Last updated: 4/13/2015

Indiana Business Tax Closure Request {BC-100}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

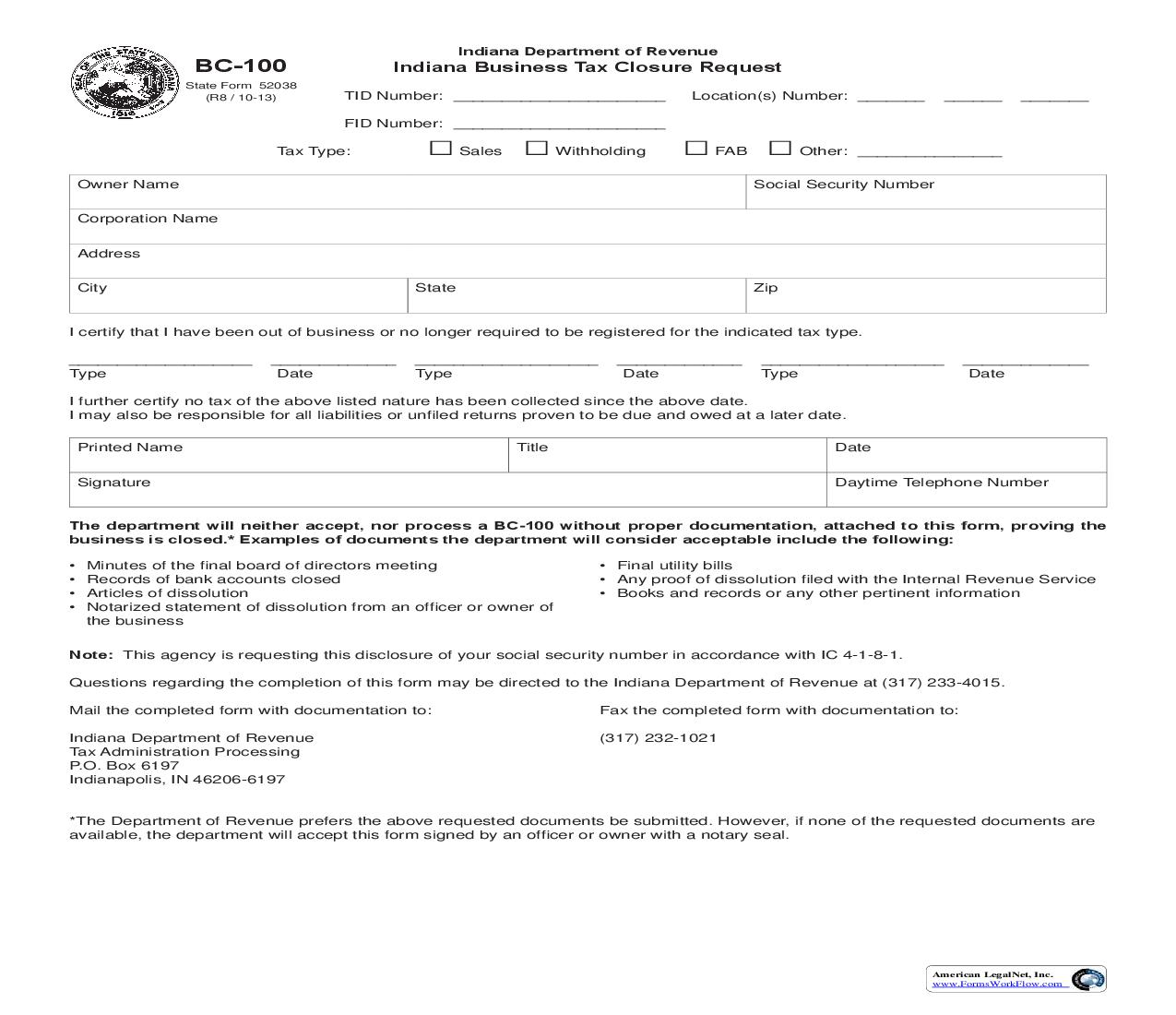

BC-100 State Form 52038 (R8 / 10-13) Indiana Department of Revenue Indiana Business Tax Closure Request TID Number: ______________________ FID Number: ______________________ Location(s) Number: _______ ______ _______ Tax Type: Owner Name Corporation Name Address City Sales Withholding FAB Other: _______________ Social Security Number State Zip I certify that I have been out of business or no longer required to be registered for the indicated tax type. ___________________ Type _____________ Date ___________________ Type _____________ Date ___________________ Type _____________ Date I further certify no tax of the above listed nature has been collected since the above date. I may also be responsible for all liabilities or unfiled returns proven to be due and owed at a later date. Printed Name Signature Title Date Daytime Telephone Number The department will neither accept, nor process a BC-100 without proper documentation, attached to this form, proving the business is closed.* Examples of documents the department will consider acceptable include the following: · · · · Minutes of the final board of directors meeting Records of bank accounts closed Articles of dissolution Notarized statement of dissolution from an officer or owner of the business · Final utility bills · Any proof of dissolution filed with the Internal Revenue Service · Books and records or any other pertinent information Note: This agency is requesting this disclosure of your social security number in accordance with IC 4-1-8-1. Questions regarding the completion of this form may be directed to the Indiana Department of Revenue at (317) 233-4015. Mail the completed form with documentation to: Indiana Department of Revenue Tax Administration Processing P.O. Box 6197 Indianapolis, IN 46206-6197 Fax the completed form with documentation to: (317) 232-1021 *The Department of Revenue prefers the above requested documents be submitted. However, if none of the requested documents are available, the department will accept this form signed by an officer or owner with a notary seal. American LegalNet, Inc. www.FormsWorkFlow.com