Last updated: 8/23/2019

Wage Deduction Notice

Start Your Free Trial $ 13.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

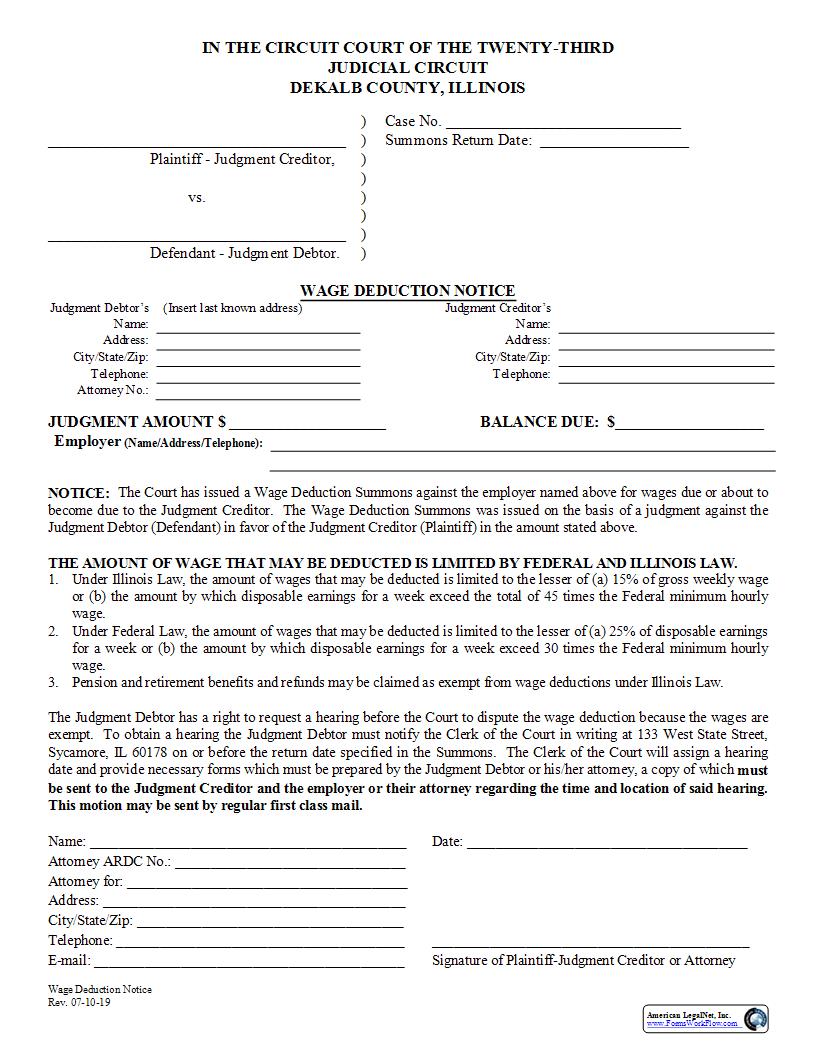

Wage Deduction Notice Rev. 07-10-19 IN THE CIRCUIT COURT OF THE TWENTY-THIRD JUDICIAL CIRCUIT DEKALB COUNTY, ILLINOIS Plaintiff - Judgment Creditor, vs. Defendant - Judgment Debtor. ) ) ) ) ) ) ) ) Case No . Summons Return Date: WAGE DEDUCTION NOTICE J udgment Debtor222s ( Insert last known address) Judgment Creditor222s Name: Name: Address: Address: City/State/Zip: City/State/Zip: Telephone : Telephone: Attorney No .: JUDGMENT AMOUNT $ BALANCE DUE: $ Employer (Name/Address/Telephone): NOTICE: The Court has issued a Wage Deduction Summons against the employer named above for wages due or about to become due to the Judgment Creditor. The Wage Deduction Summons was issued on the basis of a judgment against the Judgment Debtor (Defendant) in favor of the Judgment Creditor (Plaintiff) in the amount stated above. THE AMOUNT OF WAGE THAT MAY BE DEDUCTED IS LIMITED BY FEDERAL AND ILLINOIS LAW. 1. Under Illinois Law, the amount of wages that may be deducted is limited to the lesser of (a) 15% of gross weekly wage or (b) the amount by which disposable earnings for a week exceed the total of 45 times the Federal minimum hourly wage. 2. Under Federal Law, the amount of wages that may be deducted is limited to the lesser of (a) 25% of disposable earnings for a week or (b) the amount by which disposable earnings for a week exceed 30 times the Federal minimum hourly wage. 3. Pension and retirement benefits and refunds may be claimed as exempt from wage deductions under Illinois Law. The Judgment Debtor has a right to request a hearing before the Court to dispute the wage deduction because the wages are exempt. To obtain a hearing the Judgment Debtor must notify the Clerk of the Court in writing at 133 West State Street, Sycamore, IL 60178 on or before the return date specified in the Summons. The Clerk of the Court will assign a hearing date and provide necessary forms which must be prepared by the Judgment Debtor or his/her attorney, a copy of which must be sent to the Judgment Creditor and the employer or their attorney regarding the time and location of said hearing. This motion may be sent by regular first class mail. Name: Date: Attorney ARDC No.: Attorney for: Address: City/State/Zip: Telephone: E-mail: Signature of Plaintiff-Judgment Creditor or Attorney American LegalNet, Inc. www.FormsWorkFlow.com