Last updated: 5/21/2025

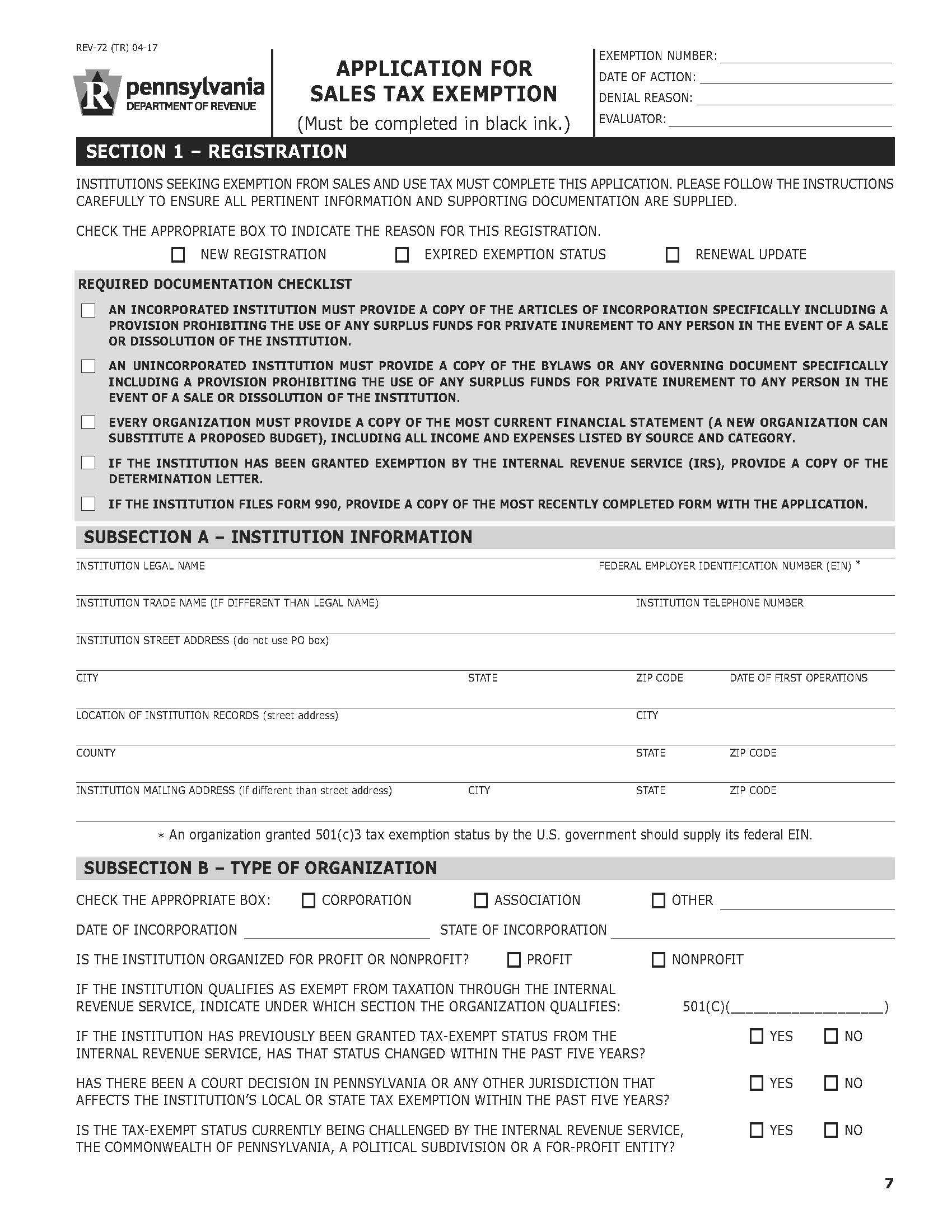

Application For Sales Tax Exemption {REV-72}

Start Your Free Trial $ 33.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

REV-72 - APPLICATION FOR SALES TAX EXEMPTION. This form is used by institutions seeking exemption from the state’s sales and use tax. This application is required for a variety of organizational types—including new applicants, institutions with lapsed exemption statuses, and currently exempt entities seeking renewal or updating their information. The purpose of the form is to determine whether an institution qualifies as a "purely public charity" or a similar nonprofit entity under Pennsylvania law, thereby entitling it to exemption from sales tax obligations. To apply, organizations must provide detailed information regarding their legal structure, operational history, finances, charitable activities, and governance. This includes submitting supporting documents such as articles of incorporation or bylaws with required clauses, recent financial statements or budgets, IRS determination letters, and Form 990s where applicable. The application requests disclosures about the institution’s income, expenses, volunteer hours, beneficiaries served, and the nature of any discounts or free services provided. It also collects details about officers’ compensation, affiliated entities, fundraising activities, and any relevant regulatory or legal challenges. www.FormsWorkflow.com

Related forms

-

Out Of Existence Withdrawal Affidavit

Out Of Existence Withdrawal Affidavit

Pennsylvania/Statewide/Department Of Revenue/ -

Shedule H Funeral Expenses And Administrative Costs

Shedule H Funeral Expenses And Administrative Costs

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule O Deferral-Election Of Spousal Trusts

Schedule O Deferral-Election Of Spousal Trusts

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule L Remainder Prepayment Or Invasion Of Trust Corpus

Schedule L Remainder Prepayment Or Invasion Of Trust Corpus

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule M Future Interest Compromise

Schedule M Future Interest Compromise

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule K Life Estate Annuity And Term Certain

Schedule K Life Estate Annuity And Term Certain

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C-1 Closely-Held Corporate Stock Information Report

Schedule C-1 Closely-Held Corporate Stock Information Report

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule N Spousal Poverty Credit

Schedule N Spousal Poverty Credit

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule A Real Estate

Schedule A Real Estate

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule B Stocks And Bonds

Schedule B Stocks And Bonds

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C Closely-Held Coporation Partnership Or Sole-Proprietorship

Schedule C Closely-Held Coporation Partnership Or Sole-Proprietorship

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C-2 Partnership Information Report

Schedule C-2 Partnership Information Report

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule D Mortgages And Notes Receivable

Schedule D Mortgages And Notes Receivable

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule E Cash Bank Deposits And Misc Personal Property

Schedule E Cash Bank Deposits And Misc Personal Property

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule J Beneficiaries

Schedule J Beneficiaries

Pennsylvania/Statewide/Department Of Revenue/ -

Estate Information Sheet

Estate Information Sheet

Pennsylvania/Statewide/Department Of Revenue/ -

Realty Transfer Tax Statement Of Value

Realty Transfer Tax Statement Of Value

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property

Pennsylvania/Statewide/Department Of Revenue/ -

Inheritance Tax Return Nonresident Decedent

Inheritance Tax Return Nonresident Decedent

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule F Jointly-Owned Property

Schedule F Jointly-Owned Property

Pennsylvania/Statewide/Department Of Revenue/ -

Safe Deposit Box Inventory

Safe Deposit Box Inventory

Pennsylvania/1 Statewide/Department Of Revenue/ -

Entry Into Safe Deposit Box To Remove A Will Or Cemetery Deed

Entry Into Safe Deposit Box To Remove A Will Or Cemetery Deed

Pennsylvania/1 Statewide/Department Of Revenue/ -

Notice Of Transfer

Notice Of Transfer

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule C-SB Qualified Family Owned Business Exemption

Schedule C-SB Qualified Family Owned Business Exemption

Pennsylvania/1 Statewide/Department Of Revenue/ -

Register Of Wills Monthly Report

Register Of Wills Monthly Report

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule AU Agriculture Use Exemptions

Schedule AU Agriculture Use Exemptions

Pennsylvania/1 Statewide/Department Of Revenue/ -

Appliction For Refund Of Inheritance Or Estate Tax

Appliction For Refund Of Inheritance Or Estate Tax

Pennsylvania/1 Statewide/Department Of Revenue/ -

Stocks And Or Bonds Inventory

Stocks And Or Bonds Inventory

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule L-1 Remainder Prepayment Election Assets

Schedule L-1 Remainder Prepayment Election Assets

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule L-2 Remainder Prepayment Election Credits

Schedule L-2 Remainder Prepayment Election Credits

Pennsylvania/1 Statewide/Department Of Revenue/ -

Nonresident Decedent Affidavit Of Domicile

Nonresident Decedent Affidavit Of Domicile

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule A Part I Real Estate In Pennsylvania

Schedule A Part I Real Estate In Pennsylvania

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule B Stocks And Bonds

Schedule B Stocks And Bonds

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule E Part I Miscellaneous Personal Property

Schedule E Part I Miscellaneous Personal Property

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule F Part I Jointly Owned Assets

Schedule F Part I Jointly Owned Assets

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule G Inter Vivos Transfers And Miscellaneous Non Probate Property

Schedule G Inter Vivos Transfers And Miscellaneous Non Probate Property

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Pennsylvania/1 Statewide/Department Of Revenue/ -

Application For Mortgage Foreclosure Inheritance Tax Release Of Lien

Application For Mortgage Foreclosure Inheritance Tax Release Of Lien

Pennsylvania/1 Statewide/Department Of Revenue/ -

Extension To File Inheritance Tax Return

Extension To File Inheritance Tax Return

Pennsylvania/1 Statewide/Department Of Revenue/ -

Identity Theft Affidavit

Identity Theft Affidavit

Pennsylvania/1 Statewide/Department Of Revenue/ -

Notice Of Intent To Enter Safe Deposit Box

Notice Of Intent To Enter Safe Deposit Box

Pennsylvania/1 Statewide/Department Of Revenue/ -

Board Of Appeals Petition Form

Board Of Appeals Petition Form

Pennsylvania/Statewide/Department Of Revenue/ -

Inheritance Tax Return Resident Decedent

Inheritance Tax Return Resident Decedent

Pennsylvania/Statewide/Department Of Revenue/ -

Application For Sales Tax Exemption

Application For Sales Tax Exemption

Pennsylvania/Statewide/Department Of Revenue/ -

Application For Tax Clearance Certificate

Application For Tax Clearance Certificate

Pennsylvania/Statewide/Department Of Revenue/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!