Last updated: 4/18/2007

Indiana Innocent Spouse Allocation Worksheet {IN-40SP}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

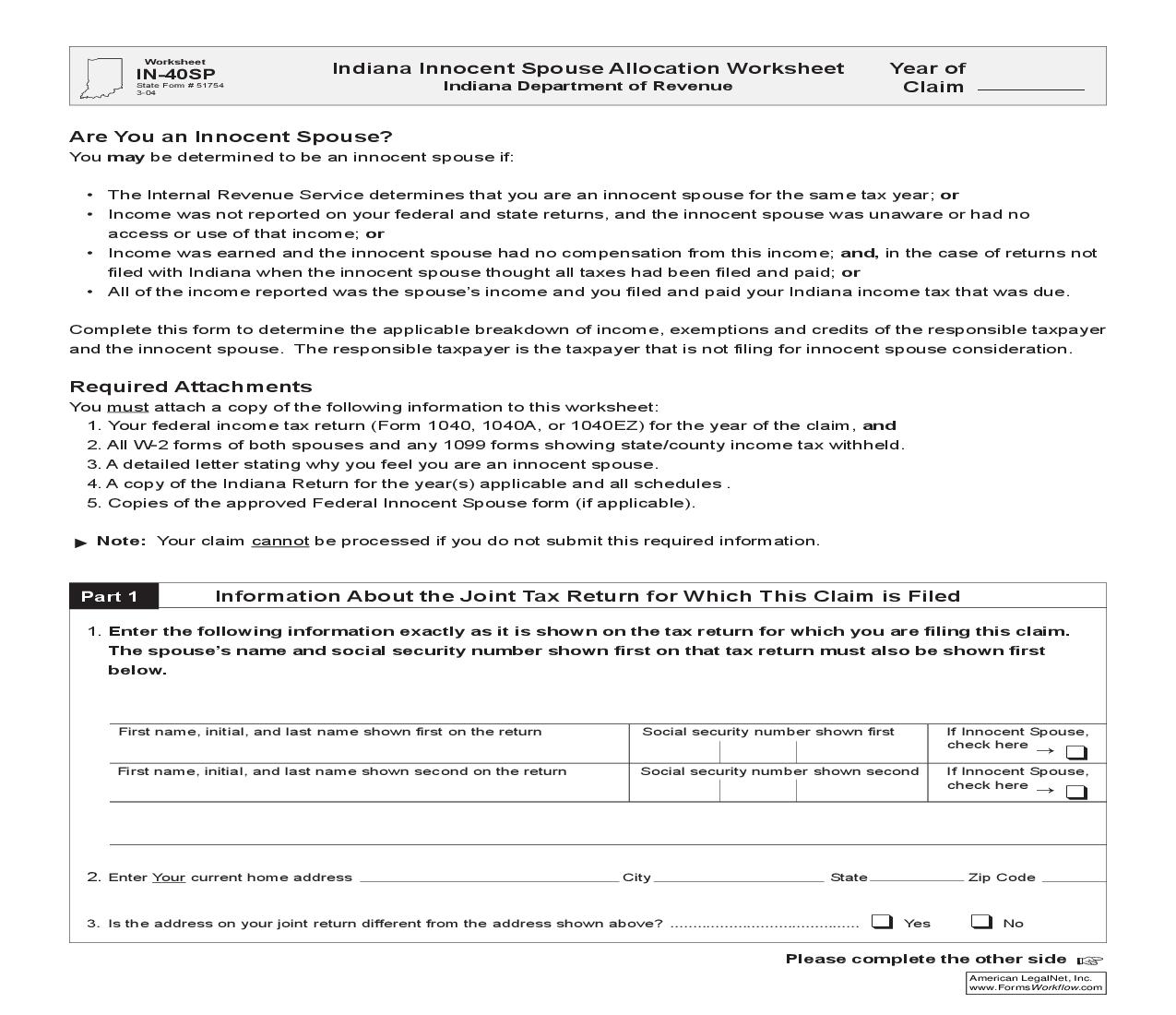

Worksheet IN-40SP Indiana Innocent Spouse Allocation Worksheet Indiana Department of Revenue State Form # 51754 3-04 Year of Claim Are You an Innocent Spouse? You may be determined to be an innocent spouse if: · The Internal Revenue Service determines that you are an innocent spouse for the same tax year; or · Income was not reported on your federal and state returns, and the innocent spouse was unaware or had no access or use of that income; or · Income was earned and the innocent spouse had no compensation from this income; and, in the case of returns not filed with Indiana when the innocent spouse thought all taxes had been filed and paid; or · All of the income reported was the spouse's income and you filed and paid your Indiana income tax that was due. Complete this form to determine the applicable breakdown of income, exemptions and credits of the responsible taxpayer and the innocent spouse. The responsible taxpayer is the taxpayer that is not filing for innocent spouse consideration. Required Attachments You must attach a copy of the following information to this worksheet: 1. Your federal income tax return (Form 1040, 1040A, or 1040EZ) for the year of the claim, and 2. All W-2 forms of both spouses and any 1099 forms showing state/county income tax withheld. 3. A detailed letter stating why you feel you are an innocent spouse. 4. A copy of the Indiana Return for the year(s) applicable and all schedules . 5. Copies of the approved Federal Innocent Spouse form (if applicable). Note: Your claim cannot be processed if you do not submit this required information. Part 1 Information About the Joint Tax Return for Which This Claim is Filed 1. Enter the following information exactly as it is shown on the tax return for which you are filing this claim. The spouse's name and social security number shown first on that tax return must also be shown first below. First name, initial, and last name shown first on the return First name, initial, and last name shown second on the return Social security number shown first Social security number shown second If Innocent Spouse, check here If Innocent Spouse, check here 2. Enter Your current home address City State Zip Code 3. Is the address on your joint return different from the address shown above? .......................................... Yes No Please complete the other side American LegalNet, Inc. www.FormsWorkflow.com Part 2 Allocation Between Spouses of Items on the Joint Indiana Individual Income Tax Return (a) Amount shown on joint federal and Indiana tax returns Allocated Items 5. Income. Enter the separate income that each spouse earned. Allocate joint income, such as interest earned on a joint bank account, as you determine. Be sure to allocate all income shown on the joint tax return. a) Wages ....................................................................... b) All other income. Identify the type and amount: (b) Amount allocated to (c) innocent spouse Amount allocated to responsible spouse 6. Adjustments claimed on your federal tax return. Enter each spouse's separate adjustments, such as an IRA deduction. Allocate other adjustments claimed on your federal return as you determine .............................. 7. Indiana deductions. Enter each spouse's share of deductions, such as renter's deduction, that was claimed on the Indiana tax return. Allocate other adjustments claimed on your Indiana return as you determine ............ 8. Number of exemptions. Allocate the exemptions claimed on the joint Indiana return to the spouse who would have claimed them if separate returns had been filed. Enter whole numbers only (for example, you cannot allocate 3 exemptions by giving 1.5 exemptions to each spouse). Show the division of exemptions by type, such as 2 exemptions claimed on Indiana return plus 1 additional exemption for certain dependent child ............ 9. Withholding credits. Enter Indiana state and county tax withheld from each spouse's income as shown on the W-2s, 1099-Rs, W-2Gs, etc. Be sure to attach copies of these forms to this worksheet ......................................... 10. Credits. Allocate any child tax credit to the spouse who was allocated the dependent's exemption. Allocate all other Indiana credits based on each spouse's interest .... 11. Payments. Allocate joint estimated tax payments as you determine ........................................................................ Note: The Indiana Department of Revenue will figure the amount of any refund due the innocent spouse, if applicable. Part 3 Signature Area Under penalties of perjury, I declare that I have examined this form and any accompanying schedules or statements and to the best of my knowledge and belief, they are true, correct, and complete. Declaration of preparer (other than taxpayer) is based on all information of which preparer has any knowledge. Keep a copy of this worksheet with your records Paid Preparer's Use Only Innocent spouse's signature Date Phone number ( Preparer's signature Date Check if selfemployed ) Preparer's SSN or PTIN American LegalNet, Inc. www.FormsWorkflow.com