Last updated: 10/29/2019

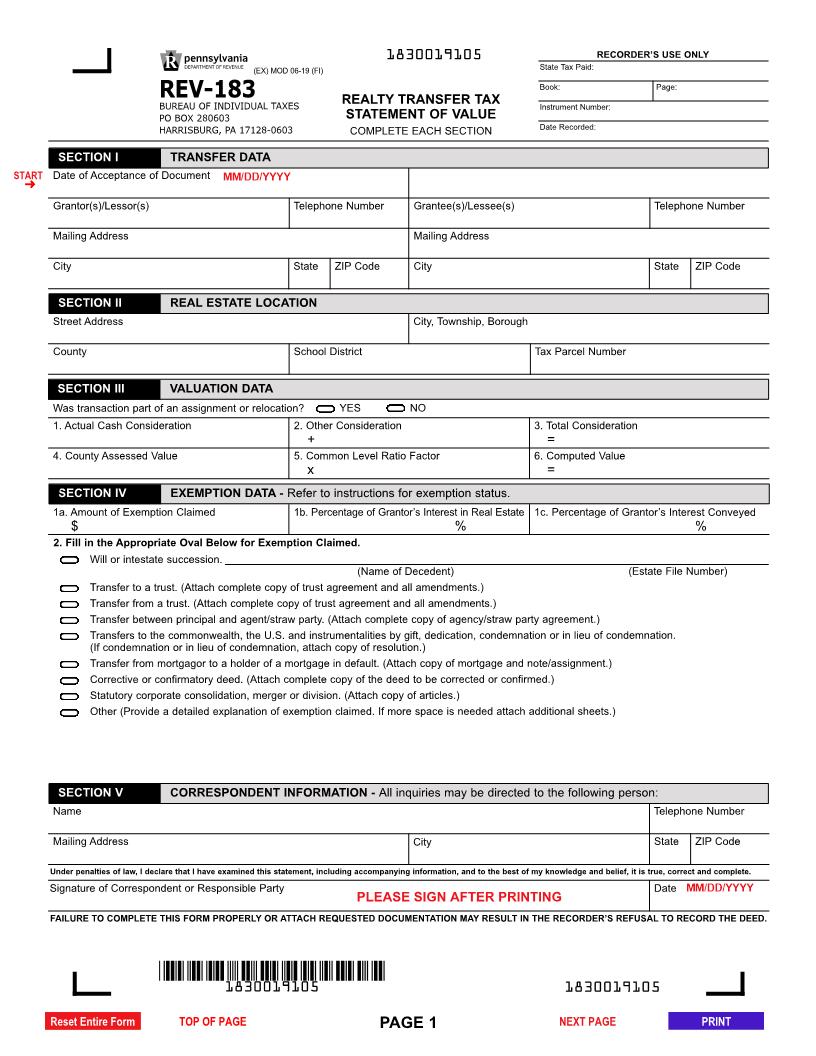

Realty Transfer Tax Statement Of Value {REV-183}

Start Your Free Trial $ 17.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

PAGE 1 TRANSFER DATA SECTION I REAL ESTATE LOCATION SECTION II Date of Acceptance of Document Grantor(s)/Lessor(s) Telephone Number Mailing Address City State ZIP Code Grantee(s)/Lessee(s) Telephone Number Mailing Address City State ZIP Code Was transaction part of an assignment or relocation? 1. Actual Cash Consideration 2. Other Consideration + 3. Total Consideration = 4. County Assessed Value 5. Common Level Ratio Factor x 6. Computed Value = 1a. Amount of Exemption Claimed $ 1b. Percentage of Grantor220s Interest in Real Estate % 1c. Percentage of Grantor220s Interest Conveyed % Street Address City, Township, Borough County School District Tax Parcel Number VALUATION DATA SECTION III 2. Check Appropriate Box Below for Exemption Claimed. REV-183 Bureau of IndIvIdual Taxes Po Box 280603 HarrIsBurg, Pa 17128-0603 RECORDER220S USE ONLYREALTY TRANSFER TAX STATEMENT OF VALUE COMPLETE EACH SECTION State Tax Paid: Book:Page:Instrument Number:Date Recorded: Under penalties of law, I declare that I have examined this statement, including accompanying information, and to the best of my knowledge and belief, it is true, correct and complete.YESNO EXEMPTION DATA - Refer to instructions for exemption status. SECTION IV V Will or intestate succession. (Name of Decedent) (Estate File Number) Transfer to a trust. (Attach complete copy of trust agreement and all amendments.) Transfer from a trust. (Attach complete copy of trust agreement and all amendments.) Transfer between principal and agent/straw party. (Attach complete copy of agency/straw party agreement.) Transfers to the commonwealth, the U.S. and instrumentalities by gift, dedication, condemnation or in lieu of condemnation. (If condemnation or in lieu of condemnation, attach copy of resolution.) Transfer from mortgagor to a holder of a mortgage in default. (Attach copy of mortgage and note/assignment.) Corrective or confirmatory deed. (Attach complete copy of the deed to be corrected or confirmed.) Statutory corporate consolidation, merger or division. (Attach copy of articles.) Other (Provide a detailed explanation of exemption claimed. If more space is needed attach additional sheets.) FAILURE TO COMPLETE THIS FORM PROPERLY OR ATTACH REQUESTED DOCUMENTATION MAY RESULT IN THE RECORDER220S REFUSAL TO RECORD THE DEED. Signature of Correspondent or Responsible Party Date CORRESPONDENT INFORMATION - All inquiries may be directed to the following person: SECTION V Name Telephone Number Mailing Address City State ZIP Code 18300191051830019105 1830019105 (EX) MOD 04-19 (FI) American LegalNet, Inc. www.FormsWorkFlow.com American LegalNet, Inc. www.FormsWorkFlow.com REV-183 1www.revenue.pa.gov Date of Acceptance - Enter the date the document was delivered to and accepted by the grantee/lessee. Enter the full names and addresses of all grantor(s)/ lessor(s) and all grantee(s)/lessee(s). Attach additional sheets if necessary. This section identifies the real estate to be transferred. Complete fully, including the tax parcel number where applicable and the county where the statement is to be filed. Indicate by checking YES or NO, whether the document represents two or more transactions accomplished by an assignment of the agreement of sale or by the use of a relocation arrangement. Complete for all transactions: 1.Actual Cash Consideration 205 Enter the amount of cash or cash equivalent that the grantor received for the transfer of the real estate. 2.Other Consideration 205 Enter the total amount of noncash consideration that the grantor received for the transfer of the real estate, such as property and securities. Include mortgages and liens existing before the transfer and not removed thereby, and the agreed consideration for the construction of improvements. 3.Total Consideration 205 Enter the sum of Lines 1 and 2. This will be the total consideration for the purchase of the real estate. 4.County Assessed Value - Enter the actual assessed value of the entire real estate, per records of the county assessment office. Do not reduce the assessed value by the grantor220s fractional interest in the real estate. 5.Common Level Ratio Factor 205 Enter the common level ratio factor for the county in which the real estate is located. An explanation of this factor is provided below. 6.Computed Value 205 Enter the product of Lines 4 and 5. Complete only for transactions claiming an exemption. For exemptions refer to Title 61 24791.193 of the Pennsylvania002Code. 1a.Amount of Exemption Claimed 205 Enter the dollar amount of the value claimed as exempt. 1b.Percentage of Grantor220s Interest in Real Estate 205 Enter the percentage of grantor220s ownership interest in the real estate listed in Section II. 1c.Percentage of Grantor220s Interest Conveyed 205 Enter the fraction or percentage of grantor220s interest in the real estate on Line 1b that the grantor conveyed to the grantee. For example, if you indicated on Line 1b that grantor owns a 50 percent tenant-in-common interest in the real estate and grantor is conveying his entire 50 percent interest to the grantee, then you would enter 100 percent on this line. 2.Check Appropriate Box for Exemption Claimed - Boxes are provided for the most common Pennsylvania realty exemptions. Each is explained in order of appearance on the Realty Transfer Statement of Value form. Will or Intestate Succession 205 A transfer by will for no or nominal consideration, or under the intestate succession laws, is exempt from tax. Provide the name of the decedent and estate file number in the space provided. Transfer to a Trust 205 A transfer for no or nominal consideration to a trust is exempt from tax when the transfer of the same property would be exempt from tax if the transfer were made directly by the grantor to all the possible (including contingent) beneficiaries. Attach a complete copy of the trust agreement and identify the grantor220s relationship to each beneficiary. Transfer from a Trust 205 Enter the date the real estate was conveyed to the trust by the prior deed. If the trust was amended after that date, attach a complete copy of the original trust and all amendments to the trust. Transfer Between Principal and Agent/Straw Party 205 A transfer between an agent/straw party and principal for no or nominal consideration is exempt. Attach a complete copy of the agency/straw party agreement. Transfer to the Commonwealth, the U.S. and Instrumentalities by Gift, Dedication, Condemnation or in Lieu of Condemnation 205 If the transfer is by condemnation or in lieu of condemnation, attach a copy of the resolution. Transfer from Mortgagor to Holder of a Mortgage in Default 205 A transfer from a mortgagor to a holder of a mortgage in default, whether pursuant to a foreclosure or in lieu thereof, is exempt. Provide a copy of the mortgage and note, and any documentation evidencing the assignment thereof. LINE INSTRUCTIONS SECTION I SECTION II SECTION III SECTION IV Pennsylvania Department of Revenue Instructions for REV-183 realty Transfer Tax statement of valuerev-183 In (ex) 04-19 American LegalNet, Inc. www.FormsWorkFlow.com 2 REV-183www.revenue.pa.gov Corrective or Confirmatory Deed 205 A deed for no or nominal consideration that corrects or confirms a previously recorded deed but does not extend or limit the title or interest under the prior deed is exempt from tax. Attach a complete copy of the prior deed being corrected or confirmed. Statutory Corporate Consolidation, Merger or Division A document that evidences the transfer of real estate pursuant to the statutory consolidation or merger of two or more corporations (15 Pa. C.S. 2471921-1932 or 15 Pa. C.S. 2475921-5930) 205 or the statutory division of a nonprofit corporation (15 Pa. C.S. 2475951-5957) 205 is exempt from tax. Attach a copy of the articles of consolidation, merger or division. Other 205 When claiming an exemption other than those listed, you must specify what exemption is claimed. When possible, provide the applicable statutory and regulatory citation. Attach additional pages, if necessary. Attach a copy of supporting documentation. Enter the name, address and telephone number of party completing this form. COMM