Last updated: 5/23/2006

Provider Cost Report Reimbursment Questionaire {CMS-339}

Start Your Free Trial $ 39.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

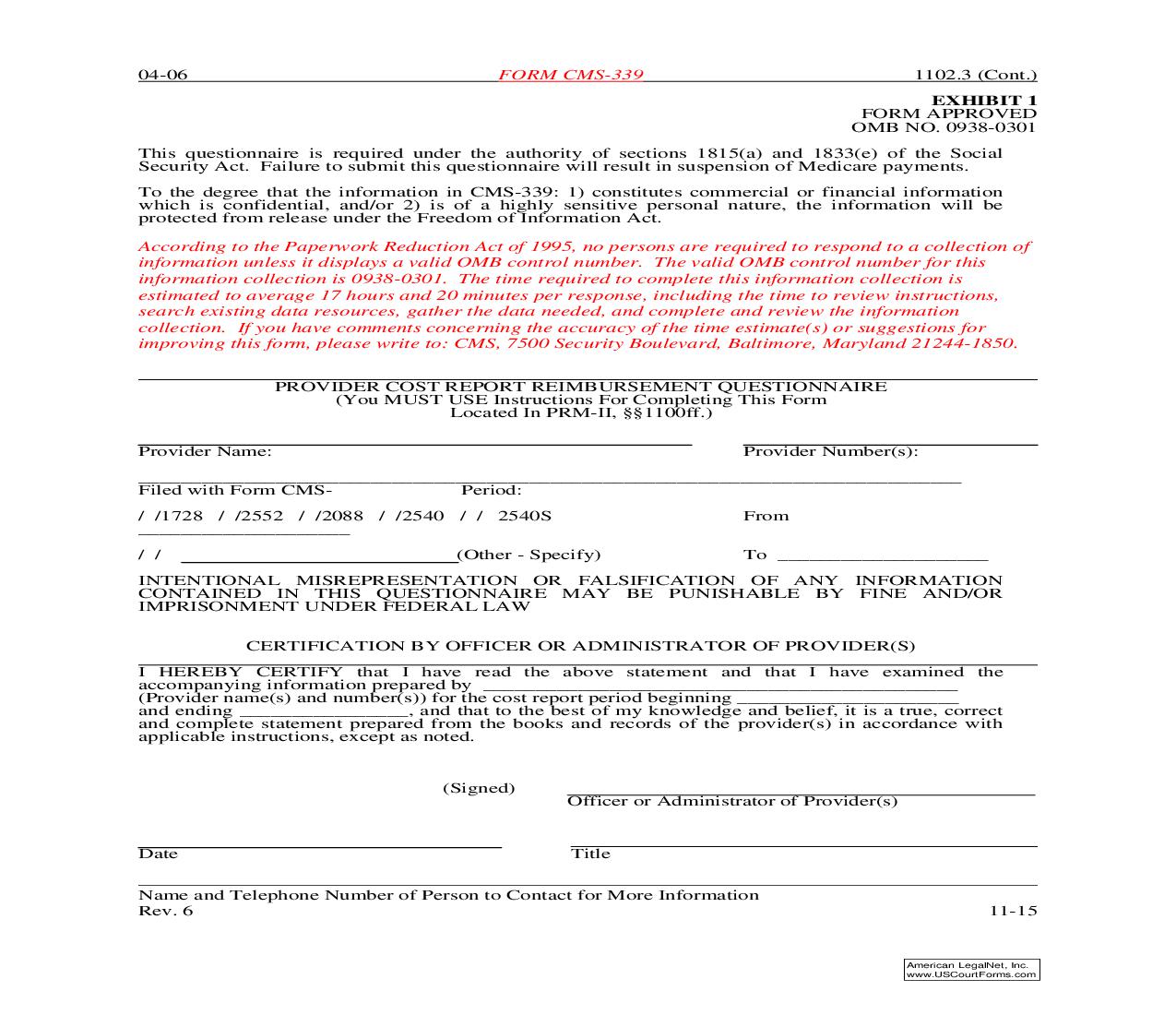

04-06 FORM CMS-339 1102.3 (Cont.) EXHIBIT 1 FORM APPROVED OMB NO. 0938-0301 This questionnaire is required under the authority of sections 1815(a) and 1833(e) of the Social Security Act. Failure to submit this questionnaire will result in suspension of Medicare payments. To the degree that the information in CMS-339: 1) constitutes commercial or financial information which is confidential, and/or 2) is of a highly sensitive personal nature, the information will be protected from release under the Freedom of Information Act. According to the Paperwork Reduction Act of 1995, no persons are required to respond to a collection of information unless it displays a valid OMB control number. The valid OMB control number for this information collection is 0938-0301. The time required to complete this information collection is estimated to average 17 hours and 20 minutes per response, including the time to review instructions, search existing data resources, gather the data needed, and complete and review the information collection. If you have comments concerning the accuracy of the time estimate(s) or suggestions for improving this form, please write to: CMS, 7500 Security Boulevard, Baltimore, Maryland 21244-1850. PROVIDER COST REPORT REIMBURSEMENT QUESTIONNAIRE (You MUST USE Instructions For Completing This Form Located In PRM-II, §§1100ff.) Provider Name: Provider Number(s): ______________________________________________________________________________ Filed with Form CMSPeriod: / /1728 / /2552 / /2088 / /2540 / / 2540S ____________________ // (Other - Specify) From To ____________________ INTENTIONAL MISREPRESENTATION OR FALSIFICATION OF ANY INFORMATION CONTAINED IN THIS QUESTIONNAIRE MAY BE PUNISHABLE BY FINE AND/OR IMPRISONMENT UNDER FEDERAL LAW CERTIFICATION BY OFFICER OR ADMINISTRATOR OF PROVIDER(S) I HEREBY CERTIFY that I have read the above statement and that I have examined the accompanying information prepared by _____________________________________________ (Provider name(s) and number(s)) for the cost report period beginning _____________________ and ending ________________, and that to the best of my knowledge and belief, it is a true, correct and complete statement prepared from the books and records of the provider(s) in accordance with applicable instructions, except as noted. (Signed) Officer or Administrator of Provider(s) Date Title Name and Telephone Number of Person to Contact for More Information Rev. 6 11-15 American LegalNet, Inc. www.USCourtForms.com 1102.3 (Cont.) EXHIBIT 1 (Cont.) 04-06 PROVIDER COST REPORT REIMBURSMENT QUESTIONAIRE YES NOTE: 42 CFR 413.20 and instructions contained in the PRM-1 require that the provider maintain adequate financial and statistical data necessary for the intermediary to use for a proper determination of costs payable under the program. Providers are, therefore, required to maintain and have available for audit all records necessary to verify the amounts and allowability of costs and equity capital included in the filed cost report. Failure to have such records available for review by fiscal intermediaries acting under the authority of the Secretary of the Department of Health and Human Services will render the amount claimed in the cost report unallowable. A. Provider Organization and Operation NOTE: Section A to be completed by all providers. 1. The provider has: a. Changed ownership. If "yes", submit name and address of new owner, date of change, copy of sales agreement, or any similar agreement affecting change of ownership. Terminated participation. If "yes", list date of termination, and reason (Voluntary/Involuntary). NO N/A b. 2. The provider, members of the board of directors, officers, medical staff or management personnel are associated with or involved in business transactions with the following: a. Related organizations, management contracts and services under arrangements as owners (stockholders), management, by family relationship, or any other similar type relationship. b. Management personnel of major suppliers of the provider (drug, medical supply companies, etc.). If "yes" to question 2a and/or 2b, attach a list of the individuals, the organizations involved, and description of the transactions. 11-16 Rev. 6 American LegalNet, Inc. www.USCourtForms.com 04-06 EXHIBIT 1 (Cont.) 1102.3 (Cont.) PROVIDER COST REPORT REIMBURSMENT QUESTIONAIRE YES B. Financial Data and Reports NOTE: Section B to be completed by all providers. 1. During this cost reporting period, the financial statements are prepared by Certified Public Accountants or Public Accountants (submit complete copy or indicate available date) and are: a. b. c. Audited; Compiled; and Reviewed. NO N/A NOTE: Where there is no affirmative response to the above described financial statements, attach a copy of the financial statements prepared and a description of the changes in accounting policies and practices if not mentioned in those statements. 2. Cost report total expenses and total revenues differ from those on the filed financial statement. If "yes", submit reconciliation. C. Capital Related Cost NOTE: Section C to be completed only by hospitals excluded from PPS (except Children's) and PPS hospitals that have a unit excluded from PPS. 1. Assets have been relifed for Medicare purposes. If "yes", attach detailed listing of these specific assets, by classes, as shown in the Fixed Asset Register. NOTE: For cost reporting periods beginning on or after October 1, 1991 and before October 1, 2001, under the capital - PPS consistency rule (42 CFR 412.302 (d)), PPS hospitals are precluded from relifing old capital. 2. Due to appraisals made during this cost reporting period, changes have occurred to Medicare depreciation expense. If "yes", attach copy of Appraisal Report and Appraisal Summary by class of asset. Rev. 6 11-17 American LegalNet, Inc. www.USCourtForms.com 1102.3 (Cont.) EXHIBIT 1 (Cont.) 04-06 PROVIDER COST REPORT REIMBURSMENT QUESTIONAIRE YES 3. New leases and/or amendments to existing leases for land, equipment, or facilities with annual rental payment in excess of the amounts listed in the instructions, have been entered into during this cost reporting period. If "yes", submit a listing of these new leases and/or amendments to existing leases that have the following information: o o o o o A new lease or lease renewal; Parties to the lease; Period covered by the lease; Description of the asset being leased; and Annual charge by the lessor. NO

Related forms

-

Financial Statement Of Debtor

Financial Statement Of Debtor

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Acknowledgment Of Request For Medicare Medical Insurance Termination

Acknowledgment Of Request For Medicare Medical Insurance Termination

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Acknowledgment Of Request For Premium Hospital Insurance Termination

Acknowledgment Of Request For Premium Hospital Insurance Termination

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

ALJ Medicare Case Folder (CMS)

ALJ Medicare Case Folder (CMS)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Rehab Unit Criteria Worksheet

Rehab Unit Criteria Worksheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Home Health Advance Beneficiary Notice

Home Health Advance Beneficiary Notice

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Long Term Care Facility Application For Medicare And Medicaid

Long Term Care Facility Application For Medicare And Medicaid

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Validation OF Accrediation Survey For Ambulatory Surgical Center (ASC)

Request For Validation OF Accrediation Survey For Ambulatory Surgical Center (ASC)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Validation Of Accrediation Survey For Home Health Agency

Request For Validation Of Accrediation Survey For Home Health Agency

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Certificate Of Medical Necessity

Certificate Of Medical Necessity

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Consent For Home Visit For Pace Services Evaluation

Consent For Home Visit For Pace Services Evaluation

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Freedom Of Information ACT Request

Freedom Of Information ACT Request

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Portable X-Ray Survey Report

Portable X-Ray Survey Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Resident Census And Conditions Of Residents

Resident Census And Conditions Of Residents

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Notice Of Denial Of Medical Coverage

Notice Of Denial Of Medical Coverage

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Credit Balance Report Certification Page

Medicare Credit Balance Report Certification Page

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Monthly Carrier Report On Medicare Secondary Payer Savings

Monthly Carrier Report On Medicare Secondary Payer Savings

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Monthly Intermediary Report On Medicare Secondary Payer Savings

Monthly Intermediary Report On Medicare Secondary Payer Savings

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Validation Of Accreditation For Critical Access Hospital Survey

Request For Validation Of Accreditation For Critical Access Hospital Survey

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Health Insurance Benefits Agreement With Organ Procurement Organization Pusuant To 1138(b)

Health Insurance Benefits Agreement With Organ Procurement Organization Pusuant To 1138(b)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Post-Certification Revisit Report

Post-Certification Revisit Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

QIO Case Summary

QIO Case Summary

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Consent For Home Visit

Consent For Home Visit

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

In-Center Hemodialysis (HD) Clinical Performance Measures Data Collection Form 2005

In-Center Hemodialysis (HD) Clinical Performance Measures Data Collection Form 2005

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Peritoneal Dialysis Clinical Performance Measures Data Collection Form 2005

Peritoneal Dialysis Clinical Performance Measures Data Collection Form 2005

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Accredited Hospital Allegation(s) Report

Accredited Hospital Allegation(s) Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Adverse Action Extract For SNFs And NFs

Adverse Action Extract For SNFs And NFs

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

CMS Death Record Review Data Sheet

CMS Death Record Review Data Sheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

CMS Nursing Complement Data

CMS Nursing Complement Data

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Data Collection Medical Staff Coverage

Data Collection Medical Staff Coverage

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Hospice Survey And Deficiencies Report

Hospice Survey And Deficiencies Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare-Medicaid Psychiatirc Hospital Survey Data

Medicare-Medicaid Psychiatirc Hospital Survey Data

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Offsite Survey Prep Worksheet

Offsite Survey Prep Worksheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Responsibilites Of Medicare Participating Hospitals In Emergency Cases Investigation

Responsibilites Of Medicare Participating Hospitals In Emergency Cases Investigation

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Surveyor Worksheet For Pyschiatric Hospital Review Two Special Conditions

Surveyor Worksheet For Pyschiatric Hospital Review Two Special Conditions

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Appointment Of Representative

Appointment Of Representative

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Transfer Of Appeal Rights

Transfer Of Appeal Rights

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Fire Safety Survey Report Abulatory Surgical Centers Medicare

Fire Safety Survey Report Abulatory Surgical Centers Medicare

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Notice Of Medicare Non-Coverage

Notice Of Medicare Non-Coverage

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Rehabilitation Hospital Work Sheet

Rehabilitation Hospital Work Sheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Addendum To The Medicaid Agency Data Use Agreement (DUA)

Addendum To The Medicaid Agency Data Use Agreement (DUA)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Inpatient Rehabilitation Facility-Patient Assessment Instrument

Inpatient Rehabilitation Facility-Patient Assessment Instrument

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicaid Agency Data Use Agreement

Medicaid Agency Data Use Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Regional Office Meeting-Speaker Request Form

Regional Office Meeting-Speaker Request Form

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Speech Invitation Request Background Information

Speech Invitation Request Background Information

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Compliance Plan For Accounting For Disclosures Of Privacy Protected Data From A System Of Records (SOR)

Compliance Plan For Accounting For Disclosures Of Privacy Protected Data From A System Of Records (SOR)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Provider Cost Report Reimbursment Questionaire

Provider Cost Report Reimbursment Questionaire

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Organ Procurement Organization Histocompatibility Laboratory General Data And Certification Statement

Organ Procurement Organization Histocompatibility Laboratory General Data And Certification Statement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Form CMS-416 Annual EPSDT Participation Report

Form CMS-416 Annual EPSDT Participation Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Waiver Demonstration Application

Medicare Waiver Demonstration Application

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Certification In The Medicare And-Or Medicaid Program To Provide Outpatient Physical Therapy

Request For Certification In The Medicare And-Or Medicaid Program To Provide Outpatient Physical Therapy

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Invoice Of Fees For FOIA Services

Invoice Of Fees For FOIA Services

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Advance Beneficiary Notice (ABN)

Advance Beneficiary Notice (ABN)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Authorization For State Agency Hospice Validation Survey

Authorization For State Agency Hospice Validation Survey

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Authorization For State Agency Hospice Validation Survey

Authorization For State Agency Hospice Validation Survey

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Certificate Of Medical Necessity Possitive Airway Pressure (PAP) Devices

Certificate Of Medical Necessity Possitive Airway Pressure (PAP) Devices

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Quality Of Care Complaint Form

Medicare Quality Of Care Complaint Form

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Notice Of Medicare Provider Non-Coverage

Notice Of Medicare Provider Non-Coverage

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Authorization For State Agency Psychiatric Hospitall Validation Survey

Authorization For State Agency Psychiatric Hospitall Validation Survey

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

DSH Data Use Agreement For Court Reporting (December 8 2004 And Thereafter)

DSH Data Use Agreement For Court Reporting (December 8 2004 And Thereafter)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

DSH Data Use Agreement For Court Reporting (Prior To December 8 2004)

DSH Data Use Agreement For Court Reporting (Prior To December 8 2004)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Application For Access To CMS Computer System

Application For Access To CMS Computer System

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Individual Observation Worksheet

Individual Observation Worksheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Intermediate Care Facilities For Individuals With Intellectual Disabilities Deficiencies Report

Intermediate Care Facilities For Individuals With Intellectual Disabilities Deficiencies Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Intermediate Care Facilities For Individuals With Intellectual Disabilities Survey Report

Intermediate Care Facilities For Individuals With Intellectual Disabilities Survey Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Worksheet For Determining Evacuation Capability ICF IID (Existing Facilities Only)

Worksheet For Determining Evacuation Capability ICF IID (Existing Facilities Only)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Fire Safety Survey Report 2012 Code Health Care Medicare Medicaid

Fire Safety Survey Report 2012 Code Health Care Medicare Medicaid

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Fire Safety Survey Report 2012 Life Safety Code Intermediate Care

Fire Safety Survey Report 2012 Life Safety Code Intermediate Care

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Fire Safety Survey Report 2012 Life Safety Code Intermediate Care Facilities

Fire Safety Survey Report 2012 Life Safety Code Intermediate Care Facilities

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Redetermination Request Form

Medicare Redetermination Request Form

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Reconsideration Request Form

Medicare Reconsideration Request Form

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Certificate Of Medical Necessity Continuation Form

Certificate Of Medical Necessity Continuation Form

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Certificate Of Medical Necessity Seat Lift Mechanisms

Certificate Of Medical Necessity Seat Lift Mechanisms

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Certificate Of Medical Necessity Transcutaneous Electrical Nerve Stimulator (TENS)

Certificate Of Medical Necessity Transcutaneous Electrical Nerve Stimulator (TENS)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Cetificate Of Medical Necessity Osteogenesis Stimulators

Cetificate Of Medical Necessity Osteogenesis Stimulators

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Certificate Of Medical Necessity Pneumatic Compression Devices

Certificate Of Medical Necessity Pneumatic Compression Devices

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Psychiatric Unit Criteria Work Sheet

Psychiatric Unit Criteria Work Sheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Advisory Panel On Ambulatory Payment Classification Groups

Advisory Panel On Ambulatory Payment Classification Groups

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Addendum To Data Use Agreement (DUA)

Addendum To Data Use Agreement (DUA)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Data Use Agreement (DUA) (Limited Data Sets)

Data Use Agreement (DUA) (Limited Data Sets)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Data Use Agreement (DUA) Update To Existing Data Use Agreement

Data Use Agreement (DUA) Update To Existing Data Use Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Data Use Agreement (DUA) (Data Containing Individual-Specific Information)

Data Use Agreement (DUA) (Data Containing Individual-Specific Information)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

End Stage Renal Disease Medical Information System ESRD Facility Survey (Dialysis Units Only)

End Stage Renal Disease Medical Information System ESRD Facility Survey (Dialysis Units Only)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

End Stage Renal Disease Medical Information System ESRD Facility Survey (Transplant Centers Only)

End Stage Renal Disease Medical Information System ESRD Facility Survey (Transplant Centers Only)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Report Of A Hospital Death Associated With Restraint Or Seclusion [CMS-10455}

Report Of A Hospital Death Associated With Restraint Or Seclusion [CMS-10455}

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

DME Information Form-External Infusion Pumps DME

DME Information Form-External Infusion Pumps DME

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

CMS Staff Data

CMS Staff Data

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Regional Office Request For Additional Information

Regional Office Request For Additional Information

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Enrollment Application Reassignment Of Medicare Benefits

Medicare Enrollment Application Reassignment Of Medicare Benefits

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Organ Procurement Organization (OPO) Request For Designation As An OPO

Organ Procurement Organization (OPO) Request For Designation As An OPO

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Fire Safety Survey Report-ICF-IID (Large Facilities) 2012 Life Safety Code

Fire Safety Survey Report-ICF-IID (Large Facilities) 2012 Life Safety Code

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Comprehensive Outpatient Rehabilitation Facility Report For Certification To Participate

Comprehensive Outpatient Rehabilitation Facility Report For Certification To Participate

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Enrollment Application Clinics-Group Practices And Certain Other Suppliers

Medicare Enrollment Application Clinics-Group Practices And Certain Other Suppliers

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Patients Request For Medical Payment

Patients Request For Medical Payment

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Notice Of Denial Of Medicare Prescription Drug Coverage

Notice Of Denial Of Medicare Prescription Drug Coverage

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Laboratory Personnel Report (CLIA)

Laboratory Personnel Report (CLIA)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Verification Of Clinic Data-Rural Health Clinic Program

Verification Of Clinic Data-Rural Health Clinic Program

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Survey Report Form (CLIA)

Survey Report Form (CLIA)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Hospice Request For Certification In The Medicare Program

Hospice Request For Certification In The Medicare Program

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Third Party Premium Billing Request

Third Party Premium Billing Request

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Physician-Information (Medicare Self-Referral Disclosure Protocol)

Physician-Information (Medicare Self-Referral Disclosure Protocol)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Statement Of Deficiencies And Plan Of Correction

Statement Of Deficiencies And Plan Of Correction

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Fire Smoke Zone Evaluation Worksheet For Health Care Facilites

Fire Smoke Zone Evaluation Worksheet For Health Care Facilites

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Participating Physician Or Supplier Agreement

Medicare Participating Physician Or Supplier Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Electronic File Interchange Organization (EFIO) Certification Statement

Electronic File Interchange Organization (EFIO) Certification Statement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Data Use Agreement (DUA) Certificate Of Disposition (COD) For Data Acquired

Data Use Agreement (DUA) Certificate Of Disposition (COD) For Data Acquired

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Application For Medicare Part A And Part B Special Enrollment

Application For Medicare Part A And Part B Special Enrollment

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Termination Of Premium Hospital Insurance Of Supplementary Medical Insurance

Request For Termination Of Premium Hospital Insurance Of Supplementary Medical Insurance

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

SSO Report Of State Buy In Program

SSO Report Of State Buy In Program

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare-Medicaid Certification And Transmittal

Medicare-Medicaid Certification And Transmittal

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Application For Enrollment In Part B Immunosuppressive Drug Coverage

Application For Enrollment In Part B Immunosuppressive Drug Coverage

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Application For Part A (Hospital Insurance)

Application For Part A (Hospital Insurance)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

HHA Survey Report

HHA Survey Report

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Enrollment Application Physicians And Non-Physician Practitioners

Medicare Enrollment Application Physicians And Non-Physician Practitioners

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

1 800 Medicare Authorization To Disclosure Personal Health Information

1 800 Medicare Authorization To Disclosure Personal Health Information

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Enrollment In Supplementary Medical Insurance

Request For Enrollment In Supplementary Medical Insurance

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Roster-Sample Matrix

Roster-Sample Matrix

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Transmittal And Notice Of Approval Of State Plan Material

Transmittal And Notice Of Approval Of State Plan Material

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Health Insurance Benefit Agreement

Health Insurance Benefit Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Health Insurance Benefits Agreement

Health Insurance Benefits Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Electronic Funds Transfer (EFT) Authorization Agreement

Electronic Funds Transfer (EFT) Authorization Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Clinical Laboratory Improvement Amendments (CLIA) Application For Certification

Clinical Laboratory Improvement Amendments (CLIA) Application For Certification

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Enrollment Application Durable Medical Equipment Prosthetics Orthotics And Supplies (DMEPOS) Supplier

Medicare Enrollment Application Durable Medical Equipment Prosthetics Orthotics And Supplies (DMEPOS) Supplier

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

End Stage Renal Disease Medical Evidence Report Medicare Entitlement And-Or Patient Registration

End Stage Renal Disease Medical Evidence Report Medicare Entitlement And-Or Patient Registration

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

ESRD Death Notification

ESRD Death Notification

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Surveyor Notes Worksheet

Surveyor Notes Worksheet

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Independent Diagnostic Testing Facilities-Site Investigation

Independent Diagnostic Testing Facilities-Site Investigation

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Model Letter Requesting Identification Of Extension Units

Model Letter Requesting Identification Of Extension Units

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Enrollment Application Institutional Providers

Medicare Enrollment Application Institutional Providers

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Medicare Enrollment Application-For Eligible Ordering And Referring Physicians And Non-Physician Practitioners

Medicare Enrollment Application-For Eligible Ordering And Referring Physicians And Non-Physician Practitioners

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Ambulatory Surgical Center Request For Certification In The Medicare Program

Ambulatory Surgical Center Request For Certification In The Medicare Program

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Retirement Benefit Information

Request For Retirement Benefit Information

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Health Insurance Benefits Agreement

Health Insurance Benefits Agreement

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

National Provider Identifier (NPI) Application-Update Form

National Provider Identifier (NPI) Application-Update Form

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Application For Enrollment In Medicare-Part B (Medical Insurance)

Application For Enrollment In Medicare-Part B (Medical Insurance)

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Application For Hospital Insurance Benefits For Individuals With End Stage Renal Disease

Application For Hospital Insurance Benefits For Individuals With End Stage Renal Disease

Official Federal Forms/Centers For Medicare And Medicaid Services/ -

Request For Employment Information

Request For Employment Information

Official Federal Forms/Centers For Medicare And Medicaid Services/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!