than the employer's normal work week must become eligible within 175 days of work (Section 203 of the WCL). If the employee is eligible for paid family leave (after working 26 consecutive weeks or 175 days), there can be no waiting period for paid family leave benefits. EMPLOYEE CONTRIBUTION PER WEEK: If the total amount of employee contributions entered above is in excess of the maximum statutory contributions set annually by the Department of Financial Services pursuant to Section 209 of the WCL, such contributions must be entered into by agreement and reasonably related to the value of the benefits as determined by the Chair under Section 211 of the WCL. NOTICE REQUIRED FOR FORESEEABLE LEAVE: The Policy cannot require an employee to give more than 30 days of notice for foreseeable leave, or as soon as practicable for unforeseeable leave (Section 205 of the WCL). EMPLOYEE HEALTH INSURANCE CONTRIBUTION: If an employee is covered by group health insurance, an employer cannot require an employee on paid family leave to contribute more than the amount he or she did prior to beginning leave. NOTE: The Policy cannot negate the employee's right to reinstatement, to the same or comparable job, on return from paid family leave (Section 203-b of the WCL).DO NOT SCAN American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Application For Acceptance Of Insurance Form

Application For Acceptance Of Insurance Form

New York/Workers Compensation/ -

Carriers Report On Rehabilitation To Chair Workers Compensation Board

Carriers Report On Rehabilitation To Chair Workers Compensation Board

New York/Workers Compensation/ -

Claim For Compensation In Death Case

Claim For Compensation In Death Case

New York/Workers Compensation/ -

Claimants Authorization To Disclose Workers Compensation Records

Claimants Authorization To Disclose Workers Compensation Records

New York/Workers Compensation/ -

Notice Of Election Provide WC To Participants In Sheltered Workshop

Notice Of Election Provide WC To Participants In Sheltered Workshop

New York/Workers Compensation/ -

Notice To Liable Political Subdivision Of Volunteer Firefighters Injury Or Death

Notice To Liable Political Subdivision Of Volunteer Firefighters Injury Or Death

New York/Workers Compensation/ -

Statement Of Unresolved Issues-Special Part For Expedited Hearings

Statement Of Unresolved Issues-Special Part For Expedited Hearings

New York/Workers Compensation/ -

Carriers Request For Reimbursement Of Compensation Payments Under Section 14(6) (Blue Paper)

Carriers Request For Reimbursement Of Compensation Payments Under Section 14(6) (Blue Paper)

New York/Workers Compensation/ -

Claim For Volunteer Ambulance Workers Benefits In A Death Case

Claim For Volunteer Ambulance Workers Benefits In A Death Case

New York/Workers Compensation/ -

Claim For Volunteer Firefighters Benefits In A Death Case

Claim For Volunteer Firefighters Benefits In A Death Case

New York/Workers Compensation/ -

Electronic Attachment

Electronic Attachment

New York/Workers Compensation/ -

Proof Of Death By Physician Last In Attendance On Deceased

Proof Of Death By Physician Last In Attendance On Deceased

New York/Workers Compensation/ -

ADR Program Final Disposition Of Claim

ADR Program Final Disposition Of Claim

New York/Workers Compensation/ -

Record Of Percentage Hearing Loss

Record Of Percentage Hearing Loss

New York/Workers Compensation/ -

Carriers Request For Reimbursement Of Medical Expenses Under Section 15-8 (Pink Paper)

Carriers Request For Reimbursement Of Medical Expenses Under Section 15-8 (Pink Paper)

New York/Workers Compensation/ -

Notice Of Election To Bring Partners Or Self Employed Under NY WC

Notice Of Election To Bring Partners Or Self Employed Under NY WC

New York/Workers Compensation/ -

Notice Of Right To Select Workers Compensation Board Authorized Health Care Provider

Notice Of Right To Select Workers Compensation Board Authorized Health Care Provider

New York/Workers Compensation/ -

Claimants Authorization To Disclose Workers Compensation Records (Autorizacion Del Reclamante - Spanish)

Claimants Authorization To Disclose Workers Compensation Records (Autorizacion Del Reclamante - Spanish)

New York/Workers Compensation/ -

Notice Of Right To Reimbursement Of Compensation Payments

Notice Of Right To Reimbursement Of Compensation Payments

New York/Workers Compensation/ -

Disability Benefits Law Employer Identification Information

Disability Benefits Law Employer Identification Information

New York/Workers Compensation/ -

Health Insurers Request For Reimbursement

Health Insurers Request For Reimbursement

New York/Workers Compensation/ -

Notice Of Election Corporation Exclude Sole Shareholder Officers Shareholders From WC

Notice Of Election Corporation Exclude Sole Shareholder Officers Shareholders From WC

New York/Workers Compensation/ -

Notice Of Election Municipal Corporation Other Political Subdivision Bring Executives Under NY WC

Notice Of Election Municipal Corporation Other Political Subdivision Bring Executives Under NY WC

New York/Workers Compensation/ -

Notice Of Election Nonprofit To Exclude Unsalaried Executive Officer From WC

Notice Of Election Nonprofit To Exclude Unsalaried Executive Officer From WC

New York/Workers Compensation/ -

Notice Of Retainer And Appearance On Behalf Of Employer

Notice Of Retainer And Appearance On Behalf Of Employer

New York/Workers Compensation/ -

Revocation Of Election Corporation Exclude Sole Shareholder Officer From WC Coverage

Revocation Of Election Corporation Exclude Sole Shareholder Officer From WC Coverage

New York/Workers Compensation/ -

Revocation Of Election Municipal Corporation Other Political Subdivision Bring Executives Under NY WC

Revocation Of Election Municipal Corporation Other Political Subdivision Bring Executives Under NY WC

New York/Workers Compensation/ -

Revocation Of Election Nonprofit Or Unincorporated Assoc To Exclude Unsalaried Officer From WC

Revocation Of Election Nonprofit Or Unincorporated Assoc To Exclude Unsalaried Officer From WC

New York/Workers Compensation/ -

Cover Sheet-List Of Itemized Medical Bills In Controverted World Trade Center Case

Cover Sheet-List Of Itemized Medical Bills In Controverted World Trade Center Case

New York/Workers Compensation/ -

Licensed Representatives Disclosure Of Conflict Of Interest To Client

Licensed Representatives Disclosure Of Conflict Of Interest To Client

New York/Workers Compensation/ -

Notice Of Election Of Corporation To Exclude Shareholder Officers From Disability Coverage

Notice Of Election Of Corporation To Exclude Shareholder Officers From Disability Coverage

New York/Workers Compensation/ -

Modification Of Previous Report (ADR Program)

Modification Of Previous Report (ADR Program)

New York/Workers Compensation/ -

Self Insurers Representatives Bond

Self Insurers Representatives Bond

New York/Workers Compensation/ -

Request For Judicial Order - Access To Case Files

Request For Judicial Order - Access To Case Files

New York/Workers Compensation/ -

Claimants Record Of Job Search Efforts Contacts

Claimants Record Of Job Search Efforts Contacts

New York/Workers Compensation/ -

Loss Of Wage Earning Capacity Vocational Data Form

Loss Of Wage Earning Capacity Vocational Data Form

New York/Workers Compensation/ -

Notice That Claimant Must Arrange For Diagnostic Tests And Examinations Through Network Provider

Notice That Claimant Must Arrange For Diagnostic Tests And Examinations Through Network Provider

New York/Workers Compensation/ -

Initial Application To Take License Rep Exam To Appear On Behalf Of Claimants Or To Represent Carriers-Self-Insurers

Initial Application To Take License Rep Exam To Appear On Behalf Of Claimants Or To Represent Carriers-Self-Insurers

New York/Workers Compensation/ -

Attorney-Representatives Certification Of Form C-3 Or Notice Of Controversy

Attorney-Representatives Certification Of Form C-3 Or Notice Of Controversy

New York/Workers Compensation/ -

Independent Examiners Report Of Request For Information Or Response To Request Regarding Ind Med Exam

Independent Examiners Report Of Request For Information Or Response To Request Regarding Ind Med Exam

New York/Workers Compensation/ -

Paid Family Leave Supplement To Certificate Of Insurance

Paid Family Leave Supplement To Certificate Of Insurance

New York/Workers Compensation/ -

Employer Whistleblower Form

Employer Whistleblower Form

New York/Workers Compensation/ -

Attachment For Report Of Ind Med Exam Non Scheduled Perm Partial Disability

Attachment For Report Of Ind Med Exam Non Scheduled Perm Partial Disability

New York/Workers Compensation/ -

Attachment For Report Of Independent Med Exam Scheduled Loss Of Use

Attachment For Report Of Independent Med Exam Scheduled Loss Of Use

New York/Workers Compensation/ -

Claimants Record Of Independent Job Search Efforts

Claimants Record Of Independent Job Search Efforts

New York/7 Workers Compensation/ -

Claimants Statement Regarding No Fault Or Personal Injury

Claimants Statement Regarding No Fault Or Personal Injury

New York/7 Workers Compensation/ -

Report Of Impartial Specialist Examination Or Record Review

Report Of Impartial Specialist Examination Or Record Review

New York/7 Workers Compensation/ -

Application For License To Represent Insurers And Or Self-Insurers

Application For License To Represent Insurers And Or Self-Insurers

New York/Workers Compensation/ -

Independent Examiners Report of Independent Medical Examination

Independent Examiners Report of Independent Medical Examination

New York/Workers Compensation/ -

Direct Deposit Authorization Form

Direct Deposit Authorization Form

New York/7 Workers Compensation/ -

Extreme Hardship Redetermination Request

Extreme Hardship Redetermination Request

New York/7 Workers Compensation/ -

Practitioners Report Of Functional Capacity Evaluation

Practitioners Report Of Functional Capacity Evaluation

New York/Workers Compensation/ -

Claimants Record Of Medical And Travel Expenses And Request For Reimbursement

Claimants Record Of Medical And Travel Expenses And Request For Reimbursement

New York/7 Workers Compensation/ -

Carriers Request Benefit Increase Reimbursement Under VF-VAW Benefit Laws

Carriers Request Benefit Increase Reimbursement Under VF-VAW Benefit Laws

New York/7 Workers Compensation/ -

Sexual Harassment Policy

Sexual Harassment Policy

New York/7 Workers Compensation/ -

Sexual Harassment Prevention Poster

Sexual Harassment Prevention Poster

New York/7 Workers Compensation/ -

Insurers Notification Of Initial Request For Reimbursement 14(6) Or 15(8)

Insurers Notification Of Initial Request For Reimbursement 14(6) Or 15(8)

New York/7 Workers Compensation/ -

Limited Release Of Health Information (HIPAA)

Limited Release Of Health Information (HIPAA)

New York/Workers Compensation/ -

Report Of Work-Related Injury Or Occupational Disease

Report Of Work-Related Injury Or Occupational Disease

New York/Workers Compensation/ -

Volunteers Notification Of Exec Officer Fire-Ambulance Company-Significant Risk Of HIV

Volunteers Notification Of Exec Officer Fire-Ambulance Company-Significant Risk Of HIV

New York/Workers Compensation/ -

Notice Of Insurers Refusal To Pay Medical Bill Valuation Objections

Notice Of Insurers Refusal To Pay Medical Bill Valuation Objections

New York/7 Workers Compensation/ -

Employee Claim

Employee Claim

New York/Workers Compensation/ -

World Trade Center Volunteers Claim For Compensation

World Trade Center Volunteers Claim For Compensation

New York/Workers Compensation/ -

Request For Further Action By Legal Counsel

Request For Further Action By Legal Counsel

New York/Workers Compensation/ -

Application For A Fee By Claimants Attorney Or Representative

Application For A Fee By Claimants Attorney Or Representative

New York/Workers Compensation/ -

Notice Of Retainer And Appearance Or Notice Of Substitution And Appearance

Notice Of Retainer And Appearance Or Notice Of Substitution And Appearance

New York/Workers Compensation/ -

Notice That You May Be Responsible For Medical Costs

Notice That You May Be Responsible For Medical Costs

New York/Workers Compensation/ -

Settlement Agreement - Section 32 WCL Indemnity Only Settlement Agreement

Settlement Agreement - Section 32 WCL Indemnity Only Settlement Agreement

New York/Workers Compensation/ -

Section 32 Electronic Signature

Section 32 Electronic Signature

New York/Workers Compensation/ -

Claimants Notice Of Independent Medical Examination

Claimants Notice Of Independent Medical Examination

New York/Workers Compensation/ -

Physicians Application For Designation As Impartial Specialist

Physicians Application For Designation As Impartial Specialist

New York/7 Workers Compensation/ -

Physicians Application For Renewal Of Designation As Impartial Specialist

Physicians Application For Renewal Of Designation As Impartial Specialist

New York/7 Workers Compensation/ -

Notice To Chair Of Withdrawal Of Request For Arbitration

Notice To Chair Of Withdrawal Of Request For Arbitration

New York/Workers Compensation/ -

Supplement To Certificate Of Insurance

Supplement To Certificate Of Insurance

New York/Workers Compensation/ -

Employers Statement Of Wage Earnings (Preceding Date Of Injury-Illness)

Employers Statement Of Wage Earnings (Preceding Date Of Injury-Illness)

New York/7 Workers Compensation/ -

Impartial Specialists Report Of Medical Records Review

Impartial Specialists Report Of Medical Records Review

New York/Workers Compensation/ -

Employers Application Voluntary For Employees Benefits Not Required (No Contrib)

Employers Application Voluntary For Employees Benefits Not Required (No Contrib)

New York/Workers Compensation/ -

Employers Application Voluntary For Employees Benefits Not Required (Employee Contrib)

Employers Application Voluntary For Employees Benefits Not Required (Employee Contrib)

New York/Workers Compensation/ -

Employers Statement For Purpose Of Terminating Status As Covered Employer

Employers Statement For Purpose Of Terminating Status As Covered Employer

New York/Workers Compensation/ -

Claim For Compensation And Notice Of Commencement Of Third Party Action

Claim For Compensation And Notice Of Commencement Of Third Party Action

New York/Workers Compensation/ -

World Trade Center September 11th Victim Compensation Fund Authorization

World Trade Center September 11th Victim Compensation Fund Authorization

New York/7 Workers Compensation/ -

World Trade Center Volunteer HIPAA Authorization

World Trade Center Volunteer HIPAA Authorization

New York/7 Workers Compensation/ -

Biannual Recertification To Entitlement To Benefits

Biannual Recertification To Entitlement To Benefits

New York/Workers Compensation/ -

Pre Hearing Conference Statement

Pre Hearing Conference Statement

New York/Workers Compensation/ -

Notice To Liable Political Subdivision Or Unaffiliated Ambulance Service

Notice To Liable Political Subdivision Or Unaffiliated Ambulance Service

New York/Workers Compensation/ -

Occupational Injury-Illness Statement Of Rights

Occupational Injury-Illness Statement Of Rights

New York/7 Workers Compensation/ -

Attorney-Licensed Representative Request To Withdraw From Representation

Attorney-Licensed Representative Request To Withdraw From Representation

New York/Workers Compensation/ -

Notice Of Election Religious Charitable Organization Bring Executives Under NY WC

Notice Of Election Religious Charitable Organization Bring Executives Under NY WC

New York/Workers Compensation/ -

Revocation Of Election Religious Charitable Organization Bring Executives Under NY WC

Revocation Of Election Religious Charitable Organization Bring Executives Under NY WC

New York/Workers Compensation/ -

Volunteer Firefighters Claim For Benefits

Volunteer Firefighters Claim For Benefits

New York/Workers Compensation/ -

Volunteer Ambulance Workers Claim For Benefits

Volunteer Ambulance Workers Claim For Benefits

New York/Workers Compensation/ -

Employers Report Of Injured Employees Change In Employment Status Resulting From Injury

Employers Report Of Injured Employees Change In Employment Status Resulting From Injury

New York/Workers Compensation/ -

Request For Assistance By Injured Worker

Request For Assistance By Injured Worker

New York/Workers Compensation/ -

Request For Further Action By Insurer-Employer

Request For Further Action By Insurer-Employer

New York/Workers Compensation/ -

Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan

Employers Application To Have Association Union Or Trustee Plan Accepted As Employers Plan

New York/Workers Compensation/ -

Statement Of Registration Section 13n-WCL IME Entity

Statement Of Registration Section 13n-WCL IME Entity

New York/Workers Compensation/ -

Application For Plan Of Employer - Disability And-Or Family Leave

Application For Plan Of Employer - Disability And-Or Family Leave

New York/7 Workers Compensation/ -

Employees Statement Of Exempt Status

Employees Statement Of Exempt Status

New York/Workers Compensation/ -

Registration Of Participation In WTC Rescue Recovery Clean-Up Operations

Registration Of Participation In WTC Rescue Recovery Clean-Up Operations

New York/Workers Compensation/ -

Notice And Proof Of Claim For Disability Benefits

Notice And Proof Of Claim For Disability Benefits

New York/Workers Compensation/ -

Providers Request For Judgment Of Award

Providers Request For Judgment Of Award

New York/Workers Compensation/ -

Carriers Or Self-Insured Employers Affirmation

Carriers Or Self-Insured Employers Affirmation

New York/7 Workers Compensation/ -

Affirmation For Death Benefits

Affirmation For Death Benefits

New York/Workers Compensation/ -

Consent To NYS WCB Jurisdiction For Non-NY Carriers (3C Coverage)

Consent To NYS WCB Jurisdiction For Non-NY Carriers (3C Coverage)

New York/Workers Compensation/ -

Insurers Request For Reconsideration Of Reduction Under WCL § 14(6) Or 15(8)

Insurers Request For Reconsideration Of Reduction Under WCL § 14(6) Or 15(8)

New York/7 Workers Compensation/ -

Insurers Request For Reimbursement Of Medical Payments WCL Section 15(8)

Insurers Request For Reimbursement Of Medical Payments WCL Section 15(8)

New York/7 Workers Compensation/ -

Proof Of Burial And Funeral Expenses By Undertaker

Proof Of Burial And Funeral Expenses By Undertaker

New York/Workers Compensation/ -

Renewal Application For License To Appear On Behalf Of Claimant

Renewal Application For License To Appear On Behalf Of Claimant

New York/Workers Compensation/ -

Employers First Report Of Work-Related Injury Or Illness

Employers First Report Of Work-Related Injury Or Illness

New York/Workers Compensation/ -

Discharge Or Discrimination Complaint

Discharge Or Discrimination Complaint

New York/Workers Compensation/ -

Affirmation For License To Operate An X-Ray Bureau Or Laboratory

Affirmation For License To Operate An X-Ray Bureau Or Laboratory

New York/Workers Compensation/ -

Application For Approval Plan Of Association - Disability Family Leave Benefits

Application For Approval Plan Of Association - Disability Family Leave Benefits

New York/7 Workers Compensation/ -

Application For Board Review

Application For Board Review

New York/Workers Compensation/ -

Rebuttal Of Application For Board Review

Rebuttal Of Application For Board Review

New York/Workers Compensation/ -

Application For Reconsideration Full Board Review

Application For Reconsideration Full Board Review

New York/Workers Compensation/ -

Rebuttal Of Application For Reconsideration Full Board Review

Rebuttal Of Application For Reconsideration Full Board Review

New York/Workers Compensation/ -

Unemployment – Record of Employment

Unemployment – Record of Employment

New York/7 Workers Compensation/ -

Reclamacion Del Empleado

Reclamacion Del Empleado

New York/Workers Compensation/ -

Claimant Name And Address Form

Claimant Name And Address Form

New York/Workers Compensation/ -

Application For Self-Insurance (Disability And Paid Family Leave Benefits)

Application For Self-Insurance (Disability And Paid Family Leave Benefits)

New York/Workers Compensation/ -

Application For Self-Insurance (Workers Compensation Law))

Application For Self-Insurance (Workers Compensation Law))

New York/Workers Compensation/ -

Agreed Upon Findings And Awards For Proposed Conciliation Decision (Represented Claimants Only)

Agreed Upon Findings And Awards For Proposed Conciliation Decision (Represented Claimants Only)

New York/Workers Compensation/ -

Stipulation

Stipulation

New York/Workers Compensation/ -

Section 32 Waiver Agreement Claimant Release

Section 32 Waiver Agreement Claimant Release

New York/Workers Compensation/ -

Self Insurers Report Of Payroll For All Operations

Self Insurers Report Of Payroll For All Operations

New York/Workers Compensation/ -

Certification Of Excess Insurance Contract For Self Insurer (SI-21}

Certification Of Excess Insurance Contract For Self Insurer (SI-21}

New York/Workers Compensation/ -

Doctors Report Of MMI-Permanent Partial Impairment

Doctors Report Of MMI-Permanent Partial Impairment

New York/Workers Compensation/ -

Medical Narrative Report Template For CMS-1500

Medical Narrative Report Template For CMS-1500

New York/Workers Compensation/ -

Notice Of Election To Voluntarily Exclude Spouse From Coverage

Notice Of Election To Voluntarily Exclude Spouse From Coverage

New York/Workers Compensation/ -

Notice Of Objection To Payment Of Bill For Treatment Provided

Notice Of Objection To Payment Of Bill For Treatment Provided

New York/Workers Compensation/ -

Waiver Agreement - Section 32 WCL

Waiver Agreement - Section 32 WCL

New York/Workers Compensation/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!