Last updated: 12/1/2025

Annual Benefit Report

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

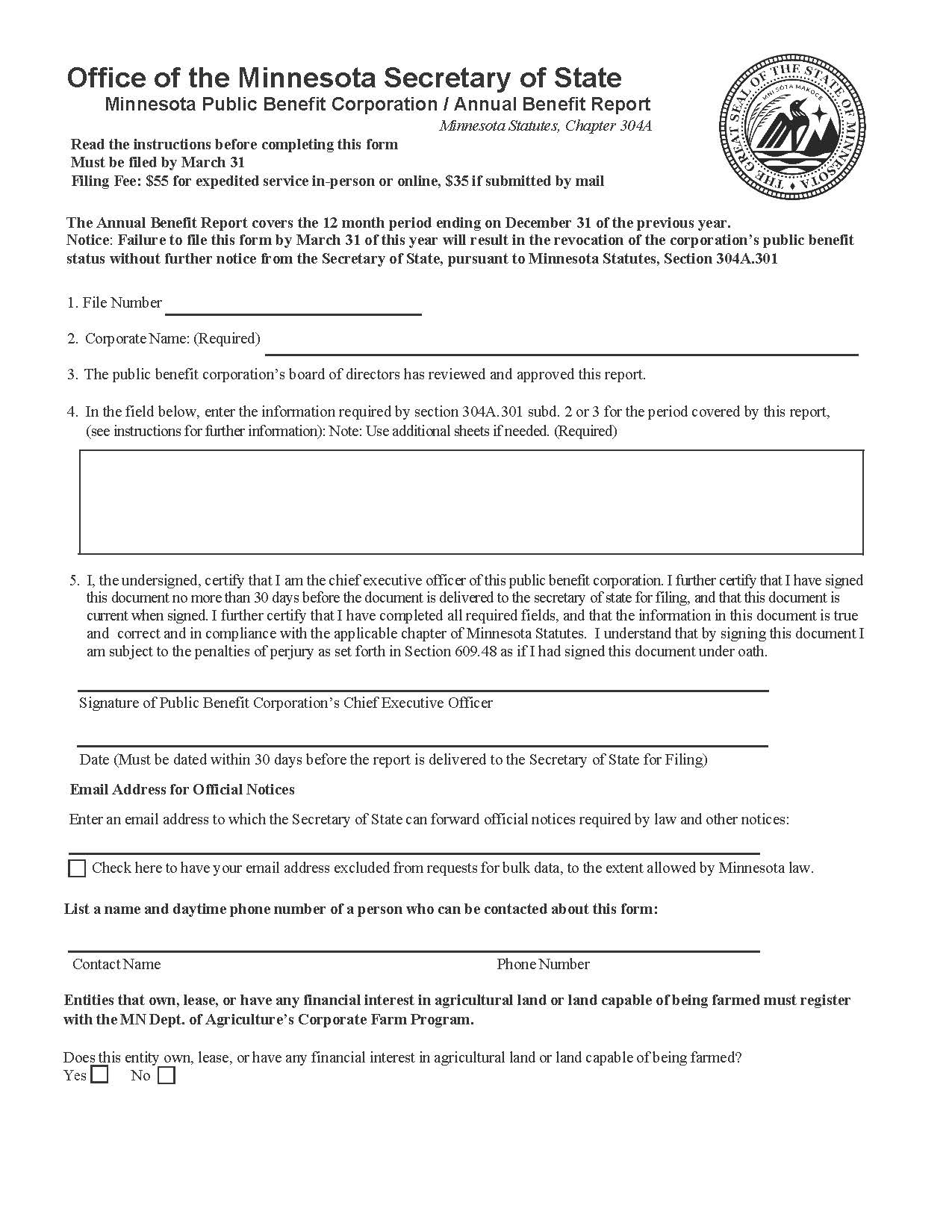

ANNUAL BENEFIT REPORT. The Minnesota Public Benefit Corporation Annual Benefit Report is a mandatory filing for public benefit corporations operating under Minnesota Statutes, Chapter 304A. This report, which must be filed by March 31 each year, covers the previous 12-month period ending on December 31. Its primary purpose is to document how the corporation has pursued and achieved its stated public benefit purpose. Failure to file on time results in automatic revocation of public benefit status without further notice. To comply, the corporation must provide its file number and legal name, certify that the board of directors has reviewed and approved the report, and include a detailed description of how the corporation pursued and created its public benefit, any challenges encountered, and, if applicable, any independent third-party standard used to measure its impact. The chief executive officer must sign the report, certifying its accuracy under penalty of perjury. The filing fee for the report is $55 for in-person expedited service and $35 if submitted by mail. Additionally, corporations that own, lease, or have a financial interest in agricultural land must register with the Minnesota Department of Agriculture’s Corporate Farm Program. If a corporation fails to file the report on time, it may reinstate its public benefit status by submitting the required report and paying a $500 reinstatement fee ($520 for expedited in-person filing) within 30 days of revocation. However, if a corporation's public benefit status is revoked a second time, it will be unable to reinstate for three years. www.FormsWorkflow.com