Last updated: 1/25/2024

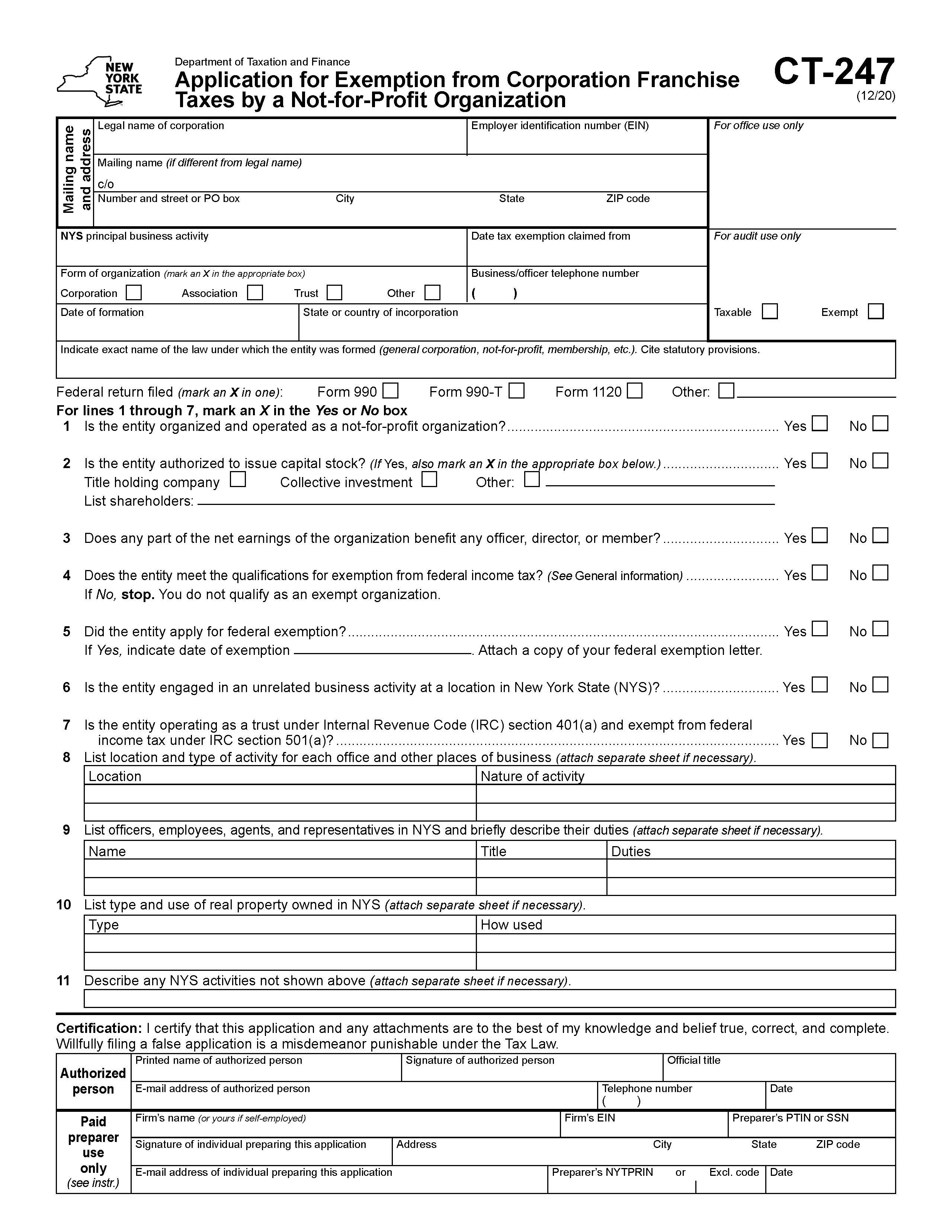

Application For Exemption From Corporation Franchise Taxes By Not-For-Profit Corporation {CT-247}

Start Your Free Trial $ 12.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CT-247 - APPLICATION FOR EXEMPTION FROM CORPORATION FRANCHISE TAXES BY A NOT-FOR-PROFIT ORGANIZATION. Certain not-for-profit and religious corporations are exempt from the New York State (NYS) corporation franchise tax imposed by Tax Law Article 9-A (Article 9-A regulations, section 1-3.4(b)(6)). You must file Form CT-247 to apply for exemption. Generally, a corporation or an organization treated as a corporation must meet all of the following requirements to be tax exempt: • It must be organized and operated as a not-for-profit organization. • It must not have stock, shares, or certificates for stock or for shares. Not-for-profit corporations that issue stock are taxable under Article 9-A. However, title holding companies as described in Internal Revenue Code (IRC) section 501(c)(2), and collective investment entities as described in IRC section 501(c)(25), are exempt from tax under Article 9-A. For additional information, see TSB‑M‑87(9)C, Exemption for Title Holding Companies (THC) and Collective Investment Entities (CIE). • No part of its net earnings may benefit any officer, director, or member. • It must be exempt from federal income taxation under IRC section 501, subsection (a). If the organization meets all of the above requirements, it will be presumed to be exempt from tax under Tax Law Article 9-A. An organization denied exemption from taxation under the IRC will be presumed to be subject to tax under Article 9-A. An organization whose tax exempt status has been revoked and later restored by the Internal Revenue Service (IRS), must file a new application on Form CT‑247. The new application must be approved before any tax-exempt status under Article 9-A is restored. Not-for-profit, nonstock organizations that are subject to the federal tax on unrelated business income are taxable under NYS Tax Law Article 13, if they pursue those unrelated business activities in NYS. File Form CT-13, Unrelated Business Income Tax Return, to report those activities. Organizations required to file federal Form 1120 may be taxable under Article 9-A and may be required to file Form CT-3, General Business Corporation Franchise Tax Return. When filing Form CT-247, submit all documents granting or denying exemption from tax by the IRS, the corporation’s articles of incorporation, and its bylaws. Promptly report any changes in the corporation’s federal tax status to the NYS Tax Department. Any exemption granted by the filing of Form CT-247 is strictly for NYS corporation franchise tax. For federal exemption, contact the IRS. www.FormsWorkflow.com