Last updated: 7/2/2018

Schedule O Deferral-Election Of Spousal Trusts {REV-1649}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

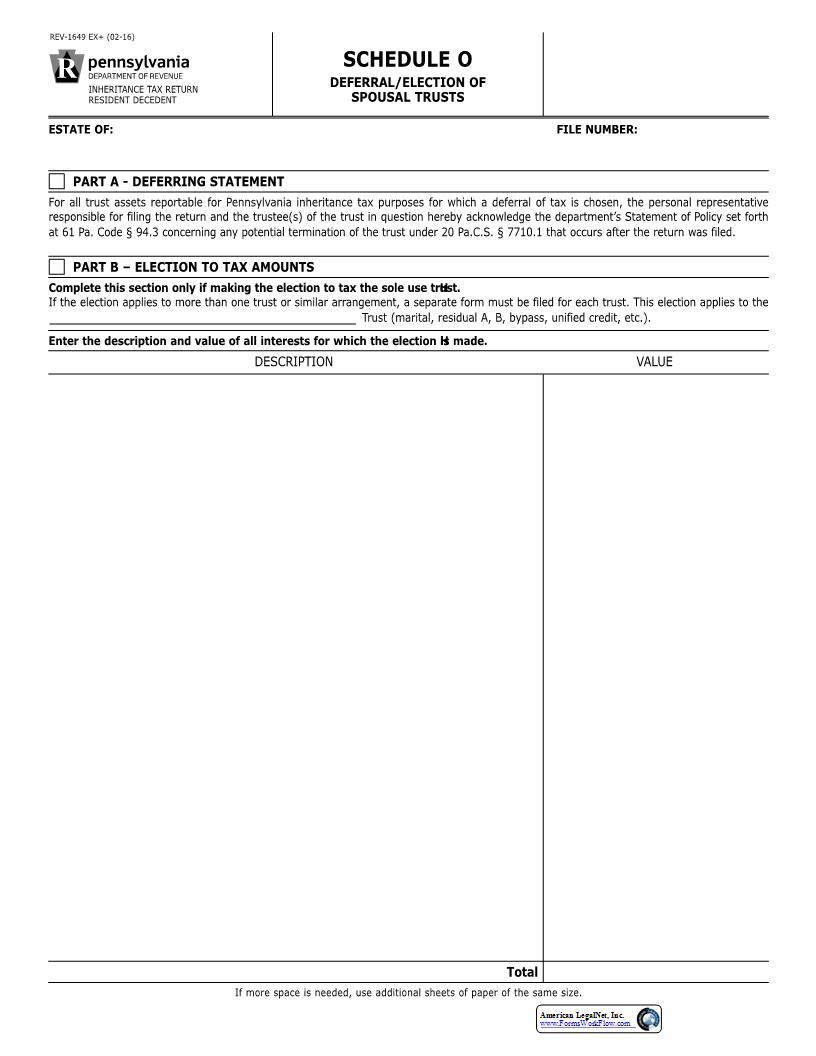

INHERITANCE TAX RETURN RESIDENT DECEDENTSCHEDULE ODEFERRAL/ELECTION OFSPOUSAL TRUSTSESTATE OF:FILE NUMBER: PART A - DEFERRING STATEMENTFor all trust assets reportable for Pennsylvania inheritance tax purposes for which a deferral of tax is chosen, the personal representativeresponsible for filing the return and the trustee(s) of the trust in question hereby acknowledge the department220s Statement of Policy set forthat 61 Pa. Code 247 94.3 concerning any potential termination of the trust under 20 Pa.C.S. 247 7710.1that occurs after the return was filed. PART B 205 ELECTION TO TAX AMOUNTSComplete this section only if making the election to tax the sole use trust.If the election applies to more than one trust or similar arrangement, a separate form must be filed for each trust. This election applies to theTrust (marital, residual A, B, bypass, unified credit, etc.). Enter the description and value of all interests for which the election is made. DESCRIPTIONVALUE Total REV-1649 EX+ (02-16) If more space is needed, use additional sheets of paper of the same size. American LegalNet, Inc. www.FormsWorkFlow.com

Related forms

-

Out Of Existence Withdrawal Affidavit

Out Of Existence Withdrawal Affidavit

Pennsylvania/Statewide/Department Of Revenue/ -

Shedule H Funeral Expenses And Administrative Costs

Shedule H Funeral Expenses And Administrative Costs

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule O Deferral-Election Of Spousal Trusts

Schedule O Deferral-Election Of Spousal Trusts

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule L Remainder Prepayment Or Invasion Of Trust Corpus

Schedule L Remainder Prepayment Or Invasion Of Trust Corpus

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule M Future Interest Compromise

Schedule M Future Interest Compromise

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule K Life Estate Annuity And Term Certain

Schedule K Life Estate Annuity And Term Certain

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C-1 Closely-Held Corporate Stock Information Report

Schedule C-1 Closely-Held Corporate Stock Information Report

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule N Spousal Poverty Credit

Schedule N Spousal Poverty Credit

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule A Real Estate

Schedule A Real Estate

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule B Stocks And Bonds

Schedule B Stocks And Bonds

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C Closely-Held Coporation Partnership Or Sole-Proprietorship

Schedule C Closely-Held Coporation Partnership Or Sole-Proprietorship

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule C-2 Partnership Information Report

Schedule C-2 Partnership Information Report

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule D Mortgages And Notes Receivable

Schedule D Mortgages And Notes Receivable

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule E Cash Bank Deposits And Misc Personal Property

Schedule E Cash Bank Deposits And Misc Personal Property

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule J Beneficiaries

Schedule J Beneficiaries

Pennsylvania/Statewide/Department Of Revenue/ -

Estate Information Sheet

Estate Information Sheet

Pennsylvania/Statewide/Department Of Revenue/ -

Realty Transfer Tax Statement Of Value

Realty Transfer Tax Statement Of Value

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property

Schedule G - Inter-Vivos Transfers And Misc. Non-Probate Property

Pennsylvania/Statewide/Department Of Revenue/ -

Inheritance Tax Return Nonresident Decedent

Inheritance Tax Return Nonresident Decedent

Pennsylvania/Statewide/Department Of Revenue/ -

Schedule F Jointly-Owned Property

Schedule F Jointly-Owned Property

Pennsylvania/Statewide/Department Of Revenue/ -

Safe Deposit Box Inventory

Safe Deposit Box Inventory

Pennsylvania/1 Statewide/Department Of Revenue/ -

Entry Into Safe Deposit Box To Remove A Will Or Cemetery Deed

Entry Into Safe Deposit Box To Remove A Will Or Cemetery Deed

Pennsylvania/1 Statewide/Department Of Revenue/ -

Notice Of Transfer

Notice Of Transfer

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule C-SB Qualified Family Owned Business Exemption

Schedule C-SB Qualified Family Owned Business Exemption

Pennsylvania/1 Statewide/Department Of Revenue/ -

Register Of Wills Monthly Report

Register Of Wills Monthly Report

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule AU Agriculture Use Exemptions

Schedule AU Agriculture Use Exemptions

Pennsylvania/1 Statewide/Department Of Revenue/ -

Appliction For Refund Of Inheritance Or Estate Tax

Appliction For Refund Of Inheritance Or Estate Tax

Pennsylvania/1 Statewide/Department Of Revenue/ -

Stocks And Or Bonds Inventory

Stocks And Or Bonds Inventory

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule L-1 Remainder Prepayment Election Assets

Schedule L-1 Remainder Prepayment Election Assets

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule L-2 Remainder Prepayment Election Credits

Schedule L-2 Remainder Prepayment Election Credits

Pennsylvania/1 Statewide/Department Of Revenue/ -

Nonresident Decedent Affidavit Of Domicile

Nonresident Decedent Affidavit Of Domicile

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule A Part I Real Estate In Pennsylvania

Schedule A Part I Real Estate In Pennsylvania

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule B Stocks And Bonds

Schedule B Stocks And Bonds

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule E Part I Miscellaneous Personal Property

Schedule E Part I Miscellaneous Personal Property

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule F Part I Jointly Owned Assets

Schedule F Part I Jointly Owned Assets

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule G Inter Vivos Transfers And Miscellaneous Non Probate Property

Schedule G Inter Vivos Transfers And Miscellaneous Non Probate Property

Pennsylvania/1 Statewide/Department Of Revenue/ -

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Schedule I Debts Of Decedent Mortgage Liabilities And Liens

Pennsylvania/1 Statewide/Department Of Revenue/ -

Application For Mortgage Foreclosure Inheritance Tax Release Of Lien

Application For Mortgage Foreclosure Inheritance Tax Release Of Lien

Pennsylvania/1 Statewide/Department Of Revenue/ -

Extension To File Inheritance Tax Return

Extension To File Inheritance Tax Return

Pennsylvania/1 Statewide/Department Of Revenue/ -

Identity Theft Affidavit

Identity Theft Affidavit

Pennsylvania/1 Statewide/Department Of Revenue/ -

Notice Of Intent To Enter Safe Deposit Box

Notice Of Intent To Enter Safe Deposit Box

Pennsylvania/1 Statewide/Department Of Revenue/ -

Board Of Appeals Petition Form

Board Of Appeals Petition Form

Pennsylvania/Statewide/Department Of Revenue/ -

Inheritance Tax Return Resident Decedent

Inheritance Tax Return Resident Decedent

Pennsylvania/Statewide/Department Of Revenue/ -

Application For Sales Tax Exemption

Application For Sales Tax Exemption

Pennsylvania/Statewide/Department Of Revenue/ -

Application For Tax Clearance Certificate

Application For Tax Clearance Certificate

Pennsylvania/Statewide/Department Of Revenue/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!