Last updated: 4/10/2017

Notification Of Sale Transfer Or Assignment In Bulk {AU-196.10}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

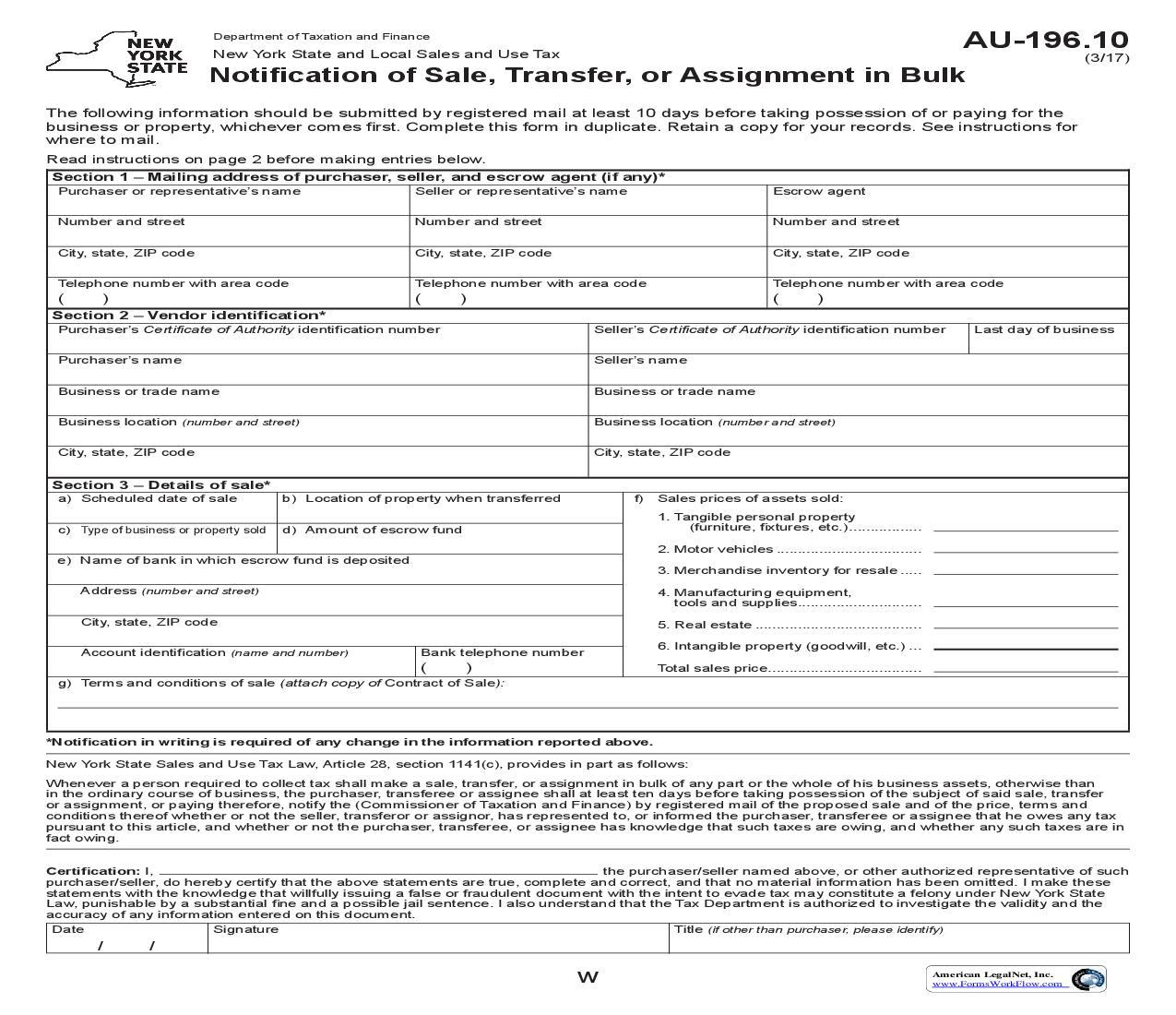

Department of Taxation and Finance Notification of Sale, Transfer, or Assignment in Bulk The following information should be submitted by registered mail at least 10 days before taking possession of or paying for the business or property, whichever comes first. Complete this form in duplicate. Retain a copy for your records. See instructions for where to mail. Read instructions on page 2 before making entries below. Section 1 Mailing address of purchaser, seller, and escrow agent (if any)* Purchaser or representative's name Number and street City, state, ZIP code Telephone number with area code Seller or representative's name Number and street City, state, ZIP code Telephone number with area code Escrow agent Number and street City, state, ZIP code Telephone number with area code New York State and Local Sales and Use Tax AU-196.10 (3/17) ( ) ( ) ( ) Section 2 Vendor identification* Purchaser's Certificate of Authority identification number Seller's Certificate of Authority identification number Seller's name Business or trade name Business location (number and street) City, state, ZIP code Last day of business Purchaser's name Business or trade name Business location (number and street) City, state, ZIP code Section 3 Details of sale* a) Scheduled date of sale b) Location of property when transferred d) Amount of escrow fund f) Sales prices of assets sold: 1. Tangible personal property (furniture, fixtures, etc.) ................. 2. Motor vehicles .................................. 3. Merchandise inventory for resale ..... 4. Manufacturing equipment, tools and supplies............................. 5. Real estate ....................................... c) Type of business or property sold e) Name of bank in which escrow fund is deposited Address (number and street) City, state, ZIP code Account identification (name and number) Bank telephone number 6. Intangible property (goodwill, etc.) ... Total sales price.................................... ( ) g) Terms and conditions of sale (attach copy of Contract of Sale): *Notification in writing is required of any change in the information reported above. New York State Sales and Use Tax Law, Article 28, section 1141(c), provides in part as follows: Whenever a person required to collect tax shall make a sale, transfer, or assignment in bulk of any part or the whole of his business assets, otherwise than in the ordinary course of business, the purchaser, transferee or assignee shall at least ten days before taking possession of the subject of said sale, transfer or assignment, or paying therefore, notify the (Commissioner of Taxation and Finance) by registered mail of the proposed sale and of the price, terms and conditions thereof whether or not the seller, transferor or assignor, has represented to, or informed the purchaser, transferee or assignee that he owes any tax pursuant to this article, and whether or not the purchaser, transferee, or assignee has knowledge that such taxes are owing, and whether any such taxes are in fact owing. Certification: I, the purchaser/seller named above, or other authorized representative of such purchaser/seller, do hereby certify that the above statements are true, complete and correct, and that no material information has been omitted. I make these statements with the knowledge that willfully issuing a false or fraudulent document with the intent to evade tax may constitute a felony under New York State Law, punishable by a substantial fine and a possible jail sentence. I also understand that the Tax Department is authorized to investigate the validity and the accuracy of any information entered on this document. Date Signature Title (if other than purchaser, please identify) / / W American LegalNet, Inc. www.FormsWorkFlow.com Page 2 of 2 AU-196.10 (3/17) Instructions Section 1 Mailing address of purchaser, seller, and escrow agent (if any) 6. Sales price of intangible assets. Include goodwill, accounts receivable, notes receivable, mortgages, securities, and all other intangible assets. g) Terms and conditions of sale Outline manner of payment and any conditional provisions of the contract. Since Transaction Desk Audit Bureau will be contacting the purchaser, seller, and escrow agent, a mailing address for each is required. The mailing address provided may be the business or home address of the officer, partner, or other representative responsible for the records of the parties involved. If the mailing address is that of a representative, a power of attorney must be attached. Mailing address Mail original to: NYS TAX DEPARTMENT TDABBULK SALES UNIT W A HARRIMAN CAMPUS ALBANY NY 12227-0299 Section 2 Vendor identification List each vendor's identification number as shown on the Certificate of Authority issued by the NYS Tax Department. If the purchaser is not a registered vendor, indicate none. List the purchaser and seller as stated in the sales contract, including their trade name (corporation, partnership, name under which an individual owner is doing business, assignee, trustee, estate, etc.) and business location. If not using U.S. Mail, see Publication 55, Designated Private Delivery Services. Attention Section 3 Details of sale In connection with the proposed sale, the following information is required: a) Scheduled date of sale The date to be entered is the date that the purchaser is taking possession of the business or property sold, or paying therefor, whichever comes first. b) Location of property when transferred to the purchaser If more than one location, attach a detailed schedule. c) Type of business or property sold for example, restaurant, retail clothing, fuel oil distributor, wholesale automotive supply, hardware manufacturer, etc. d) Amount of escrow fund (if any). e) Name, address, and telephone number of bank and identification of account in which escrow fund is or will be deposited. f) Sales prices of assets sold If the sales contract does not provide a sales price for the asset, the amount to be listed is the depreciable value for income tax purposes or the fair market value, whichever is higher. Do not reduce the sales price or valuation assigned by the amount of any mortgage or other liability assumed by the purchaser. 1. Sales price of tangible personal property. Include furniture, fixtures, supplies, and all other tangible personal property (except for inventory for resale, manufacturing equipment, tools and supplies, and motor vehicles). 2. Sales