Last updated: 7/22/2021

Articles Of Incorporation Close Corporation {BCA-2.10 2A}

Start Your Free Trial $ 11.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

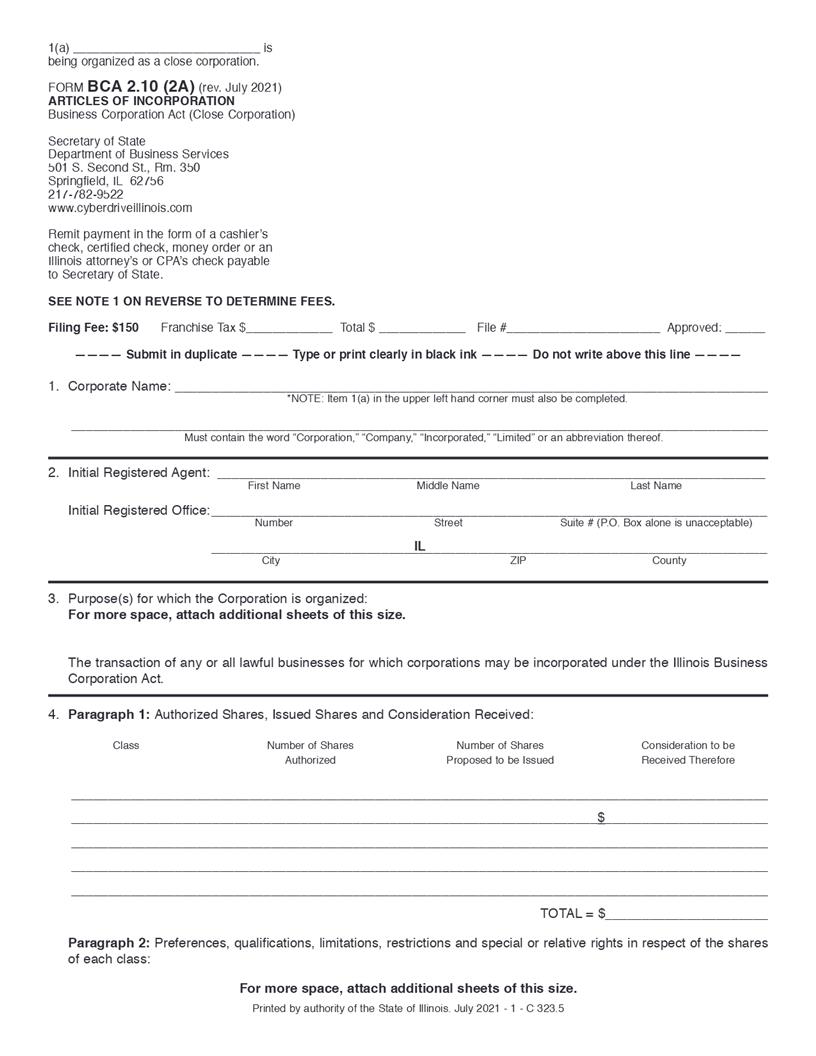

1(a) ____________________________ is being organized as a close corporation. FORM BCA 2.10 (2A) (rev. Dec. 2003) ARTICLES OF INCORPORATION Business Corporation Act (Close Corporation) Secretary of State Department of Business Services 501 S. Second St., Rm. 350 Springfield, IL 62756 217-782-9522 www.cyberdriveillinois.com Remit payment in the form of a cashier's check, certified check, money order or an Illinois attorney's or CPA's check payable to Secretary of State. Filing Fee: $150 SEE NOTE 1 ON REVERSE TO DETERMINE FEES. 1. Corporate Name: ________________________________________________________________________________ *NOTE: Item 1(a) in the upper left hand corner must also be completed. Must contain the word "Corporation," "Company," "Incorporated," "Limited" or an abbreviation thereof. First Name Number City Middle Name Street -------- Submit in duplicate -------- Type or Print clearly in black ink -------- Do not write above this line -------- Franchise Tax $_____________ Total $ _____________ File #_______________________ Approved: ______ ______________________________________________________________________________________________ Last Name 2. Initial Registered Agent: __________________________________________________________________________ Suite # (P.O. Box alone is unacceptable) County Initial Registered Office:___________________________________________________________________________ ZIP Code Initial Registered Office___________________________________________________________________________ 3. Purpose(s) for which the Corporation is organized: For more space, attach additional sheets of this size. 4. Paragraph 1: Authorized Shares, Issued Shares and Consideration Received: Class Number of Shares Authorized The transaction of any or all lawful businesses for which corporations may be incorporated under the Illinois Business Corporation Act. Number of Shares Proposed to be Issued Consideration to be Received Therefore ______________________________________________________________________________________________ ______________________________________________________________________________________________ ______________________________________________________________________________________________ ______________________________________________________________________________________________ Paragraph 2: Preferences, qualifications, limitations, restrictions and special or relative rights in respect of the shares of each class: For more space, attach additional sheets of this size. Printed by authority of the State of Illinois. March 2016 - 1 - C 323.3 American LegalNet, Inc. www.FormsWorkFlow.com _______________________________________________________________________$______________________ TOTAL = $______________________ 5. OPTIONAL: a. Number of directors constituting the initial board of directors of the Corporation: ____________________________ b. Names and addresses of persons who are to serve as directors until the first annual meeting of shareholders or until their successors are elected and qualify. ____________________________________________________________________________________________ ____________________________________________________________________________________________ 6. OPTIONAL: a. Estimated value of all property to be owned by the Corporation for the following year wherever located: b. Estimated value of the property to be located within the State of Illinois during the following year: c. Estimated gross amount of business that will be transacted by the corporation during the following year: d. Estimated gross amount of business that will be transacted from places of business in the State of Illinois during the following year: ____________________________________________________________________________________________ $___________________________ $___________________________ $___________________________ $___________________________ Name Address City, State, ZIP 7. OPTIONAL: OTHER PROVISIONS Attach a separate sheet of this size for any other provision to be included in the Articles of Incorporation (e.g., authorizing preemptive rights, denying cumulative voting, regulating internal affairs, voting majority requirements, fixing a duration other than perpetual, etc.). 8. NAME(S) & ADDRESS(ES) OF INCORPORATOR(S) The undersigned incorporator(s) hereby declare(s), under penalties of perjury, that the statements made in the foregoing Articles of Incorporation are true and correct. Dated ________________________________ , ______ 1. ___________________________________________ Name (type or print) Signature Signature Month & Day Year Signature and Name 1. ___________________________________________ 2. ___________________________________________ 1. ___________________________________________ 3. ___________________________________________ 1. ___________________________________________ Name (type or print) Signature Name (type or print) 1. ___________________________________________ 2. ___________________________________________ 3. ___________________________________________ City/Town Street State ZIP Code City/Town Street State ZIP Code City/Town Street State ZIP Code Address 1. ___________________________________________ 1. ___________________________________________ 1. ___________________________________________ Note 1: Fee Schedule The initial franchise tax is assessed at the rate of 15/100 of 1 percent ($1.50 per $1,000) on the paid-in capital represented in this State. (Minimum initial franchise tax is $25.) The filing fee is $150 The minimum total due (franchise tax + filing fee) is $175. Signatures must be in BLACK INK on original document. Carbon copy, photocopy or rubber stamp signatures may only be used on conformed copies. NOTE: If a Corporation acts as incorporator, the name of the Corporation and the state of incorporation shall be shown and the execution shall be by a duly authorized corporate officer. Note 2: Return to: _______________________________ Firm name Attention Mailing Address _______________________________ _______________________________ _______________________________ City, State, ZIP Code American LegalNet, Inc. www.FormsWorkFlow.com