Last updated: 4/8/2025

Reinstatement {525B}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

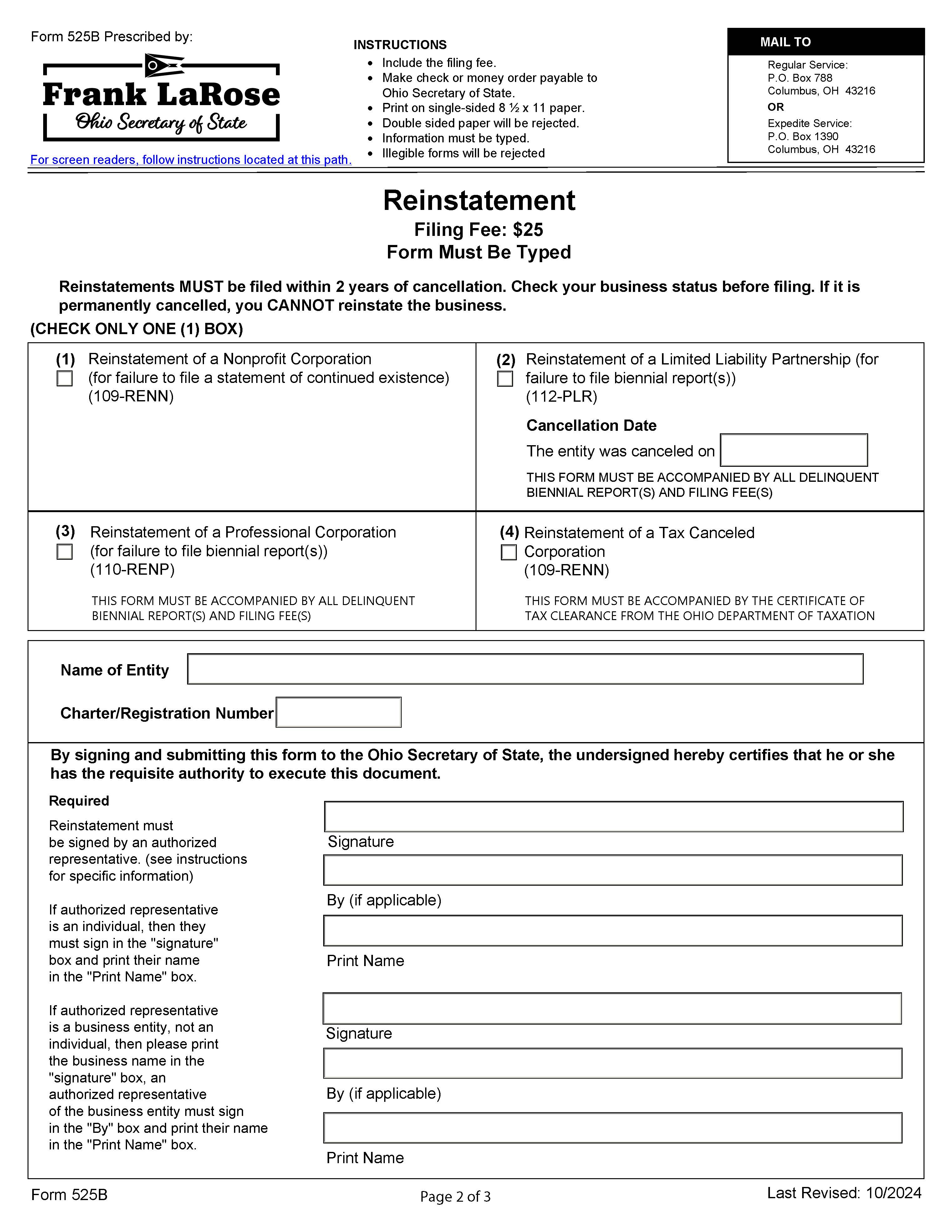

Form 525B - REINSTATEMENT. This form should be used to apply for reinstatement of (1) a nonprofit corporation whose articles or registration have been canceled for failure to file a statement of continued existence; (2) a limited liability partnership or professional corporation for failure to file a biennial report; or (3) a corporation whose articles have been cancelled by the Ohio Department of Taxation. The corporation or limited liability partnership must provide its name and charter/registration number. No other information is required for a nonprofit corporation reinstating for failure to file a statement of continued existence. A limited liability partnership or professional corporation reinstating for failure to file biennial report(s) must attach all delinquent biennial report(s) and associated filing fee(s) for each delinquent report in addition to the reinstatement filing fee. Pursuant to Ohio Revised Code §1776.83, a limited liability partnership must provide the date of cancellation. Also, a limited liability partnership may reinstate within two years after the effective date of the cancellation. After two years, the limited liability partnership must re-file a statement of qualification and cannot reinstate the original entity. When a corporation is canceled for nonpayment of taxes, it can be reinstated after it has cleared its tax obligation with the Ohio Department of Taxation. Once outstanding tax issues are resolved, the tax department will issue the corporation a Certificate of Tax Clearance showing the corporation has no outstanding tax obligations. The Certificate of Tax Clearance must be submitted with this form. After completing all information on the filing form, please make sure that the form is signed by an authorized representative. If the applicant is a domestic nonprofit corporation, the reinstatement form must be signed by an officer, director or three members in good standing. www.FormsWorkflow.com

Related forms

-

Certificate Of Disclaimer Of General Partner Status Certificate Of Cancellation Of Disclaimer

Certificate Of Disclaimer Of General Partner Status Certificate Of Cancellation Of Disclaimer

Ohio/Secretary Of State/Corporations/ -

Statement Of Denial Dissociation Dissolution

Statement Of Denial Dissociation Dissolution

Ohio/Secretary Of State/Corporations/ -

Statement Of Correction (Partnership or LLP)

Statement Of Correction (Partnership or LLP)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment Of A Cooperative Association

Certificate Of Amendment Of A Cooperative Association

Ohio/Secretary Of State/Corporations/ -

Registration Of Corporation Name

Registration Of Corporation Name

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment (For Profit Domestic Corporation)

Certificate Of Amendment (For Profit Domestic Corporation)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Limited Partnership Cancellation Limited Partnership Cancellation Amendment

Certificate Of Limited Partnership Cancellation Limited Partnership Cancellation Amendment

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment Correction Of Certification Of Limited Partnership

Certificate Of Amendment Correction Of Certification Of Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment To Foreign Licensed Corporation Application

Certificate Of Amendment To Foreign Licensed Corporation Application

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution (LLC)

Certificate Of Dissolution (LLC)

Ohio/Secretary Of State/Corporations/ -

Domestic Limited Liability Company Certificate Of Amendment Or Restatement

Domestic Limited Liability Company Certificate Of Amendment Or Restatement

Ohio/Secretary Of State/Corporations/ -

Certificate Of Correction (LLC)

Certificate Of Correction (LLC)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Surrender Of Foreign Licensed Corporation

Certificate Of Surrender Of Foreign Licensed Corporation

Ohio/Secretary Of State/Corporations/ -

Verified Oath To Submit Foreign Corporation Application For License

Verified Oath To Submit Foreign Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Statutory Agent Update

Statutory Agent Update

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution For Profit Domestic Corporation

Certificate Of Dissolution For Profit Domestic Corporation

Ohio/Secretary Of State/Corporations/ -

Reinstatement And Appointment Of Agent

Reinstatement And Appointment Of Agent

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Certificate Of Amendment (Nonprofit Domestic Corporation)

Certificate Of Amendment (Nonprofit Domestic Corporation)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution Nonprofit Domestic Corporation

Certificate Of Dissolution Nonprofit Domestic Corporation

Ohio/Secretary Of State/Corporations/ -

Statement Of Continued Existence

Statement Of Continued Existence

Ohio/Secretary Of State/Corporations/ -

Reinstatement

Reinstatement

Ohio/Secretary Of State/Corporations/ -

Amendment Cancellation Of Partnership Statement

Amendment Cancellation Of Partnership Statement

Ohio/Secretary Of State/Corporations/ -

Articles Of Organization (LLC)

Articles Of Organization (LLC)

Ohio/Secretary Of State/Corporations/ -

Biennial Report

Biennial Report

Ohio/Secretary Of State/Corporations/ -

Certificate Of Dissolution (Cooperative Association)

Certificate Of Dissolution (Cooperative Association)

Ohio/Secretary Of State/Corporations/ -

Certificate Of Domestic Limited Partnership

Certificate Of Domestic Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Certificate Of Foreign Limited Partnership

Certificate Of Foreign Limited Partnership

Ohio/Secretary Of State/Corporations/ -

Foreign For-Profit Corporation Application For License

Foreign For-Profit Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Foreign Nonprofit Corporation Application For License

Foreign Nonprofit Corporation Application For License

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation

Initial Articles Of Incorporation

Ohio/Secretary Of State/Corporations/ -

Multiple Agent Name And Address Change

Multiple Agent Name And Address Change

Ohio/Secretary Of State/Corporations/ -

Registration Of A Foreign LLC

Registration Of A Foreign LLC

Ohio/Secretary Of State/Corporations/ -

Reinstatement And Appointment Of Agent

Reinstatement And Appointment Of Agent

Ohio/Secretary Of State/Corporations/ -

Statement Of Domestic Qualification

Statement Of Domestic Qualification

Ohio/Secretary Of State/Corporations/ -

Statement Of Foreign Qualification (Limited Liability Partnership)

Statement Of Foreign Qualification (Limited Liability Partnership)

Ohio/Secretary Of State/Corporations/ -

Statement Of Partnership Authority

Statement Of Partnership Authority

Ohio/Secretary Of State/Corporations/ -

Initial Articles Of Incorporation For A Cooperative Association

Initial Articles Of Incorporation For A Cooperative Association

Ohio/Secretary Of State/Corporations/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!