Last updated:

14.400 Condemnation; Leased Property

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

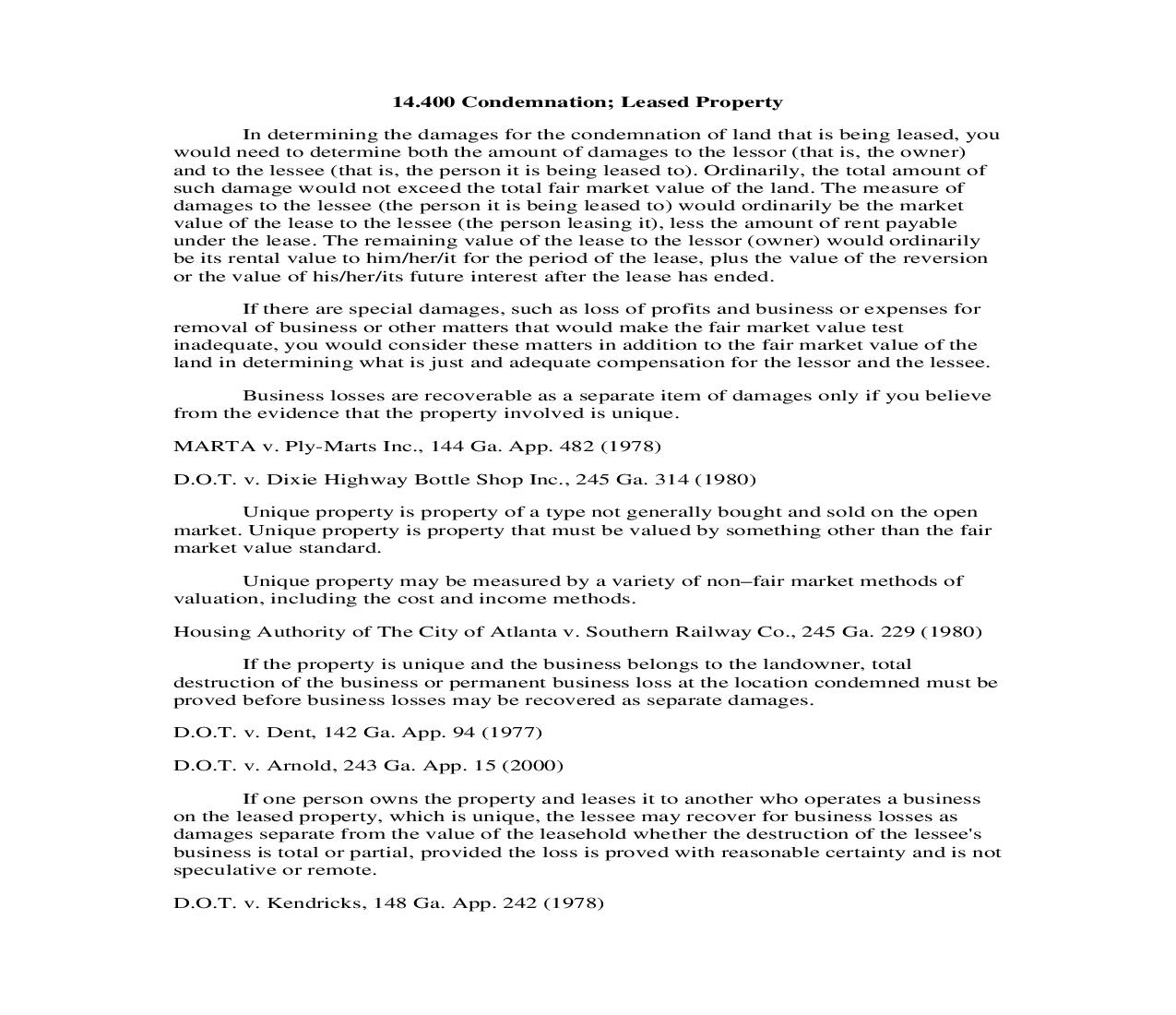

14.400 Condemnation; Leased Property In determining the damages for the condemnation of land that is being leased, you would need to determine both the amount of damages to the lessor (that is, the owner) and to the lessee (that is, the person it is being leased to). Ordinarily, the total amount of such damage would not exceed the total fair market value of the land. The measure of damages to the lessee (the person it is being leased to) would ordinarily be the market value of the lease to the lessee (the person leasing it), less the amount of rent payable under the lease. The remaining value of the lease to the lessor (owner) would ordinarily be its rental value to him/her/it for the period of the lease, plus the value of the reversion or the value of his/her/its future interest after the lease has ended. If there are special damages, such as loss of profits and business or expenses for removal of business or other matters that would make the fair market value test inadequate, you would consider these matters in addition to the fair market value of the land in determining what is just and adequate compensation for the lessor and the lessee. Business losses are recoverable as a separate item of damages only if you believe from the evidence that the property involved is unique. MARTA v. Ply-Marts Inc., 144 Ga. App. 482 (1978) D.O.T. v. Dixie Highway Bottle Shop Inc., 245 Ga. 314 (1980) Unique property is property of a type not generally bought and sold on the open market. Unique property is property that must be valued by something other than the fair market value standard. Unique property may be measured by a variety of nonfair market methods of valuation, including the cost and income methods. Housing Authority of The City of Atlanta v. Southern Railway Co., 245 Ga. 229 (1980) If the property is unique and the business belongs to the landowner, total destruction of the business or permanent business loss at the location condemned must be proved before business losses may be recovered as separate damages. D.O.T. v. Dent, 142 Ga. App. 94 (1977) D.O.T. v. Arnold, 243 Ga. App. 15 (2000) If one person owns the property and leases it to another who operates a business on the leased property, which is unique, the lessee may recover for business losses as damages separate from the value of the leasehold whether the destruction of the lessee's business is total or partial, provided the loss is proved with reasonable certainty and is not speculative or remote. D.O.T. v. Kendricks, 148 Ga. App. 242 (1978) State Highway Dept. v. Thomas, 115 Ga. App. 372 (1967) McGhee v. Floyd County, 95 Ga. App. 221, 223 (1957) Housing Authority of Savannah v. Savannah Iron & Wire Works Inc., 91 Ga. App. 881 (1955)