Last updated: 11/5/2021

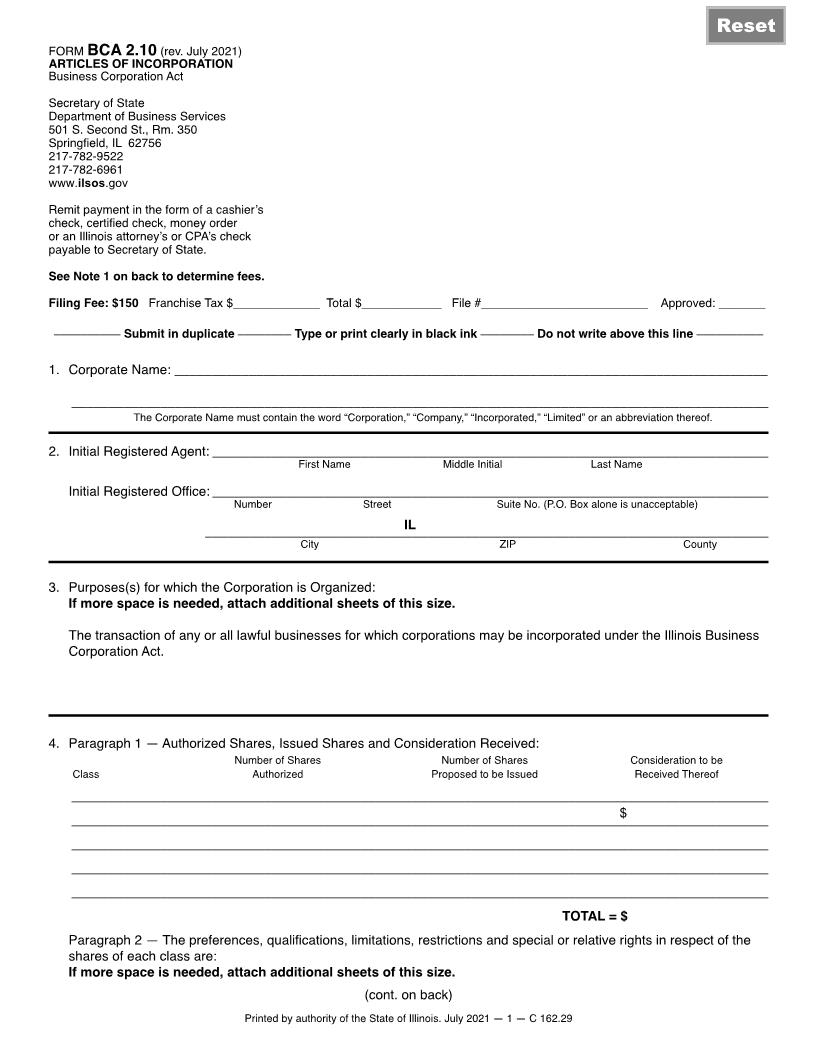

Articles Of Incorporation {BCA-2.10}

Start Your Free Trial $ 12.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

FORM BCA 2.10 (PSCA) (rev. Dec. 2003) ARTICLES OF INCORPORATION Professional Service Corporation Secretary of State Department of Business Services 501 S. Second St., Rm. 350 Springfield, IL 62756 217-782-9522 www.cyberdriveillinois.com Print Reset Save Remit payment in the form of a cashier's check, certified check, money order or an Illinois attorney's or CPA's check payable to Secretary of State. Filing Fee: $150 SEE NOTE 1 ON REVERSE TO DETERMINE FEES. -------- Submit in duplicate -------- Type or Print clearly in black ink -------- Do not write above this line -------- Franchise Tax $_____________ Total $ _____________ File #_______________________ Approved: ______ 1. Corporate Name: ________________________________________________________________________________ 2. Initial Registered Agent: ___________________________________________________________________________ Initial Registered Office:___________________________________________________________________________ Number City Street Suite # (P.O. Box alone is unacceptable) County ZIP Code First Name Middle Name Last Name IL Initial Registered Office: __________________________________________________________________________ Must end with one of the following words or abbreviations: "Chartered," "Limited," "Ltd.," "Professional Corporation," "Prof. Corp." or "P.C." ______________________________________________________________________________________________ 3. Purpose(s) for which the Corporation is organized: Professional Corporation: To practice the profession of ________________________________________________, rendering that type of professional service and services ancillary thereto. Professional service will be rendered from the following address(es): Number and Street City ______________________________________________________________________________________________ State ZIPCode 4. Paragraph 1: Authorized Shares, Issued Shares and Consideration Received: Class Number of Shares Authorized ______________________________________________________________________________________________ ______________________________________________________________________________________________ ______________________________________________________________________________________________ ______________________________________________________________________________________________ TOTAL = $______________________ Paragraph 2: The preferences, qualification, limitations, restrictions and special or relative rights in respect of the shares of each class are: For more space, attach additional sheets of this size. Printed by authority of the State of Illinois. January 2015 - 1 - C 324.3 Number of Shares Proposed to be Issued Consideration to be Received Therefore _______________________________________________________________________$______________________ American LegalNet, Inc. www.FormsWorkFlow.com 5. OPTIONAL: a. Number of directors constituting the initial board of directors of the Corporation: ____________________________ b. Names and addresses of persons who will serve as directors until the first annual meeting of shareholders or until their successors are elected and qualify. ____________________________________________________________________________________________ ____________________________________________________________________________________________ 6. OPTIONAL: a. Estimated value of all property to be owned by the Corporation for the following year wherever located: b. Estimated value of the property to be located within the State of Illinois during the following year: c. Estimated gross amount of business that will be transacted by the corporation during the following year: d. Estimated gross amount of business that will be transacted from places of business in the State of Illinois during the following year: ____________________________________________________________________________________________ $___________________________ $___________________________ $___________________________ $___________________________ Name Address City, State, ZIP 7. OPTIONAL: OTHER PROVISIONS Attach a separate sheet of this size for any other provision to be included in the Articles of Incorporation (e.g., authorizing preemptive rights, denying cumulative voting, regulating internal affairs, voting majority requirements, fixing a duration other than perpetual, etc.). 8. NAME(S) and ADDRESS(ES) OF INCORPORATOR(S) The undersigned incorporator(s) hereby declare(s), under penalties of perjury, that the statements made in the foregoing Articles of Incorporation are true and correct. Dated ________________________________ , ______ 1. ___________________________________________ Signature Name (type or print) Signature Signature and Name Month & Day Year 1. ___________________________________________ 2. ___________________________________________ 1. ___________________________________________ 3. ___________________________________________ 1. ___________________________________________ Name (type or print) Signature Name (type or print) 1. ___________________________________________ Street City/Town State ZIP Code Address 2. ___________________________________________ Street City/Town State ZIP Code 1. ___________________________________________ 3. ___________________________________________ Street City/Town State ZIP Code 1. ___________________________________________ Note 1: Fee Schedule The initial franchise tax is assessed at the rate of 15/100 of 1 percent ($1.50 per $1,000) on the paid-in capital represented in this State. (Minimum initial franchise tax is $25.) The filing fee is $150 The minimum total due (franchise tax + filing fee) is $175. Signatures must be in BLACK INK on original document. Carbon copy, photocopy or rubber stamp signatures may only be used on conformed copies. NOTE: The incorporator must be either one or more persons licensed pursuant to the relevant profession or an Illinois attorney. Note 2: Return to: _______________________________ Firm name Attention Mailing Address 1. ___________________________________________ _______________________________ _______________________________ _______________________________ City, State, ZIP Code American LegalNet, Inc. www.FormsWorkFlow.com