Last updated: 10/15/2025

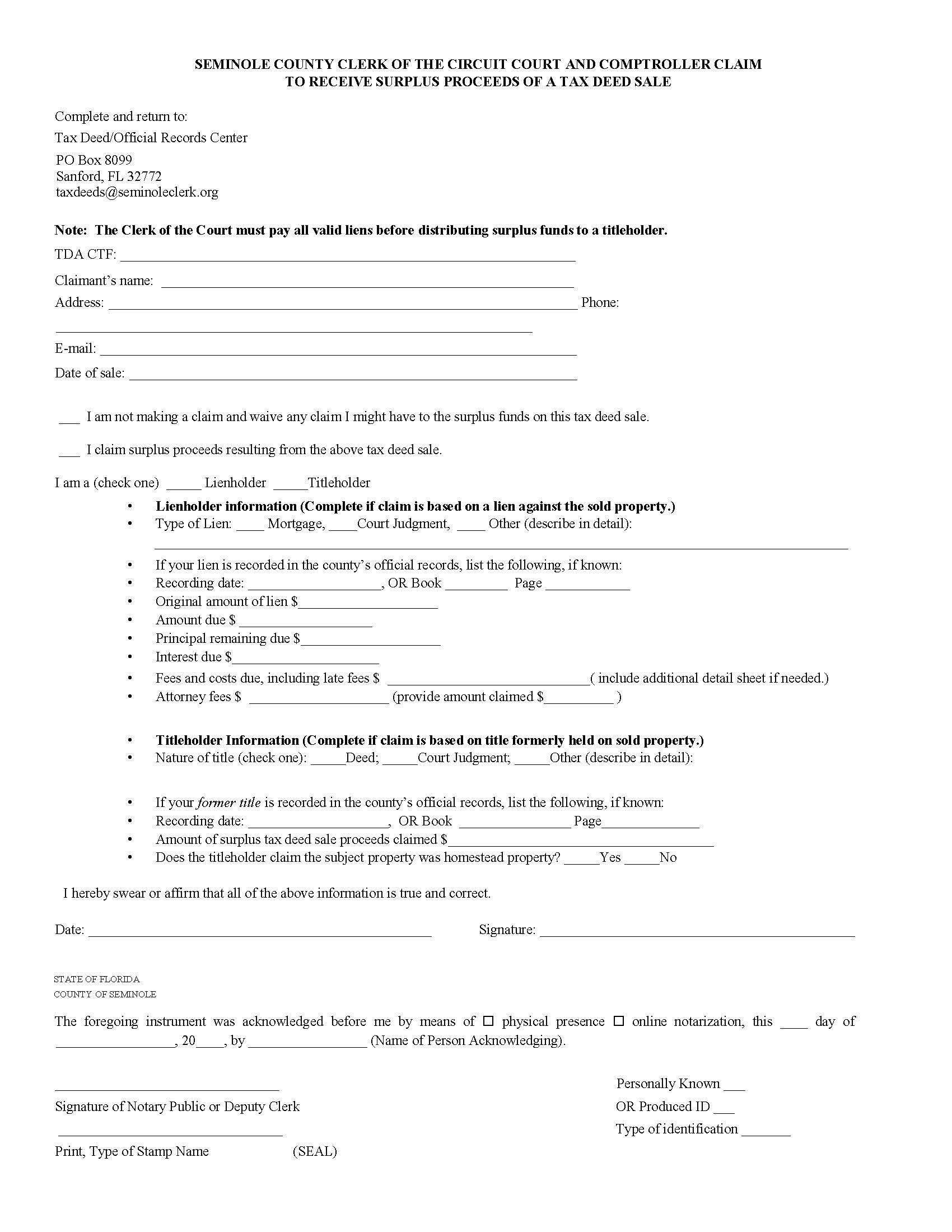

Claim To Receive Surplus Proceeds Of Tax Deed Sale

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CLAIM TO RECEIVE SURPLUS PROCEEDS OF A TAX DEED SALE. This form is used in the Seminole County Clerk of the Circuit Court and Comptroller (Florida) for individuals or entities seeking to recover excess funds remaining after a tax deed sale. Claimants must identify themselves as either a lienholder or titleholder, provide supporting lien or ownership documentation (including recording information, lien amounts, and legal fees), and specify whether the property was homestead. The form requires notarization and acknowledgment before submission to the Tax Deed/Official Records Center by mail or email. The Clerk must first satisfy all valid liens before distributing any remaining surplus proceeds to rightful claimants. www.FormsWorkflow.com

Related forms

-

Claim Of Lien

Claim Of Lien

Florida/Local County/Seminole/General/ -

Satisfaction Of Lien Claim

Satisfaction Of Lien Claim

Florida/Local County/Seminole/General/ -

Satisfaction Of Mortgage

Satisfaction Of Mortgage

Florida/Local County/Seminole/General/ -

Warranty Deed

Warranty Deed

Florida/Local County/Seminole/General/ -

Patient Information (Probate Division)

Patient Information (Probate Division)

Florida/2 Local County/Seminole/General/ -

Petition For Involuntary Services

Petition For Involuntary Services

Florida/2 Local County/Seminole/General/ -

Request For Redaction Of Exempt Personal Information From Public Records

Request For Redaction Of Exempt Personal Information From Public Records

Florida/2 Local County/Seminole/General/ -

Value Of Real Property Or Mortgage Foreclosure Claim

Value Of Real Property Or Mortgage Foreclosure Claim

Florida/2 Local County/Seminole/General/ -

Final Disposition Form

Final Disposition Form

Florida/2 Local County/Seminole/General/ -

Standby Guardian Advocate Joinder In Petition

Standby Guardian Advocate Joinder In Petition

Florida/2 Local County/Seminole/General/ -

Order Appointing Standby Guardian Advocate Of The Person

Order Appointing Standby Guardian Advocate Of The Person

Florida/2 Local County/Seminole/General/ -

Petition And Affidavit For Involuntary Assessment And Stabilization

Petition And Affidavit For Involuntary Assessment And Stabilization

Florida/2 Local County/Seminole/General/ -

Petition For Involuntary Services

Petition For Involuntary Services

Florida/2 Local County/Seminole/General/ -

Petition And Affidavit Seeking Ex Parte Order Requiring Involuntary Examination

Petition And Affidavit Seeking Ex Parte Order Requiring Involuntary Examination

Florida/2 Local County/Seminole/General/ -

Quit Claim Deed

Quit Claim Deed

Florida/Local County/Seminole/General/ -

Power Of Attorney

Power Of Attorney

Florida/Local County/Seminole/General/ -

Case Management Order (County Court)

Case Management Order (County Court)

Florida/2 Local County/Seminole/General/ -

Case Management Order (County Court Cases Filed 4-30-21 To 5-5-21)

Case Management Order (County Court Cases Filed 4-30-21 To 5-5-21)

Florida/2 Local County/Seminole/General/ -

Notice Of Termination Of Notice Of Commencement

Notice Of Termination Of Notice Of Commencement

Florida/Local County/Seminole/General/ -

Request (By Protected Party) To Release Redacted Information On Recorded Documents

Request (By Protected Party) To Release Redacted Information On Recorded Documents

Florida/Local County/Seminole/General/ -

Case Managment Plan And Order (General)

Case Managment Plan And Order (General)

Florida/2 Local County/Seminole/General/ -

Application For Appointment As Guardian Advocate

Application For Appointment As Guardian Advocate

Florida/2 Local County/Seminole/General/ -

Notice Of Petition For Appointment Of Guardian Advocate

Notice Of Petition For Appointment Of Guardian Advocate

Florida/2 Local County/Seminole/General/ -

Petition For Appointment As Guardian Advocate Of The Person

Petition For Appointment As Guardian Advocate Of The Person

Florida/2 Local County/Seminole/General/ -

Order Appointing Attorney And Elisor For Person With Developmental Disability

Order Appointing Attorney And Elisor For Person With Developmental Disability

Florida/2 Local County/Seminole/General/ -

Oath Of Guardian Advocate Designation Of Resident Agent Acceptance

Oath Of Guardian Advocate Designation Of Resident Agent Acceptance

Florida/2 Local County/Seminole/General/ -

Notice Of Confidential Information Within Court Filing

Notice Of Confidential Information Within Court Filing

Florida/2 Local County/Seminole/General/ -

Application For Determination Of Civil Indigent Status

Application For Determination Of Civil Indigent Status

Florida/2 Local County/Seminole/General/ -

Order Appointing Guardian Advocate Of The Person

Order Appointing Guardian Advocate Of The Person

Florida/2 Local County/Seminole/General/ -

Letters Of Guardian Advocacy Of The Person

Letters Of Guardian Advocacy Of The Person

Florida/2 Local County/Seminole/General/ -

Initial Guardian Advocacy Plan Of The Person

Initial Guardian Advocacy Plan Of The Person

Florida/2 Local County/Seminole/General/ -

Order Approving Initial Guardian Advocacy Plan Of The Person

Order Approving Initial Guardian Advocacy Plan Of The Person

Florida/2 Local County/Seminole/General/ -

Annual Guardian Advocacy Plan With Physicians Report

Annual Guardian Advocacy Plan With Physicians Report

Florida/2 Local County/Seminole/General/ -

Order Approving Annual Guardian Advocacy Plan

Order Approving Annual Guardian Advocacy Plan

Florida/2 Local County/Seminole/General/ -

Notice Of Designation Of E-Mail And Cellular Phone For E Service

Notice Of Designation Of E-Mail And Cellular Phone For E Service

Florida/Local County/Seminole/General/ -

Summary Administration Checklist

Summary Administration Checklist

Florida/2 Local County/Seminole/General/ -

Complaint Commercial For Tenant Eviction

Complaint Commercial For Tenant Eviction

Florida/Local County/Seminole/General/ -

Eviction Summons Non Residential Commercial

Eviction Summons Non Residential Commercial

Florida/Local County/Seminole/General/ -

Civil Cover Sheet

Civil Cover Sheet

Florida/2 Local County/Seminole/General/ -

Claim To Receive Surplus Proceeds Of Tax Deed Sale

Claim To Receive Surplus Proceeds Of Tax Deed Sale

Florida/2 Local County/Seminole/General/ -

Declaration Of Domicile

Declaration Of Domicile

Florida/Local County/Seminole/General/ -

Form Letter To Clerk Of Court

Form Letter To Clerk Of Court

Florida/2 Local County/Seminole/General/ -

Notice Of Commencement

Notice Of Commencement

Florida/Local County/Seminole/General/ -

Notice Of Contest Of Lien

Notice Of Contest Of Lien

Florida/Local County/Seminole/General/ -

Petition For Involuntary Treatment

Petition For Involuntary Treatment

Florida/2 Local County/Seminole/General/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!