Last updated: 2/28/2017

Request For Monthly Cash Flow Statements Financial Records {PROB 48C}

Start Your Free Trial $ 15.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

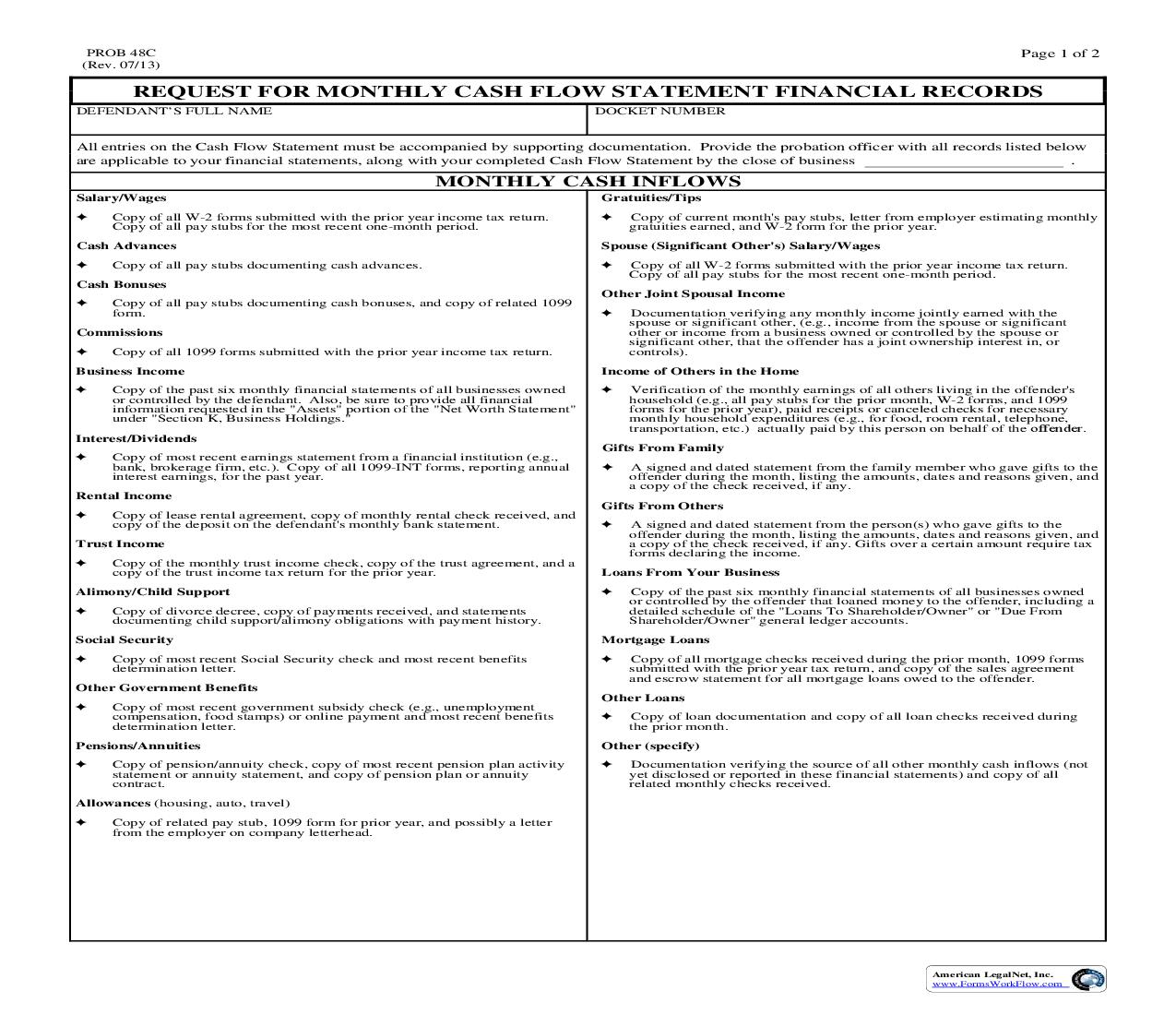

PROB 48C (Rev. 07/13) Page 1 of 2 REQUEST FOR MONTHLY CASH FLOW STATEMENT FINANCIAL RECORDS DEFENDANT'S FULL NAME DOCKET NUMBER All entries on the Cash Flow Statement must be accompanied by supporting documentation. Provide the probation officer with all records listed below are applicable to your financial statements, along with your completed Cash Flow Statement by the close of business . MONTHLY CASH INFLOWS Salary/Wages g Copy of all W-2 forms submitted with the prior year income tax return. Copy of all pay stubs for the most recent one-month period. Gratuities/Tips g Copy of current month's pay stubs, letter from employer estimating monthly gratuities earned, and W-2 form for the prior year. Cash Advances g Copy of all pay stubs documenting cash advances. Spouse (Significant Other's) Salary/Wages g Copy of all W-2 forms submitted with the prior year income tax return. Copy of all pay stubs for the most recent one-month period. Cash Bonuses g Other Joint Spousal Income Copy of all pay stubs documenting cash bonuses, and copy of related 1099 form. g Documentation verifying any monthly income jointly earned with the spouse or significant other, (e.g., income from the spouse or significant other or income from a business owned or controlled by the spouse or significant other, that the offender has a joint ownership interest in, or controls). Commissions g Copy of all 1099 forms submitted with the prior year income tax return. Business Income g Copy of the past six monthly financial statements of all businesses owned or controlled by the defendant. Also, be sure to provide all financial information requested in the "Assets" portion of the "Net Worth Statement" under "Section K, Business Holdings." Income of Others in the Home g Verification of the monthly earnings of all others living in the offender's household (e.g., all pay stubs for the prior month, W-2 forms, and 1099 forms for the prior year), paid receipts or canceled checks for necessary monthly household expenditures (e.g., for food, room rental, telephone, transportation, etc.) actually paid by this person on behalf of the offender. Interest/Dividends g Copy of most recent earnings statement from a financial institution (e.g., bank, brokerage firm, etc.). Copy of all 1099-INT forms, reporting annual interest earnings, for the past year. g Gifts From Family A signed and dated statement from the family member who gave gifts to the offender during the month, listing the amounts, dates and reasons given, and a copy of the check received, if any. Rental Income g Gifts From Others Copy of lease rental agreement, copy of monthly rental check received, and copy of the deposit on the defendant's monthly bank statement. g A signed and dated statement from the person(s) who gave gifts to the offender during the month, listing the amounts, dates and reasons given, and a copy of the check received, if any. Gifts over a certain amount require tax forms declaring the income. Trust Income g Copy of the monthly trust income check, copy of the trust agreement, and a copy of the trust income tax return for the prior year. Loans From Your Business g Copy of the past six monthly financial statements of all businesses owned or controlled by the offender that loaned money to the offender, including a detailed schedule of the "Loans To Shareholder/Owner" or "Due From Shareholder/Owner" general ledger accounts. Alimony/Child Support g Copy of divorce decree, copy of payments received, and statements documenting child support/alimony obligations with payment history. Social Security g Copy of most recent Social Security check and most recent benefits determination letter. Mortgage Loans g Copy of all mortgage checks received during the prior month, 1099 forms submitted with the prior year tax return, and copy of the sales agreement and escrow statement for all mortgage loans owed to the offender. Other Government Benefits g Other Loans Copy of most recent government subsidy check (e.g., unemployment compensation, food stamps) or online payment and most recent benefits determination letter. g Copy of loan documentation and copy of all loan checks received during the prior month. Pensions/Annuities g Copy of pension/annuity check, copy of most recent pension plan activity statement or annuity statement, and copy of pension plan or annuity contract. Other (specify) g Documentation verifying the source of all other monthly cash inflows (not yet disclosed or reported in these financial statements) and copy of all related monthly checks received. Allowances (housing, auto, travel) g Copy of related pay stub, 1099 form for prior year, and possibly a letter from the employer on company letterhead. American LegalNet, Inc. www.FormsWorkFlow.com PROB 48C (Rev. 07/13) Page 2 of 2 REQUEST FOR MONTHLY CASH FLOW STATEMENT FINANCIAL RECORDS (cont.) NECESSARY MONTHLY CASH OUTFLOWS Rent or Mortgage (including taxes) g Copy of apartment rental lease agreement or home mortgage, most recent mortgage statement, and verification of payment. Loan Payments g Copy of loan statements for all loans. Also, provide a copy of any financial statements submitted to obtain credit in the past three years. Groceries (# of people) g Purchase receipts for the past month. Credit Card Payments g Copy of most current billing statement for all charge accounts (e.g., credit cards, revolving charge cards, and department store cards) and lines of credit (e.g., bank line of credit). Utilities g Copy of most current utility bills (e.g., electric, heating oil/gas, water/sewer, telephone, and basic cable). Medical g Documentation of medical expenses (e.g., billing statements, payment receipts). Public Transportation g Receipts of amount paid. Alimony/Child Support g Copy of divorce decree and statements documenting child support/alimony obligations with payment history. Car Payments g Receipts for car lease or purchase payments. Criminal Monetary Penalty Commuting Expenses g Receipt for gasoline/motor oil, tolls, etc. Court-Ordered Costs (electronic monitoring, drug/mental health treatment) Insurance g Copy of most current insurance bills for all types of insurance (auto, health, homeowners). g g Verification of payments, along with statement from the service provider (if any) g Receipt of monthly payment Other (specify) Clothing g Purchase receipts with corresponding canceled checks. Specific receipts, billing statements. ADDITIONAL INSTRUCTIONS: A personal interview has been scheduled for