Last updated: 11/3/2022

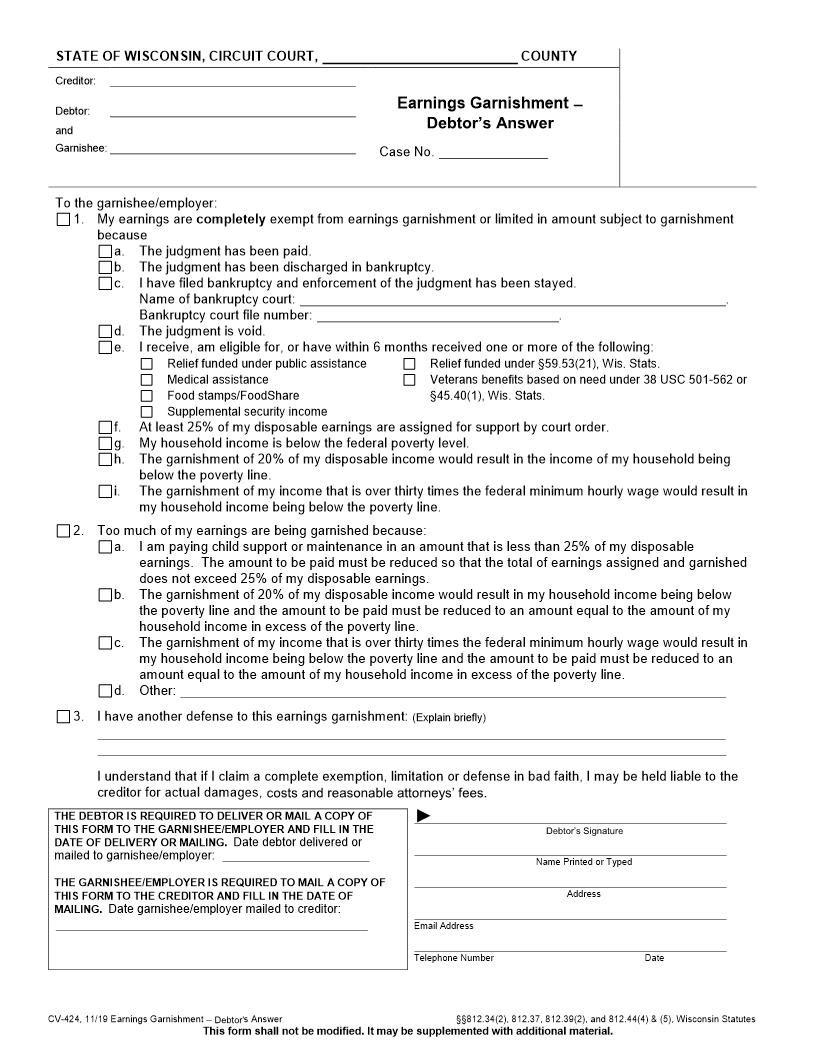

Earnings Garnishment - Debtors Answer {CV-424}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

STATE OF WISCONSIN, CIRCUIT COURT, Creditor: Debtor: and Garnishee: COUNTY For Official Use Earnings Garnishment Debtor's Answer Case No. To the garnishee/employer: 1. My earnings are completely exempt from earnings garnishment or limited in amount subject to garnishment because: a. The judgment has been paid. b. The judgment has been discharged in bankruptcy. c. I have filed bankruptcy and enforcement of the judgment has been stayed. Name of bankruptcy court: . Bankruptcy court file number: . d. The judgment is void. e. I receive, am eligible for, or have within 6 months received one or more of the following: Relief funded under public assistance Medical assistance Food stamps/FoodShare Supplemental security income Relief funded under §59.53(21), Wis. Stats. Veterans benefits based on need under 38 USC 501-562 or §45.40(1), Wis. Stats. f. At least 25% of my disposable earnings are assigned for support by court order. g. My household income is below the federal poverty level. h. The garnishment of 20% of my disposable income would result in the income of my household being below the poverty line. i. The garnishment of my income that is over thirty times the federal minimum hourly wage would result in my household income being below the poverty line. 2. Too much of my earnings are being garnished because: a. I am paying child support or maintenance in an amount that is less than 25% of my disposable earnings. The amount to be paid must be reduced so that the total of earnings assigned and garnished does not exceed 25% of my disposable earnings. b. The garnishment of 20% of my disposable income would result in my household income being below the poverty line and the amount to be paid must be reduced to an amount equal to the amount of my household income in excess of the poverty line. c. The garnishment of my income that is over thirty times the federal minimum hourly wage would result in my household income being below the poverty line and the amount to be paid must be reduced to an amount equal to the amount of my household income in excess of the poverty line. d. Other: 3. I have another defense to this earnings garnishment: (explain briefly) I understand that if I claim a complete exemption, limitation or defense in bad faith, I may be held liable to the creditor for actual damages, costs and reasonable attorneys' fees. Signature of Debtor THE DEBTOR IS REQUIRED TO DELIVER OR MAIL A COPY OF THIS FORM TO THE GARNISHEE/EMPLOYER AND FILL IN THE DATE OF DELIVERY OR MAILING. Date debtor delivered or Name Printed or Typed mailed to garnishee/employer: Date THE GARNISHEE/MPLOYER IS REQUIRED TO MAIL A COPY OF THIS FORM TO THE CREDITOR AND FILL IN THE DATE OF MAILING. Date garnishee/employer mailed to creditor: Address Telephone Number CV-424, 11/11 Earnings Garnishment - Debtor's Answer §§812.34(2), 812.37, 812.39(2), and 812.44(4) & (5), Wisconsin Statutes This form shall not be modified. It may be supplemented with additional material. American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Garnishment Exemption Worksheet

Garnishment Exemption Worksheet

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice To Department Of Corrections Of Actual Filing Fees And Costs

Notice To Department Of Corrections Of Actual Filing Fees And Costs

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Modify Mandatory Release Date Extended Supervision Good Time

Order To Modify Mandatory Release Date Extended Supervision Good Time

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Sheriff For Firearms Record Check Response To Sheriff

Order To Sheriff For Firearms Record Check Response To Sheriff

Wisconsin/Statewide/Circuit Court/Civil/ -

Publication Notice (Domestic Abuse Injunction Hearing)

Publication Notice (Domestic Abuse Injunction Hearing)

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Denying Change Of Name

Order Denying Change Of Name

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Denying Confidential Name Change

Order Denying Confidential Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Non-Earnings Garnishment Objection To Answer(s) And Demand For Hearing

Non-Earnings Garnishment Objection To Answer(s) And Demand For Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Wireless Telephone Service Transfer In Injunction Case

Wireless Telephone Service Transfer In Injunction Case

Wisconsin/Statewide/Circuit Court/Civil/ -

Order For Collection Of A Biological Specimen For DNA Analysis

Order For Collection Of A Biological Specimen For DNA Analysis

Wisconsin/Statewide/Circuit Court/Civil/ -

Bench Warrant - Capias Failure To Provide Biological Specimen

Bench Warrant - Capias Failure To Provide Biological Specimen

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice and Order For Injunction Hearing-TRO Not Issued (Individual at Risk)

Notice and Order For Injunction Hearing-TRO Not Issued (Individual at Risk)

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice And Order For Injunction Hearing-TRO Not Issued-Harassment

Notice And Order For Injunction Hearing-TRO Not Issued-Harassment

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice Of Firearm Surrender Hearing

Notice Of Firearm Surrender Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice-Order For Injunction Hearing TRO Not Issued (Child Abuse)

Notice-Order For Injunction Hearing TRO Not Issued (Child Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice-Order For Injunction Hearing When TRO Not Issued (Domestic Abuse)

Notice-Order For Injunction Hearing When TRO Not Issued (Domestic Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Civil Or Juvenile Child Abuse

Order Extending Injunction - Civil Or Juvenile Child Abuse

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Civil Or Juvenile Harassment

Order Extending Injunction - Civil Or Juvenile Harassment

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Domestic Abuse

Order Extending Injunction - Domestic Abuse

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Injunction - Individual At Risk

Order Extending Injunction - Individual At Risk

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Produce A DNA Specimen

Order To Produce A DNA Specimen

Wisconsin/Statewide/Circuit Court/Civil/ -

Publication Notice (Harrasment Injunction Hearing)

Publication Notice (Harrasment Injunction Hearing)

Wisconsin/Statewide/Circuit Court/Civil/ -

Confidential Address Information Domestic Abuse-Harassment-TRO And Injunction Actions

Confidential Address Information Domestic Abuse-Harassment-TRO And Injunction Actions

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment Objection To Debtors Answer And Demand For Hearing

Earnings Garnishment Objection To Debtors Answer And Demand For Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Motion For De Novo Hearing TRO Injunction

Motion For De Novo Hearing TRO Injunction

Wisconsin/Statewide/Circuit Court/Civil/ -

Non-Earnings Garnishment Debtors Answer

Non-Earnings Garnishment Debtors Answer

Wisconsin/Statewide/Circuit Court/Civil/ -

Respondent Statement Of Possession Of Firearms

Respondent Statement Of Possession Of Firearms

Wisconsin/1 Statewide/Circuit Court/Civil/ -

Application For Order Of Satisfaction Of Judgment(s) Due To Discharge In Bankruptcy

Application For Order Of Satisfaction Of Judgment(s) Due To Discharge In Bankruptcy

Wisconsin/Statewide/Circuit Court/Civil/ -

Petitioner Statement Of Respondent Possession Of Firearms

Petitioner Statement Of Respondent Possession Of Firearms

Wisconsin/1 Statewide/Circuit Court/Civil/ -

Order For Name Change

Order For Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Order To Surrender Firearms And Notice Of Firearm Surrender Hearing

Order To Surrender Firearms And Notice Of Firearm Surrender Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment Exemption Notice

Earnings Garnishment Exemption Notice

Wisconsin/Statewide/Circuit Court/Civil/ -

Dismissal Order

Dismissal Order

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment - Debtors Answer

Earnings Garnishment - Debtors Answer

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment

Earnings Garnishment

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Individual At Risk (Order Of Protection)

Injunction-Individual At Risk (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Non-Earnings Garnishment Garnishee Answer

Non-Earnings Garnishment Garnishee Answer

Wisconsin/Statewide/Circuit Court/Civil/ -

Order For Confidential Name Change

Order For Confidential Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Confidential Name Change

Petition For Confidential Name Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition Change Of Name (Adult or Minor 14 or Older)

Petition Change Of Name (Adult or Minor 14 or Older)

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Confidential Name Change - Minor

Petition For Confidential Name Change - Minor

Wisconsin/1 Statewide/Circuit Court/Civil/ -

Dismissal Order Prisoner Litigation

Dismissal Order Prisoner Litigation

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Child Abuse (Order Of Protection)

Injunction-Child Abuse (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Domestic Abuse (Order Of Protection)

Injunction-Domestic Abuse (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Injunction-Harassment (Order Of Protection)

Injunction-Harassment (Order Of Protection)

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice Of Firearms Possession Penalties

Notice Of Firearms Possession Penalties

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Concerning Return Of Firearms

Order Concerning Return Of Firearms

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Petition For Waiver Of Fees And Costs

Order On Petition For Waiver Of Fees And Costs

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice Of Injunction Hearing (Domestic Abuse-30709)

Temporary Restraining Order And Notice Of Injunction Hearing (Domestic Abuse-30709)

Wisconsin/Statewide/Circuit Court/Civil/ -

Earnings Garnishment Notice

Earnings Garnishment Notice

Wisconsin/Statewide/Circuit Court/Civil/ -

Summons And Complaint Non-Earnings Garnishment

Summons And Complaint Non-Earnings Garnishment

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Of Satisfaction Due To Bankruptcy

Order Of Satisfaction Due To Bankruptcy

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Gender Change

Petition For Gender Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Petition For Gender Change

Order On Petition For Gender Change

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition To Return Firearms

Petition To Return Firearms

Wisconsin/Statewide/Circuit Court/Civil/ -

Response Non-Petitioning Parent To Name Change Of Minor Child Under 14

Response Non-Petitioning Parent To Name Change Of Minor Child Under 14

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And-Or Injunction (Individual At Risk)

Petition For Temporary Restraining Order And-Or Injunction (Individual At Risk)

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice of Injunction Hearing (Individual At Risk-30713)

Temporary Restraining Order And Notice of Injunction Hearing (Individual At Risk-30713)

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice Of Injunction Hearing (Harassment-30711)

Temporary Restraining Order And Notice Of Injunction Hearing (Harassment-30711)

Wisconsin/Statewide/Circuit Court/Civil/ -

Temporary Restraining Order And Notice Of Injunction Hearing (Child Abuse-30710)

Temporary Restraining Order And Notice Of Injunction Hearing (Child Abuse-30710)

Wisconsin/Statewide/Circuit Court/Civil/ -

Publication Affidavit Of Mailing Or Facsimile For Domestic-Harassment

Publication Affidavit Of Mailing Or Facsimile For Domestic-Harassment

Wisconsin/Statewide/Circuit Court/Civil/ -

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger - Affidavit Of Indigency

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger - Affidavit Of Indigency

Wisconsin/Statewide/Circuit Court/Civil/ -

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs - Affidavit Of Indigency

Prisoners Petition For Waiver Of Prepayment Of Fees-Costs - Affidavit Of Indigency

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Waiver Of Fees And Costs Affidavit Of Indigency

Petition For Waiver Of Fees And Costs Affidavit Of Indigency

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And-Or Injunction (Domestic Abuse)

Petition For Temporary Restraining Order And-Or Injunction (Domestic Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And-Or Injunction (Child Abuse)

Petition For Temporary Restraining Order And-Or Injunction (Child Abuse)

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Name Change (Under 14)

Petition For Name Change (Under 14)

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs Based On Imminent Danger

Wisconsin/Statewide/Circuit Court/Civil/ -

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs

Order On Prisoners Petition For Waiver Of Prepayment Of Fees-Costs

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Extending Time For Hearing

Order Extending Time For Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Order Dismissing-Denying Petition for TRO

Order Dismissing-Denying Petition for TRO

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice And Order For Name Change Hearing

Notice And Order For Name Change Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Notice And Order For Confidential Name Change Hearing

Notice And Order For Confidential Name Change Hearing

Wisconsin/Statewide/Circuit Court/Civil/ -

Eligible Thrid Party Bidder Affidavit

Eligible Thrid Party Bidder Affidavit

Wisconsin/Statewide/Circuit Court/Civil/ -

Affidavit Of Mailing - Bankruptcy

Affidavit Of Mailing - Bankruptcy

Wisconsin/Statewide/Circuit Court/Civil/ -

Affidavit Of Attempted Service On Non-Petitioning Parent

Affidavit Of Attempted Service On Non-Petitioning Parent

Wisconsin/Statewide/Circuit Court/Civil/ -

Petition For Temporary Restraining Order And Injunction

Petition For Temporary Restraining Order And Injunction

Wisconsin/Statewide/Circuit Court/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!