Last updated: 3/24/2025

Disposition Of Personal Property Without Administration Intestate Property Small Estates

Start Your Free Trial $ 14.00What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

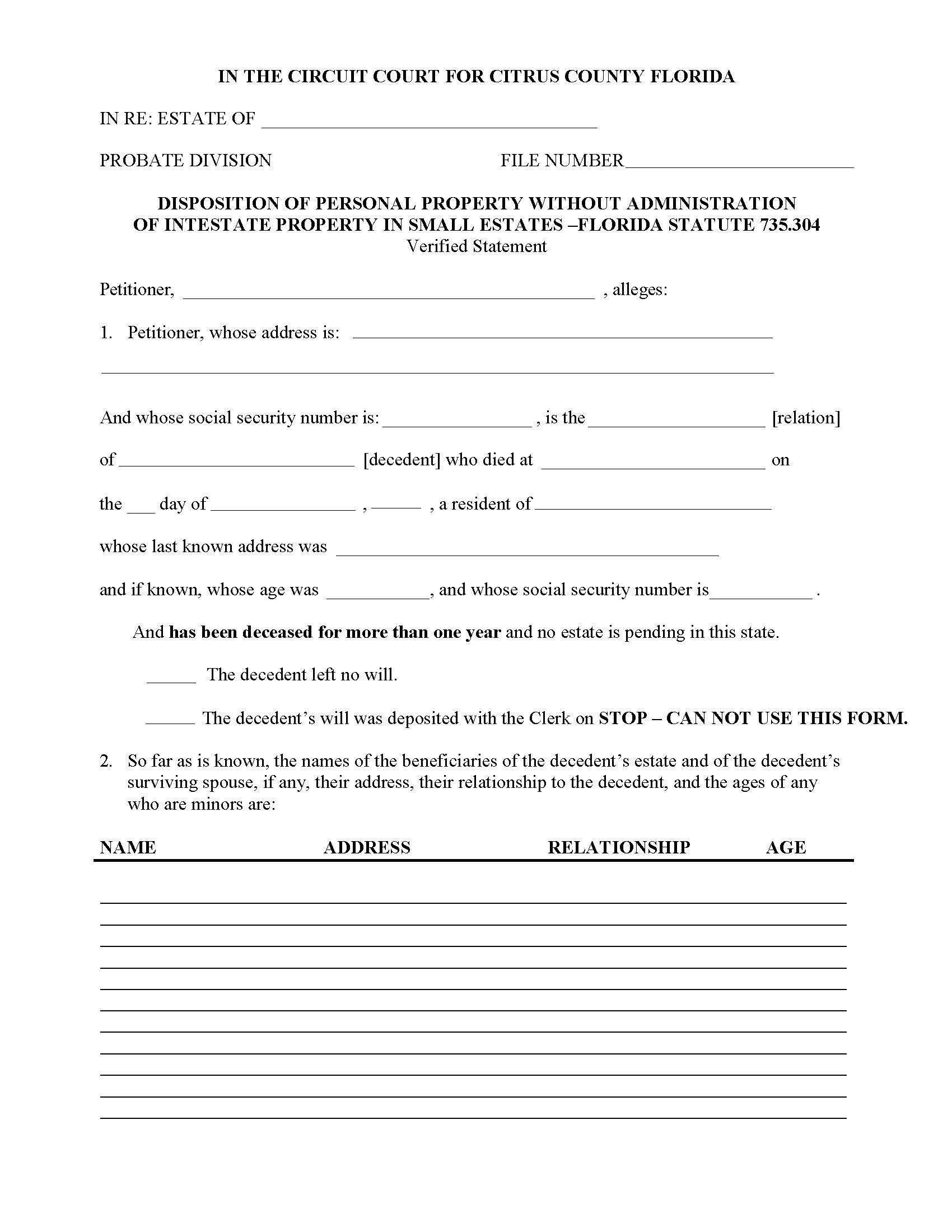

DISPOSITION OF PERSONAL PROPERTY WITHOUT ADMINISTRATION OF INTESTATE PROPERTY IN SMALL ESTATES –FLORIDA STATUTE 735.304. This form is used in Florida probate law for the disposition of personal property without administration in small estates, particularly when dealing with intestate property (property of a decedent who has died without a will). It is applicable under Florida Statute 735.304 for estates where the total value of the property does not exceed $10,000, excluding exempt property. The petitioner, typically someone closely related to the decedent (such as a spouse or child), completes this form to request the distribution of the decedent's personal property without requiring formal probate administration. The form requires the petitioner to provide detailed information about the decedent, including their name, date of death, and social security number. It also asks for a list of beneficiaries, their relationship to the decedent, and the assets of the decedent's estate, such as exempt and non-exempt property, as well as any funeral and medical expenses. The petitioner must also outline the distribution of the estate’s assets and certify the accuracy of the information provided under penalty of perjury. The form includes a Consent to Disposition of Personal Property section where beneficiaries agree to the proposed distribution and a Proof of Service section to confirm that notice has been provided to relevant authorities, such as the Florida Medicaid Estate Recovery Program. www.FormsWorkflow.com