Last updated: 1/29/2007

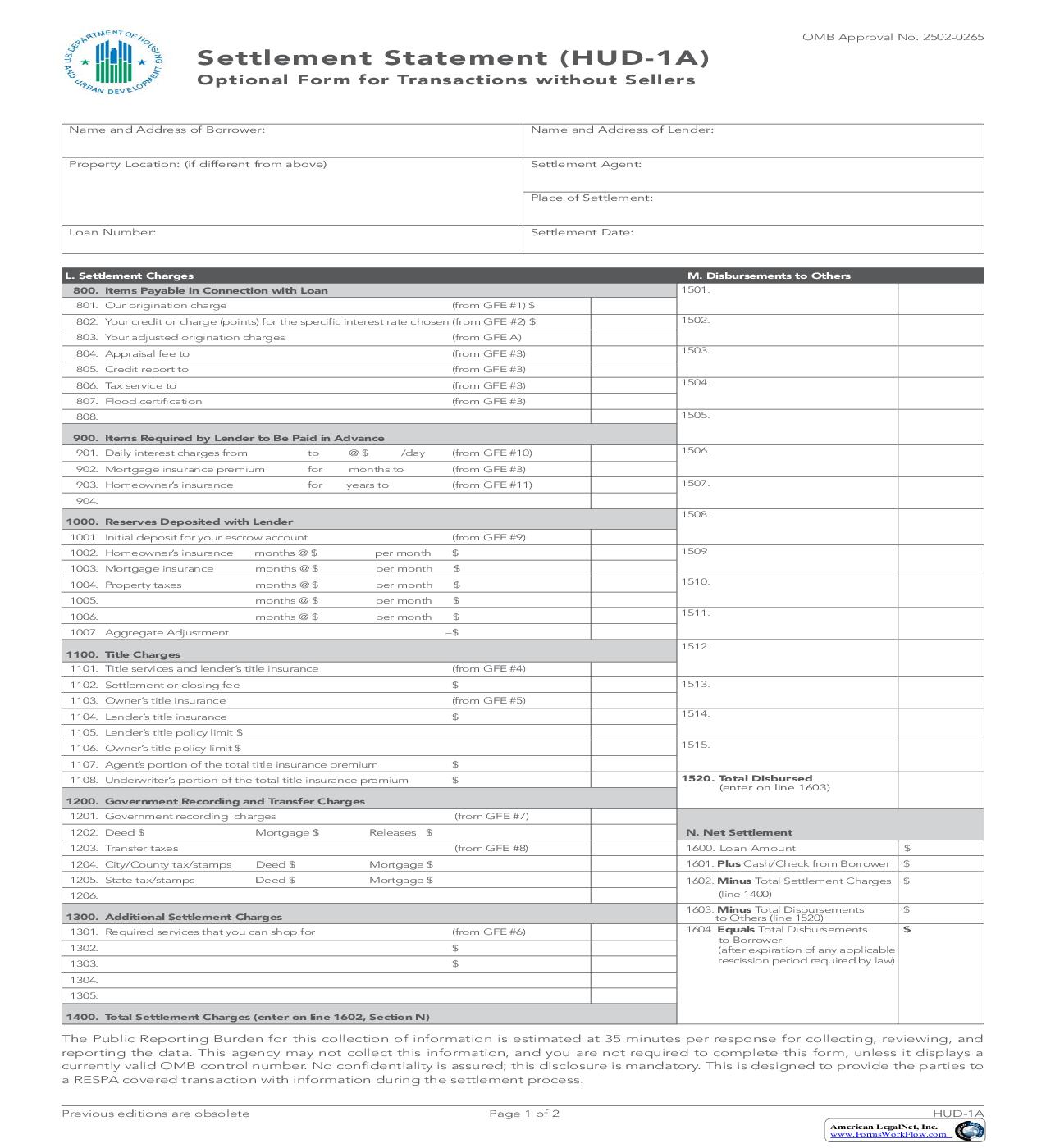

Settlement Statement Optional Form For Transactions Without Sellers {HUD-1A}

Start Your Free Trial $ 12.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

Settlement Statement Optional Form for Transactions without Sellers Name & Address of Borrower: U.S. Department of Housing and Urban Development OMB Approval No. 2502-0265 (expires 11/30/2006) Name & Address of Lender: Property Location: (if different from above) Settlement Agent: Place of Settlement: Loan Number: Settlement Date: L. 800. 801. 802. 803. 804. 805 806. 807. 808. 809. 810. 811. 900. 901. 902. Settlement Charges Items Payable In Connection with Loan Loan origination fee % to Loan discount % to Appraisal fee to Credit report to Inspection fee to Mortgage insurance application fee to Mortgage broker fee to M. 1501. 1502. 1503. 1504. 1505. 1506. Disbursement to Others Items Required by Lender to be Paid in Advance Interest from to @$ per day Mortgage insurance premium for months to year(s) to 1507. 1508. 903. Hazard insurance premium for 1509. 904. 1000.Reserves Deposited with Lender 1001.Hazard insurance months @ $ 1002.Mortgage insurance months @ $ 1003.City property taxes months @ $ 1004.County property taxes months @ $ 1005.Annual assessments months @ $ 1006. months @ $ 1007. months @ $ 1008. months @ $ 1100.Title Charges 1101.Settlement or closing fee to 1102.Abstract or title search to 1103.Title examination to 1104.Title Insurance binder to 1105.Document preparation to 1106.Notary fees to 1107.Attorney's fees to (includes above item numbers 1108.Title insurance to (includes above item numbers 1109.Lender's coverage $ 1110.Owner's coverage $ 1111. 1112. 1113. 1200.Government Recording and Transfer Charges 1201.Recording fees: 1202.City/county tax/stamps: 1203.State tax/stamps: 1204. 1205. 1300.Additional Settlement Charges 1301.Survey to 1302.Pest inspection to 1303.Architectural/engineering services to 1304.Building permit to 1305. 1306. 1307. 1400.Total Settlement Charges (enter on line 1602) Borrower(s) Signature(s): 1510. per per per per per per per per month month month month month month month month 1511. 1512. 1513. 1514. 1515. 1520. TOTAL DISBURSED (enter on line 1603) ) ) N. NET SETTLEMENT $ $ $ 1600.Loan Amount 1601.Plus Cash/Check from Borrower 1602. Minus Total Settlement Charges (line 1400) 1603. Minus Total Disbursements to Others (line 1520) $ 1604.Equals Disbursements to Borrower (after expiration of any applicable rescission period required by law) $ X form HUD-1A (2/94) ref. RESPA American LegalNet, Inc. www.FormsWorkflow.com Public reporting burden for this collection of information is estimated to average 0.35 hours per response, including the time for reviewing instructions, searching existing data sources, gathering and maintaining the data needed, and completing and reviewing the collection of information. This agency may not collect this information, and you are not required to complete this form, unless it displays a currently valid OMB control number. Instructions for completing form HUD-1A Note: This form is issued under authority of the Real Estate Settlement Procedures Act (RESPA), 12 U.S.C. 2601 et seq. The regulation for RESPA is Regulation X, codified as 24 CFR 3500, and administered by the Department of Housing and Urban Development (HUD). Regulation Z referred to in the next paragraph is the regulation implementing the Truth in Lending Act (TILA), 15 U.S.C. 1601 et seq. and codified as 12 CFR part 226. HUD-1A is an optional form that may be used for refinancing and subordinate lien federally related mortgage loans, as well as for any other one-party transaction that does not involve the transfer of title to residential real property. The HUD-1 form may also be used for such transactions, by utilizing the borrower's side of the HUD1 and following the relevant parts of the instructions set forth in Appendix A of Regulation X. The use of either the HUD-1 or HUD-1A is not mandatory for open-end lines of credit (homeequity plans), as long as the provisions of Regulation Z are followed. Background The HUD-1A settlement statement is to be used as a statement of actual charges and adjustments to be given to the borrower at settlement. The instructions for completion of the HUD-1A are for the benefit of the settlement agent who prepares the statement; the instructions are not a part of the statement and need not be transmitted to the borrower. There is no objection to using the HUD-1A in transactions in which it is not required, and its use in open-end lines of credit transactions (home-equity plans) is encouraged. It may not be used as a substitute for a HUD-1 in any transaction in which there is a transfer of title and a first lien is taken as security. Refer to the "definitions" section of Regulation X for specific definitions of terms used in these instructions. General Instructions Information and amounts may be filled in by typewriter, hand printing, computer printing, or any other method producing clear and legible results. Additional pages may be attached to the HUD1A for the inclusion of customary recitals and information used locally for settlements or if there are insufficient lines on the HUD1A. The settlement agent shall complete the HUD-1A to itemize all charges imposed upon the borrower by the lender, whether to be paid at settlement or outside of settlement, and any other charges that the borrower will pay for at settlement. In the case of "no cost" or "no point" loans, these charges include any payments the lender will make to affiliated or independent settlement service providers relating to this settlement. These charges shall be included on the HUD-1A, but marked "P.O.C." for "paid outside of closing," and shall not be used in computing totals. Such charges also include indirect payments or back-funded payments to mortgage brokers that arise from the settlement transaction. When used, "P.O.C." should be placed in the appropriate lines next to the identified item, not in the columns themselves. Blank lines are provided in Section L for any additional settlement charges. Blank lines are also provided in Section M for recipients of all or portions of the loan proceeds. The names of the recipients of the settlement charges in Section L and the names of the recipients of the loan proceeds in Section M should be set forth on the blank lines. Line item instructions The identification information at the top of the HUD-1A should be completed as follows: The borrower's name and address is entered in the space provided. If the property securing the loan is different from the borrower's address, the address or other location info

Related forms

-

Settlement Statement Optional Form For Transactions Without Sellers

Settlement Statement Optional Form For Transactions Without Sellers

Official Federal Forms/US Department Of Housing And Urban Development/ -

Settlement Statement

Settlement Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

ACH Debit Authorization

ACH Debit Authorization

Official Federal Forms/US Department Of Housing And Urban Development/ -

Advice Of Allotment

Advice Of Allotment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Assignment-Assumption Agreement

Assignment-Assumption Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Assistance Award-Amendment

Assistance Award-Amendment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Selection Roster

Selection Roster

Official Federal Forms/US Department Of Housing And Urban Development/ -

Statement

Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Authority For Release Of Information

Authority For Release Of Information

Official Federal Forms/US Department Of Housing And Urban Development/ -

Classified Document Destruction Certificate

Classified Document Destruction Certificate

Official Federal Forms/US Department Of Housing And Urban Development/ -

Correspondence Change Request

Correspondence Change Request

Official Federal Forms/US Department Of Housing And Urban Development/ -

Statement

Statement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Status Report On Actions Promised On GAO Report Recommendations

Status Report On Actions Promised On GAO Report Recommendations

Official Federal Forms/US Department Of Housing And Urban Development/ -

Deposit Agreement

Deposit Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Disposition Report

Disposition Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Denial Of Reasonable Accomodation Request

Denial Of Reasonable Accomodation Request

Official Federal Forms/US Department Of Housing And Urban Development/ -

Document Control Register

Document Control Register

Official Federal Forms/US Department Of Housing And Urban Development/ -

Document Control Register

Document Control Register

Official Federal Forms/US Department Of Housing And Urban Development/ -

Excess Records Files And Publications Clean-Up Report

Excess Records Files And Publications Clean-Up Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Field Issue Resolution System Input Record

Field Issue Resolution System Input Record

Official Federal Forms/US Department Of Housing And Urban Development/ -

Grant Award-Amendment

Grant Award-Amendment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Classified Document Receipt

Classified Document Receipt

Official Federal Forms/US Department Of Housing And Urban Development/ -

Liquidation Schedule (GNMA)

Liquidation Schedule (GNMA)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Articles Of Incorporation Of Association

Articles Of Incorporation Of Association

Official Federal Forms/US Department Of Housing And Urban Development/ -

Residual Receipts Note Nonprofit Mortgagors

Residual Receipts Note Nonprofit Mortgagors

Official Federal Forms/US Department Of Housing And Urban Development/ -

Cash Receipt Voucher

Cash Receipt Voucher

Official Federal Forms/US Department Of Housing And Urban Development/ -

Chronology Of Actions

Chronology Of Actions

Official Federal Forms/US Department Of Housing And Urban Development/ -

Clearance Log

Clearance Log

Official Federal Forms/US Department Of Housing And Urban Development/ -

FHA Legal Requirements For Closing

FHA Legal Requirements For Closing

Official Federal Forms/US Department Of Housing And Urban Development/ -

By-Laws Of Association

By-Laws Of Association

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Permission To Commence Construction Prior To Initial Endorsement

Request For Permission To Commence Construction Prior To Initial Endorsement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Travel Voucher Attachment

Travel Voucher Attachment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Regional Fund Assignment

Regional Fund Assignment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Loan Contract And Trust Agreement (Low-And Moderate-Income Sponsor Assistance)

Loan Contract And Trust Agreement (Low-And Moderate-Income Sponsor Assistance)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Imprest Fund Emergency Salary Payment

Record Of Imprest Fund Emergency Salary Payment

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Employee Interview

Record Of Employee Interview

Official Federal Forms/US Department Of Housing And Urban Development/ -

Bond Guaranteeing Sponsors Performance

Bond Guaranteeing Sponsors Performance

Official Federal Forms/US Department Of Housing And Urban Development/ -

Overtime Authorization

Overtime Authorization

Official Federal Forms/US Department Of Housing And Urban Development/ -

Newly Insured Case Binder Shipping List

Newly Insured Case Binder Shipping List

Official Federal Forms/US Department Of Housing And Urban Development/ -

Record Of Clearances

Record Of Clearances

Official Federal Forms/US Department Of Housing And Urban Development/ -

Report Of Investigation

Report Of Investigation

Official Federal Forms/US Department Of Housing And Urban Development/ -

Miscellaneous Disbursement Voucher

Miscellaneous Disbursement Voucher

Official Federal Forms/US Department Of Housing And Urban Development/ -

Accomodation Request For Persons With Disabilites

Accomodation Request For Persons With Disabilites

Official Federal Forms/US Department Of Housing And Urban Development/ -

Model Form Mortgagees Title Evidence

Model Form Mortgagees Title Evidence

Official Federal Forms/US Department Of Housing And Urban Development/ -

Mortgagors Oath

Mortgagors Oath

Official Federal Forms/US Department Of Housing And Urban Development/ -

Multifamily Insurance Benefit Claim (Payment Information Treasury Financial Communication System)

Multifamily Insurance Benefit Claim (Payment Information Treasury Financial Communication System)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Project Mortgage Servicing Control Record

Project Mortgage Servicing Control Record

Official Federal Forms/US Department Of Housing And Urban Development/ -

Property Insurance Requirements

Property Insurance Requirements

Official Federal Forms/US Department Of Housing And Urban Development/ -

Personal Undertaking

Personal Undertaking

Official Federal Forms/US Department Of Housing And Urban Development/ -

Off-Site Bond

Off-Site Bond

Official Federal Forms/US Department Of Housing And Urban Development/ -

Receipt

Receipt

Official Federal Forms/US Department Of Housing And Urban Development/ -

Regulatory Agreement For Non Profit And Public Mortgagors

Regulatory Agreement For Non Profit And Public Mortgagors

Official Federal Forms/US Department Of Housing And Urban Development/ -

Requisition For Supplies Equipment Forms Publications And Procurement

Requisition For Supplies Equipment Forms Publications And Procurement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Endorsement Of Credit Instrument Certificate Of Mortgagee Mortgagor

Request For Endorsement Of Credit Instrument Certificate Of Mortgagee Mortgagor

Official Federal Forms/US Department Of Housing And Urban Development/ -

Good Faith Estimate

Good Faith Estimate

Official Federal Forms/US Department Of Housing And Urban Development/ -

Corporate Guaranty Agreement

Corporate Guaranty Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Time Limit And Mentoring Agreement

Time Limit And Mentoring Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Custodians Certification For Construction Securities

Custodians Certification For Construction Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Graduated Payment Mortgage Or Growing Mortgage Pool Or Loan Package Composition

Graduated Payment Mortgage Or Growing Mortgage Pool Or Loan Package Composition

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Summary Report

Issuers Monthly Summary Report

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Single-Family Mortgages

Prospectus GNMA I Single-Family Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Growing Equity Mortgages

Prospectus GNMA II Growing Equity Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I

Prospectus GNMA I

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Accounting Report (GNMA Mortgage-Backed Securities Program)

Issuers Monthly Accounting Report (GNMA Mortgage-Backed Securities Program)

Official Federal Forms/US Department Of Housing And Urban Development/ -

IPIA Request For Labels (Order Control)

IPIA Request For Labels (Order Control)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Projected Pool Report (Guaranty Program-GNMA Mortgage-Backed Securities)

Projected Pool Report (Guaranty Program-GNMA Mortgage-Backed Securities)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II

Prospectus GNMA II

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Serial Notes Accounting Schedule (GNMA Mortgage-Backed Securities Program)

Issuers Monthly Serial Notes Accounting Schedule (GNMA Mortgage-Backed Securities Program)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I

Prospectus GNMA I

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities

Prospectus Supplemental To Ginnie Mae II Home Equity Conversion Mortgage-Backed-Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities

Prospectus Supplement-Ginnie Mae II Home Equity Conversion Mortgage-Backed Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Reasonable Accommodation Information Reporting Form

Reasonable Accommodation Information Reporting Form

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Remittance Advice

Issuers Monthly Remittance Advice

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Construction And Loan Securities

Prospectus GNMA I Construction And Loan Securities

Official Federal Forms/US Department Of Housing And Urban Development/ -

Issuers Monthly Serial Note Remittance Advice

Issuers Monthly Serial Note Remittance Advice

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Graduated Payment Mortgages

Prospectus GNMA I Graduated Payment Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA I Growing Equity Mortgages

Prospectus GNMA I Growing Equity Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Certificate Of Sanitization (HUD Only)

Certificate Of Sanitization (HUD Only)

Official Federal Forms/US Department Of Housing And Urban Development/ -

HUD Records Destruction Form (Housing)

HUD Records Destruction Form (Housing)

Official Federal Forms/US Department Of Housing And Urban Development/ -

Certification And Agreement

Certification And Agreement

Official Federal Forms/US Department Of Housing And Urban Development/ -

Release Of Security Interest

Release Of Security Interest

Official Federal Forms/US Department Of Housing And Urban Development/ -

Multifamily Insurance Benefit Claim

Multifamily Insurance Benefit Claim

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Adjustable Rate Mortgages

Prospectus GNMA II Adjustable Rate Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Prospectus GNMA II Single-Family Mortgages

Prospectus GNMA II Single-Family Mortgages

Official Federal Forms/US Department Of Housing And Urban Development/ -

Request For Release Of Documents

Request For Release Of Documents

Official Federal Forms/US Department Of Housing And Urban Development/

Form Preview

Contact Us

Success: Your message was sent.

Thank you!