Last updated: 4/14/2025

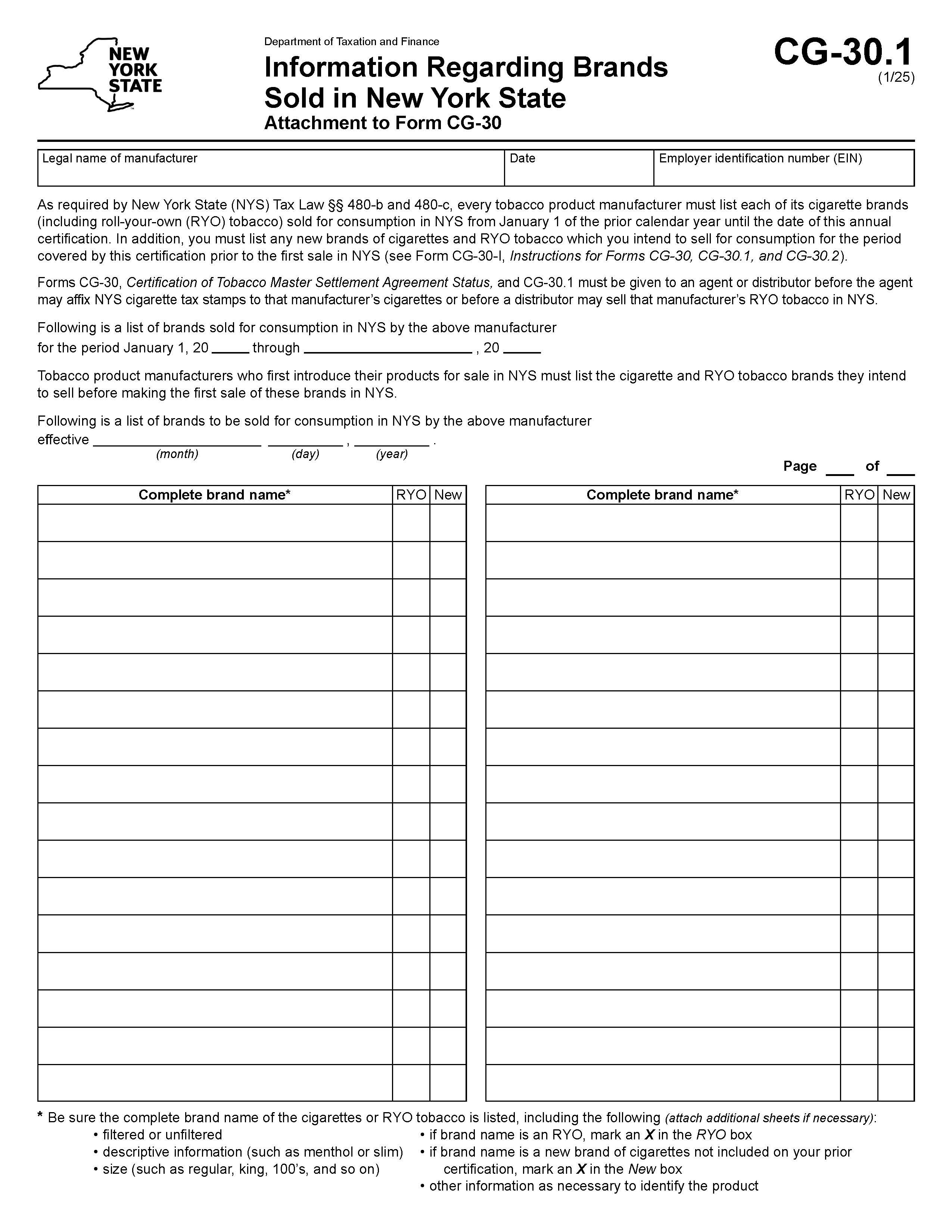

Information Regarding Brands Sold In New York State {CG-30.1}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CG-30.1 - INFORMATION REGARDING BRANDS SOLD IN NEW YORK STATE ATTACHMENT TO FORM CG-30. As required by New York State (NYS) Tax Law §§ 480-b and 480-c, every tobacco product manufacturer must list each of its cigarette brands (including roll-your-own (RYO) tobacco) sold for consumption in NYS from January 1 of the prior calendar year until the date of this annual certification. In addition, you must list any new brands of cigarettes and RYO tobacco which you intend to sell for consumption for the period covered by this certification prior to the first sale in NYS (see Form CG-30-I, Instructions for Forms CG-30, CG-30.1, and CG-30.2). Forms CG-30, Certification of Tobacco Master Settlement Agreement Status, and CG-30.1 must be given to an agent or distributor before the agent may affix NYS cigarette tax stamps to that manufacturer’s cigarettes or before a distributor may sell that manufacturer’s RYO tobacco in NYS. Tobacco product manufacturers who first introduce their products for sale in NYS must list the cigarette and RYO tobacco brands they intend to sell before making the first sale of these brands in NYS. www.FormsWorkflow.com