Last updated: 6/12/2018

Declaration Of Electronic Filing {IT-8453OL}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

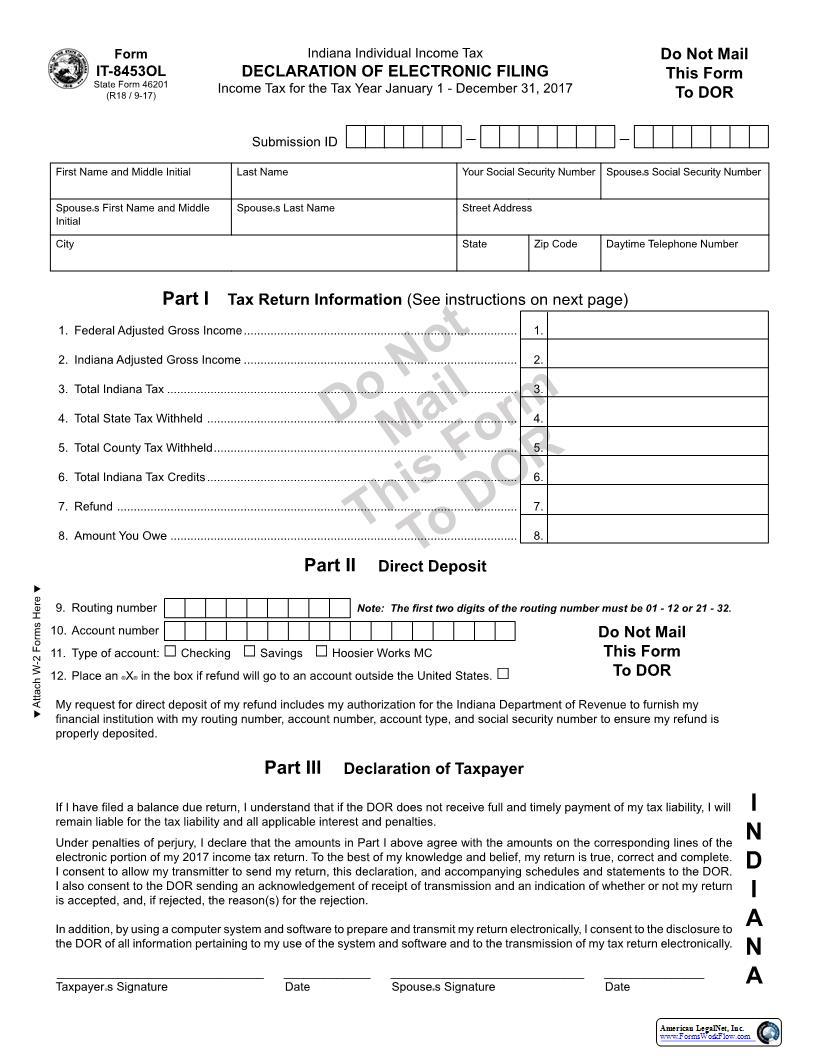

Do NotMailThis FormTo DOR Indiana Individual Income TaxDECLARATION OF ELECTRONIC FILINGIncome Tax for the Tax Year January 1 - December 31, 2017 First Name and Middle InitialLast NameYour Social Security NumberSpouse222s Social Security NumberSpouse222s First Name and Middle InitialSpouse222s Last NameStreet AddressCityStateZip CodeDaytime Telephone NumberPart I Tax Return Information (See instructions on next page) 1. þ Federal Adjusted Gross Income þ. .................................................................................. þ 1. 2. þ Indiana Adjusted Gross Income þ. .................................................................................. þ 2. 3. þ Total Indiana Tax þ. ......................................................................................................... þ 3. 4. þ Total State Tax Withheld þ. ............................................................................................. þ 4. 5. þ Total County Tax Withheld þ. ........................................................................................... þ 5. 6. þ Total Indiana Tax Credits þ. ............................................................................................. þ 6. 7. þ Refund þ. ........................................................................................................................ þ 7. 8. þ Amount You Owe ........................................................................................................ þ 8. Part II Direct Deposit 9. þ Routing number þ 10. þ Account number 11. þ Type of account: Checking þ Savings þ Hoosier Works MC 12. þ Place an 223X224 in the box if refund will go to an account outside the United States. My request for direct deposit of my refund includes my authorization for the Indiana Department of Revenue to furnish my properly deposited.Part III Declaration of Taxpayerremain liable for the tax liability and all applicable interest and penalties.Under penalties of perjury, I declare that the amounts in Part I above agree with the amounts on the corresponding lines of the electronic portion of my 2017 income tax return. To the best of my knowledge and belief, my return is true, correct and complete. I consent to allow my transmitter to send my return, this declaration, and accompanying schedules and statements to the DOR. I also consent to the DOR sending an acknowledgement of receipt of transmission and an indication of whether or not my return is accepted, and, if rejected, the reason(s) for the rejection.In addition, by using a computer system and software to prepare and transmit my return electronically, I consent to the disclosure to the DOR of all information pertaining to my use of the system and software and to the transmission of my tax return electronically. þ þ þ þ þ þ þ Taxpayer222s Signature þ Date þ Spouse222s Signature þ Date Form IT-8453OLState Form 46201(R18 / 9-17)Do Not MailThis FormTo DOR Attach W-2 Forms Here Do Not MailThis Form To DORINDIANASubmission ID American LegalNet, Inc. www.FormsWorkFlow.com Do NotMailThis FormTo DORIT-8453OLPurpose of this formState Online Filing Program.The Online Software will: 1. þ -phone number where indicated at the top of the form. 2. þ Complete Part I, using the amounts from the taxpayer222s Indiana individual income tax return. 3. þ checking account or deposited into their Hoosier Works MasterCard256 account.The Taxpayer will: 1. þ Complete Part III, with their signature and date. 2. þ Fill in the submission ID once that information is provided. 3. þ Mail nothing into the Indiana Department of Revenue, unless requested by the department. 4. þ Keep and maintain the IT-8453OL for three (3) years from December 31st of the year the return was signed.IT-8453OL Part I Instructions þ þ Form IT-40RNR. Line 2: þ Indiana Adjusted Gross Income from Forms IT-40 (Line 7), IT-40PNR (Line 7) or IT-40RNR (Lines 5A + 5B). Line 3: þ Total Indiana Tax from Forms IT-40 (Line 11), IT-40PNR (Line 11) or IT-40RNR (Line 8). Line 4: þ Total State Tax Withheld from Forms IT-40 Schedule 5 (Line 1), IT-40PNR Schedule F (Line 1) or IT-40RNR þ (Line 9). Line 5: þ Total County Tax Withheld from Forms IT-40 Schedule 5 (Line 2), IT-40PNR (Schedule F Line 2), or þ IT-40RNR (Line 10). Line 6: þ Total Indiana Credits from Forms IT-40 (Line 14), IT-40PNR (Line 14) or IT-40RNR (Line 11). Line 7: þ Refund from Forms IT-40 (Line 21), IT-40PNR (Line 21) or IT-40RNR (Line 12). Line 8: þ Amount You Owe from Forms IT-40 (Line 26), IT-40PNR (Line 26) or IT-40RNR (Line 17). Lines 10, 11: Hoosier Works MasterCard256 - To directly deposit a refund in a Hoosier Works MasterCard256 account, enter account monthly statement. DO NOT use the MasterCard256 16-digit number. Make sure to check the 223Hoosier Works MC224 box on line 11. American LegalNet, Inc. www.FormsWorkFlow.com