Last updated: 6/12/2025

Earnings Execution Disclosure For Non Child Support Judgments {JGM-703}

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

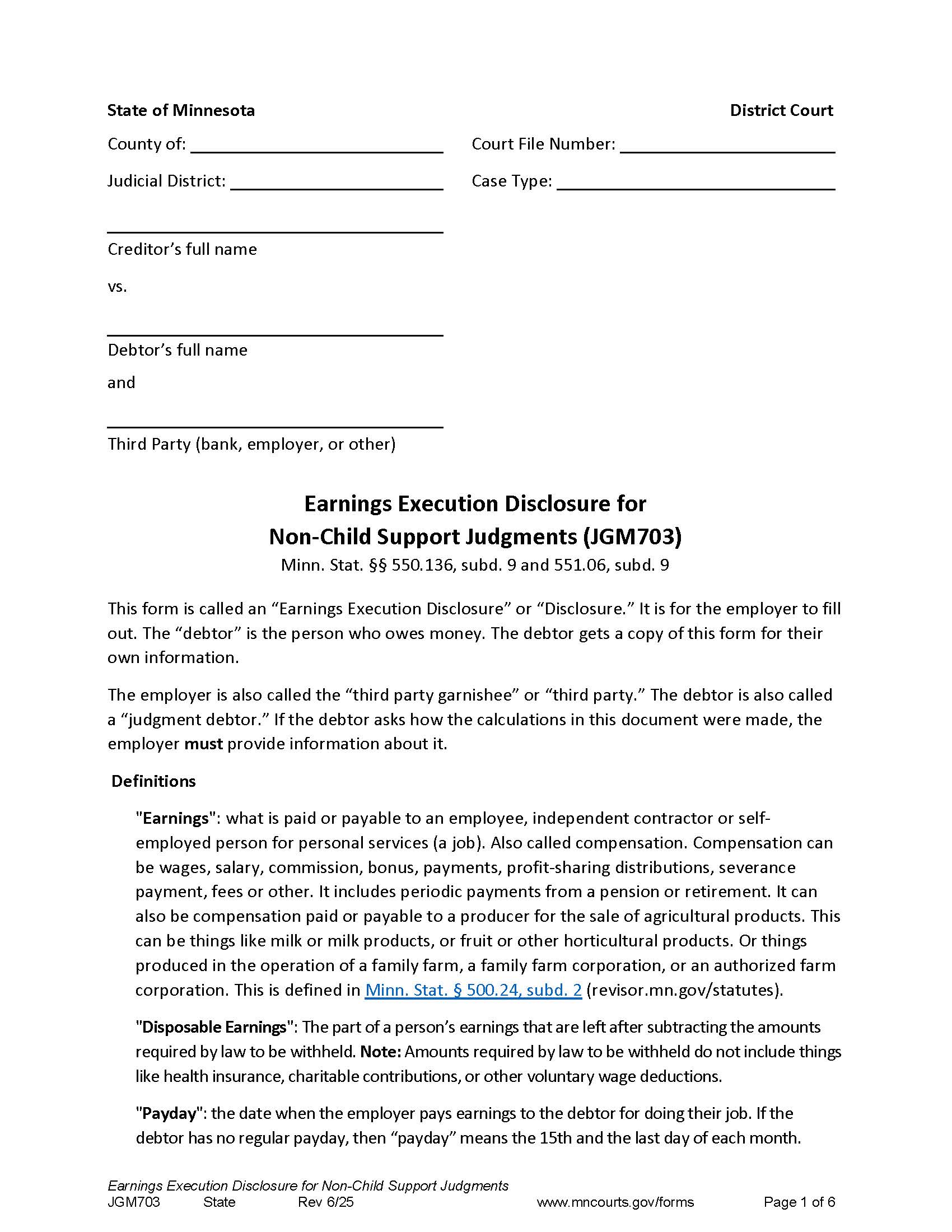

JGM703 - EARNINGS EXECUTION DISCLOSURE FOR NON-CHILD SUPPORT JUDGMENTS Minn. Stat. §§ 550.136, subd. 9 and 551.06, subd. 9. This form is used in Minnesota district courts to gather information from an employer (also called a third party or garnishee) regarding the earnings of an employee (the debtor) who owes money as a result of a court judgment. The form is required when a creditor has obtained a legal judgment against a debtor and is attempting to collect that debt through wage garnishment. The employer must disclose whether they currently owe, or will owe within 90 days, any earnings to the debtor, and whether the debtor earns above the minimum wage threshold. If so, the employer is required to calculate the amount of the debtor’s earnings that can legally be withheld and forwarded to the sheriff for payment to the creditor. The form includes definitions, a worksheet to determine the garnishable amount based on Minnesota law, and instructions for returning the disclosure to the sheriff and providing notice to the debtor. It also allows employers to note any claims, such as liens or setoffs, that may affect the garnishment amount. www.FormsWorkflow.com