Last updated: 7/11/2012

Income Withholding For Support Instructions {OMB 0970-0154In}

Start Your Free Trial $ 21.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

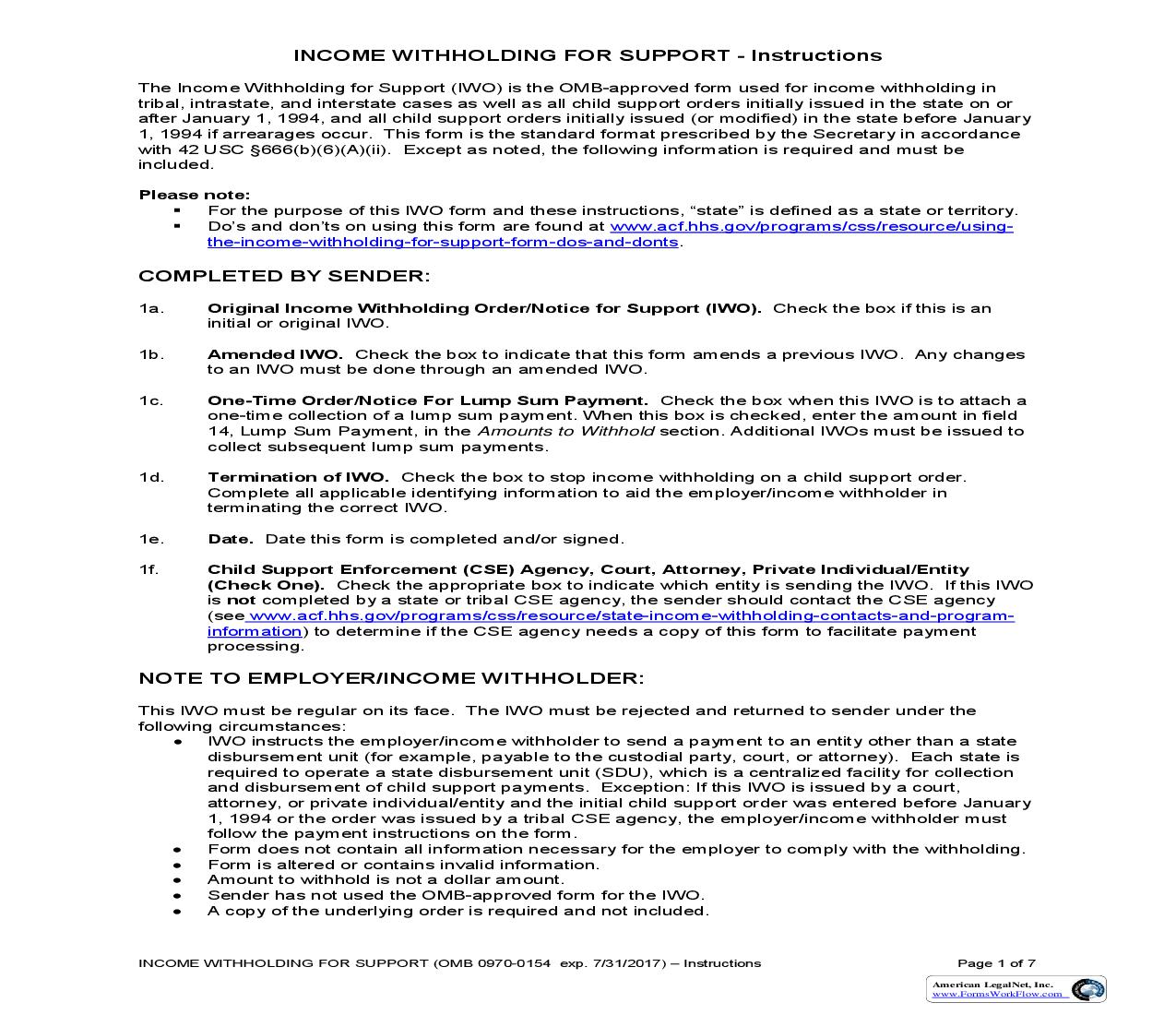

INCOME WITHHOLDING FOR SUPPORT - Instructions The Income Withholding for Support (IWO) is the OMB-approved form used for income withholding in Tribal, intrastate, and interstate cases as well as all child support orders which are initially issued in the State on or after January 1, 1994, and all child support orders which are initially issued (or modified) in the State before January 1, 1994 if arrearages occur. This form is the standard format prescribed by the Secretary in accordance with USC 42 §666(b)(6)(A)(ii). Except as noted, the following information must be included. Please note: For the purpose of this IWO form and these instructions, "State" is defined as a State or Territory. COMPLETED BY SENDER: 1a. Original Income Withholding Order/Notice for Support (IWO). Check the box if this is an original IWO. Amended IWO. Check the box to indicate that this form amends a previous IWO. Any changes to an IWO must be done through an amended IWO. One-Time Order/Notice For Lump Sum Payment. Check the box when this IWO is to attach a one-time collection of a lump sum payment. When this box is checked, enter the amount in field 14, Lump Sum Payment, in the Amounts to Withhold section. Additional IWOs must be issued to collect subsequent lump sum payments. Termination of IWO. Check the box to stop income withholding on an IWO. Complete all applicable identifying information to aid the employer/income withholder in terminating the correct IWO. Date. Date this form is completed and/or signed. Child Support Enforcement (CSE) Agency, Court, Attorney, Private Individual/Entity (Check One). Check the appropriate box to indicate which entity is sending the IWO. If this IWO is not completed by a State or Tribal CSE agency, the sender should contact the CSE agency (see http://www.acf.hhs.gov/programs/cse/newhire/employer/contacts/contact_map.htm) to determine if the CSE agency needs a copy of this form to facilitate payment processing. 1b. 1c. 1d. 1e. 1f. NOTE TO EMPLOYER/INCOME WITHHOLDER: This IWO must be regular on its face. Under the following circumstances, the IWO must be rejected and returned to sender: · IWO instructs the employer/income withholder to send a payment to an entity other than a State Disbursement Unit (e.g., payable to the custodial party, court, or attorney). Each State is required to operate a State Disbursement Unit (SDU), which is a centralized facility for collection and disbursement of child support payments. Exception: If this IWO is issued by a Court, Attorney, or Private Individual/Entity and the initial child support order was entered before January 1, 1994 or the order was issued by a Tribal CSE agency, the employer/income withholder must follow the payment instructions on the form. · Form does not contain all information necessary for the employer to comply with the withholding. · Form is altered or contains invalid information. · Amount to withhold is not a dollar amount. · Sender has not used the OMB-approved form for the IWO (effective May 31, 2012). · A copy of the underlying order is required and not included. If you receive this document from an Attorney or Private Individual/Entity, a copy of the underlying order containing a provision authorizing income withholding must be attached. INCOME WITHHOLDING FOR SUPPORT (OMB 0970-0154) Instructions Page 1 of 6 American LegalNet, Inc. www.FormsWorkFlow.com COMPLETED BY SENDER: 1g. State/Tribe/Territory. Name of State or Tribe sending this form. This must be a governmental entity of the State or a Tribal organization authorized by a Tribal government to operate a CSE program. If you are a Tribe submitting this form on behalf of another Tribe, complete line 1i. Remittance Identifier (include w/payment). Identifier that employers must include when sending payments for this IWO. The remittance identifier is entered as the case identifier on the Electronic Funds Transfer/Electronic Data Interchange (EFT/EDI) record. 1h. NOTE TO EMPLOYER/INCOME WITHHOLDER: The employer/income withholder must use the Remittance Identifier when remitting payments so the SDU or Tribe can identify and apply the payment correctly. The remittance identifier is entered as the case identifier on the EFT/EDI record. COMPLETED BY SENDER: 1i. City/County/Dist./Tribe. Name of the city, county or district sending this form. This must be a governmental entity of the State or the name of the Tribe authorized by a Tribal government to operate a CSE program for which this form is being sent. (A Tribe should leave this field blank unless submitting this form on behalf of another Tribe.) Order Identifier. Unique identifier that is associated with a specific child support obligation. It could be a court case number, docket number, or other identifier designated by the sender. Private Individual/Entity. Name of the private individual/entity or non-IV-D Tribal CSE organization sending this form. CSE Agency Case Identifier. Unique identifier assigned to a State or Tribal CSE case. In a State CSE case, this is the identifier that is reported to the Federal Case Registry (FCR). For Tribes this would be either the FCR identifier or other applicable identifier. 1j. 1k. 1l. Fields 2 and 3 refer to the employee/obligor's employer/income withholder and specific case information. 2a. 2b. Employer/Income Withholder's Name. Name of employer or income withholder. Employer/Income Withholder's Address. Employer/income withholder's mailing address including street/PO box, city, state and zip code. (This may differ from the employee/obligor's work site.) If the employer/income withholder is a federal government agency, the IWO should be sent to the address listed under Federal Agencies Addresses for Income Withholding Purposes at http://www.acf.hhs.gov/programs/cse/newhire/contacts/iw_fedcontacts.htm. Employer/Income Withholder's FEIN. Employer/income withholder's nine-digit Federal Employer Identification Number (FEIN) (if available). Employee/Obligor's Name. Employee/obligor's last name, first name, middle name. Employee/Obligor's Social Security Number. Employee/obligor's Social Security number or other taxpayer identification number. Custodial Party/Obligee's Name. Custodial party/obligee's last name, first name, middle name. Child(ren)'s Name(s). Child(ren)'s last name(s), first name(s), middle name(s). (Note: If there are more than six children for this IWO, list additional children's names and birth dates in field 33 - Additional Information). 2c. 3a. 3b.

Related forms

-

Affidavit And Request For Hearing In Claim And Delivery

Affidavit And Request For Hearing In Claim And Delivery

North Carolina/Statewide/Civil/ -

Affidavit In Attachment Proceeding

Affidavit In Attachment Proceeding

North Carolina/Statewide/Civil/ -

Affidavit Of Parentage

Affidavit Of Parentage

North Carolina/Statewide/Civil/ -

Application And Order Extending Time to File Complaint

Application And Order Extending Time to File Complaint

North Carolina/Statewide/Civil/ -

Application And Order To Appoint Guardian Ad Litem In Action For Domestic Violence Protective Order

Application And Order To Appoint Guardian Ad Litem In Action For Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Appointment Of Mediator In Prelitigation Farm Nuisance Dispute

Appointment Of Mediator In Prelitigation Farm Nuisance Dispute

North Carolina/Statewide/Civil/ -

Arbitration Application And Order For Payment To Arbitrator

Arbitration Application And Order For Payment To Arbitrator

North Carolina/Statewide/Civil/ -

Arbitration Assessment Of Arbitration Fee

Arbitration Assessment Of Arbitration Fee

North Carolina/Statewide/Civil/ -

Arbitration Notice Of Arbitration Hearing

Arbitration Notice Of Arbitration Hearing

North Carolina/Statewide/Civil/ -

Arbitration Stipulation And Order

Arbitration Stipulation And Order

North Carolina/Statewide/Civil/ -

Certificate Of Paternity

Certificate Of Paternity

North Carolina/Statewide/Civil/ -

Certificate Of Payment On Judgment

Certificate Of Payment On Judgment

North Carolina/Statewide/Civil/ -

Child Support Payment Transmittal

Child Support Payment Transmittal

North Carolina/Statewide/Civil/ -

Civil Docket

Civil Docket

North Carolina/Statewide/Civil/ -

Civil Docket Extra Defendants

Civil Docket Extra Defendants

North Carolina/Statewide/Civil/ -

Consent Agreement And Order To Modify Child Support Order

Consent Agreement And Order To Modify Child Support Order

North Carolina/Statewide/Civil/ -

Contempt Order Domestic Violence Protective Order

Contempt Order Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Court Action Cover Sheet

Court Action Cover Sheet

North Carolina/Statewide/Civil/ -

Defendants Motion To Discharge Attachment

Defendants Motion To Discharge Attachment

North Carolina/Statewide/Civil/ -

Delayed Service Of Complaint

Delayed Service Of Complaint

North Carolina/Statewide/Civil/ -

Findings On Application For Claim And Delivery Order

Findings On Application For Claim And Delivery Order

North Carolina/Statewide/Civil/ -

Identifying Information about Defendant Domestic Violence Action

Identifying Information about Defendant Domestic Violence Action

North Carolina/Statewide/Civil/ -

Information Request To Determine Appropriate Forum

Information Request To Determine Appropriate Forum

North Carolina/Statewide/Civil/ -

Limited Driving Privilege Speeding Out Of County Out Of State Or Federal Convictions

Limited Driving Privilege Speeding Out Of County Out Of State Or Federal Convictions

North Carolina/Statewide/Civil/ -

Mediators Certification In Prelitigation Farm Nuisance Dispute

Mediators Certification In Prelitigation Farm Nuisance Dispute

North Carolina/Statewide/Civil/ -

Memorandum Of Judgment Order

Memorandum Of Judgment Order

North Carolina/Statewide/Civil/ -

Motion And Notice Of Hearing To Rescind Affidavit Of Parentage

Motion And Notice Of Hearing To Rescind Affidavit Of Parentage

North Carolina/Statewide/Civil/ -

Motion And Order To Show Cause For Failure To Comply With Order In Child Support Action

Motion And Order To Show Cause For Failure To Comply With Order In Child Support Action

North Carolina/Statewide/Civil/ -

Motion And Order To Waive Custody Mediation

Motion And Order To Waive Custody Mediation

North Carolina/Statewide/Civil/ -

Motion Cover Sheet

Motion Cover Sheet

North Carolina/Statewide/Civil/ -

Motion To Claim Exempt Property Constitutional Exemptions

Motion To Claim Exempt Property Constitutional Exemptions

North Carolina/Statewide/Civil/ -

Notice Of Change Or Termination Of Withholding For Child Support

Notice Of Change Or Termination Of Withholding For Child Support

North Carolina/Statewide/Civil/ -

Notice Of Ex Parte Hearing Before District Court Judge

Notice Of Ex Parte Hearing Before District Court Judge

North Carolina/Statewide/Civil/ -

Notice Of Hearing For Enforcement In Child Support Action

Notice Of Hearing For Enforcement In Child Support Action

North Carolina/Statewide/Civil/ -

Notice Of Hearing In Claim And Delivery

Notice Of Hearing In Claim And Delivery

North Carolina/Statewide/Civil/ -

Notice Of Hearing On Domestic Violence Protection Order

Notice Of Hearing On Domestic Violence Protection Order

North Carolina/Statewide/Civil/ -

Notice Of Hearing On Exempt Property

Notice Of Hearing On Exempt Property

North Carolina/Statewide/Civil/ -

Notice Of Registration Of Foreign Support Order

Notice Of Registration Of Foreign Support Order

North Carolina/Statewide/Civil/ -

Notice Of Right To Have Exemptions Designated

Notice Of Right To Have Exemptions Designated

North Carolina/Statewide/Civil/ -

Notice Of Upset Bid In Judicial Sale Or Execution Sale To Person Holding The Sale

Notice Of Upset Bid In Judicial Sale Or Execution Sale To Person Holding The Sale

North Carolina/Statewide/Civil/ -

Notice Of Voluntary Dismissal

Notice Of Voluntary Dismissal

North Carolina/Statewide/Civil/ -

Notice Payment On Judgment Judgment Paid In Full Partial Payment

Notice Payment On Judgment Judgment Paid In Full Partial Payment

North Carolina/Statewide/Civil/ -

Order Approving Parenting Agreement

Order Approving Parenting Agreement

North Carolina/Statewide/Civil/ -

Order Approving Partial Parenting Agreement

Order Approving Partial Parenting Agreement

North Carolina/Statewide/Civil/ -

Order Authorizing Reinstatement Of Obligors Licensing Privileges

Order Authorizing Reinstatement Of Obligors Licensing Privileges

North Carolina/Statewide/Civil/ -

Order Continuing Domestic Violence Hearing and Ex Parte Order

Order Continuing Domestic Violence Hearing and Ex Parte Order

North Carolina/Statewide/Civil/ -

Order Designating Exempt Property

Order Designating Exempt Property

North Carolina/Statewide/Civil/ -

Order Establishing Child Support

Order Establishing Child Support

North Carolina/Statewide/Civil/ -

Order Of Attachment

Order Of Attachment

North Carolina/Statewide/Civil/ -

Order On Child Custody Mediation

Order On Child Custody Mediation

North Carolina/Statewide/Civil/ -

Order Renewing Domestic Violence Protective Order

Order Renewing Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Order Revoking Obligors Licensing Privileges And Notice To Agency

Order Revoking Obligors Licensing Privileges And Notice To Agency

North Carolina/Statewide/Civil/ -

Order To Withhold Wages To Enforce Child Support

Order To Withhold Wages To Enforce Child Support

North Carolina/Statewide/Civil/ -

Petition For Reinstatement Of Licensing Privileges

Petition For Reinstatement Of Licensing Privileges

North Carolina/Statewide/Civil/ -

Request For Certification Of Reinstatement And Certificate Authorizing Reinstatement Of Licensing Privileges

Request For Certification Of Reinstatement And Certificate Authorizing Reinstatement Of Licensing Privileges

North Carolina/Statewide/Civil/ -

Request For Hearing To Contest Withholding To Enforce Child Support

Request For Hearing To Contest Withholding To Enforce Child Support

North Carolina/Statewide/Civil/ -

Request For Issuance Of Writ Of Possession Of Real Property When Judgment More Than 30 Days Old

Request For Issuance Of Writ Of Possession Of Real Property When Judgment More Than 30 Days Old

North Carolina/Statewide/Civil/ -

Summons To Garnishee And Notice Of Levy

Summons To Garnishee And Notice Of Levy

North Carolina/Statewide/Civil/ -

Verified Statement And Notice Of Lien For Delinquent Child Support

Verified Statement And Notice Of Lien For Delinquent Child Support

North Carolina/Statewide/Civil/ -

Voluntary Waiver Of Hearing In Claim And Delivery

Voluntary Waiver Of Hearing In Claim And Delivery

North Carolina/Statewide/Civil/ -

Waiver Of Prelitigation Mediation In Farm Nuisance Dispute

Waiver Of Prelitigation Mediation In Farm Nuisance Dispute

North Carolina/Statewide/Civil/ -

Writ Of Possession Personal Property

Writ Of Possession Personal Property

North Carolina/Statewide/Civil/ -

Writ Of Possession Real Property

Writ Of Possession Real Property

North Carolina/Statewide/Civil/ -

Income Withholding For Support

Income Withholding For Support

North Carolina/Statewide/Civil/ -

Income Withholding For Support Instructions

Income Withholding For Support Instructions

North Carolina/Statewide/Civil/ -

Motion To Claim Exempt Property Statutory Exemptions

Motion To Claim Exempt Property Statutory Exemptions

North Carolina/Statewide/Civil/ -

Commitment Order For Civil Contempt Child Support

Commitment Order For Civil Contempt Child Support

North Carolina/Statewide/Civil/ -

Motion To Modify Custody

Motion To Modify Custody

North Carolina/Statewide/Civil/ -

Order Dismissing Complaint For Domestic Violence Protective Order For Failure To Prosecute

Order Dismissing Complaint For Domestic Violence Protective Order For Failure To Prosecute

North Carolina/Statewide/Civil/ -

Transcript Request

Transcript Request

North Carolina/Statewide/Civil/ -

Notice Of Hearing On No Contact Order For Stalking Or Nonconsensual Sexual Conduct

Notice Of Hearing On No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Commitment Order For Civil Contempt

Commitment Order For Civil Contempt

North Carolina/Statewide/Civil/ -

Order Upon Motion To Return Weapons Surrendered Under Domestic Violence Protective Order

Order Upon Motion To Return Weapons Surrendered Under Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Motion And Notice Of Hearing For Disposal Of Weapons Surrendered Under Domestic Violence Protective Order

Motion And Notice Of Hearing For Disposal Of Weapons Surrendered Under Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Order Upon Motion For Disposal Of Weapons Surrendered Under Domestic Violence Proctective Order

Order Upon Motion For Disposal Of Weapons Surrendered Under Domestic Violence Proctective Order

North Carolina/Statewide/Civil/ -

Order Setting Aside No Contact Order For Stalking Or Nonconsensual Sexual Conduct

Order Setting Aside No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Motion To Renew Set Aside No Contact Order For Stalking Or Nonconsensual Sexual Conduct (CV-525}

Motion To Renew Set Aside No Contact Order For Stalking Or Nonconsensual Sexual Conduct (CV-525}

North Carolina/Statewide/Civil/ -

Order Renewing No Contact Order For Stalking Or Nonconsensual Sexual Conduct

Order Renewing No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Order Continuing No Contact Hearing And Temporary Order

Order Continuing No Contact Hearing And Temporary Order

North Carolina/Statewide/Civil/ -

Motion And Order To Show Cause-Failure To Comply (Stalking-Nonconsensual Sexual Conduct)

Motion And Order To Show Cause-Failure To Comply (Stalking-Nonconsensual Sexual Conduct)

North Carolina/Statewide/Civil/ -

Contempt Order No Contact Order For Stalking Or Nonconsensual Sexual Conduct

Contempt Order No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Notice Of Hearing On No Contact Order Pursuant To The Workplace Violence Prevention Act Temporary Order Permanent Order

Notice Of Hearing On No Contact Order Pursuant To The Workplace Violence Prevention Act Temporary Order Permanent Order

North Carolina/Statewide/Civil/ -

Temporary No Contact Order Pursuant To The Workplace Violence Prevention Act Ex Parte

Temporary No Contact Order Pursuant To The Workplace Violence Prevention Act Ex Parte

North Carolina/Statewide/Civil/ -

No Contact Order Pursuant To The Workplace Violence Prevention Act

No Contact Order Pursuant To The Workplace Violence Prevention Act

North Carolina/Statewide/Civil/ -

Affidavit As To Status Of Minor Child

Affidavit As To Status Of Minor Child

North Carolina/Statewide/Civil/ -

Arbitration Request For Trial De Novo

Arbitration Request For Trial De Novo

North Carolina/Statewide/Civil/ -

Limited Driving Privlege Driving While License Revoked Or Committing Moving Offense

Limited Driving Privlege Driving While License Revoked Or Committing Moving Offense

North Carolina/Statewide/Civil/ -

Motion For Modification Termination Of Order For Wage Withholding

Motion For Modification Termination Of Order For Wage Withholding

North Carolina/Statewide/Civil/ -

Domestic Civil Action Cover Sheet

Domestic Civil Action Cover Sheet

North Carolina/Statewide/Civil/ -

General Civil Action Cover Sheet

General Civil Action Cover Sheet

North Carolina/Statewide/Civil/ -

Motion And Order For Show Cause Hearing

Motion And Order For Show Cause Hearing

North Carolina/Statewide/Civil/ -

Order Of Contempt For Non Payment Of Mediators Fees

Order Of Contempt For Non Payment Of Mediators Fees

North Carolina/Statewide/Civil/ -

Petition And Order For Relief From Obligation To Pay All Or Part Of Mediators Fee In Family Financial Case

Petition And Order For Relief From Obligation To Pay All Or Part Of Mediators Fee In Family Financial Case

North Carolina/Statewide/Civil/ -

Petition And Order For Relief From Obligation To Pay Mediators Fee

Petition And Order For Relief From Obligation To Pay Mediators Fee

North Carolina/Statewide/Civil/ -

Arbitration Award Superior Court

Arbitration Award Superior Court

North Carolina/1 Statewide/Civil/ -

Motion For An Order To Use Settlement Procedure

Motion For An Order To Use Settlement Procedure

North Carolina/1 Statewide/Civil/ -

Arbitration Award And Judgment

Arbitration Award And Judgment

North Carolina/Statewide/Civil/ -

Arbitration Notice Of Case Selection For Arbitration

Arbitration Notice Of Case Selection For Arbitration

North Carolina/Statewide/Civil/ -

Certificate Of Payment Satisfaction Of Judgment By Judgment Creditor Payment In Full Partial Payment

Certificate Of Payment Satisfaction Of Judgment By Judgment Creditor Payment In Full Partial Payment

North Carolina/Statewide/Civil/ -

Defendants Bond In Claim And Delivery

Defendants Bond In Claim And Delivery

North Carolina/Statewide/Civil/ -

Motion For Return Of Weapons Surrendered Under Domestic Violence Proctective Order And Notice Of Hearing

Motion For Return Of Weapons Surrendered Under Domestic Violence Proctective Order And Notice Of Hearing

North Carolina/Statewide/Civil/ -

Motion To Join Employer As Party To Enforce Wage Withholding And Notice Of Hearing

Motion To Join Employer As Party To Enforce Wage Withholding And Notice Of Hearing

North Carolina/Statewide/Civil/ -

Order Of Seizure In Claim And Delivery

Order Of Seizure In Claim And Delivery

North Carolina/Statewide/Civil/ -

Writ Of Execution

Writ Of Execution

North Carolina/Statewide/Civil/ -

Cover Sheet For Child Support Cases Nov IV D Only

Cover Sheet For Child Support Cases Nov IV D Only

North Carolina/Statewide/Civil/ -

Motion And Notice Of Hearing For Modification Of Child Support Order

Motion And Notice Of Hearing For Modification Of Child Support Order

North Carolina/Statewide/Civil/ -

Motion To Join Payor As Party To Enforce Income Withholding And Notice Of Hearing

Motion To Join Payor As Party To Enforce Income Withholding And Notice Of Hearing

North Carolina/Statewide/Civil/ -

Motion To Withhold From Income Other Than Wages To Enforce Child Support Order

Motion To Withhold From Income Other Than Wages To Enforce Child Support Order

North Carolina/Statewide/Civil/ -

Motion To Withhold Wages To Enforce Child Support Order

Motion To Withhold Wages To Enforce Child Support Order

North Carolina/Statewide/Civil/ -

Order In Civil Action To Authorize Underage Person To Marry

Order In Civil Action To Authorize Underage Person To Marry

North Carolina/Statewide/Civil/ -

Order On Motion To Join Employer As Party To Enforce Wage Withholding

Order On Motion To Join Employer As Party To Enforce Wage Withholding

North Carolina/Statewide/Civil/ -

Order On Motion To Join Payor As Party To Enforce Income Withholding

Order On Motion To Join Payor As Party To Enforce Income Withholding

North Carolina/Statewide/Civil/ -

Order To Appear And Show Cause For Failure To Comply With Support Order And Order To Produce Records And Licenses

Order To Appear And Show Cause For Failure To Comply With Support Order And Order To Produce Records And Licenses

North Carolina/Statewide/Civil/ -

Order To Withhold From Income Other Than Wages To Enforce Child Support

Order To Withhold From Income Other Than Wages To Enforce Child Support

North Carolina/Statewide/Civil/ -

Request By Supporting Party For Wage Withholding

Request By Supporting Party For Wage Withholding

North Carolina/Statewide/Civil/ -

Voluntary Support Agreement And Approval By Court

Voluntary Support Agreement And Approval By Court

North Carolina/Statewide/Civil/ -

Motion And Order For Continuance

Motion And Order For Continuance

North Carolina/Statewide/Civil/ -

Civil Bill Of Costs

Civil Bill Of Costs

North Carolina/Statewide/Civil/ -

Domestic Violence Order Of Protection

Domestic Violence Order Of Protection

North Carolina/Statewide/Civil/ -

Ex Parte Domestic Violence Order Of Protection

Ex Parte Domestic Violence Order Of Protection

North Carolina/Statewide/Civil/ -

Motion For Order To Show Cause Domestic Violence Protective Order

Motion For Order To Show Cause Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Motion To Renew Or Set Aside Domestic Violence Protective Order Notice of Hearing

Motion To Renew Or Set Aside Domestic Violence Protective Order Notice of Hearing

North Carolina/Statewide/Civil/ -

No Contact Order For Stalking Or Nonconsensual Sexual Conduct

No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Order For Mediated Settlement Conference In Family Financial Case

Order For Mediated Settlement Conference In Family Financial Case

North Carolina/Statewide/Civil/ -

Order To Appear And Show Cause For Failure To Comply With Domestic Violence Protective Order

Order To Appear And Show Cause For Failure To Comply With Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Report Of Mediator

Report Of Mediator

North Carolina/Statewide/Civil/ -

Report Of Neutral Conducting Settlement Procedure

Report Of Neutral Conducting Settlement Procedure

North Carolina/1 Statewide/Civil/ -

Request And Affidavit To Register And Registration Of Out Of State Domestic Violence Protective Order

Request And Affidavit To Register And Registration Of Out Of State Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Temporary No Contact Order For Stalking Or Nonconsensual Sexual Conduct

Temporary No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Worksheet A Child Support Obligation Sole Custody

Worksheet A Child Support Obligation Sole Custody

North Carolina/Statewide/Civil/ -

Worksheet B Child Support Obligation Joint Or Shared Physical Custody

Worksheet B Child Support Obligation Joint Or Shared Physical Custody

North Carolina/Statewide/Civil/ -

Worksheet C Child Support Obligation Split Custody

Worksheet C Child Support Obligation Split Custody

North Carolina/Statewide/Civil/ -

Civil Summons

Civil Summons

North Carolina/Statewide/Civil/ -

Civil Summons Domestic Violence

Civil Summons Domestic Violence

North Carolina/Statewide/Civil/ -

Civil Summons In Action By Underage Person For Authorization To Marry

Civil Summons In Action By Underage Person For Authorization To Marry

North Carolina/Statewide/Civil/ -

Civil Summons Permanent Civil No Contact Order Against Sex Offender Alias And Pluries Summons

Civil Summons Permanent Civil No Contact Order Against Sex Offender Alias And Pluries Summons

North Carolina/Statewide/Civil/ -

Civil Summons Third Party

Civil Summons Third Party

North Carolina/Statewide/Civil/ -

Civil Summons To Be Served With Order Extending Time To File Complaint

Civil Summons To Be Served With Order Extending Time To File Complaint

North Carolina/Statewide/Civil/ -

Civil Summons Workplace Violence Prevention Act

Civil Summons Workplace Violence Prevention Act

North Carolina/Statewide/Civil/ -

Contempt Order Permanent Civil No Contact Order Against Sex Offender

Contempt Order Permanent Civil No Contact Order Against Sex Offender

North Carolina/Statewide/Civil/ -

Motion And Order To Show Cause For Failure To Comply (Sex Offender)

Motion And Order To Show Cause For Failure To Comply (Sex Offender)

North Carolina/Statewide/Civil/ -

Motion To Rescind Set Aide Permanent Civil No Contact Order Against Sex Offender

Motion To Rescind Set Aide Permanent Civil No Contact Order Against Sex Offender

North Carolina/Statewide/Civil/ -

Notice Of Hearing On Permanent Civil No Contact Order Against Sex Offender

Notice Of Hearing On Permanent Civil No Contact Order Against Sex Offender

North Carolina/Statewide/Civil/ -

Order For Mediated Settlement Conference And Trial Calendar Notice

Order For Mediated Settlement Conference And Trial Calendar Notice

North Carolina/Statewide/Civil/ -

Permanent Civil No Contact Order Against Sex Offender

Permanent Civil No Contact Order Against Sex Offender

North Carolina/Statewide/Civil/ -

Motion For Order To Use Settlement Procedure Other Than Mediated Or Judicial Settlement Conference In Family Financial Case

Motion For Order To Use Settlement Procedure Other Than Mediated Or Judicial Settlement Conference In Family Financial Case

North Carolina/Statewide/Civil/ -

Motion To Use Settlement Procedure Other Than Mediated Settlement Conference

Motion To Use Settlement Procedure Other Than Mediated Settlement Conference

North Carolina/1 Statewide/Civil/ -

Order To Calendar Custody Or Visitation Dispute

Order To Calendar Custody Or Visitation Dispute

North Carolina/Statewide/Civil/ -

Application Summons And Order To Show Cause Child Support

Application Summons And Order To Show Cause Child Support

North Carolina/Statewide/Civil/ -

Complaint And Motion For Domestic Violence Protective Order

Complaint And Motion For Domestic Violence Protective Order

North Carolina/Statewide/Civil/ -

Complaint For Civil No Contact Order Pursuant To The Workplace Violence Prevention Act Motion For Temporary No Contact Order

Complaint For Civil No Contact Order Pursuant To The Workplace Violence Prevention Act Motion For Temporary No Contact Order

North Carolina/Statewide/Civil/ -

Complaint For Judicial Authorization For Underage Person To Marry

Complaint For Judicial Authorization For Underage Person To Marry

North Carolina/Statewide/Civil/ -

Complaint For No Contact Order For Stalking Or Nonconsensual Sexual Conduct

Complaint For No Contact Order For Stalking Or Nonconsensual Sexual Conduct

North Carolina/Statewide/Civil/ -

Complaint For Permanent Civil No Contact Order Against Sex Offender

Complaint For Permanent Civil No Contact Order Against Sex Offender

North Carolina/Statewide/Civil/ -

Designation Of Mediator

Designation Of Mediator

North Carolina/Statewide/Civil/ -

Petition For Limited Driving Privilege

Petition For Limited Driving Privilege

North Carolina/Statewide/Civil/ -

Request For Prelitigation Mediation Of Farm Nuisance Dispute

Request For Prelitigation Mediation Of Farm Nuisance Dispute

North Carolina/Statewide/Civil/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!