Last updated: 4/18/2007

Bank Information Change {EFT-BIC}

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

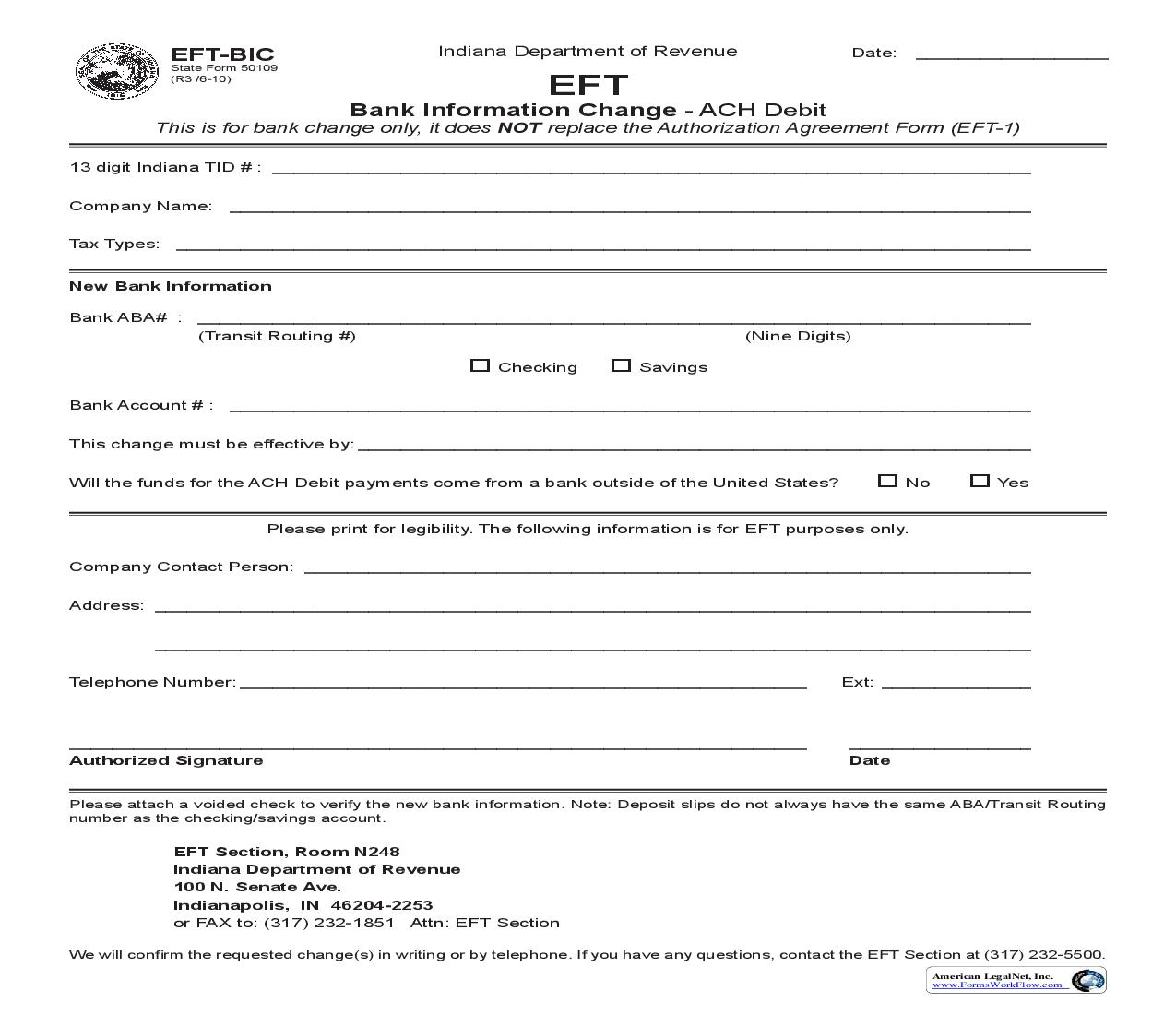

EFT-BIC State Form 50109 (R2 / 2/07) Indiana Department of Revenue Date: _____________ EFT Bank Information Change - ACH Debit This is for bank change only, it does NOT replace the Authorization Agreement Form (EFT-1). Indiana Taxpayer ID #: ___________________________________________________________________ (Must be 13 digits) Company Name: Tax Type(s): ___________________________________________________________________ ___________________________________________________________________ New Bank Information Bank ABA # (Transit Routing Number):______________________________________________________ (Must be 9 digits) Bank Account #: _______________________________ Checking or Savings This change must be effective by: ___________________________________________________________ (Date) Please print for legibility. The following information is for EFT purposes only. Company Contact Person: _________________________________________________________________ Address: __________________________________________________________________________ __________________________________________________________________________ Telephone Number: ______________________________________________________ Ext: ___________ ________________________________________________ Authorized Signature ________________________________ Date Please attach a bank information slip, voided check or a deposit slip to verify new bank information. Mail form and attachments to: EFT Section, Room N248 Indiana Department of Revenue 100 N. Senate Ave. Indianapolis, IN 46204-2253 or FAX to: (317) 232-1851 Attn: EFT Section We will confirm the requested change(s) in writing or by telephone. If you have any questions, contact the EFT Section at (317) 232-5500. American LegalNet, Inc. www.FormsWorkflow.com