Last updated: 8/23/2019

Wage Deduction Order

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

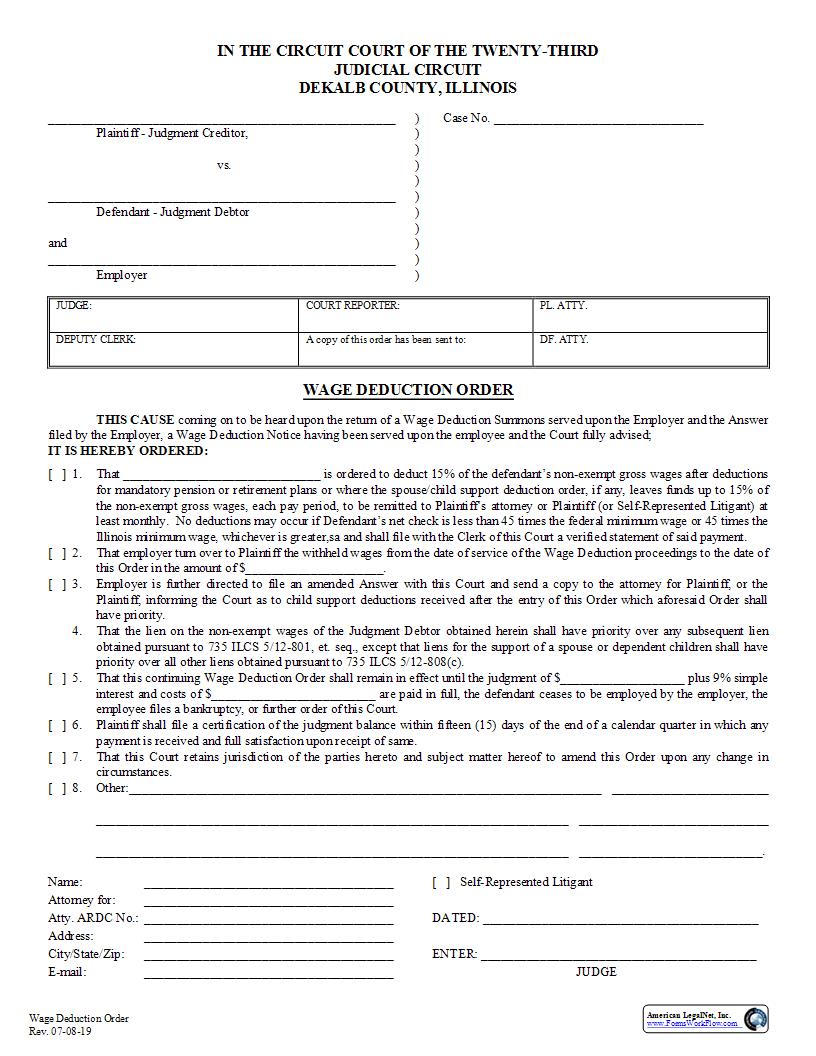

Wage Deduction Order Rev. 07-08-19 IN THE CIRCUIT COURT OF THE TWENTY-THIRD JUDICIAL CIRCUIT DEKALB COUNTY, ILLINOIS Plaintiff - Judgment Creditor, vs. Defendant - Judgment Debtor and Employer ) ) ) ) ) ) ) ) ) ) ) Case No. JUDGE: COURT REPORTER: PL. ATTY. DEPUTY CLERK: A copy of this order has been sent to: D F . ATTY. WAGE DEDUCTION ORDER THIS CAUSE coming on to be heard upon the return of a Wage Deduction Summons served upon the Employer and the Answer filed by the Employer, a Wage Deduction Notice having been served upon the employee and the Court fully advised; IT IS HEREBY ORDERED: [ ] 1. That is ordered to deduct 15% of the defendant222s non-exempt gross wages after deductions for mandatory pension or retirement plans or where the spouse/child support deduction order, if any, leaves funds up to 15% of the non-exempt gross wages, each pay period, to be remitted to Plaintiff222s attorney or Plaintiff (or Self-Represented Litigant) at least monthly. No deductions may occur if Defendant222s net check is less than 45 times the federal minimum wage or 45 times the Illinois minimum wage, whichever is greater,sa and shall file with the Clerk of this Court a verified statement of said payment. [ ] 2. That employer turn over to Plaintiff the withheld wages from the date of service of the Wage Deduction proceedings to the date of this Order in the amount of $. [ ] 3. Employer is further directed to file an amended Answer with this Court and send a copy to the attorney for Plaintiff, or the Plaintiff, informing the Court as to child support deductions received after the entry of this Order which aforesaid Order shall have priority. 4. That the lien on the non-exempt wages of the Judgment Debtor obtained herein shall have priority over any subsequent lien obtained pursuant to 735 ILCS 5/12-801, et. seq., except that liens for the support of a spouse or dependent children shall have priority over all other liens obtained pursuant to 735 ILCS 5/12-808(c). [ ] 5. That this continuing Wage Deduction Order shall remain in effect until the judgment of $ plus 9% simple interest and costs of $ are paid in full, the defendant ceases to be employed by the employer, the employee files a bankruptcy, or further order of this Court. [ ] 6. Plaintiff shall file a certification of the judgment balance within fifteen (15) days of the end of a calendar quarter in which any payment is received and full satisfaction upon receipt of same. [ ] 7. That this Court retains jurisdiction of the parties hereto and subject matter hereof to amend this Order upon any change in circumstances. [ ] 8. Other: . Name: [ ] Self-Represented Litigant Attorney for: Atty. ARDC No.: DATED: Address: City/State/Zip: ENTER: E-mail: JUDGE American LegalNet, Inc. www.FormsWorkFlow.com