Last updated: 6/12/2025

Earnings Execution Disclosure For Child Support Judgments {JGM-704}

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

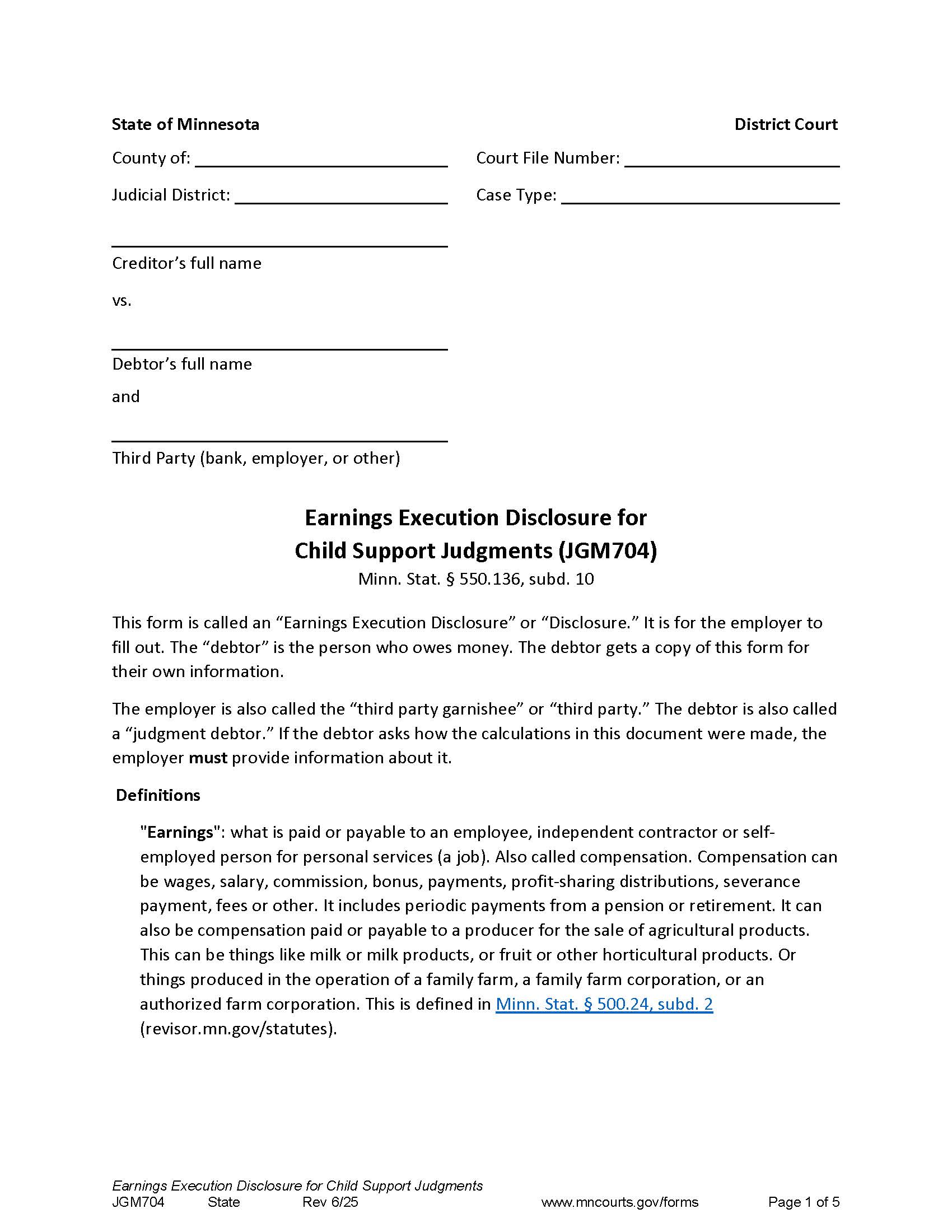

JGM704 - EARNINGS EXECUTION DISCLOSURE FOR CHILD SUPPORT JUDGMENTS Minn. Stat. § 550.136, subd. 10. This form is used by employers (also referred to as third-party garnishees) in the State of Minnesota to disclose information about the wages of an employee (the judgment debtor) who owes child support. When a court orders garnishment of a debtor’s wages to satisfy a child support judgment, the employer must complete this form to confirm whether the debtor is currently employed and to calculate how much of their earnings must be withheld. The form includes definitions of key terms, questions to confirm employment status, an affirmation of accuracy, and a worksheet used to calculate the portion of disposable earnings that can be legally withheld based on the debtor’s support status and how long the judgment has been in place. The employer is required to return the completed form and any garnished funds to the sheriff, provide a copy to the debtor, and continue withholding for up to 90 days or until the judgment is satisfied. www.FormsWorkflow.com