Last updated: 5/24/2025

Financial Disclosure Form {JGM-301}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

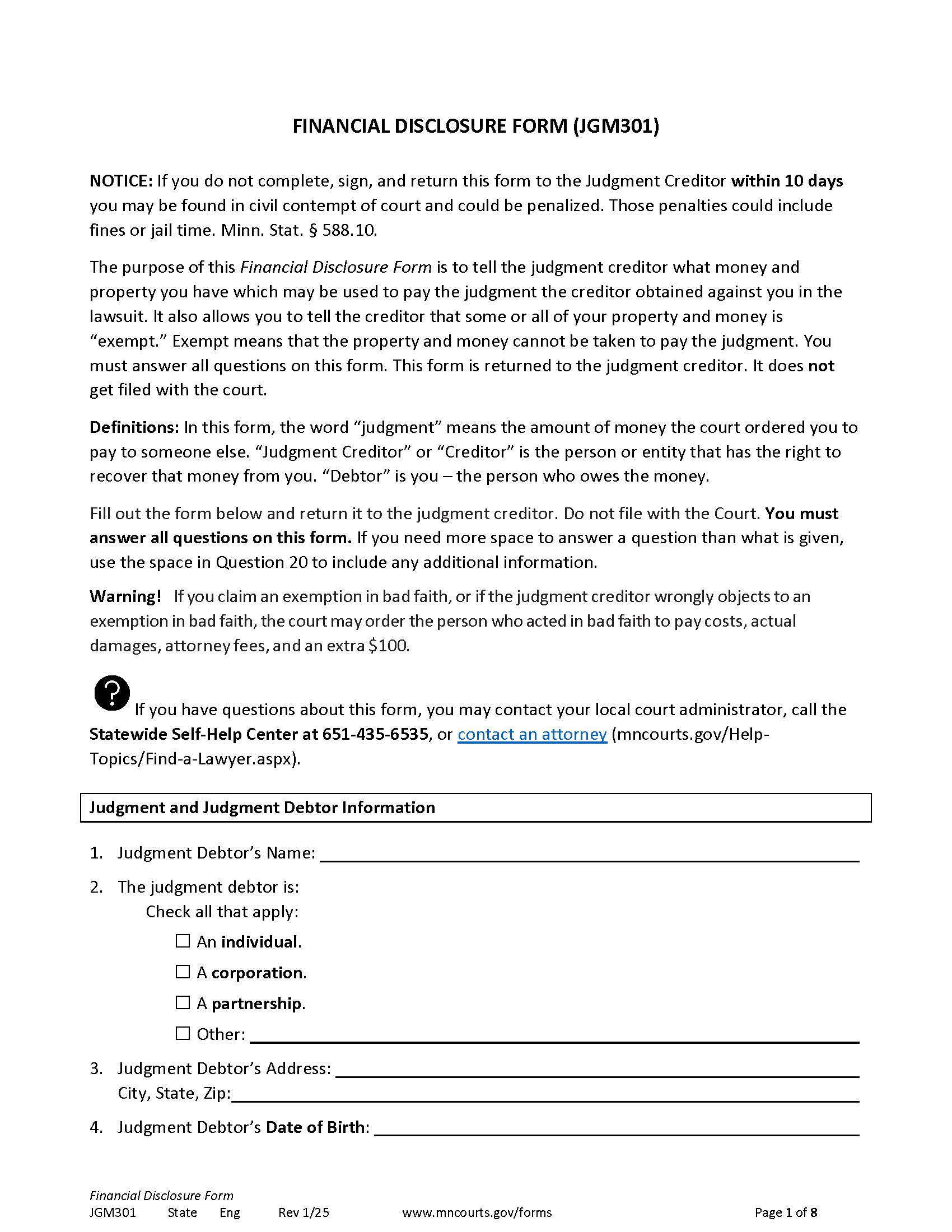

JGM301 - FINANCIAL DISCLOSURE FORM. This form is used in Minnesota to gather financial information from a person (the “judgment debtor”) who has been ordered by a court to pay money to another person or entity (the “judgment creditor”) following a lawsuit. The purpose of this form is to tell the judgment creditor what money and property you have which may be used to pay the judgment the creditor obtained against you in the lawsuit. It also allows you to tell the creditor that some or all of your property and money is “exempt.” Exempt means that the property and money cannot be taken to pay the judgment. You must answer all questions on this form. This form is returned to the judgment creditor. It does not get filed with the court. In this form, the word “judgment” means the amount of money the court ordered you to pay to someone else. “Judgment Creditor” or “Creditor” is the person or entity that has the right to recover that money from you. “Debtor” is you – the person who owes the money. The form includes detailed questions about the debtor’s employment, sources of income, bank accounts, government benefits, public assistance, real estate, vehicles, and other personal assets. Debtors must also disclose whether they claim any exemptions under state law, such as those for basic living wages, public assistance, Social Security benefits, or a homestead. The completed form must be returned to the judgment creditor — not the court — within 10 days. Failing to do so could result in civil contempt penalties, including fines or jail time. The form is signed under penalty of perjury, meaning the debtor certifies that all information provided is truthful and accurate. If a person falsely claims exemptions or the creditor challenges exemptions in bad faith, the court may impose financial penalties. www.FormsWorkflow.com