Last updated: 9/21/2021

Debtors Chapter 13 Plan {BTXN 222}

Start Your Free Trial $ 5.99What you get:

- Instant access to fillable Microsoft Word or PDF forms.

- Minimize the risk of using outdated forms and eliminate rejected fillings.

- Largest forms database in the USA with more than 80,000 federal, state and agency forms.

- Download, edit, auto-fill multiple forms at once in MS Word using our Forms Workflow Ribbon

- Trusted by 1,000s of Attorneys and Legal Professionals

Description

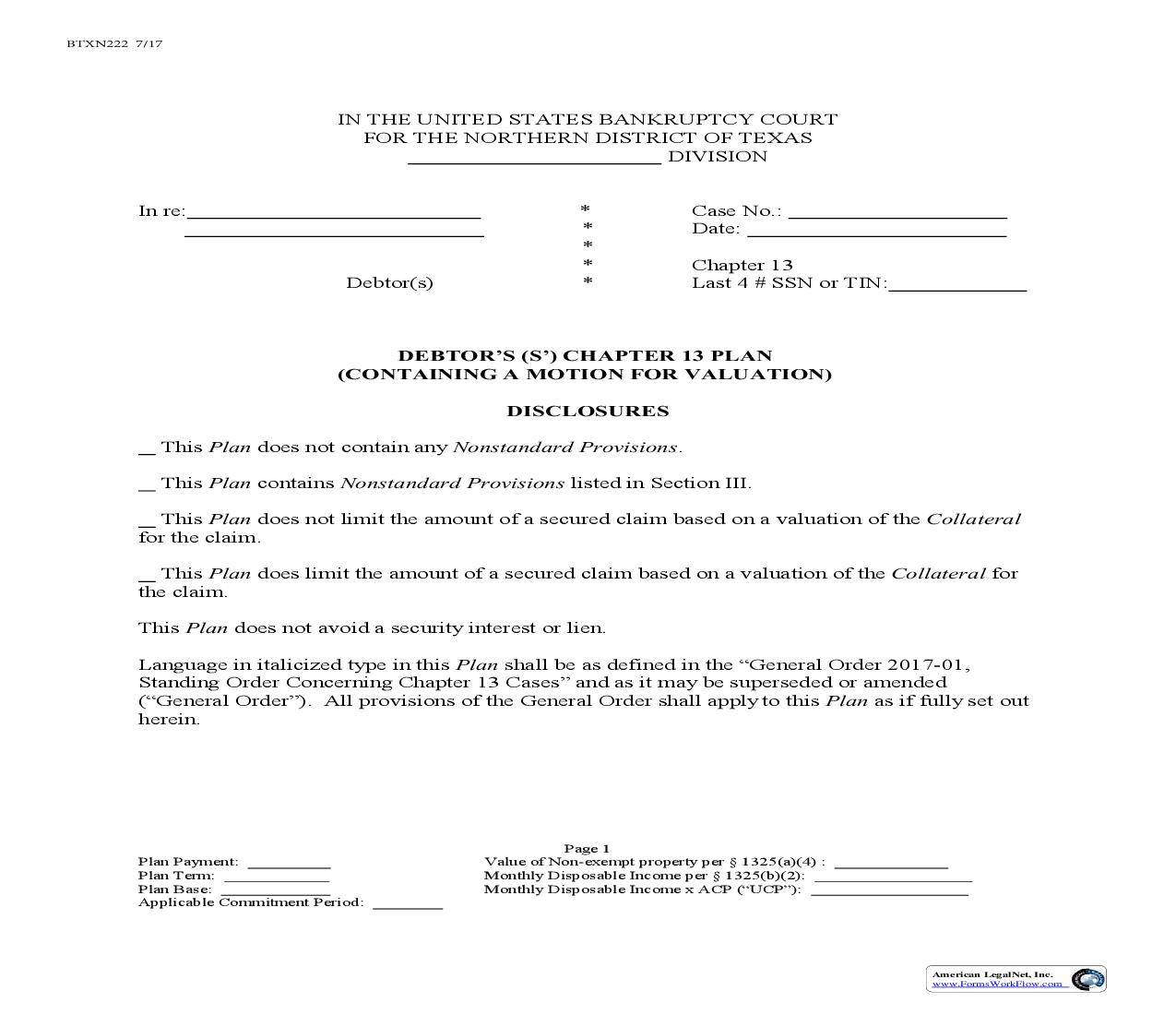

BTXN222 7/17 IN THE UNITED STATES BANKRUPTCY COURT FOR THE NORTHERN DISTRICT OF TEXAS DIVISION In re: * * * * * Case No.: Date: Chapter 13 Last 4 # SSN or TIN: Debtor(s) DEBTOR'S (S') CHAPTER 13 PLAN (CONTAINING A MOTION FOR VALUATION) DISCLOSURES This Plan does not contain any Nonstandard Provisions. This Plan contains Nonstandard Provisions listed in Section III. This Plan does not limit the amount of a secured claim based on a valuation of the Collateral for the claim. This Plan does limit the amount of a secured claim based on a valuation of the Collateral for the claim. This Plan does not avoid a security interest or lien. Language in italicized type in this Plan shall be as defined in the "General Order 2017-01, Standing Order Concerning Chapter 13 Cases" and as it may be superseded or amended ("General Order"). All provisions of the General Order shall apply to this Plan as if fully set out herein. Plan Payment: Plan Term: Plan Base: Applicable Commitment Period: Page 1 Value of Non-exempt property per § 1325(a)(4) : Monthly Disposable Income per § 1325(b)(2): Monthly Disposable Income x ACP ("UCP"): American LegalNet, Inc. www.FormsWorkFlow.com MOTION FOR VALUATION Pursuant to Bankruptcy Rule 3012, for purposes of 11 U.S.C. § 506(a) and § 1325(a)(5) and for purposes of determination of the amounts to be distributed to holders of secured claims who do not accept the Plan, Debtor(s) hereby move(s) the Court to value the Collateral described in Section I, Part E.(1) and Part F of the Plan at the lesser of the value set forth therein or any value claimed on the proof of claim. Any objection to valuation shall be filed at least seven (7) days prior to the date of the Trustee's pre-hearing conference regarding Confirmation or shall be deemed waived. SECTION I DEBTOR'S(S') CHAPTER 13 PLAN - SPECIFIC PROVISIONS FORM REVISED 7/1/17 A. PLAN PAYMENTS: Debtor(s) propose(s) to pay to the Trustee the sum of: $__________ per month, months to . For a total of $ First payment is due The applicable commitment period ("ACP") is (estimated "Base Amount"). . months. Monthly Disposable Income ("DI") calculated by Debtor(s) per§1325(b)(2) is: $ . The Unsecured Creditors' Pool ("UCP"), which is DI x ACP, as estimated by the Debtor(s), shall be no less than: $ . Debtor's(s') equity in non-exempt property, as estimated by Debtor(s) per§1325(a)(4), shall be no less than: $ . B. STATUTORY, ADMINISTRATIVE AND DSO CLAIMS: $ 1. CLERK'S FILING FEE: Total filing fees paid through the Plan, if any, are and shall be paid in full prior to disbursements to any other creditor. 2. STATUTORY TRUSTEE'S PERCENTAGE FEE(S) AND NOTICING FEES: Trustee's Percentage Fee(s) and any noticing fees shall be paid first out of each receipt as provided in General Order 2017-01 (as it may be superseded or amended) and 28 U.S.C. § 586(e)(1) and (2). Page 2 American LegalNet, Inc. www.FormsWorkFlow.com 3. DOMESTIC SUPPORT OBLIGATIONS: The Debtor is responsible for paying any Post-petition Domestic Support Obligation directly to the DSO claimant. Prepetition Domestic Support Obligations per Schedule "E/F" shall be paid in the following monthly payments: DSO CLAIMANTS SCHED. AMOUNT % TERM (APPROXIMATE) (MONTHS TO ) TREATMENT $ PER MO. C. ATTORNEY FEES: To $ Pre-petition; $ , total: $ disbursed by the Trustee. ; D.(1) PRE-PETITION MORTGAGE ARREARAGE: MORTGAGEE SCHED. ARR. AMT DATE ARR. THROUGH % TERM (APPROXIMATE) (MONTHS TO ) TREATMENT D.(2) CURRENT POST-PETITION MORTGAGE PAYMENTS DISBURSED BY THE TRUSTEE IN A CONDUIT CASE: MORTGAGEE # OF PAYMENTS PAID BY TRUSTEE CURRENT POST-PETITION MORTGAGE PAYMENT AMOUNT FIRST CONDUIT PAYMENT DUE DATE (MM-DD-YY) D.(3) POST-PETITION MORTGAGE ARREARAGE: MORTGAGEE TOTAL AMT. DUE DATE(S) (MM-DD-YY) % TERM (APPROXIMATE) (MONTHS TO ) TREATMENT Page 3 American LegalNet, Inc. www.FormsWorkFlow.com E.(1) SECURED CREDITORS-PAID BY THE TRUSTEE: A. CREDITOR COLLATERAL SCHED. AMT. VALUE % TERM (APPROXIMATE) (MONTHS __ TO __) TREATMENT Per Mo B. CREDITOR COLLATERAL SCHED. AMT. VALUE % TREATMENT Pro-rata To the extent the value amount in E.(1) is less than the scheduled amount in E.(1), the creditor may object. In the event a creditor objects to the treatment proposed in paragraph E.(1), the Debtor(s) retain(s) the right to surrender the Collateral to the creditor in satisfaction of the creditor's claim. E.(2) SECURED 1325(a)(9) CLAIMS PAID BY THE TRUSTEE - NO CRAM DOWN: A. CREDITOR COLLATERAL SCHED. AMT. % TERM (APPROXIMATE) (MONTHS __ TO __) TREATMENT Per Mo B. CREDITOR COLLATERAL SCHED. AMT. % TREATMENT Pro-rata The valuation of Collateral set out in E.(1) and the interest rate to be paid on the above scheduled claims in E.(1) and E.(2) will be finally determined at confirmation. The allowed claim amount will be determined based on a timely filed proof of claim and the Trustee's Recommendation Concerning Claims ("TRCC") or by an order on an objection to claim. Absent any objection to the treatment described in E.(1) or E.(2), the creditor(s) listed in E.(1) and E.(2) shall be deemed to have accepted the Plan per section 1325(a)(5)(A) of the Bankruptcy Code and to have waived its or their rights under section 1325(a)(5)(B) and (C) of the Bankruptcy Code. Page 4 American LegalNet, Inc. www.FormsWorkFlow.com F. SECURED CREDITORS - COLLATERAL TO BE SURRENDERED: CREDITOR COLLATERAL SCHED. AMT. VALUE TREATMENT Surrender Upon confirmation, pursuant to 11 U.S.C. § 1322 (b)(8), the surrender of the Collateral described herein will provide for the payment of all or part of a claim against the Debtor(s) in the amount of the value given herein. The valuation of Collateral in F. will be finally determined at confirmation. The allowed claim amount will be determined based on a timely filed proof of claim and the Trustee's Recommendation Concerning Claims ("TRCC") or by an order on an objection to claim. The Debtor(s) request(s) that the automatic stay be terminated as to the surrendered Collateral. If there is no objection to the surrender, the automatic stay shall terminate and the Trustee shall cease disbursements on any secured claim which is secured by the Surrendered Collateral, without further order of the Court, on the 7th day after the date the Plan is filed. However, the stay shall not be terminated if the Trustee or affected secured lender files an objection in compliance with paragraph 8 of the General Order until such objection is resolved. Nothing in this Plan shall be deemed to abrogate any applicab