Last updated: 9/19/2025

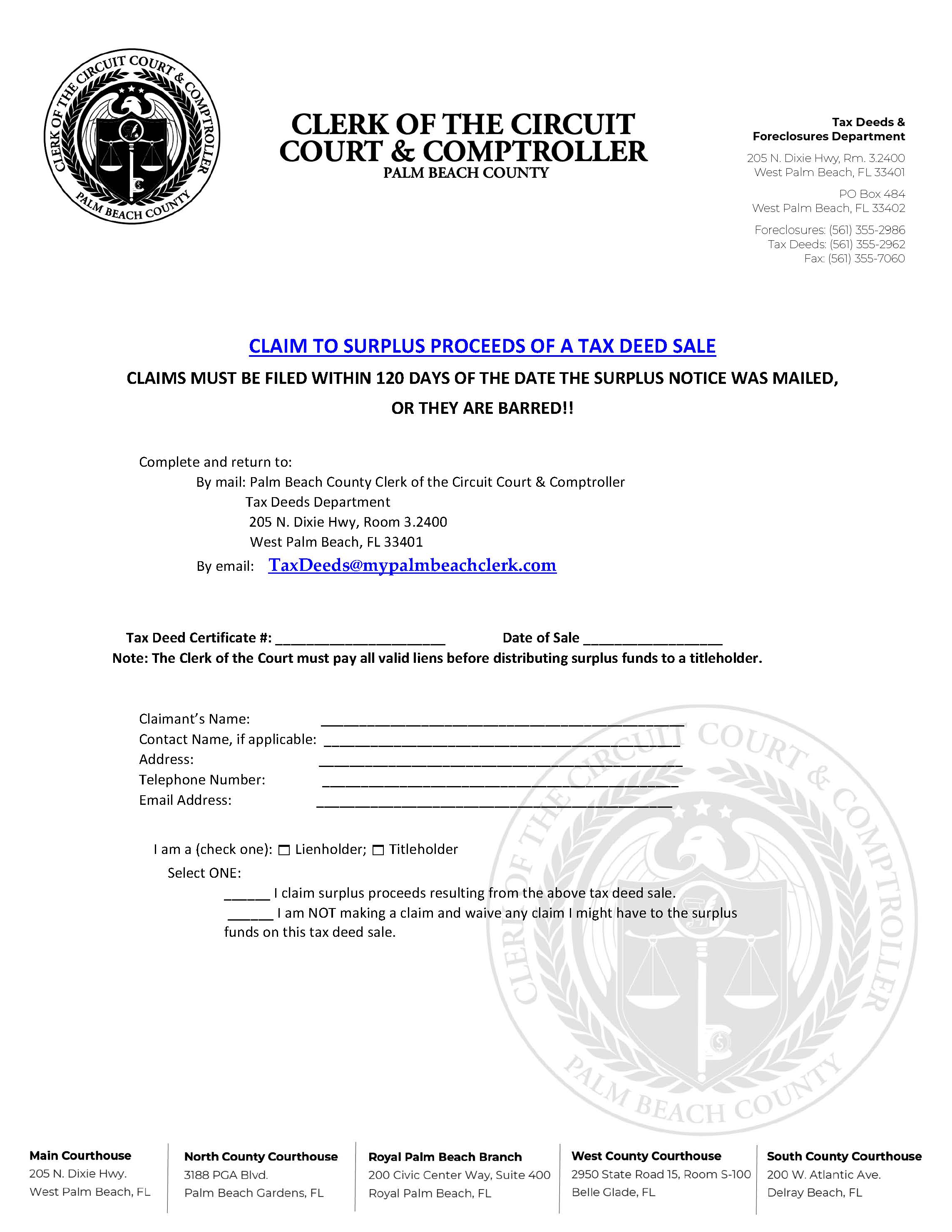

Claim To Surplus Proceeds Of Tax Deed Sale

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

CLAIM TO SURPLUS PROCEEDS OF A TAX DEED SALE. This form is used in Palm Beach County, Florida, by lienholders or former titleholders to request any surplus funds remaining after a tax deed sale, once all valid liens are paid. Claimants must file within 120 days of the surplus notice mailing date or the claim is barred. The form captures basic sale details (certificate number and sale date), claimant contact information, and whether the claimant is a lienholder (with lien type, recording data, amounts due—including interest, fees, and attorney’s fees) or a titleholder (with nature of title, recording data, amount claimed, and whether the property was homestead). Claimants indicate where payment should be sent, affirm under oath that the information is true, and have the signature notarized (with additional corporate authorization if applicable). Completed forms are submitted to the Clerk of the Circuit Court & Comptroller’s Tax Deeds Department by mail or email so the Clerk can review, prioritize, and disburse any surplus according to law. www.FormsWorkflow.com

Related forms

-

Notice Of Confidential Information Within Court Filing

Notice Of Confidential Information Within Court Filing

Florida/Local County/Palm Beach/General/ -

Notice Of Termination (Of Notice Of Commencement)

Notice Of Termination (Of Notice Of Commencement)

Florida/2 Local County/Palm Beach/General/ -

Notice Of Homestead

Notice Of Homestead

Florida/2 Local County/Palm Beach/General/ -

Notice Of Bond

Notice Of Bond

Florida/2 Local County/Palm Beach/General/ -

Warranty Deed

Warranty Deed

Florida/2 Local County/Palm Beach/General/ -

Enhanced Life Estate Deed (Lady Bird Deed)

Enhanced Life Estate Deed (Lady Bird Deed)

Florida/2 Local County/Palm Beach/General/ -

Satisfaction Of Judgment

Satisfaction Of Judgment

Florida/2 Local County/Palm Beach/General/ -

Notice Of Contest Of Lien

Notice Of Contest Of Lien

Florida/2 Local County/Palm Beach/General/ -

Satisfaction Of Claim Of Lien

Satisfaction Of Claim Of Lien

Florida/2 Local County/Palm Beach/General/ -

Notice Of Contest Of Lien (HOA)

Notice Of Contest Of Lien (HOA)

Florida/2 Local County/Palm Beach/General/ -

Declaration Of Termination Of Domestic Partnership

Declaration Of Termination Of Domestic Partnership

Florida/Local County/Palm Beach/General/ -

Motion To Determine The Confidentiality Of Trial Court Records

Motion To Determine The Confidentiality Of Trial Court Records

Florida/2 Local County/Palm Beach/General/ -

Notice Of Filing Suggestion Of Bankruptcy

Notice Of Filing Suggestion Of Bankruptcy

Florida/2 Local County/Palm Beach/General/ -

Final Judgment Against (Small Claims)

Final Judgment Against (Small Claims)

Florida/2 Local County/Palm Beach/General/ -

Authorization To Allow Employee To Represent Business Entity (Small Claims)

Authorization To Allow Employee To Represent Business Entity (Small Claims)

Florida/2 Local County/Palm Beach/General/ -

Statement Of Claim (Small Claims)

Statement Of Claim (Small Claims)

Florida/2 Local County/Palm Beach/General/ -

Owners Claim For Mortgage Foreclosure Surplus

Owners Claim For Mortgage Foreclosure Surplus

Florida/2 Local County/Palm Beach/General/ -

Request To Add Final Judgment Information Protected Minor Public Website

Request To Add Final Judgment Information Protected Minor Public Website

Florida/Local County/Palm Beach/General/ -

Consent For Petitioner To File On Behalf Of Vulnerable Adult

Consent For Petitioner To File On Behalf Of Vulnerable Adult

Florida/Local County/Palm Beach/General/ -

Request To Dismiss Petition For Injunction (Vulnerable Adult)

Request To Dismiss Petition For Injunction (Vulnerable Adult)

Florida/Local County/Palm Beach/General/ -

Vulnerable Adult Description Sheet (Sheriffs Information)

Vulnerable Adult Description Sheet (Sheriffs Information)

Florida/Local County/Palm Beach/General/ -

Petition For Injunction Against Exploitation Of A Vulnerable Adult

Petition For Injunction Against Exploitation Of A Vulnerable Adult

Florida/Local County/Palm Beach/General/ -

Petitioners Motion Testimony By Phone Or Video Conferencing (Vulnerable Adult)

Petitioners Motion Testimony By Phone Or Video Conferencing (Vulnerable Adult)

Florida/Local County/Palm Beach/General/ -

Notice Of Contest Of Claim Against Payment Bond

Notice Of Contest Of Claim Against Payment Bond

Florida/Local County/Palm Beach/General/ -

Request For Release Of Transfer Of Lien To Security

Request For Release Of Transfer Of Lien To Security

Florida/2 Local County/Palm Beach/General/ -

Claim Of Lien

Claim Of Lien

Florida/2 Local County/Palm Beach/General/ -

Statement Of Claim (Probate)

Statement Of Claim (Probate)

Florida/2 Local County/Palm Beach/General/ -

Quit Claim Deed

Quit Claim Deed

Florida/2 Local County/Palm Beach/General/ -

Summons (Personal Service On A Natural Person - County Civil)

Summons (Personal Service On A Natural Person - County Civil)

Florida/Local County/Palm Beach/General/ -

Satisfaction Of Mortage

Satisfaction Of Mortage

Florida/2 Local County/Palm Beach/General/ -

Civil Cover Sheet

Civil Cover Sheet

Florida/2 Local County/Palm Beach/General/ -

Petition For Disposition Personal Property Without Administration Affidavit Of Heirship

Petition For Disposition Personal Property Without Administration Affidavit Of Heirship

Florida/2 Local County/Palm Beach/General/ -

Declaration Of Domicile

Declaration Of Domicile

Florida/2 Local County/Palm Beach/General/ -

Eviction Summons Residential

Eviction Summons Residential

Florida/Local County/Palm Beach/General/ -

Request To Release Protected Decedents Removed Information

Request To Release Protected Decedents Removed Information

Florida/2 Local County/Palm Beach/General/ -

Request To Release Redacted Information On Recorded Documents (Title Search)

Request To Release Redacted Information On Recorded Documents (Title Search)

Florida/Local County/Palm Beach/General/ -

Official Records Escrow Agreement

Official Records Escrow Agreement

Florida/Local County/Palm Beach/General/ -

Subpoena Duces Tecum With Deposition

Subpoena Duces Tecum With Deposition

Florida/2 Local County/Palm Beach/General/ -

Request To Release The Exempt Status Of Home Address

Request To Release The Exempt Status Of Home Address

Florida/Local County/Palm Beach/General/ -

Records Services Transmittal

Records Services Transmittal

Florida/2 Local County/Palm Beach/General/ -

Request For Redaction Exempt Personal Information Non-Judicial Public Records

Request For Redaction Exempt Personal Information Non-Judicial Public Records

Florida/2 Local County/Palm Beach/General/ -

Request For Permanent Removal Of Military Separation Document

Request For Permanent Removal Of Military Separation Document

Florida/2 Local County/Palm Beach/General/ -

Declaration Of Domestic Partnership

Declaration Of Domestic Partnership

Florida/Local County/Palm Beach/General/ -

Claim To Surplus Proceeds Of Tax Deed Sale

Claim To Surplus Proceeds Of Tax Deed Sale

Florida/2 Local County/Palm Beach/General/ -

Subpoena For Inspection Of Premises

Subpoena For Inspection Of Premises

Florida/2 Local County/Palm Beach/General/ -

Request For Removal Of SS Number Bank Account CC Number

Request For Removal Of SS Number Bank Account CC Number

Florida/2 Local County/Palm Beach/General/ -

Recording Transmittal

Recording Transmittal

Florida/Local County/Palm Beach/General/ -

Request To Release Redacted Information On Recorded Documents (Protected Party)

Request To Release Redacted Information On Recorded Documents (Protected Party)

Florida/2 Local County/Palm Beach/General/ -

Request For Domestic Partnership Registration

Request For Domestic Partnership Registration

Florida/Local County/Palm Beach/General/ -

Request For Internet Document Removal

Request For Internet Document Removal

Florida/2 Local County/Palm Beach/General/ -

Summons (Personal Service On A Natural Person - Circuit Civil)

Summons (Personal Service On A Natural Person - Circuit Civil)

Florida/Local County/Palm Beach/General/ -

Notice Of Commencement

Notice Of Commencement

Florida/2 Local County/Palm Beach/General/ -

Amended Declaration Of Domestic Partnership

Amended Declaration Of Domestic Partnership

Florida/Local County/Palm Beach/General/ -

Subpoena For Deposition

Subpoena For Deposition

Florida/2 Local County/Palm Beach/General/ -

Subpoena Duces Tecum (No Deposition)

Subpoena Duces Tecum (No Deposition)

Florida/2 Local County/Palm Beach/General/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!